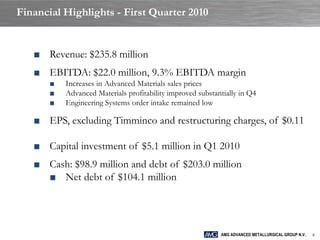

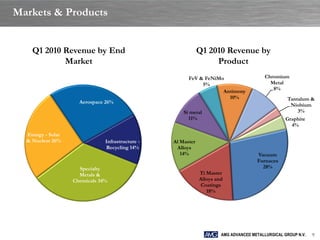

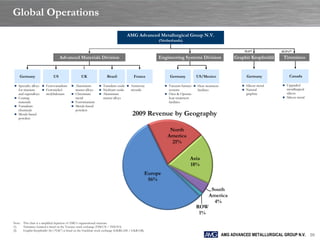

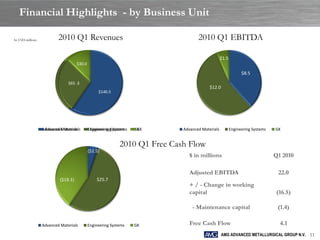

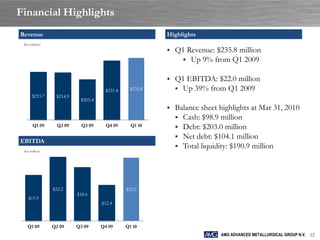

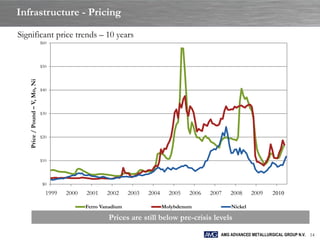

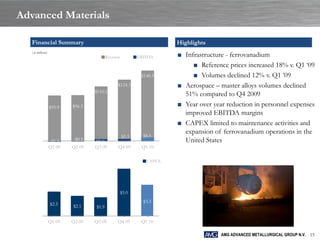

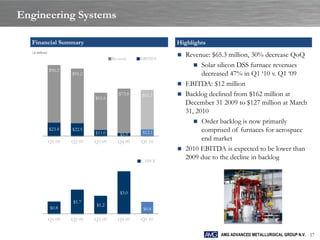

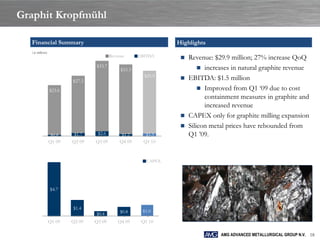

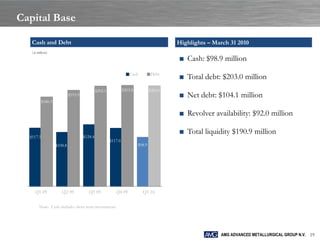

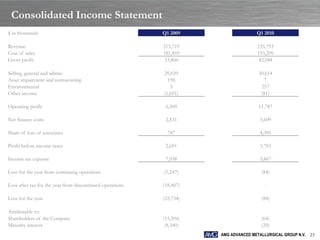

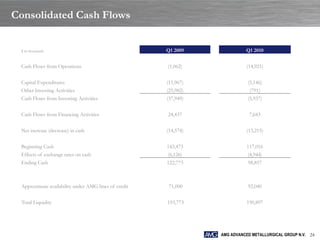

The document provides an investor presentation for AMG Advanced Metallurgical Group N.V for the second quarter of 2010. It summarizes the company's financial highlights including revenues of $235.8 million and EBITDA of $22 million for Q1 2010. It also gives an overview of AMG's global operations, product offerings in high purity metals and vacuum furnaces, and participation in key end markets such as aerospace, energy, infrastructure, and specialty metals & chemicals.