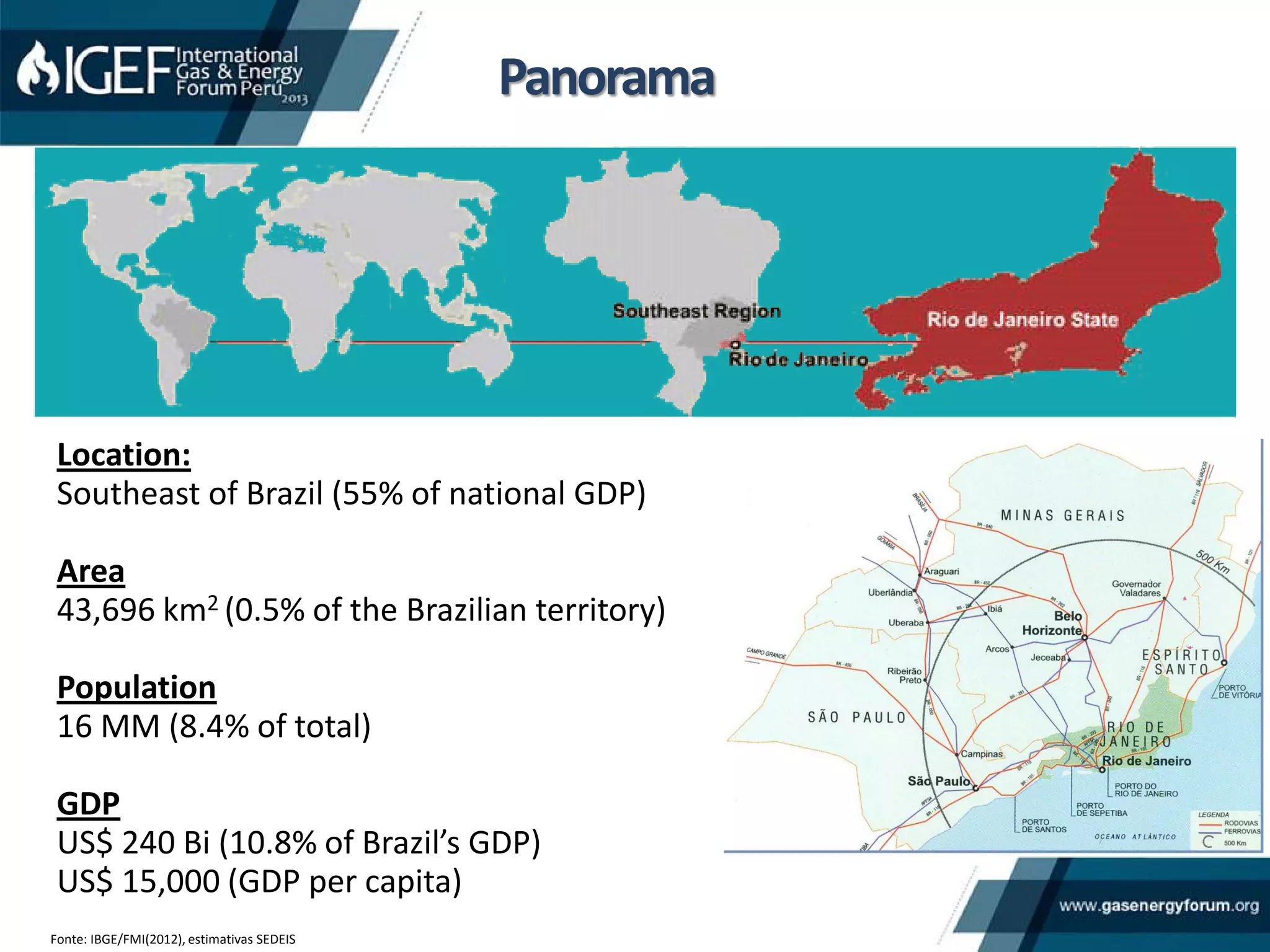

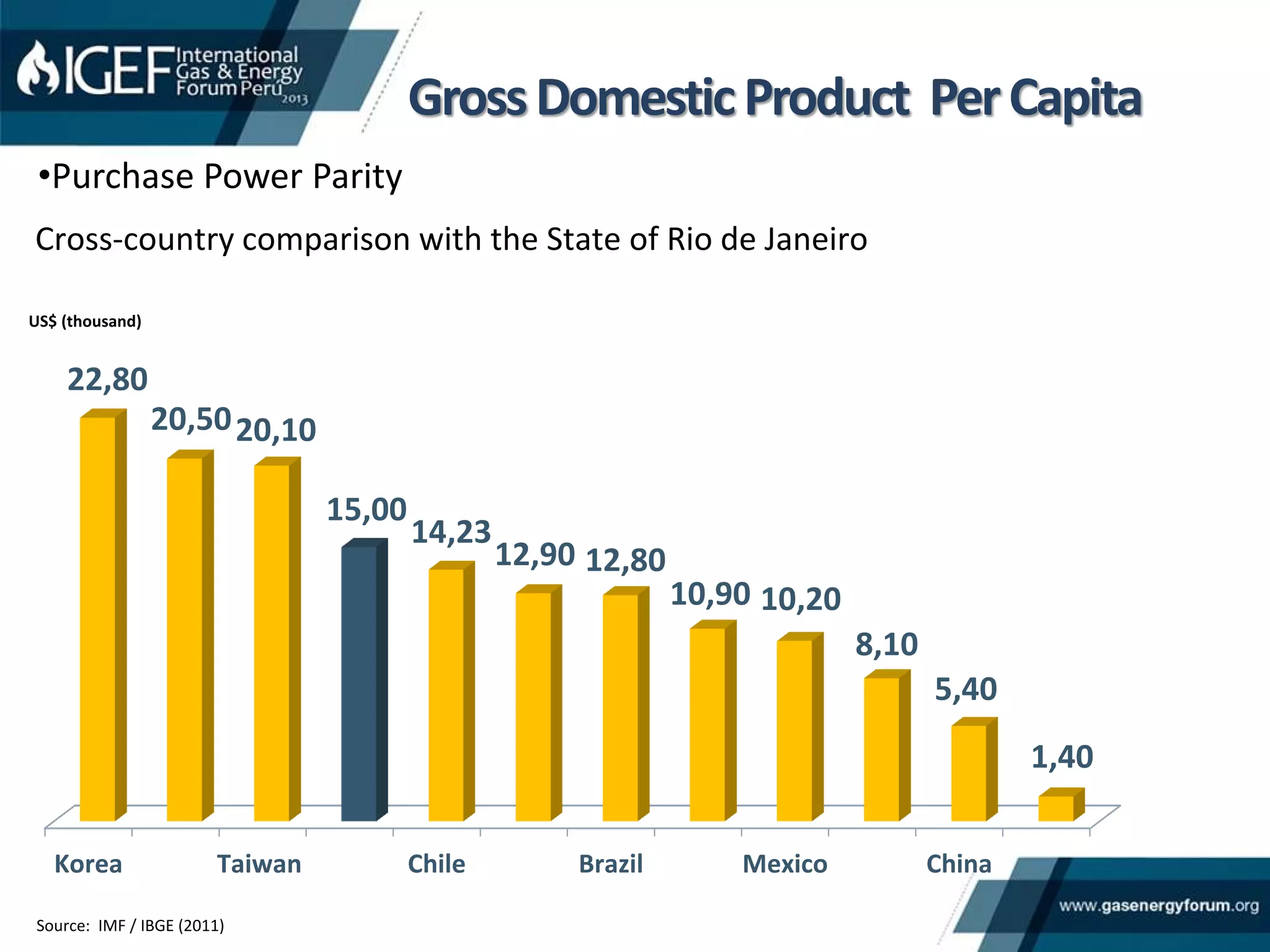

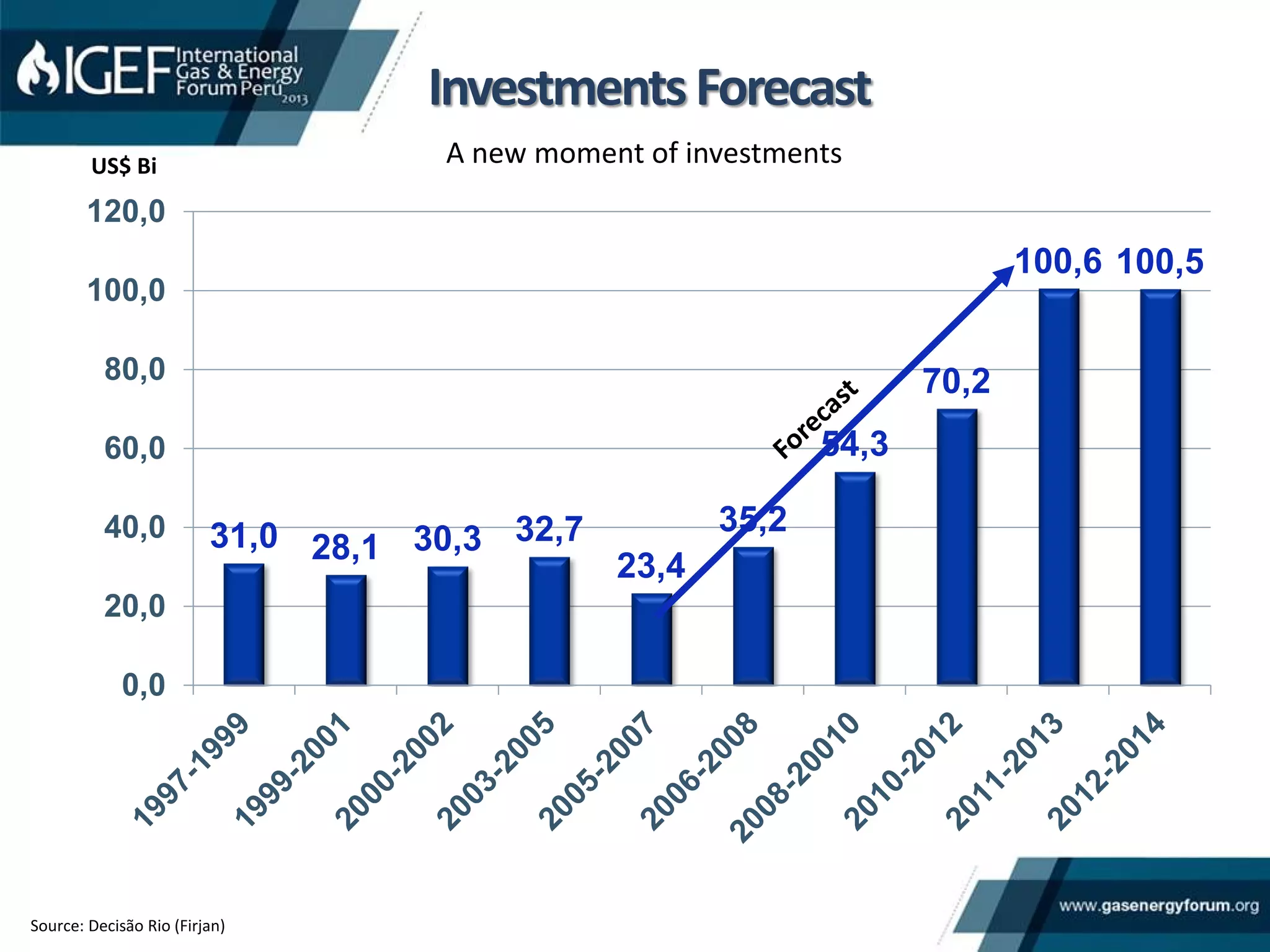

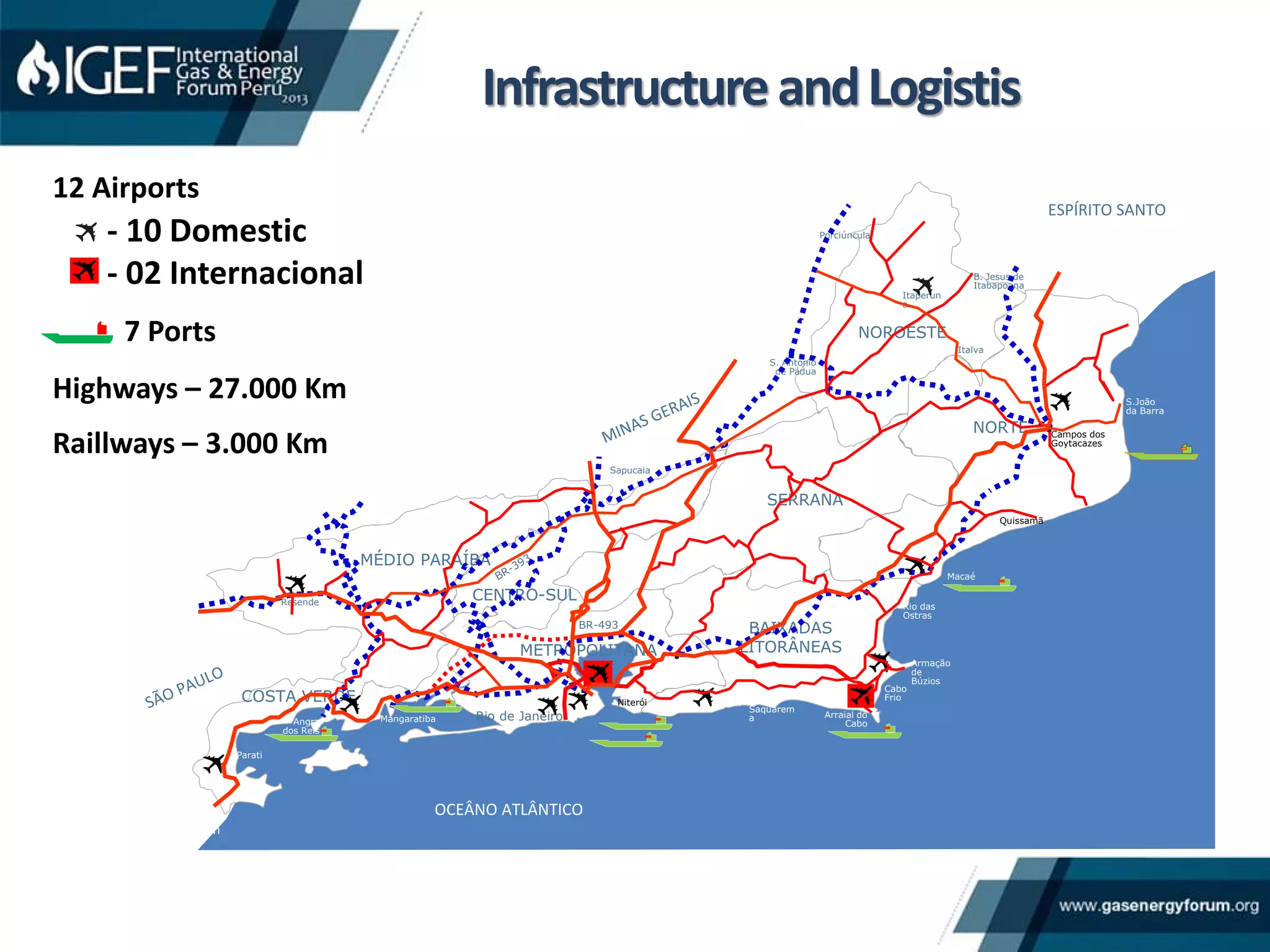

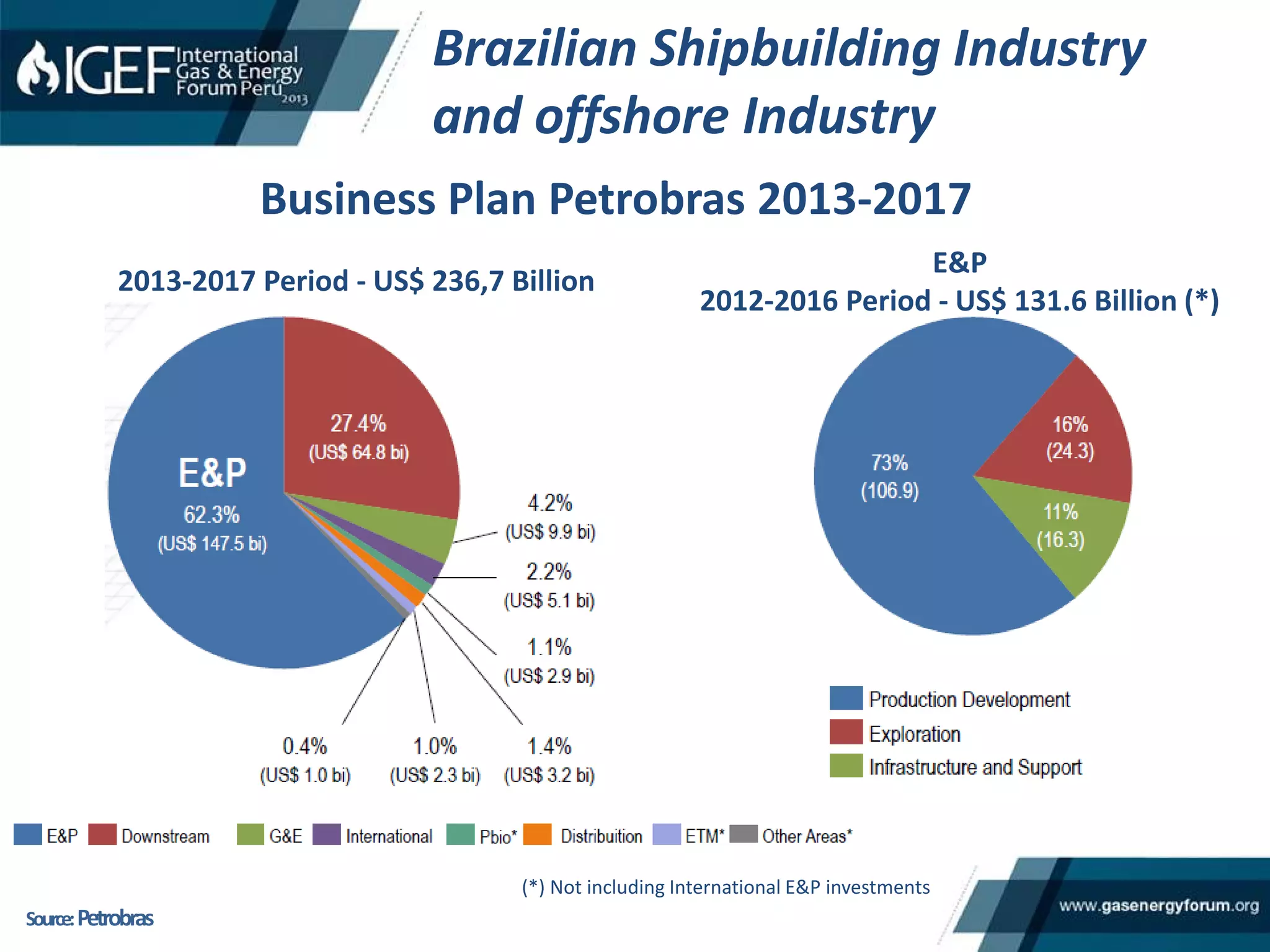

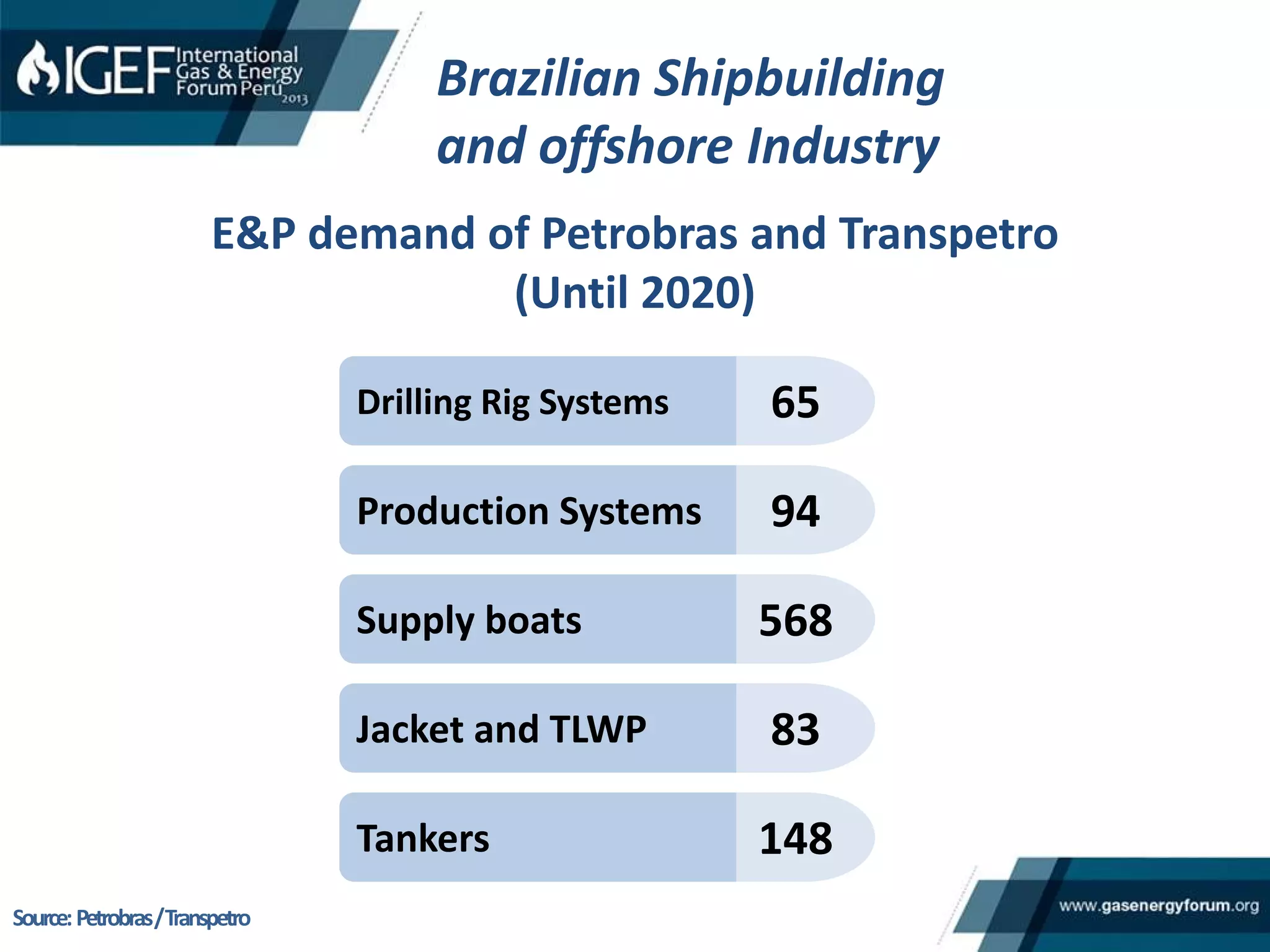

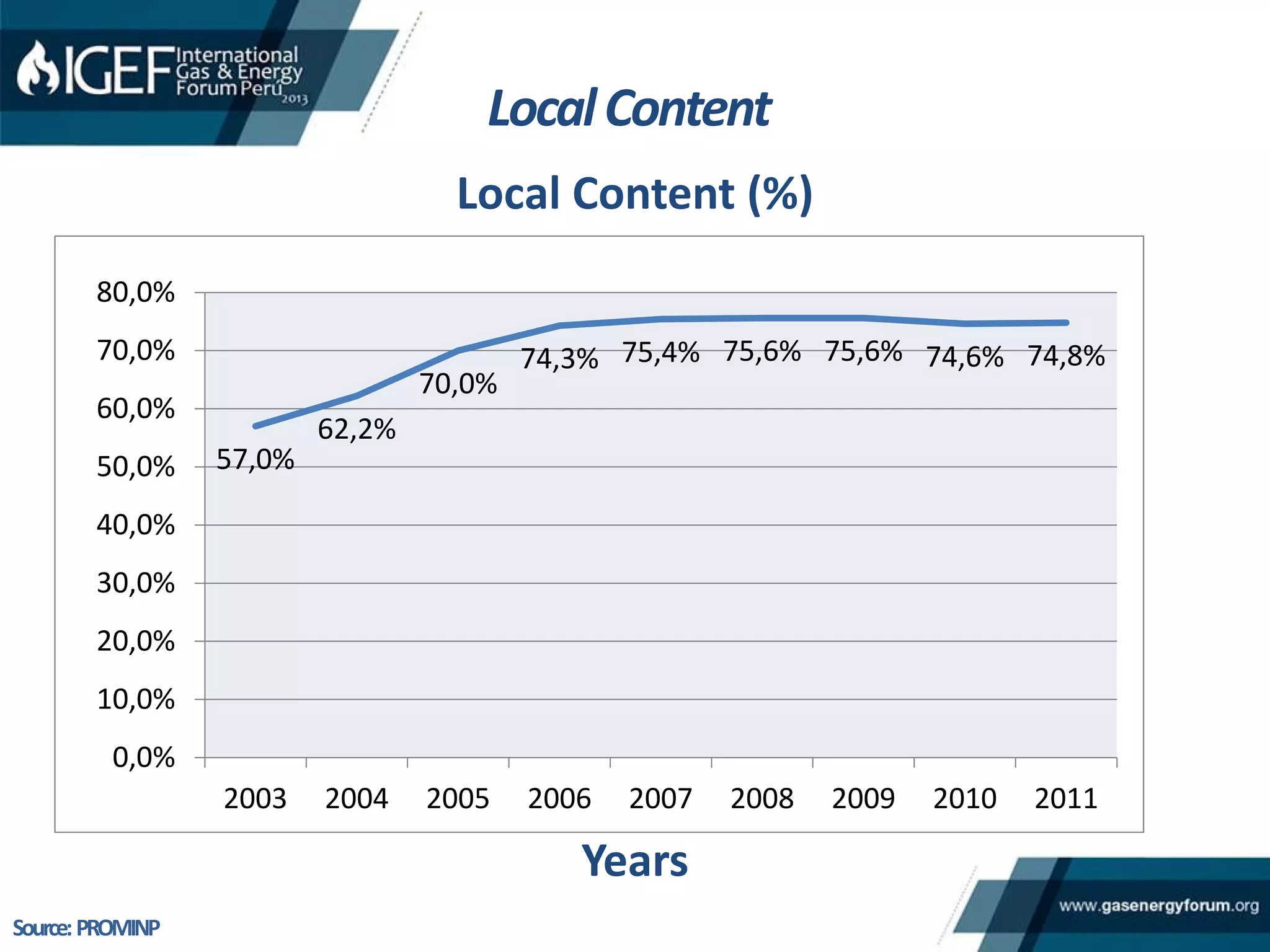

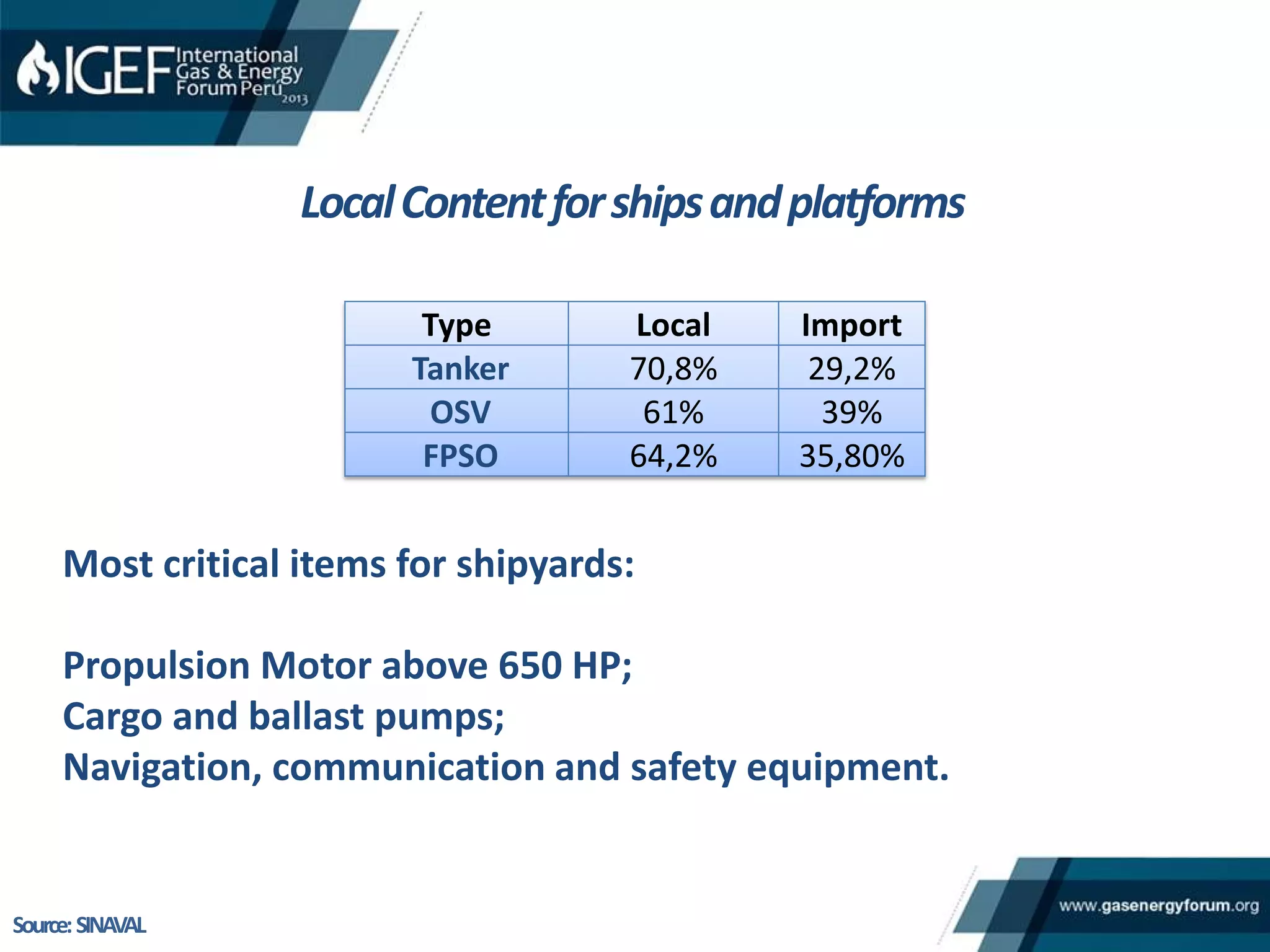

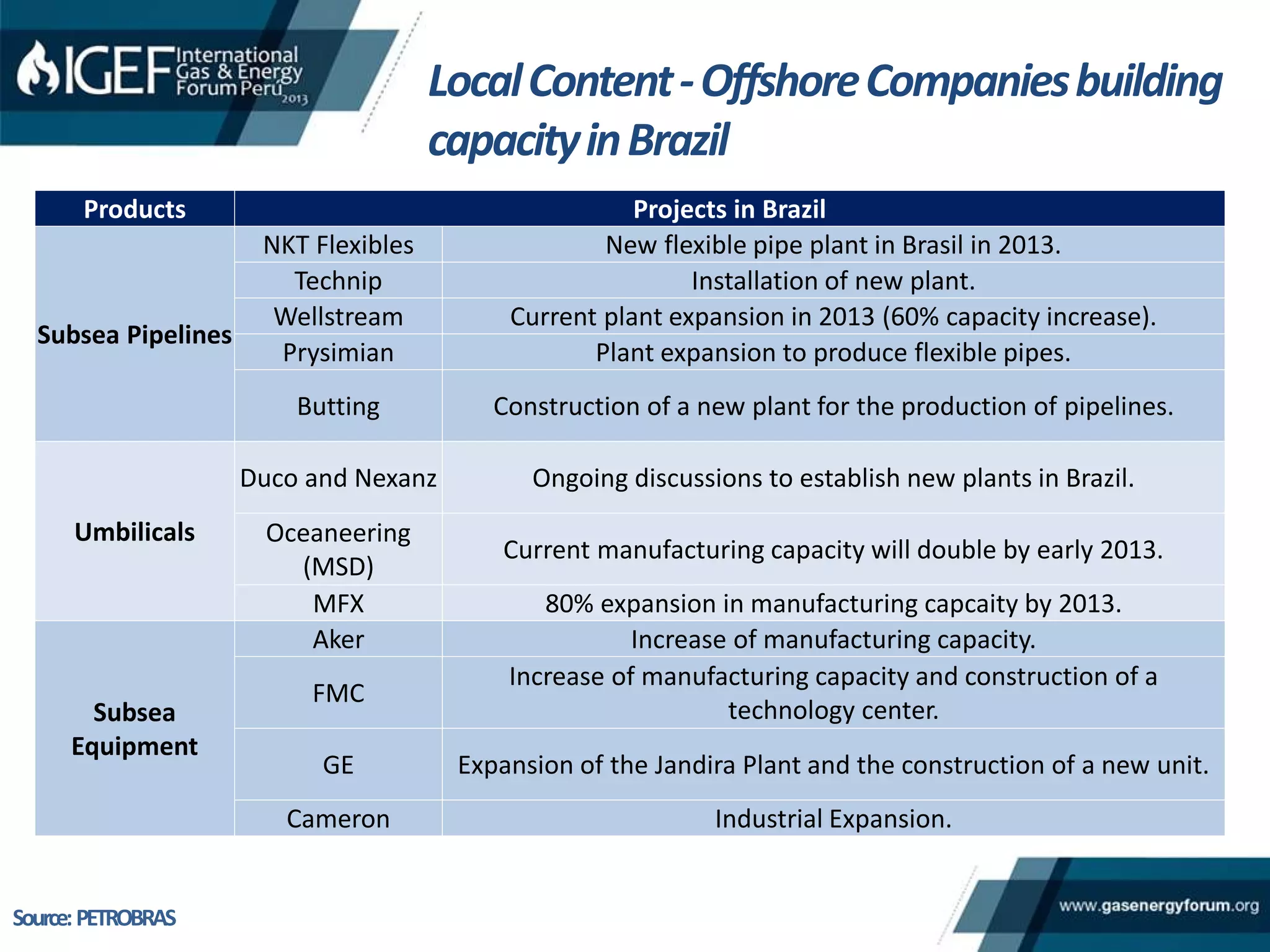

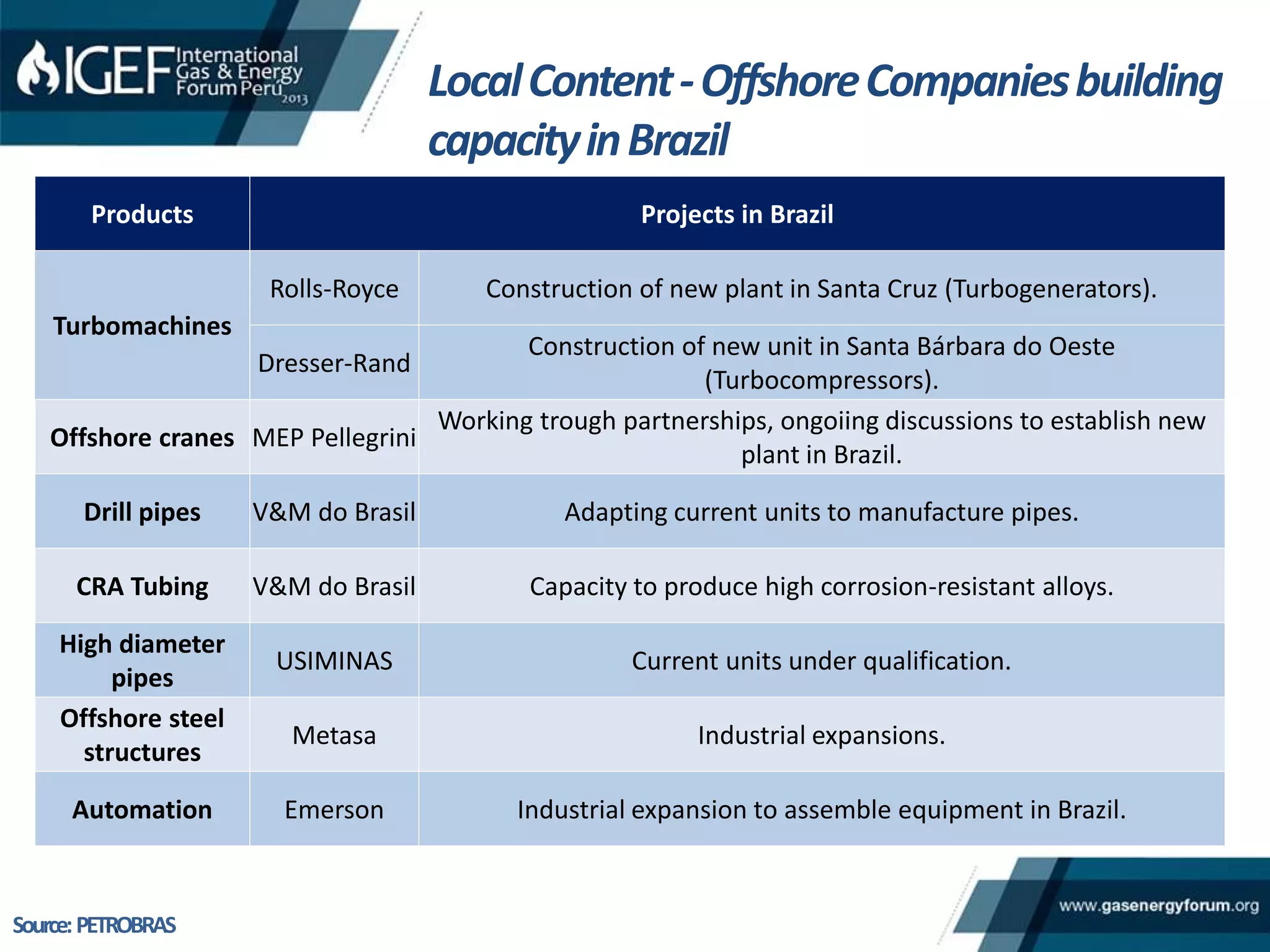

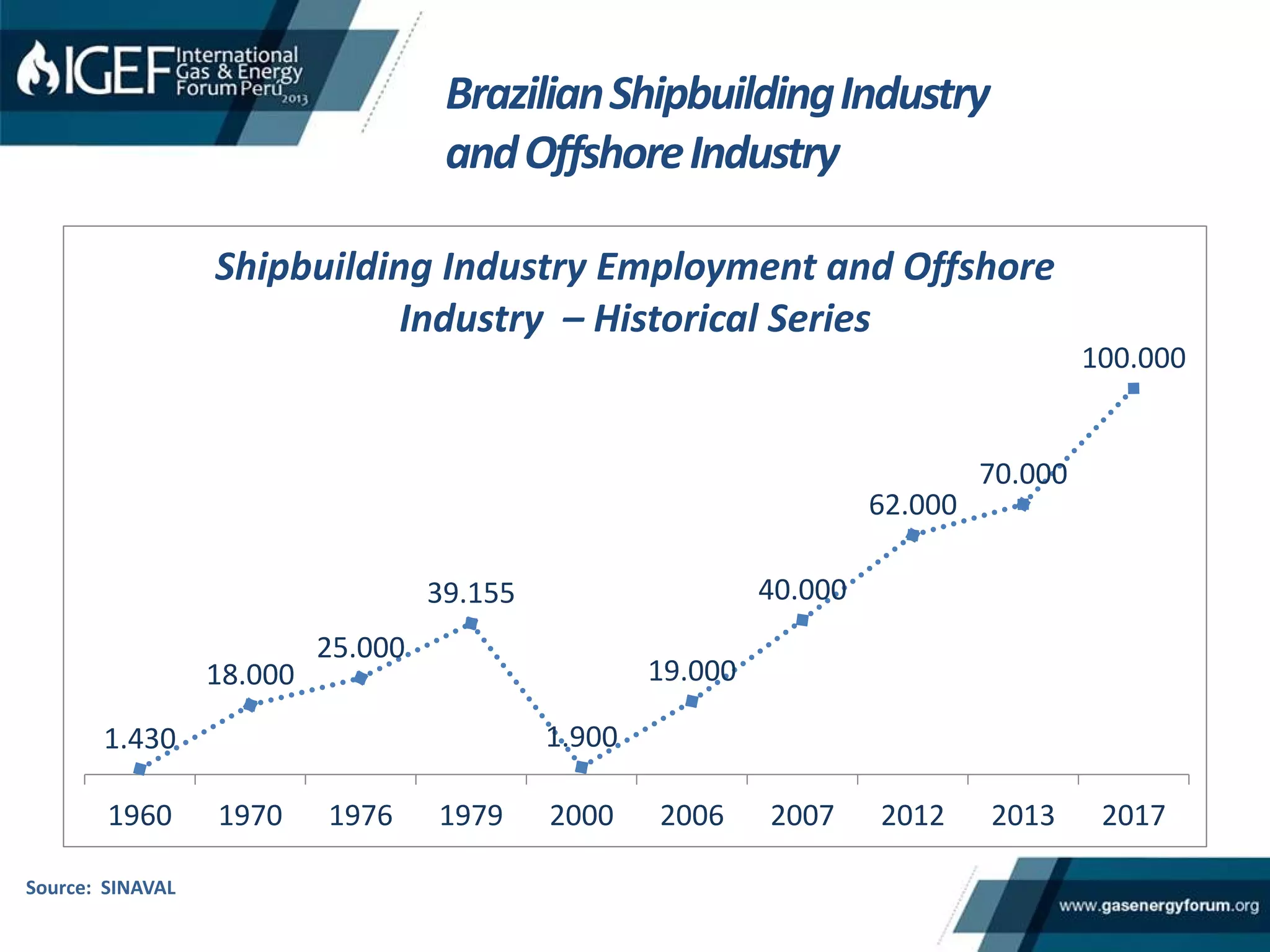

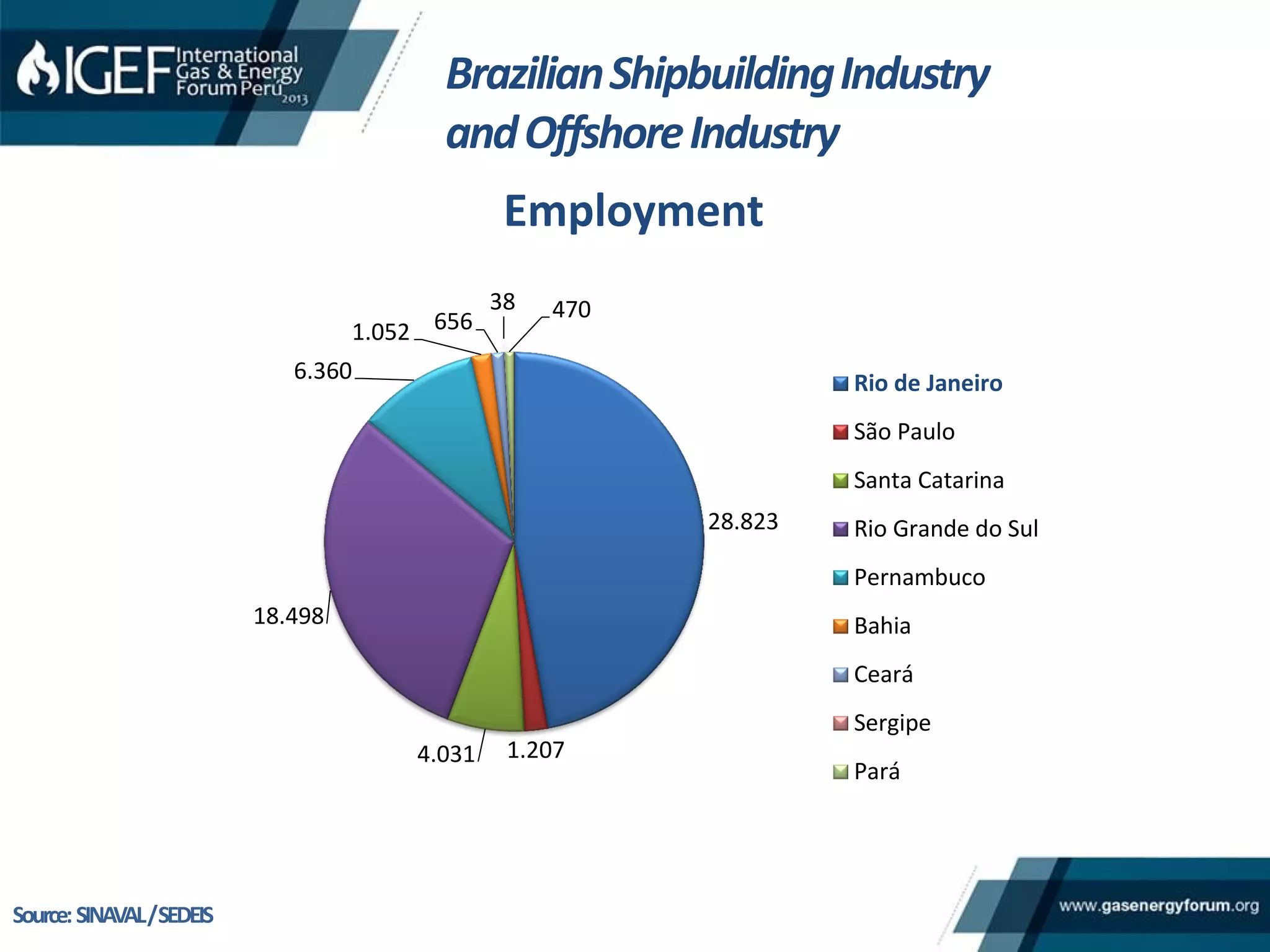

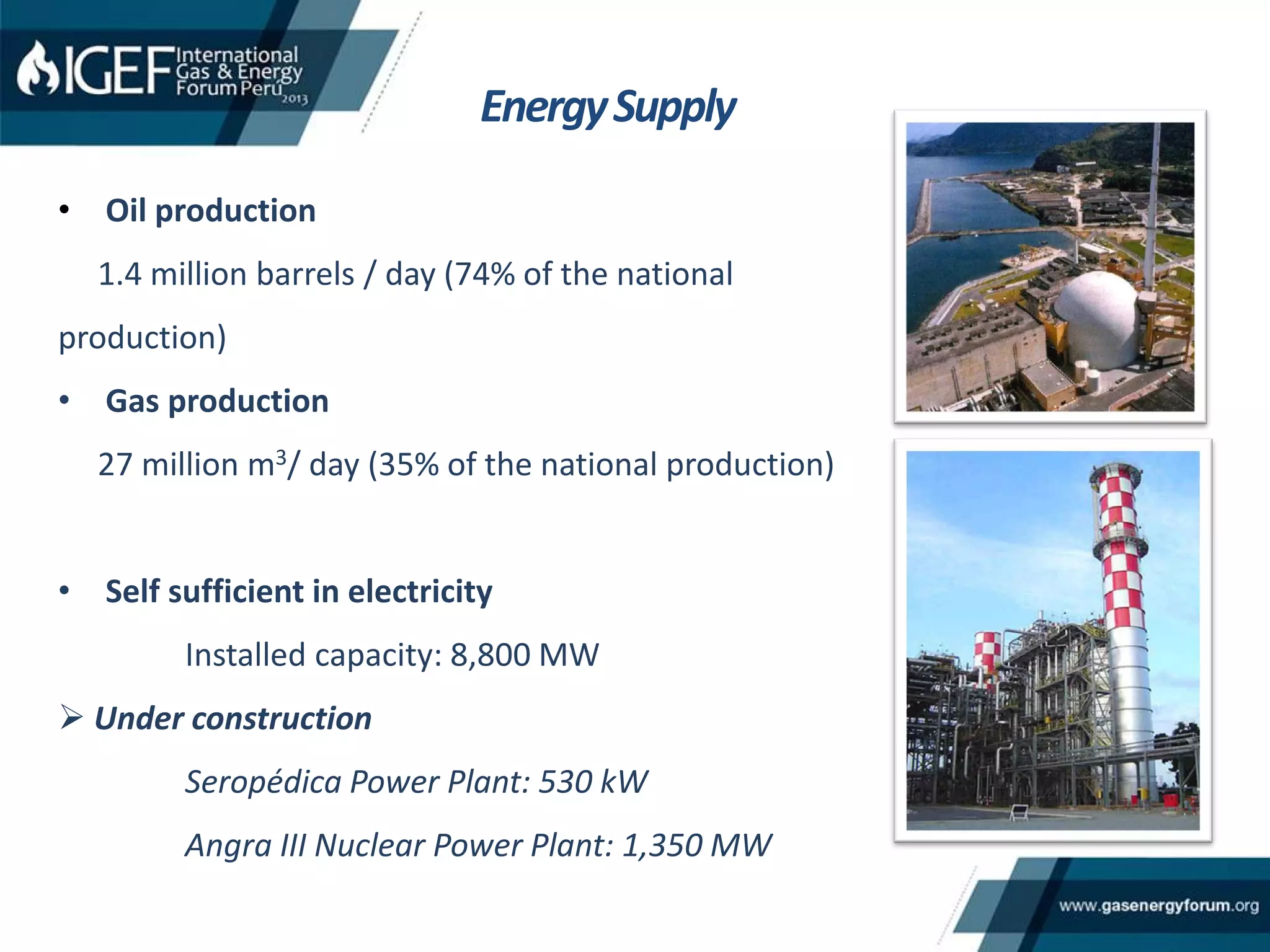

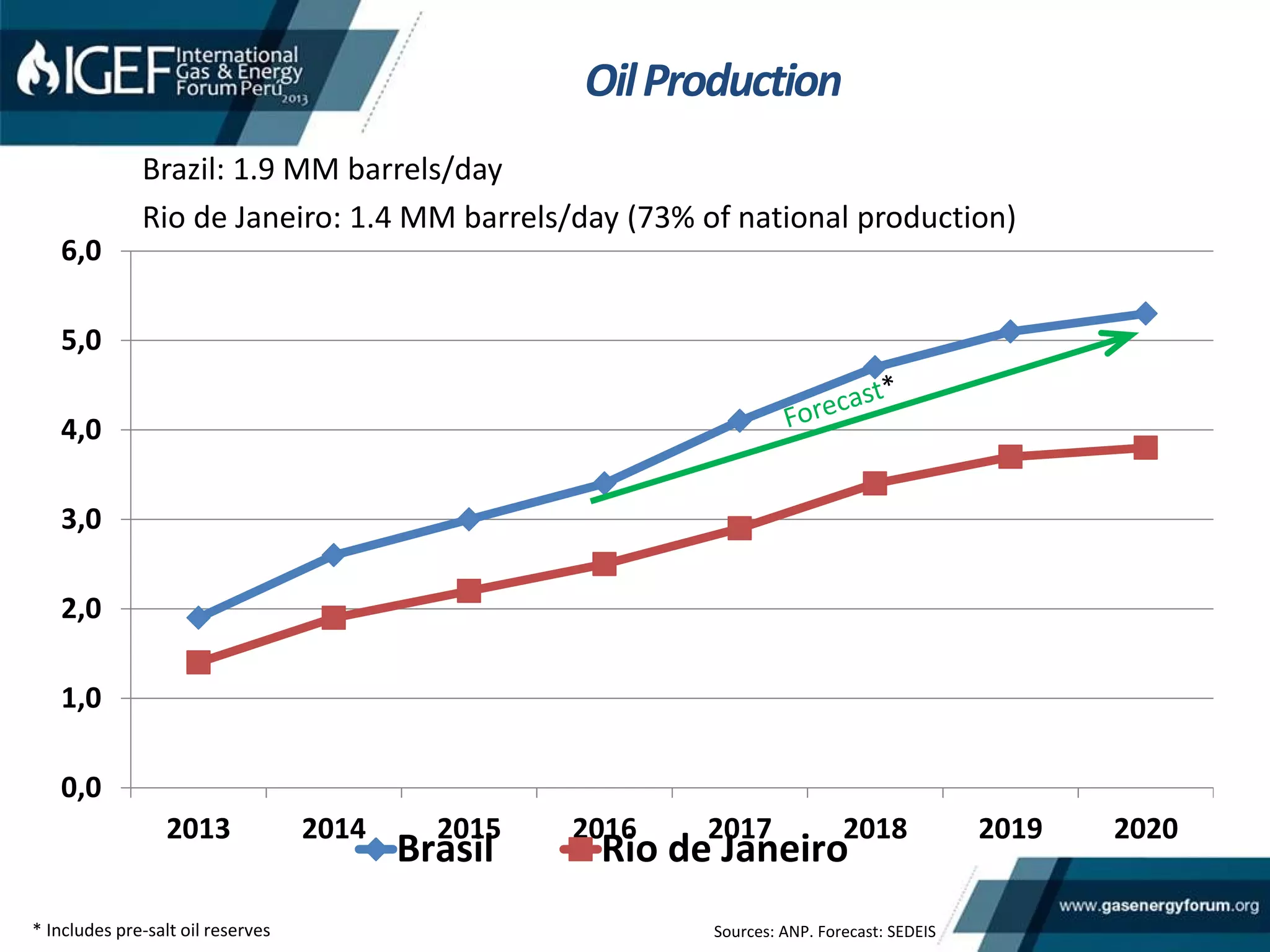

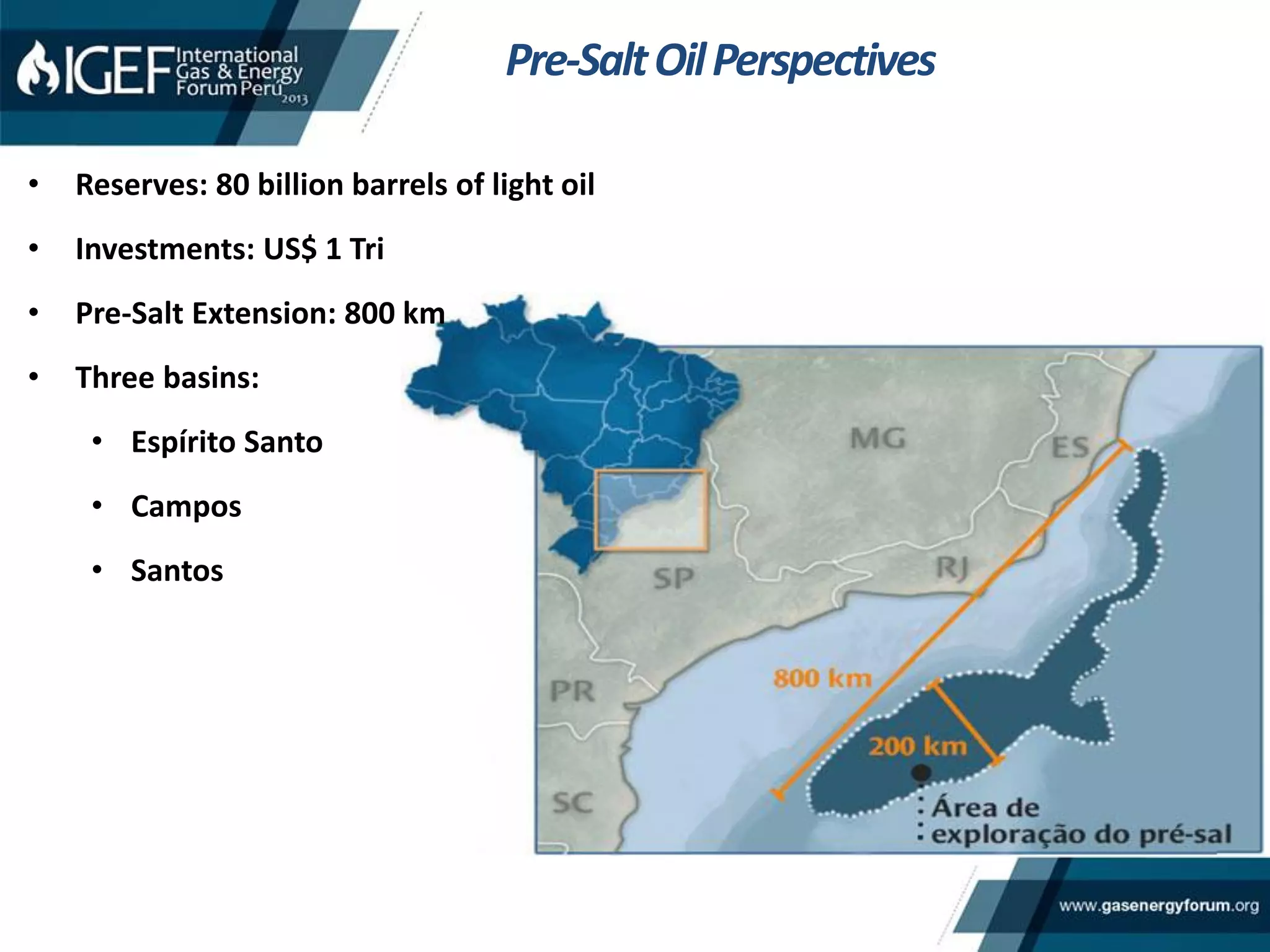

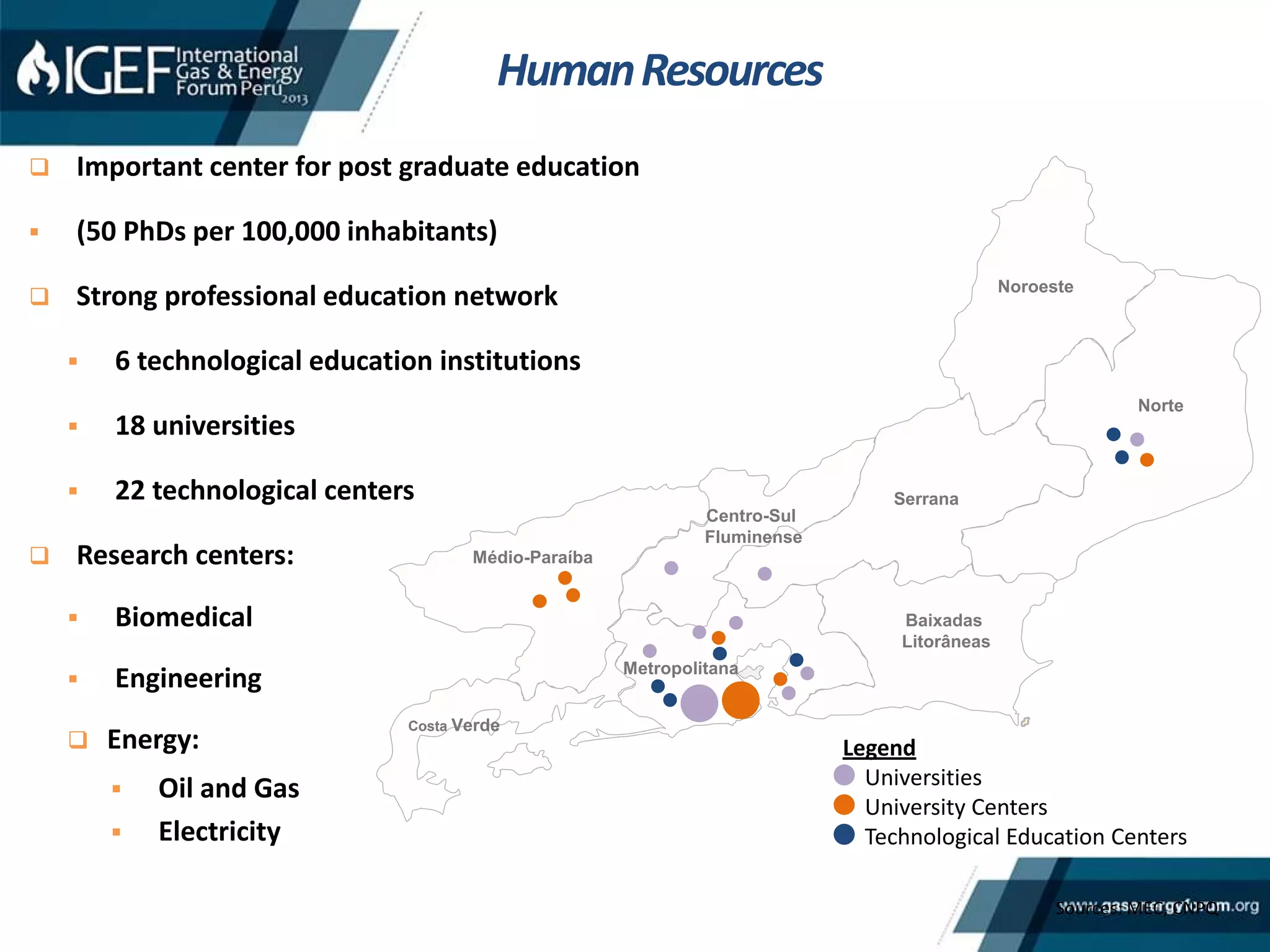

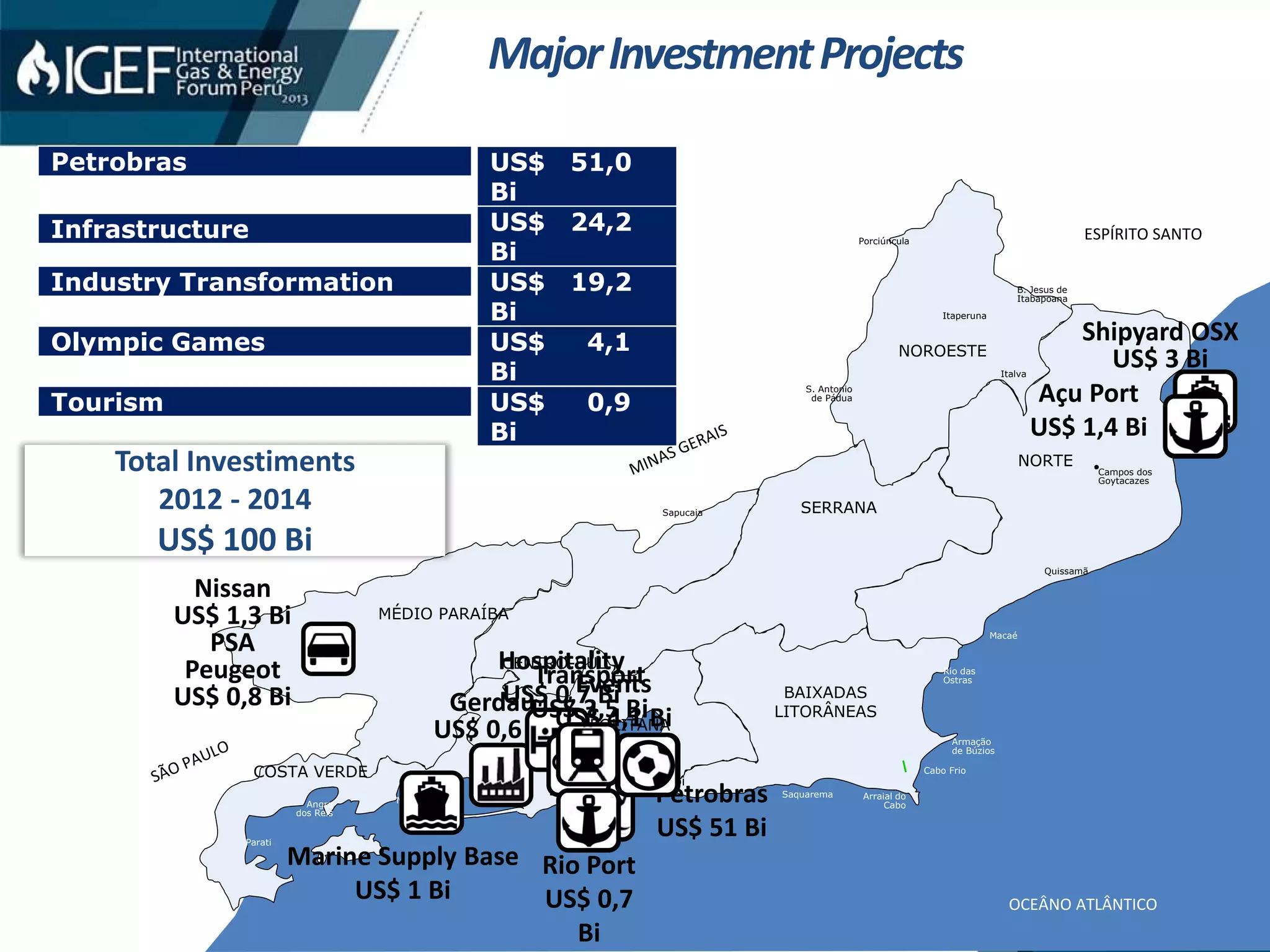

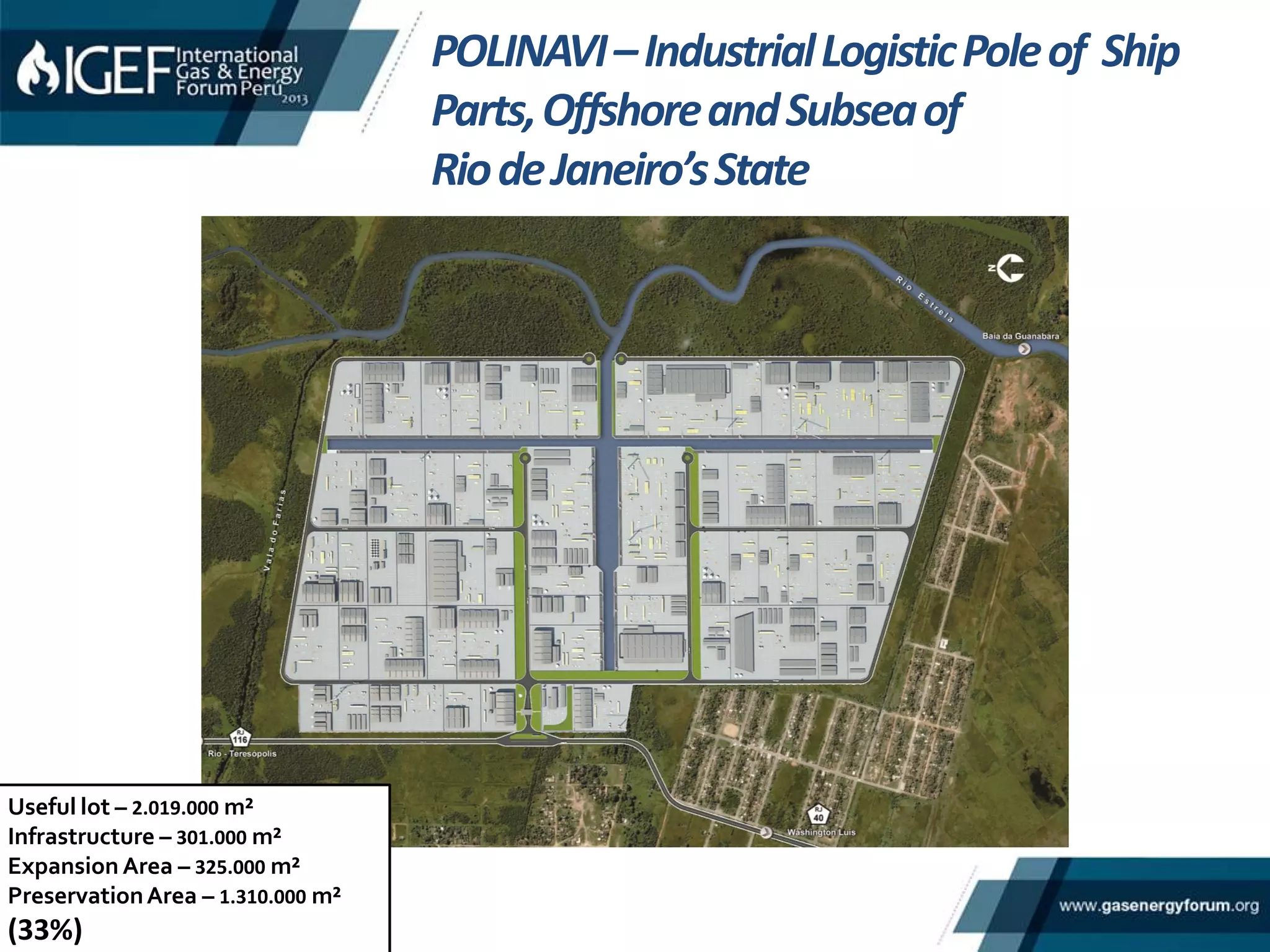

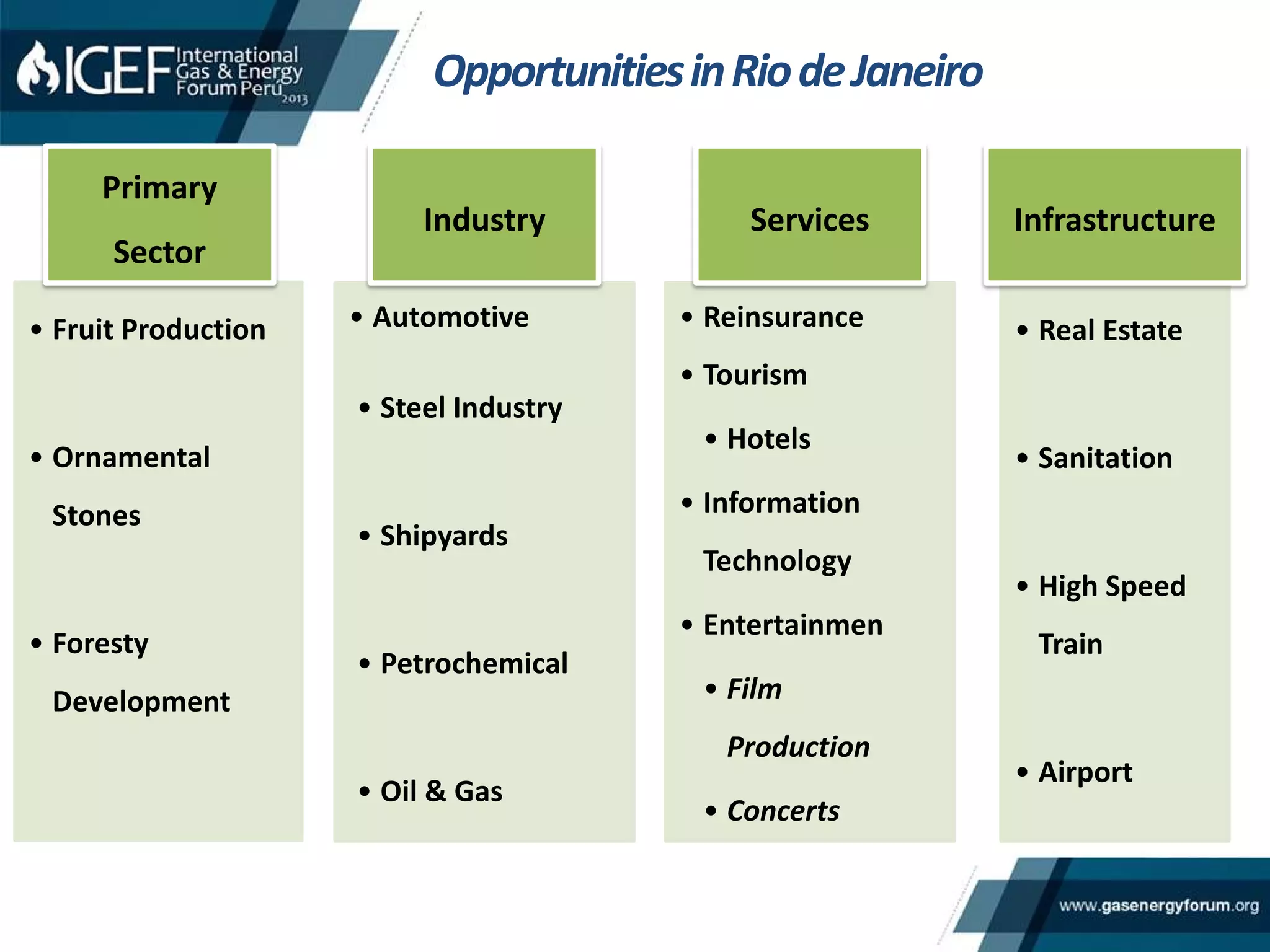

The document outlines the investment opportunities and economic development strategies in Rio de Janeiro, highlighting the region's growth in sectors such as energy, industry, and services. It emphasizes local content and infrastructure investment aimed at maximizing domestic industry participation and generating employment. With significant potential in oil and gas production, as well as various major investment projects, Rio de Janeiro is positioned as a key area for both local and foreign investors.