This document provides an overview of Avion Gold Corporation, including:

- Forward-looking statements about the company's projects and estimates.

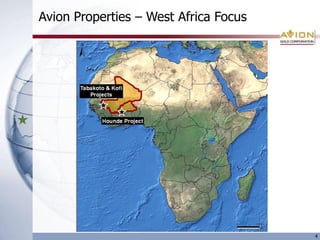

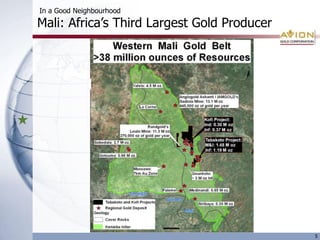

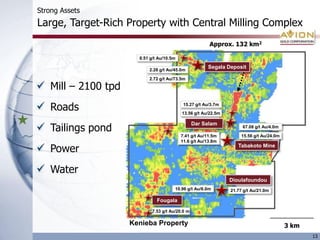

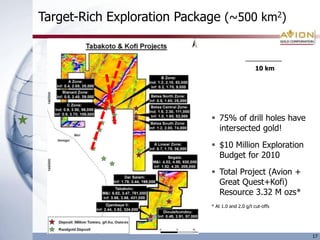

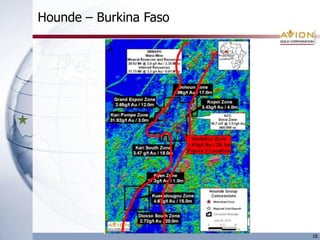

- Avion's focus on gold projects in West Africa, including Mali where it has large land holdings.

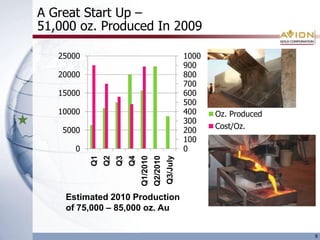

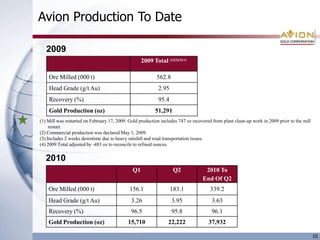

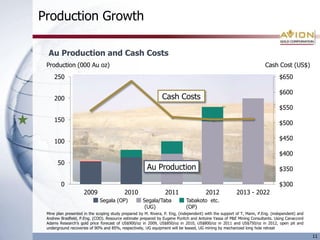

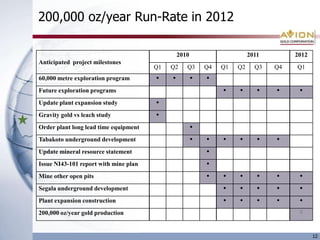

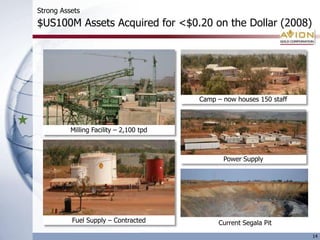

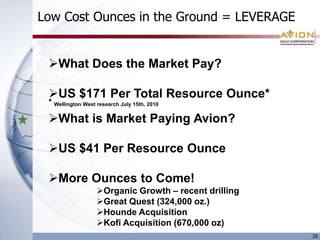

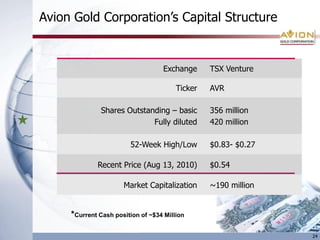

- Details of Avion's current and estimated future gold production, expanding from 75,000 ounces in 2010 to a 200,000 ounce run rate in 2012.

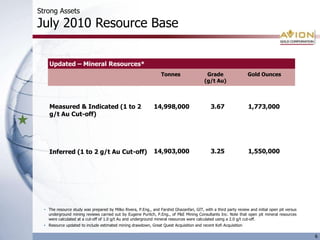

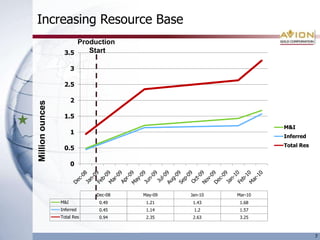

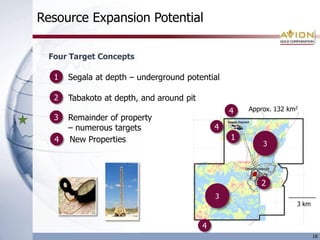

- Avion's goal of increasing its resource base through exploration of multiple targets on its properties.