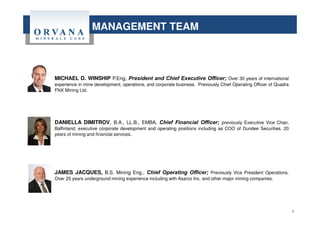

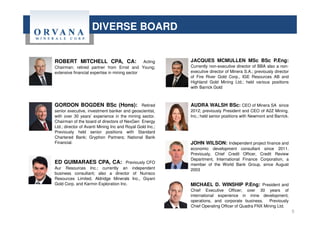

- Orvana Minerals held its annual general shareholders' meeting on February 26, 2014 to review the company's 2013 accomplishments and operations and provide an outlook for 2014.

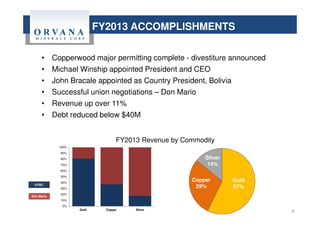

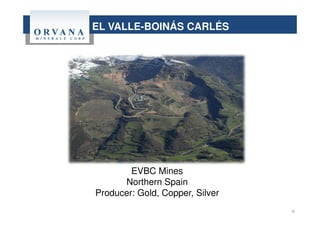

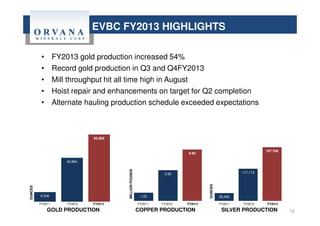

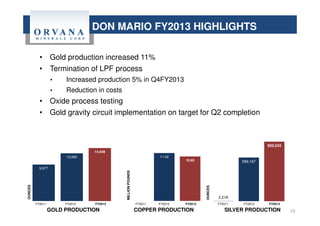

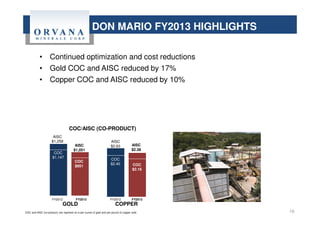

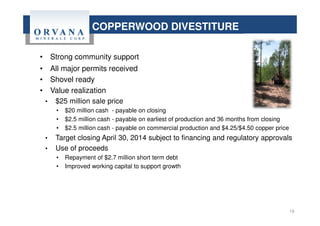

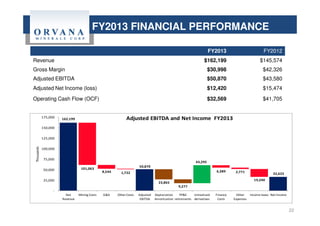

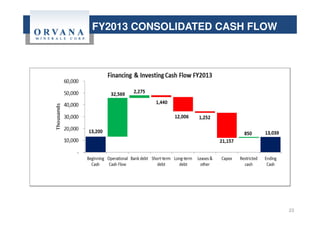

- In 2013, Orvana achieved record production across its operations in Spain and Bolivia, increased revenues by 11%, reduced debt levels, and completed key permitting for its Copperwood project leading to a sale announcement.

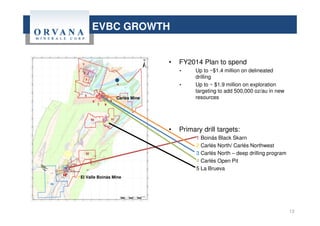

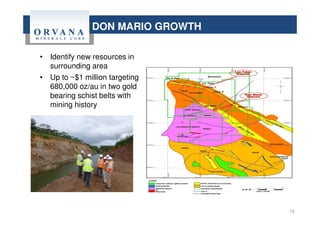

- For 2014, Orvana aims to invest in drilling programs to expand resources at its El Valle-Boinás/Carlés and Don Mario mines and expects consolidated gold production of 80-93k ounces, copper production of 18-20 million pounds, and silver production of 875-950k ounces.