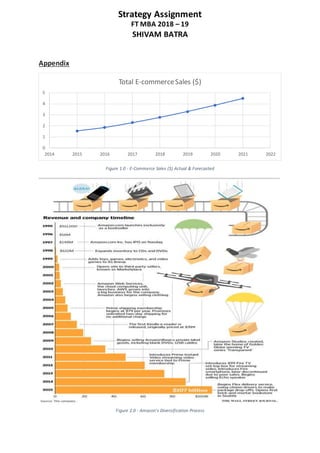

Amazon faces both opportunities and threats in its external environment. Opportunities include continued growth in e-commerce, potential for diversification and forward integration through new acquisitions, and expanding product offerings. Threats include intensifying competition from other retailers, fluctuations in foreign currency exchange rates that affect international sales, and increasing regulatory pressures.

Internally, Amazon's strengths are its low-cost structure, leadership in e-commerce and cloud services, and loyal customer base. Weaknesses include a rising debt-to-asset ratio, lower operating margins compared to competitors, and some product failures.

Potential strategic alternatives for Amazon include focusing on core competencies, expanding cloud-based services, and further global expansion