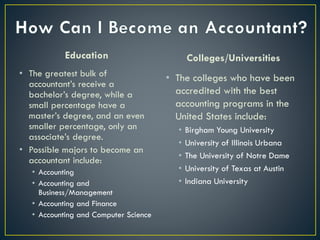

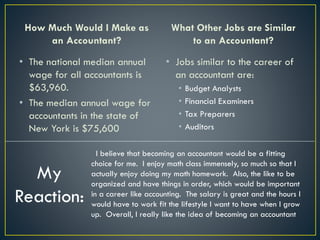

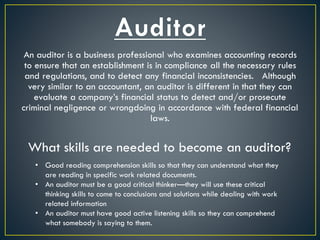

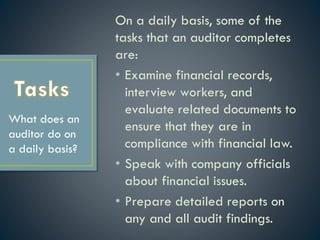

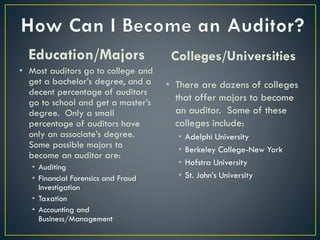

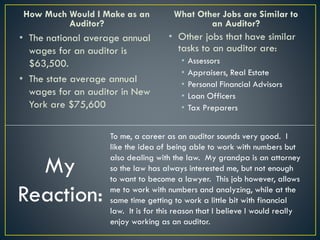

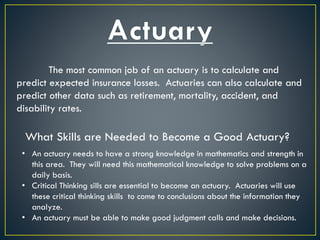

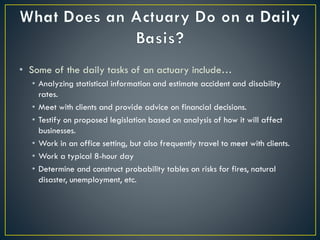

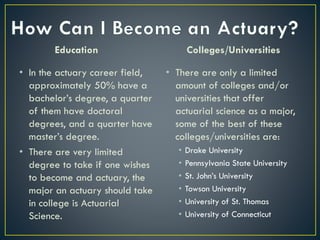

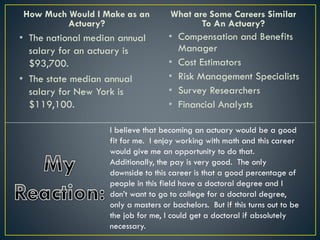

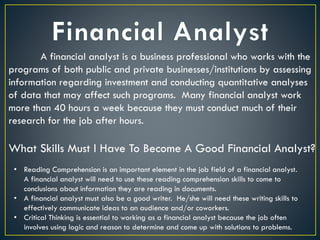

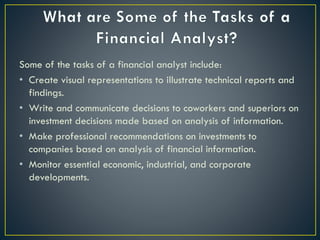

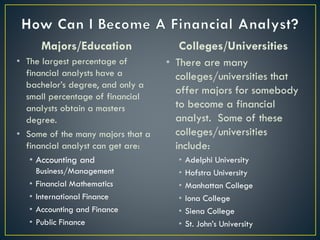

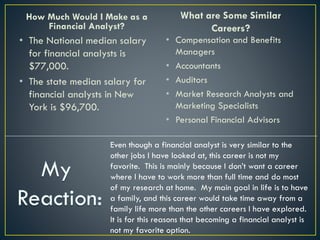

The document discusses the careers of accountant, auditor, actuary, and financial analyst. For accountants, the key skills are mathematics, active listening, and writing. Their tasks include maintaining financial records and analyzing data. For auditors, important skills are reading comprehension, critical thinking, and active listening. Their daily tasks include examining financial records and preparing audit reports. Actuaries need strong mathematics skills and critical thinking to calculate insurance and financial risk data. Financial analysts require reading comprehension, writing, and critical thinking to assess investments and make recommendations based on financial analysis. All four careers typically require at least a bachelor's degree.