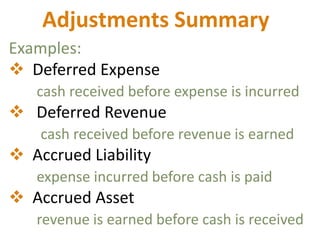

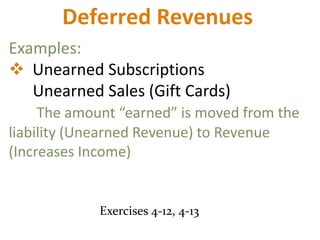

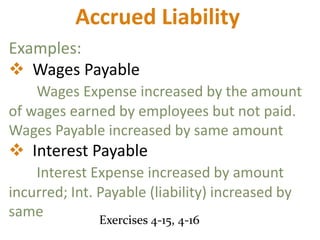

This document defines and provides examples of different types of adjustments including deferred expenses, deferred revenues, accrued liabilities, and accrued assets. Deferred expenses and revenues relate to cash received before the associated expense is incurred or revenue is earned. Accrued liabilities and assets relate to expenses incurred or revenues earned before cash is paid or received. Specific examples provided include supplies, prepaid rent, unearned subscriptions, wages payable, interest payable, rent receivable, and interest receivable.