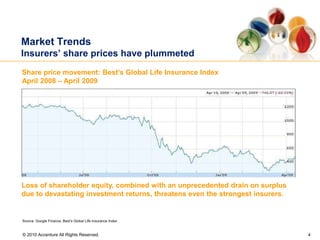

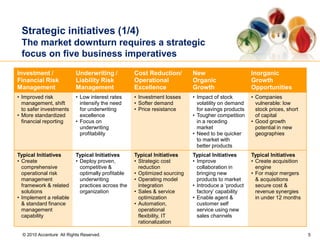

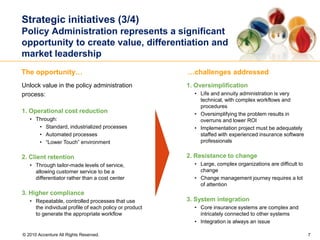

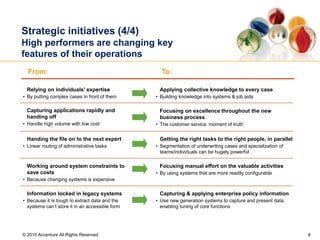

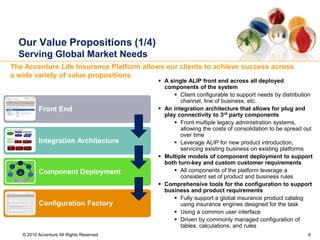

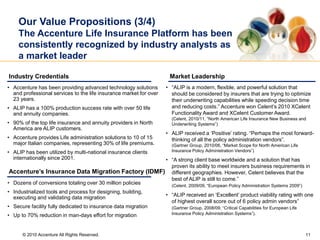

This document is a presentation deck for Accenture's Life Insurance Platform solution. It begins with contact information for Accenture sales leads. The executive summary outlines Accenture's proven policy administration platform which has over 50 life and annuity clients. It then discusses market trends in the life insurance industry and five strategic initiatives for insurers - investment risk management, underwriting risk management, cost reduction, organic growth, and inorganic growth. The deck emphasizes that policy administration represents an opportunity for insurers to reduce costs, improve customer service, and gain competitive advantage. It positions Accenture as the partner to help insurers optimize administrative operations through its market-leading software and insurance expertise.