Embed presentation

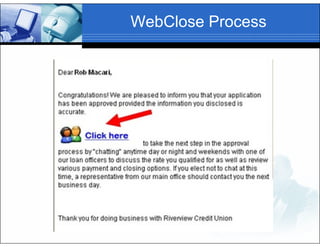

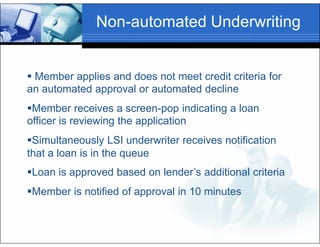

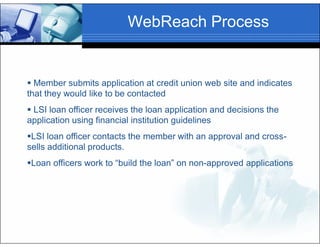

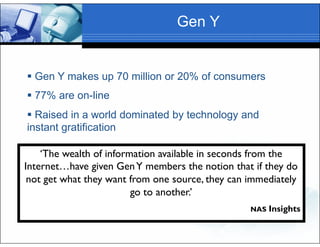

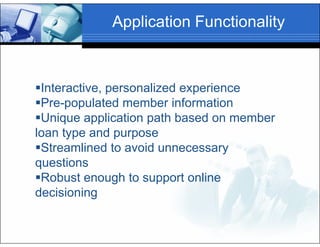

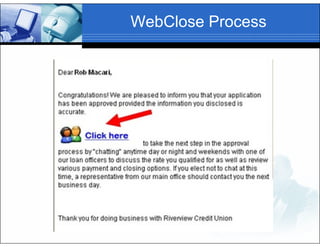

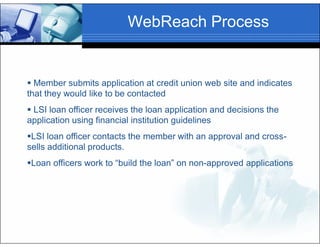

This document discusses optimizing e-lending for Gen Y consumers. It recommends providing an interactive online application, automatically populating member data, and offering automated approvals. Over 50% of one company's loan applications are online. Optimizing the online experience increases revenue, improves loan officer productivity and closing rates, and reduces costs. The document outlines features like online decisioning, system integration, web chat closings, and following up with applicants to approve more loans and cross-sell products.