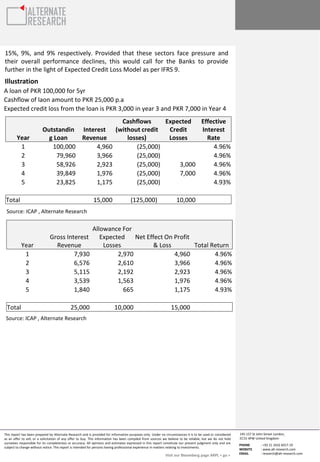

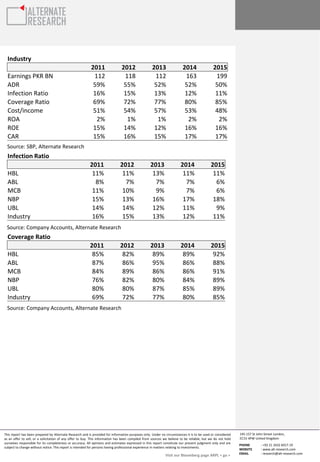

The new IFRS 9 standard will require banks to recognize expected credit losses earlier and increase provisions against loans. This will likely negatively impact bank profitability as provisions increase. It will require additional scrutiny of lending practices and increase discipline. The full impact on banks' income statements and balance sheets is still uncertain as accounting standards and regulatory bodies work to implement the new standard.