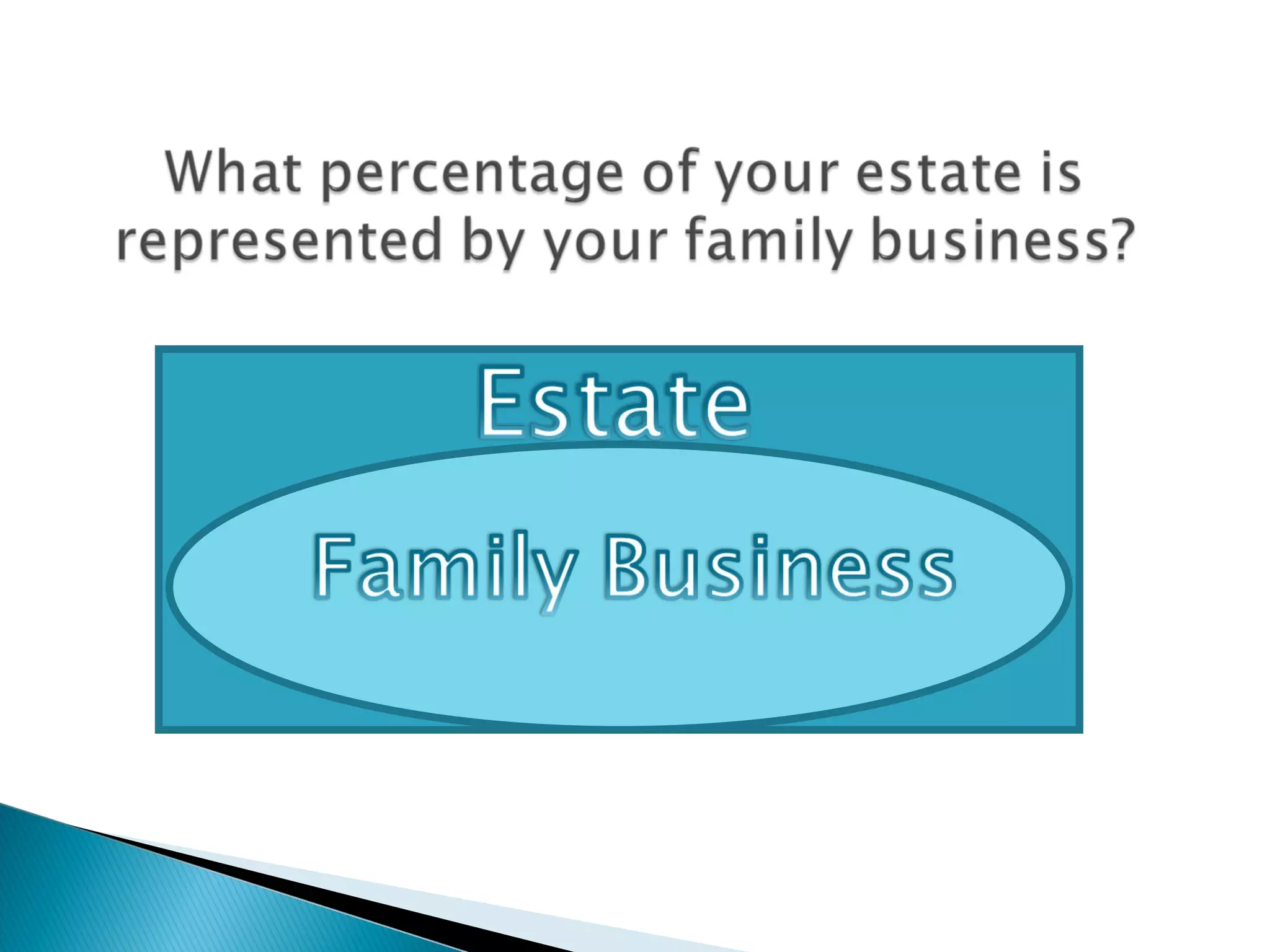

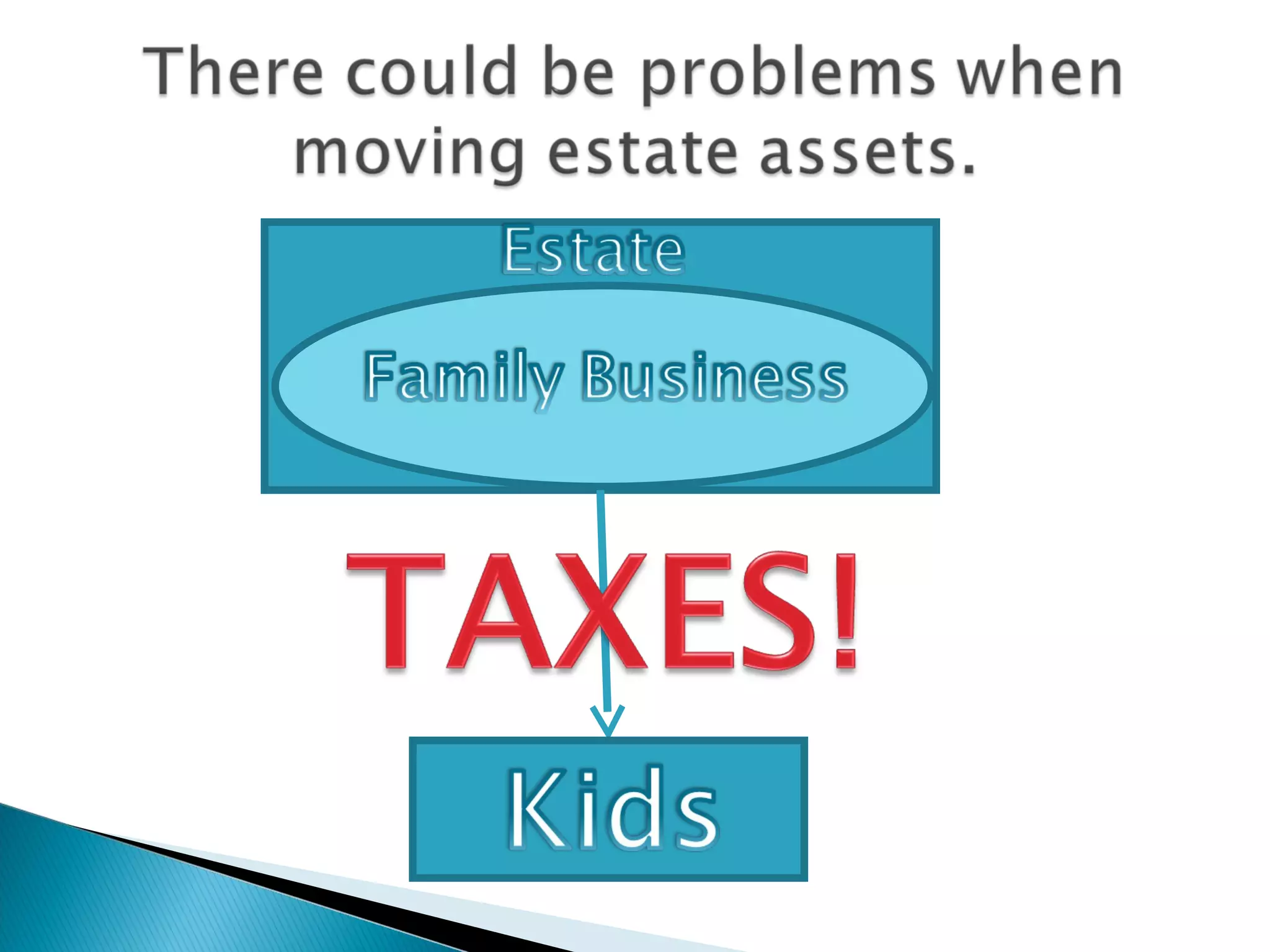

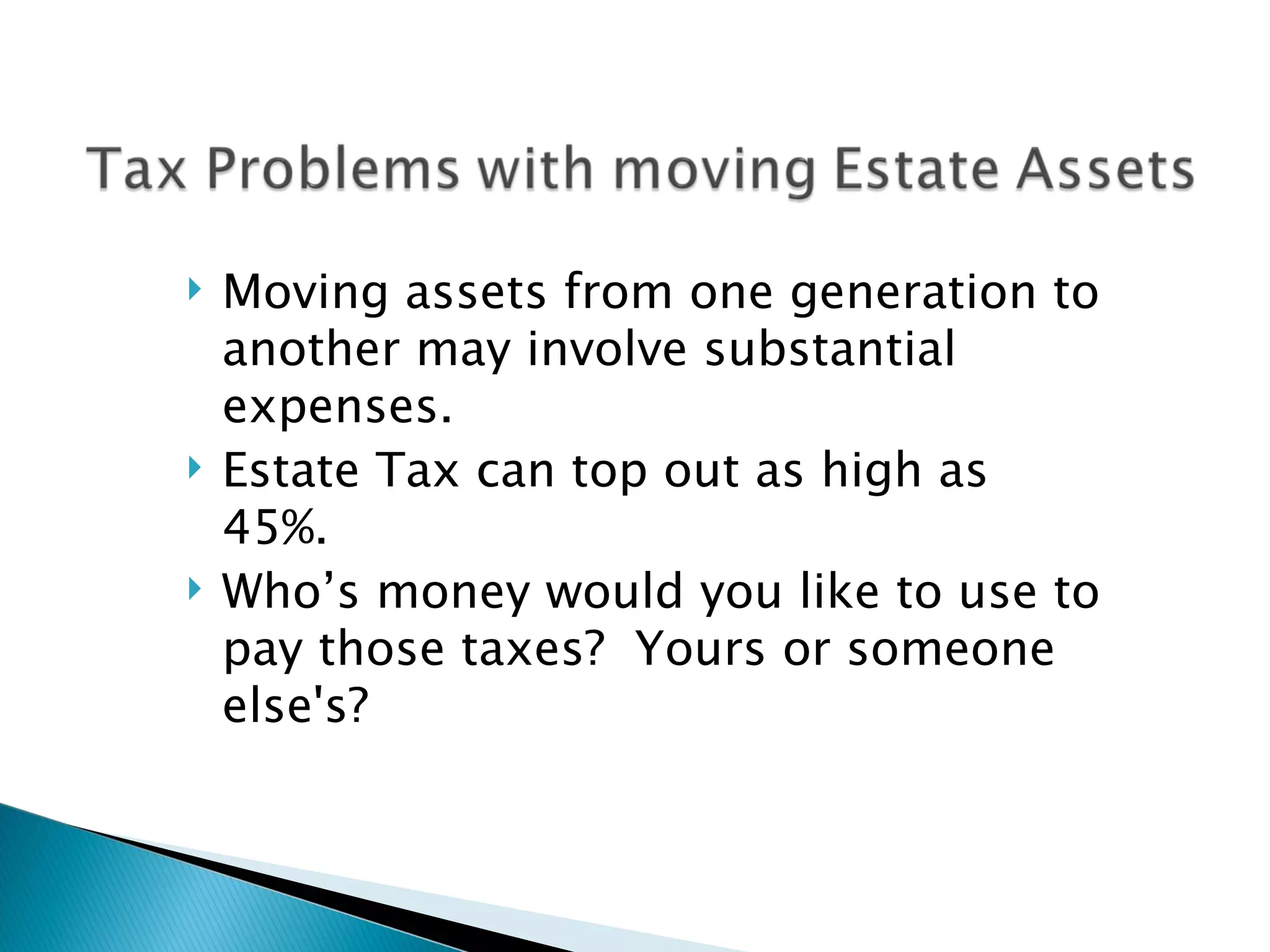

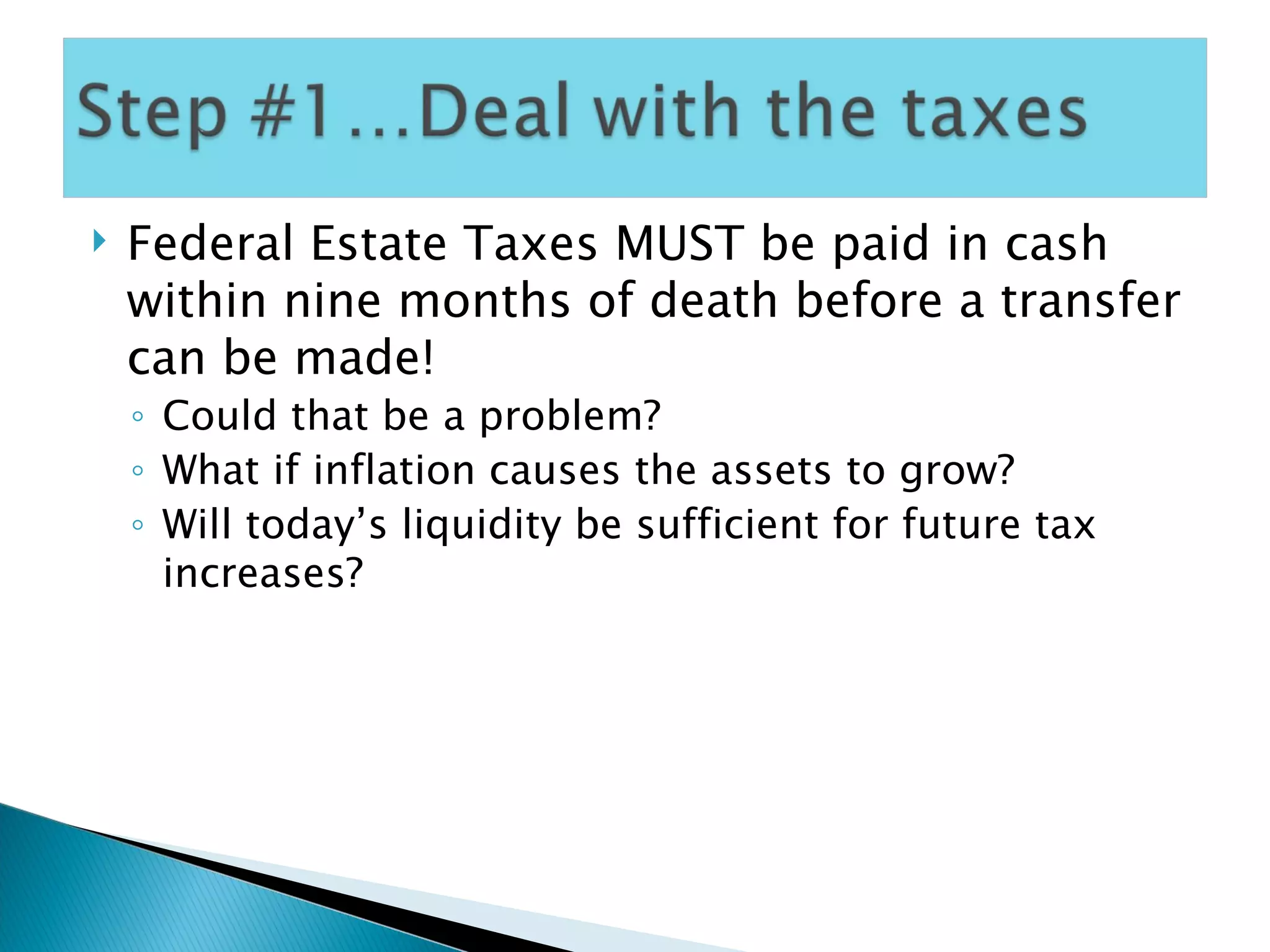

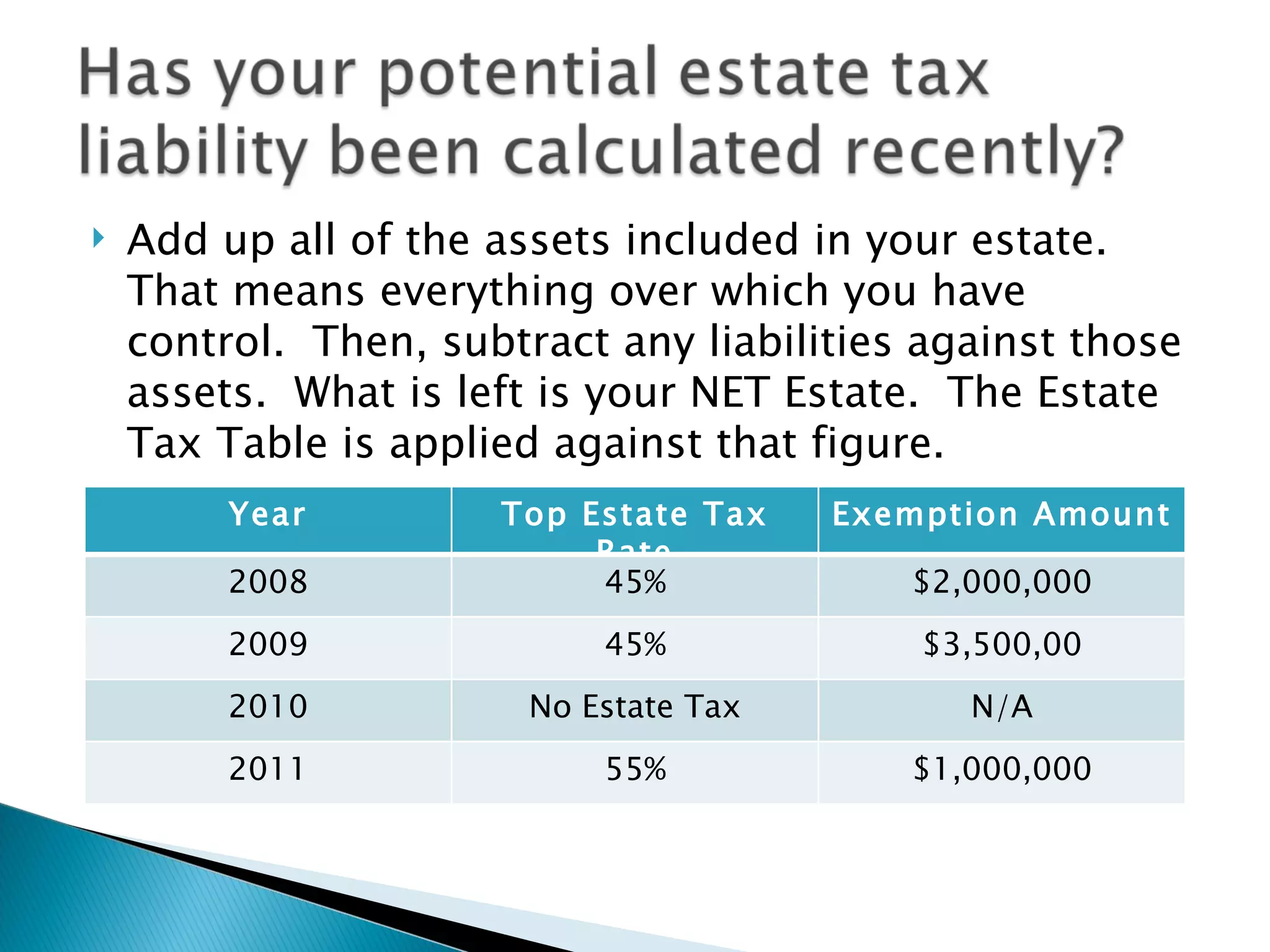

The document discusses the importance of estate planning for family businesses. It notes that the business often makes up the majority of the estate's value. Without proper planning, liquidating the business to pay estate taxes could negatively impact the family's goals of passing the business to future generations. The document outlines key steps in estate planning, including paying taxes, ensuring the business remains healthy, addressing the surviving spouse's needs, equalizing assets among heirs, and planning for different ownership scenarios.