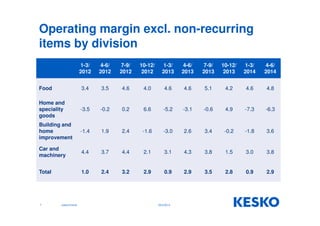

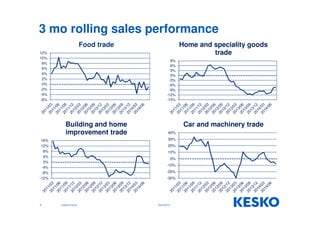

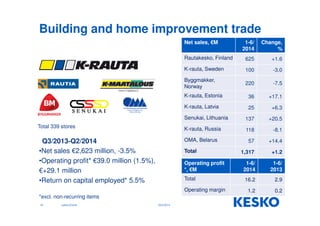

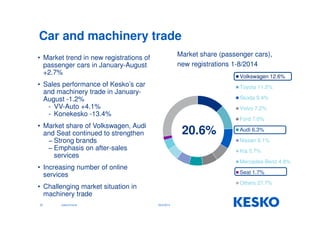

The document discusses Kesko Group's business performance and retail trends. It summarizes Kesko's Q3 2013-Q2 2014 key figures and sales performance by division. Kesko's food trade saw sales decline 1.4% in January-August. The home and speciality goods trade declined 9.3% due to changes in consumer behavior. Building and home improvement trade sales rose 0.2% excluding currency impacts. Car and machinery trade sales were flat. Looking ahead, Kesko plans to integrate its home/speciality goods and building/home improvement divisions to create a more competitive multi-channel offering, in response to the growing importance of e-commerce.