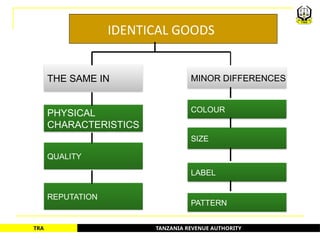

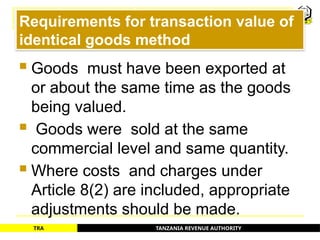

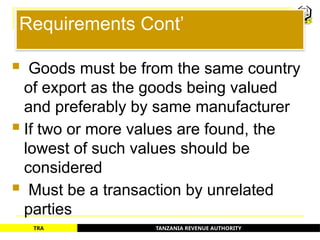

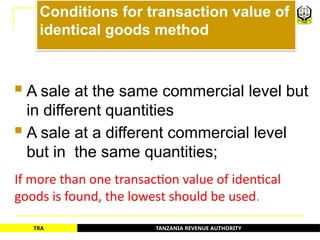

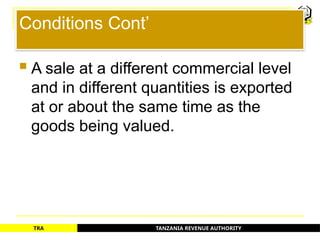

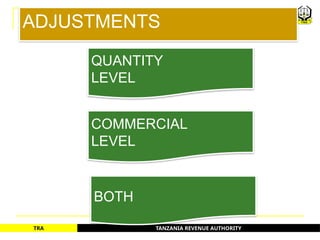

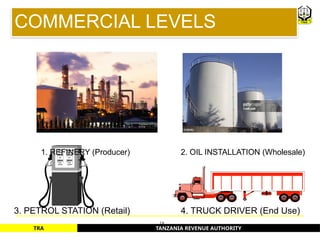

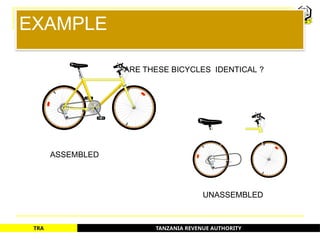

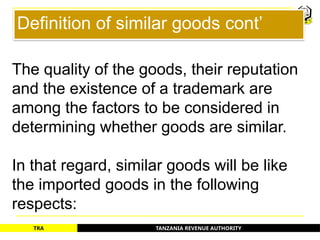

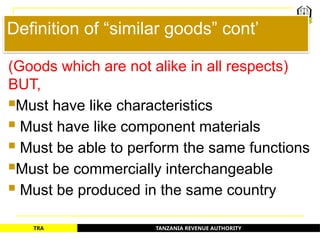

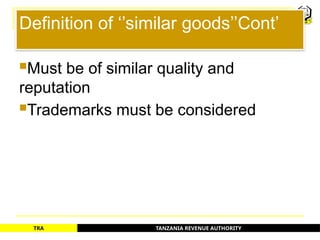

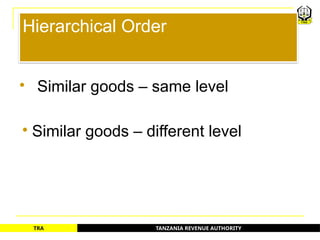

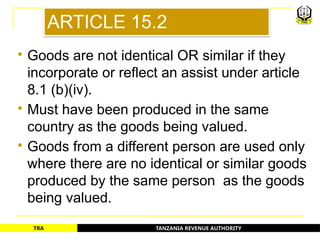

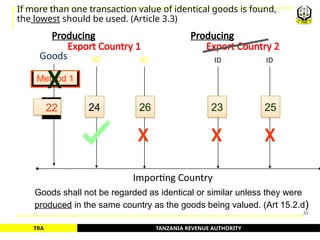

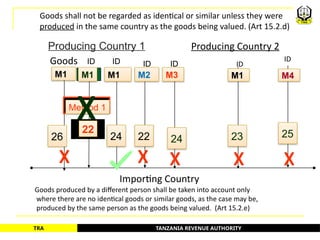

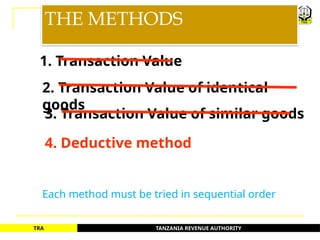

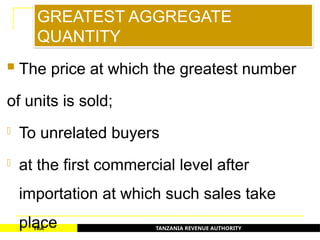

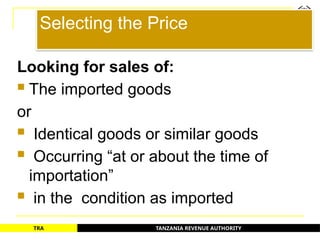

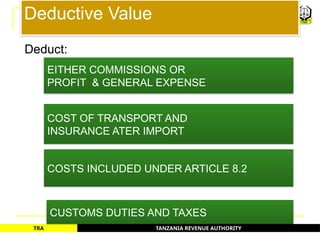

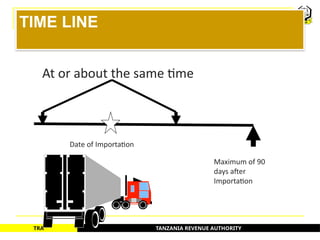

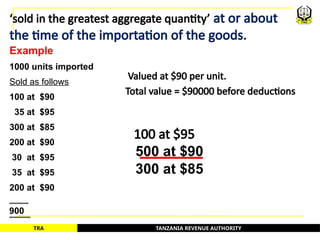

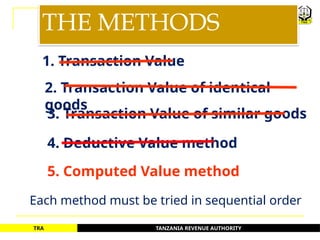

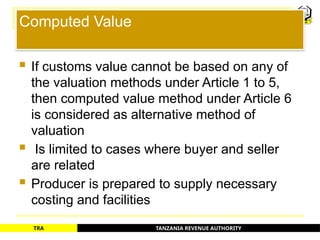

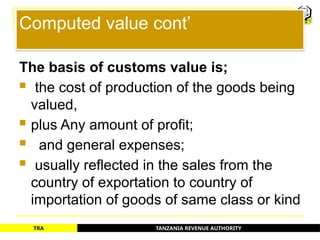

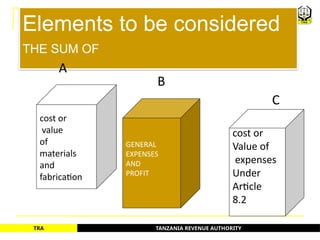

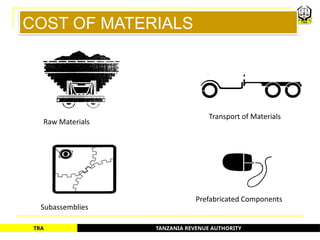

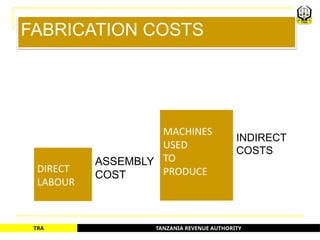

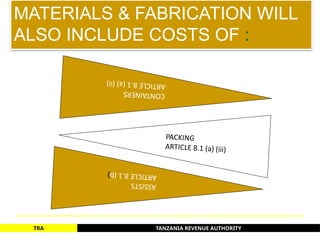

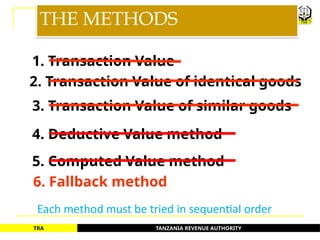

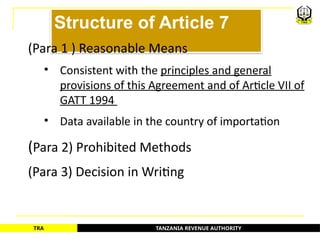

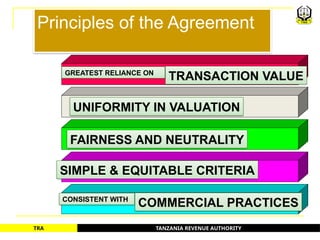

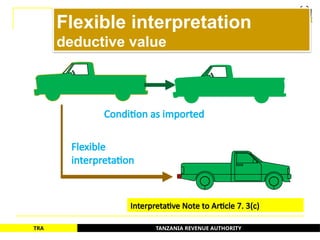

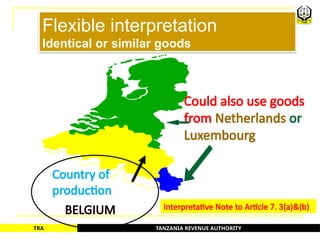

The document outlines various methods of customs valuation as per the Tanzania Revenue Authority, including methods for transaction value of identical and similar goods, and deductive and computed value methods. Each method has specific requirements and conditions that must be met, and must be used in a hierarchical order. The fallback method provides a way to determine customs value when no other valuation method applies, emphasizing reasonable adjustments based on previously determined values.