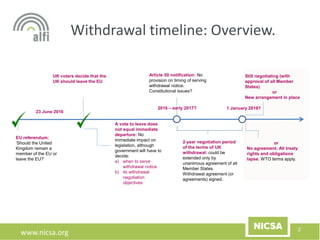

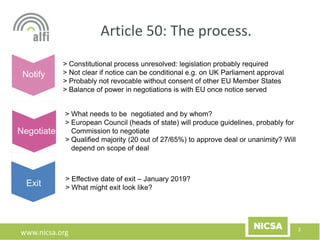

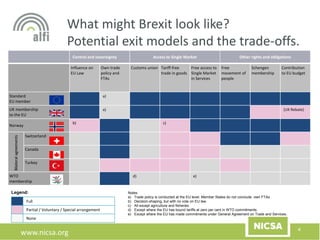

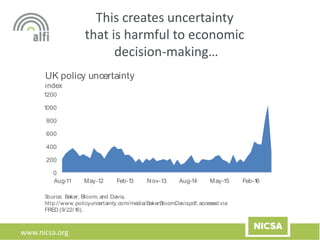

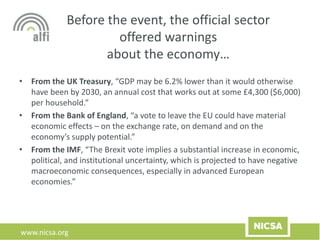

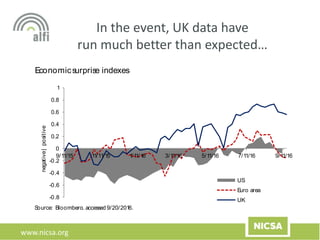

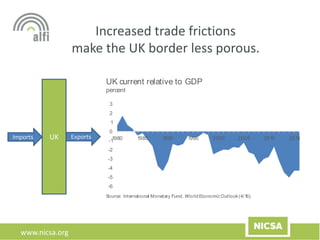

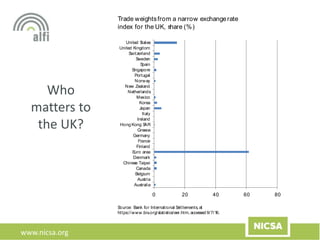

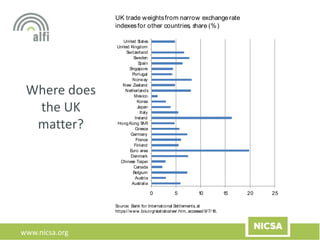

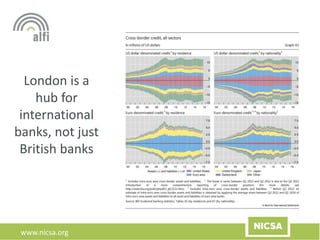

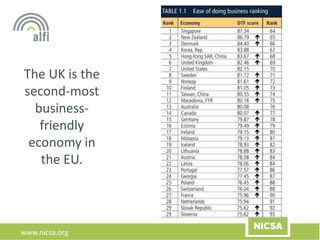

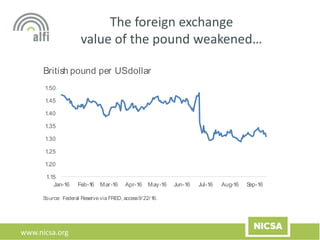

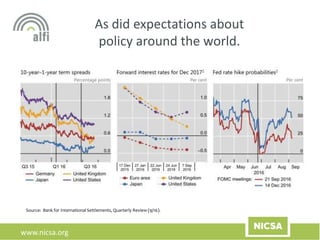

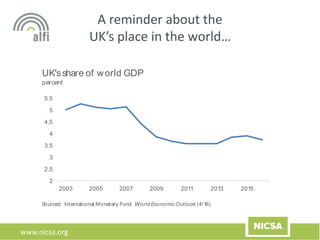

The document discusses the implications of Brexit on the UK and its economic landscape, focusing on the withdrawal process, potential exit models, and the impact on investment funds. It highlights uncertainties arising from the withdrawal timeline and possible economic consequences, such as trade frictions and impacts on the financial sector. The document also presents data on market responses, expectations, and the UK's position in the world economy.