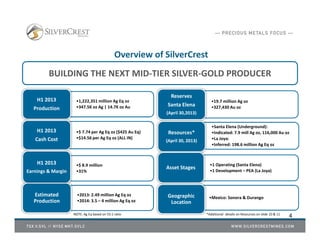

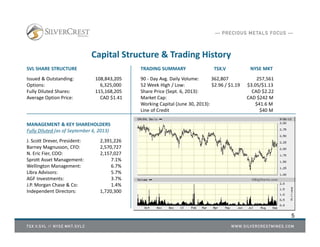

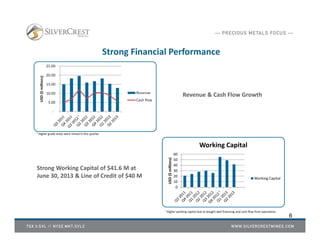

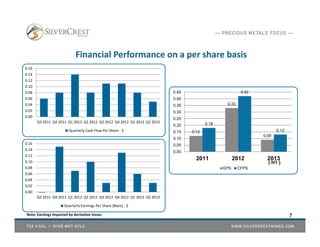

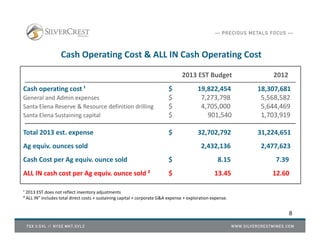

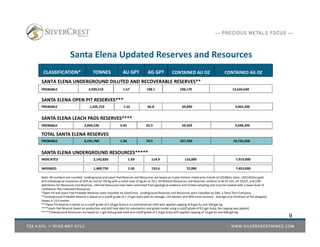

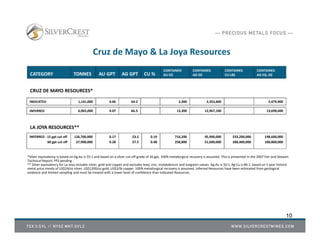

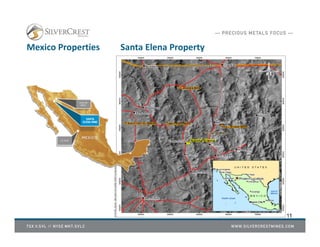

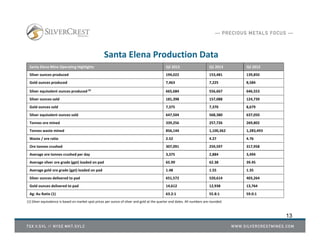

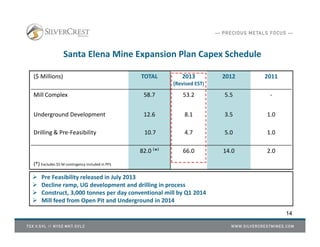

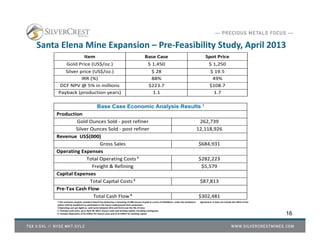

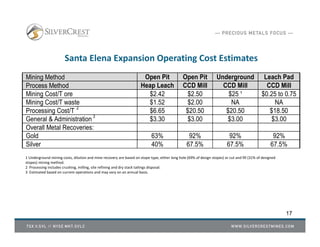

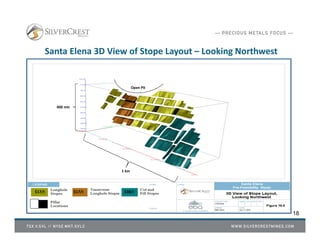

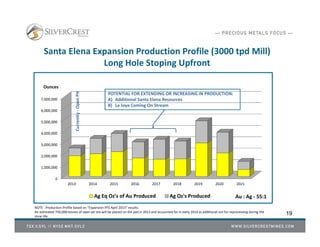

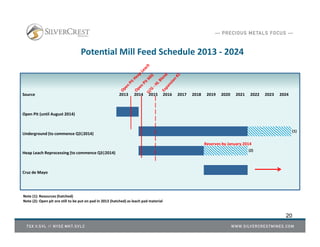

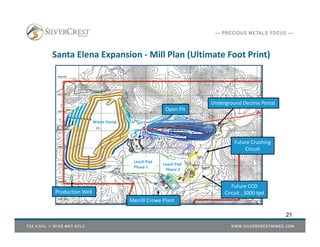

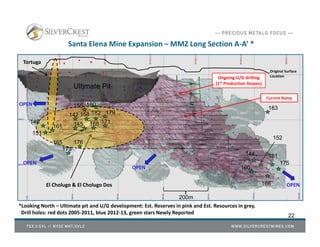

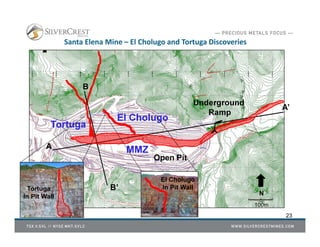

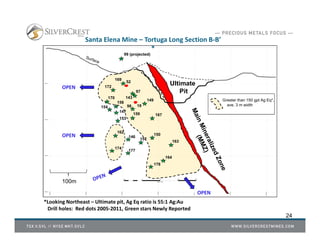

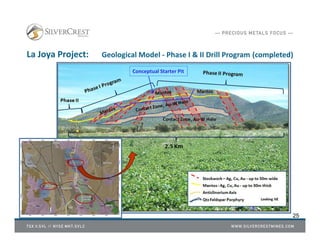

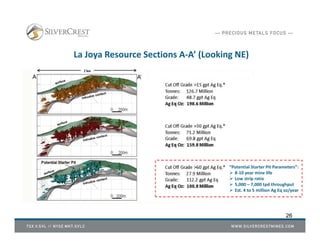

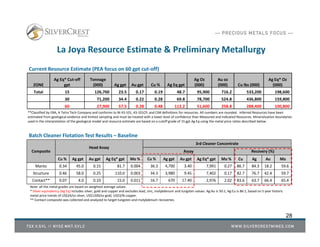

This corporate presentation from September 2013 outlines the company's financial performance, operational updates, and forward-looking statements regarding its mining activities, including risks that may affect future results. It includes a description of properties such as Santa Elena and La Joya, total reserves, production figures, and management team expertise. Investors are cautioned against relying solely on forward-looking statements due to inherent risks and uncertainties in the mining industry.