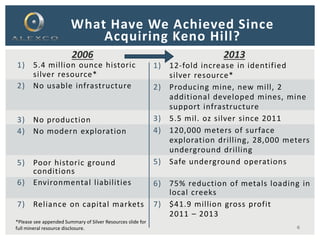

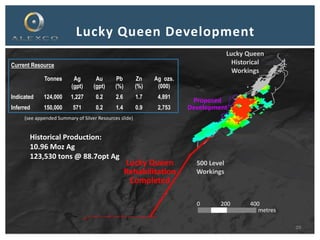

- Alexco Resource Corp owns the historic Keno Hill Silver District in Canada's Yukon Territory, which has seen significant resource growth under their ownership from 5.4 million ounces to over 64 million ounces of indicated and inferred resources.

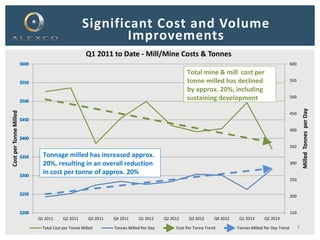

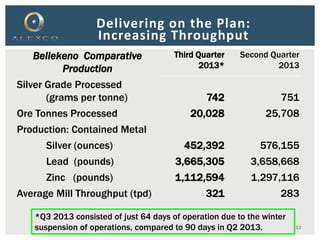

- Operations at Keno Hill have achieved cost reductions of approximately 20% since 2011 through increased throughput and efficiency improvements, however an interim suspension of operations is currently in place.

- Alexco's goal is to restructure costs and implement a long-term integrated production approach across the district to provide profitability and sustainability, with a focus on increasing throughput, self-mining, and exploration to sustain production over the long term.