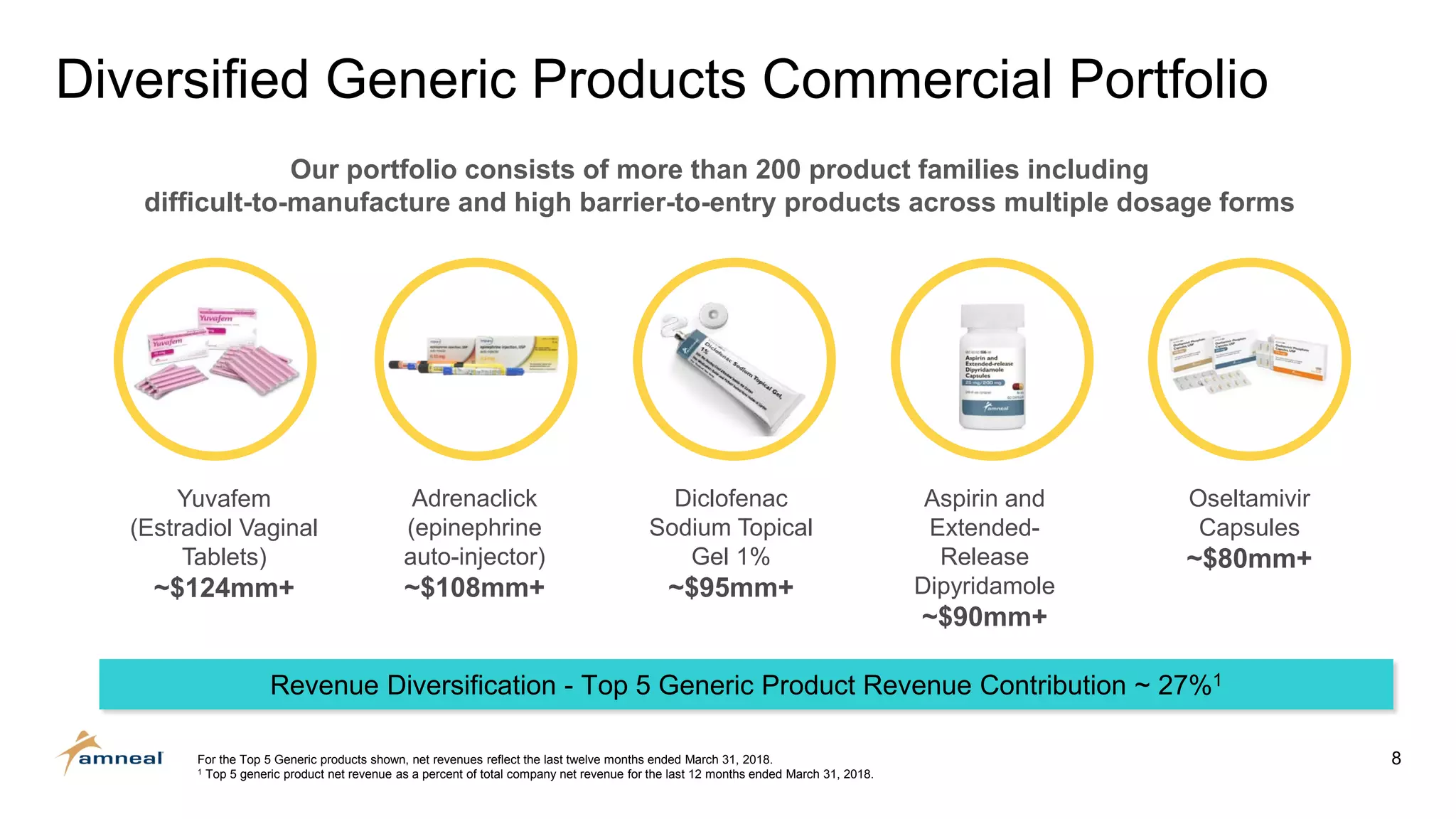

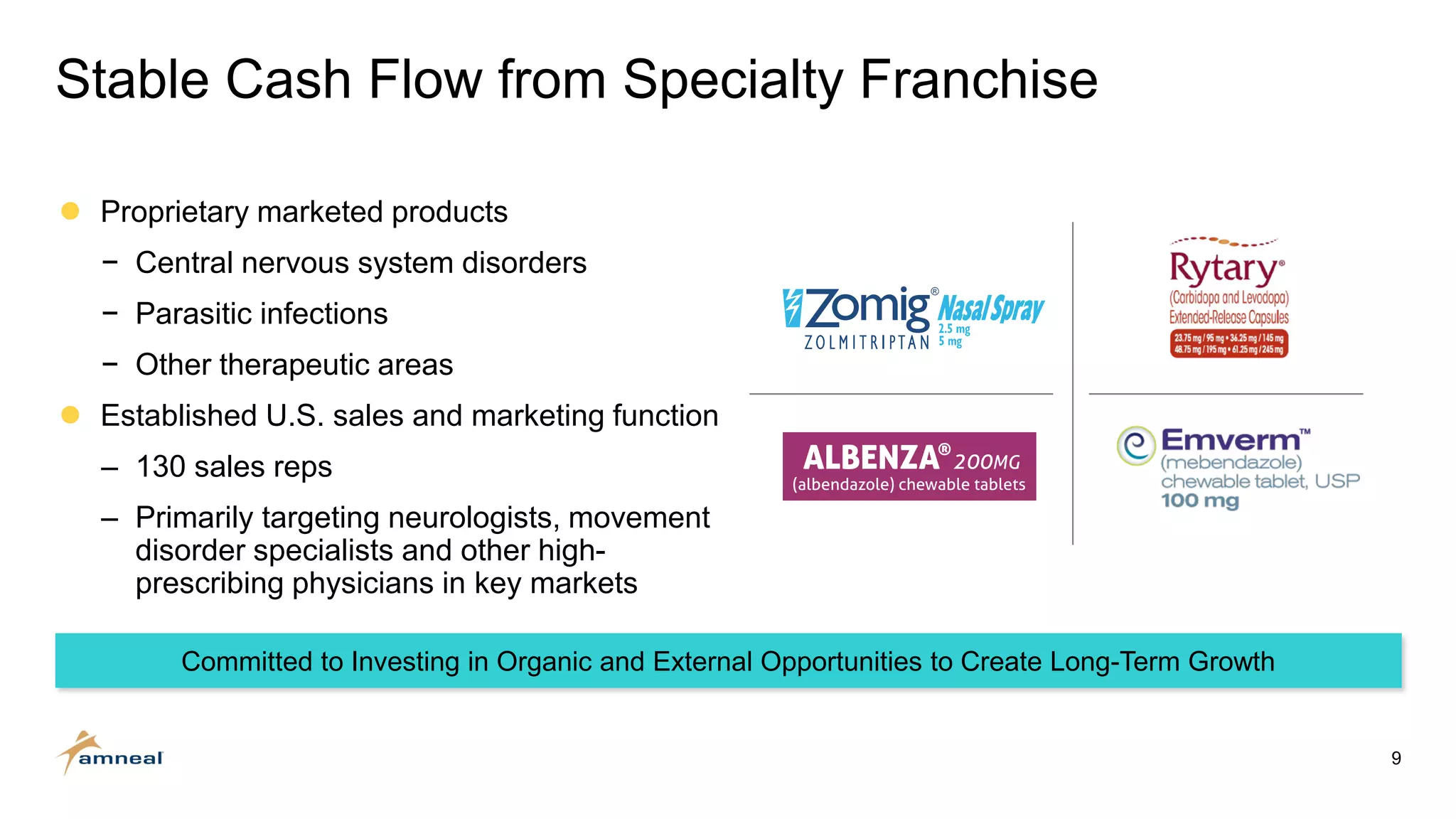

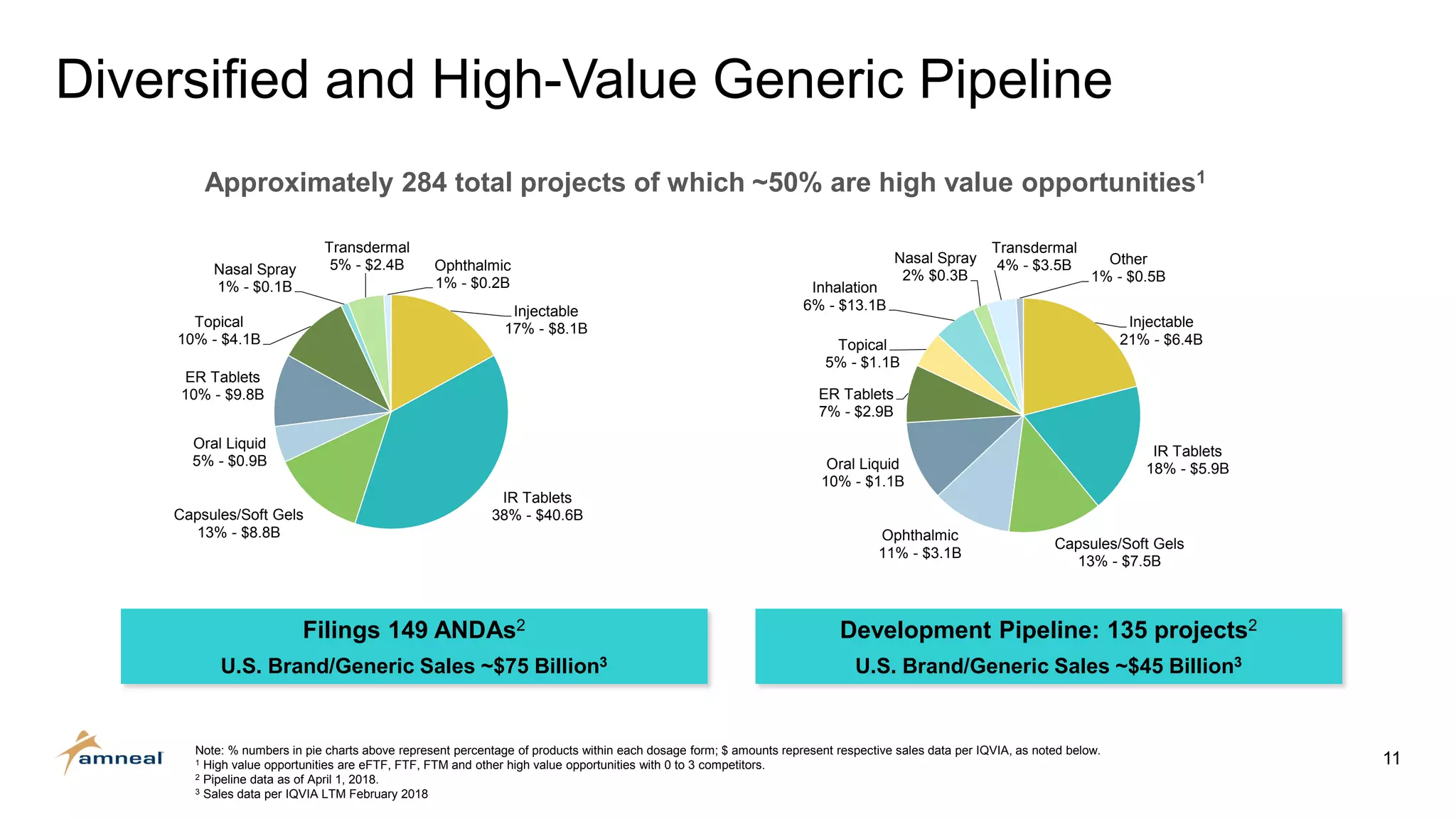

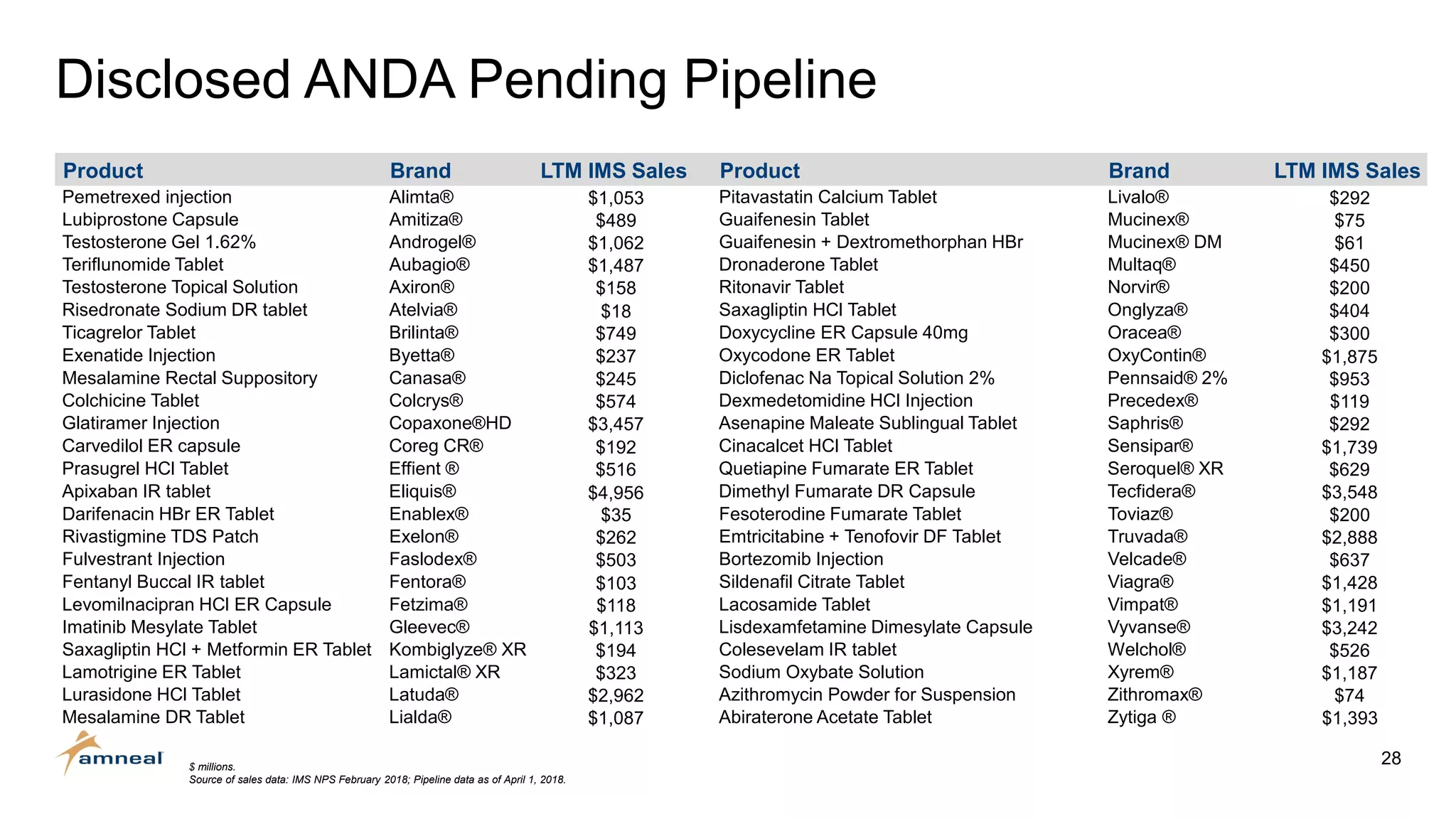

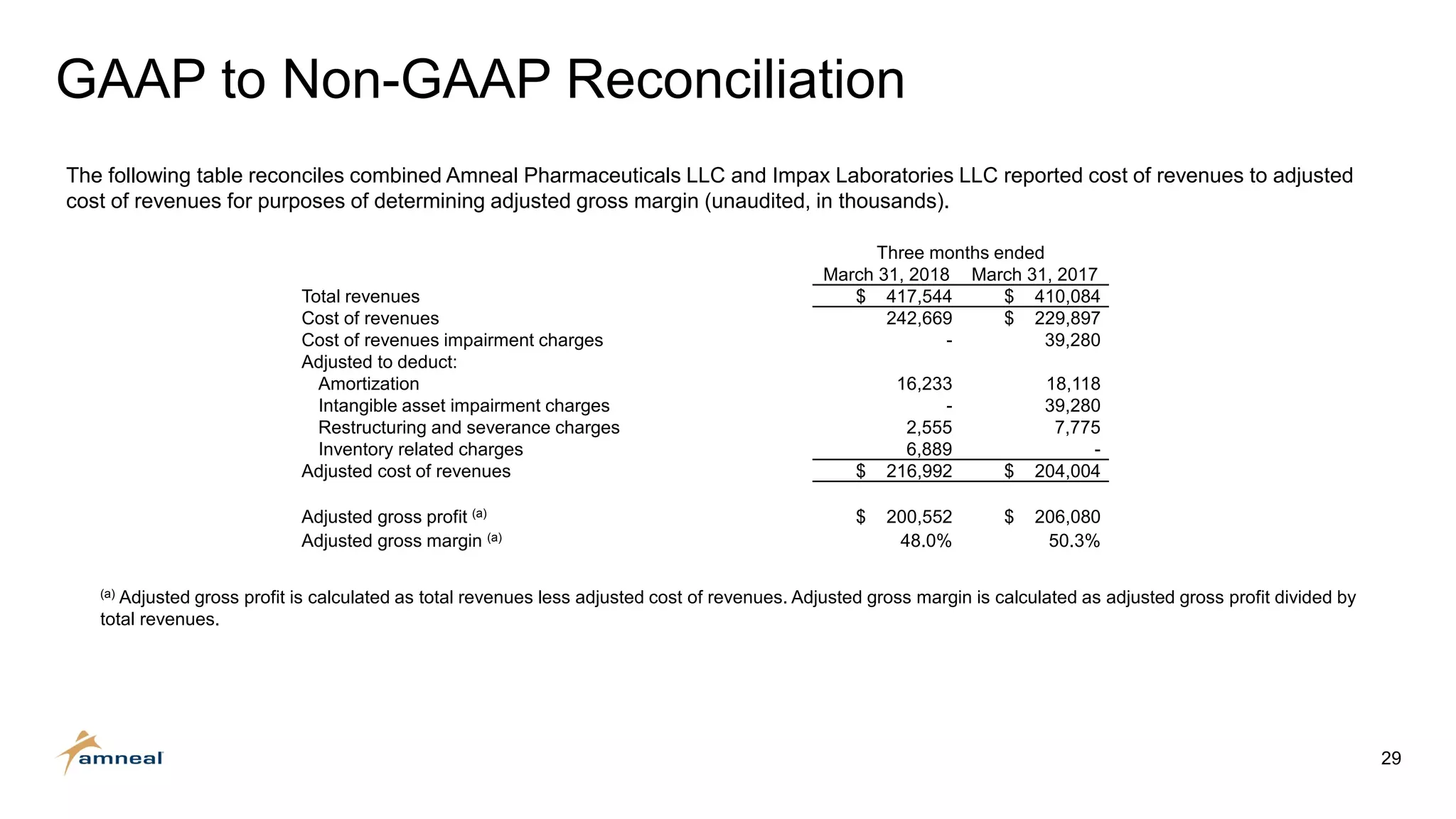

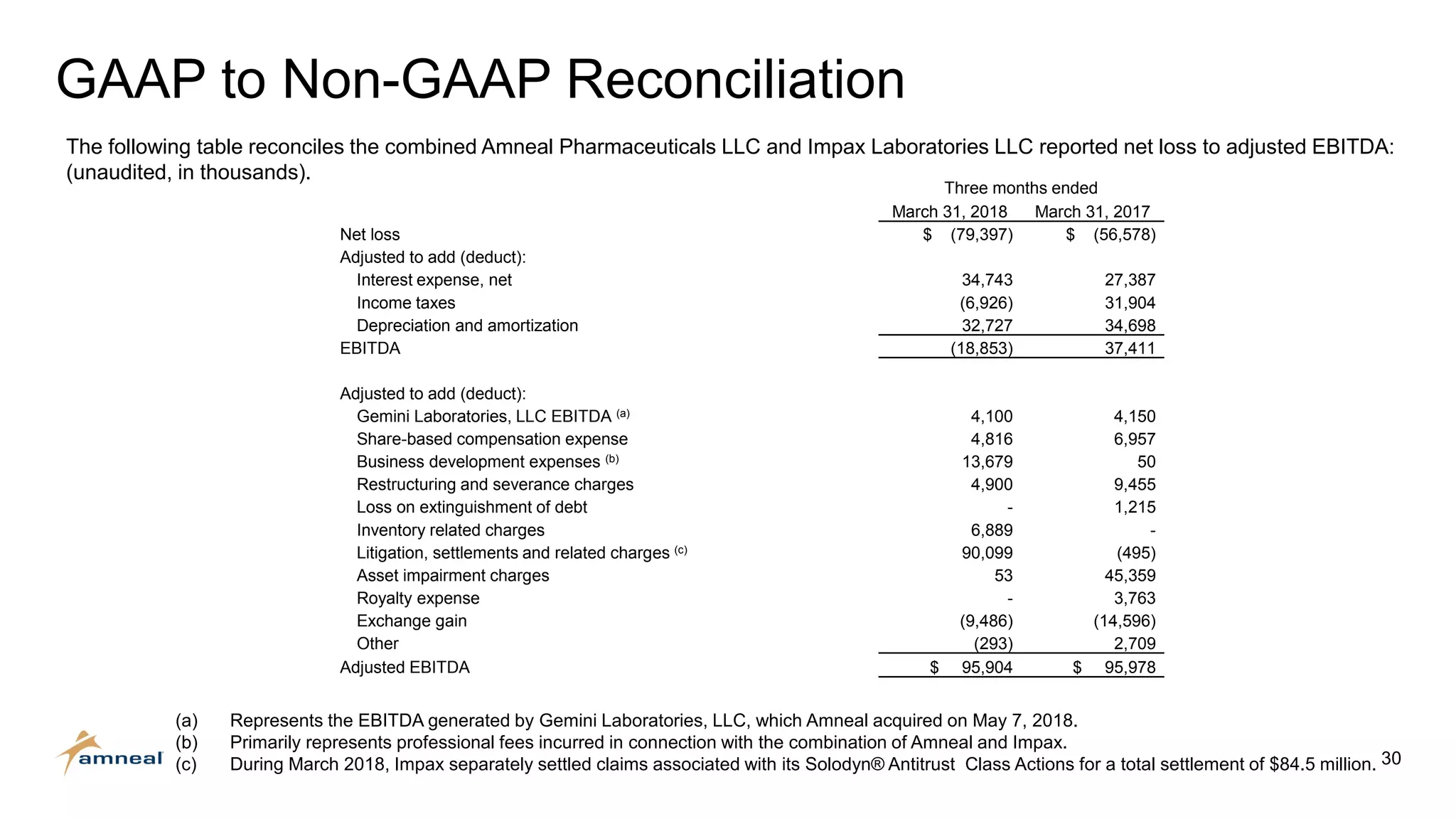

Amneal and Impax have completed a combination to create a strategic platform for long-term growth. The new Amneal has a strong foundation with a diverse generics portfolio of over 200 product families, a robust pipeline of 149 generic filings, and a specialty business. The combination provides scale across oral solids, topicals, injectables, and sterile products. Amneal is well-positioned for continued investment and debt reduction through stable cash flows from its generics and specialty franchises.