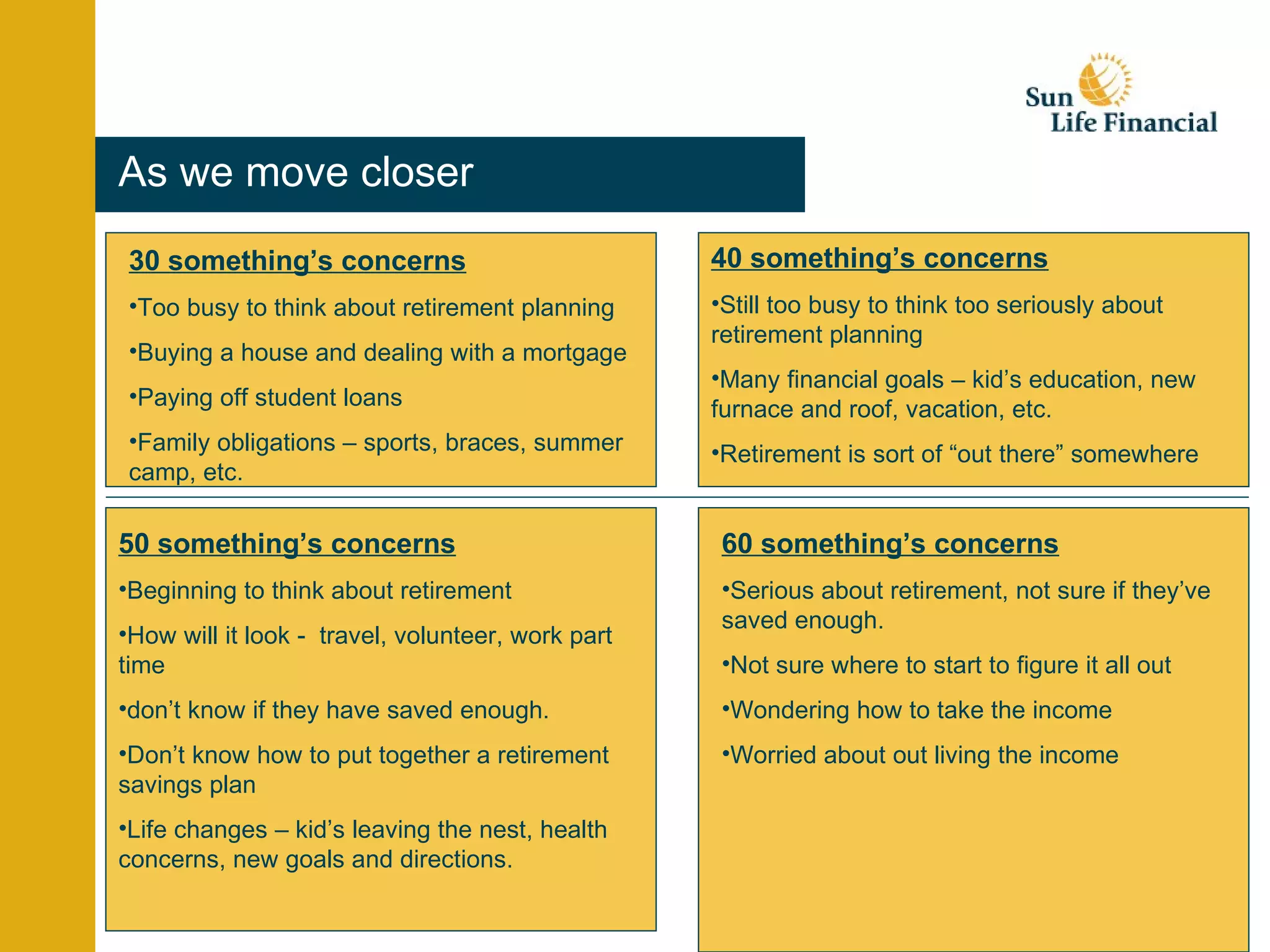

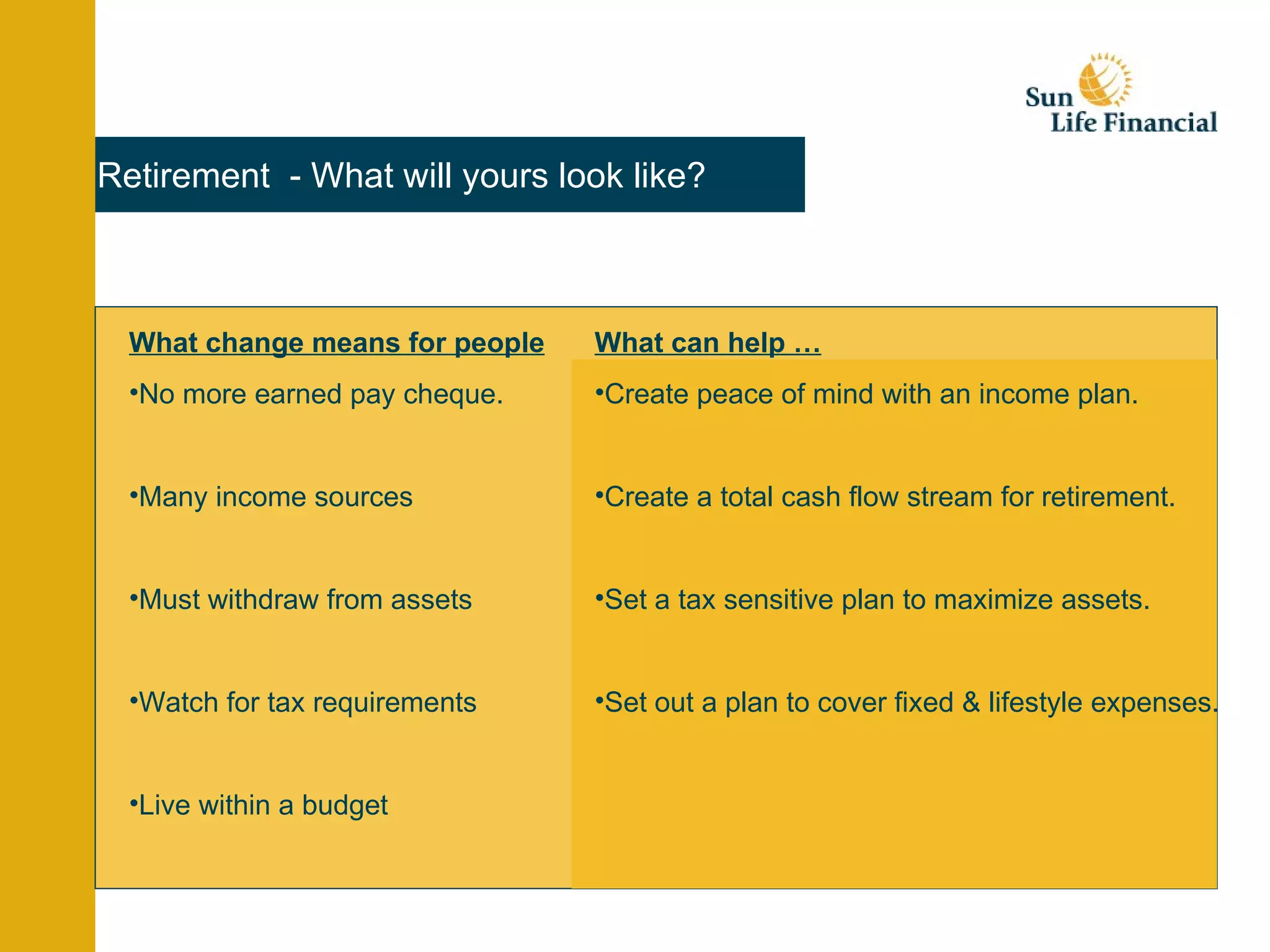

The document is an agenda for a retirement income planning seminar presented by Anna Conner, Steve Chipman, and Casey Walsh. They will educate attendees on retirement planning topics like how much income is needed, sources of retirement income, minimizing taxes, and guaranteeing retirement income. The seminar aims to help attendees create a holistic financial plan and find peace of mind in retirement.