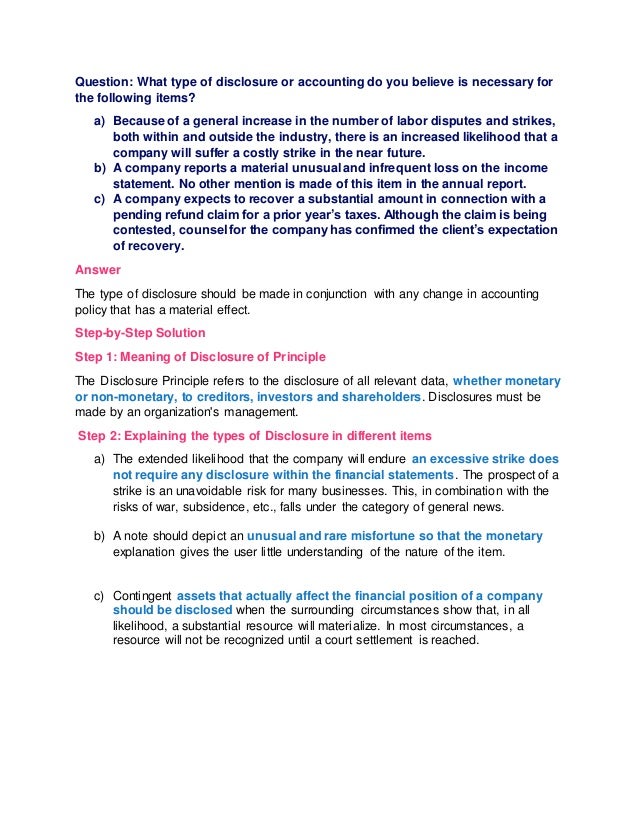

The document discusses necessary disclosures for various financial situations, such as the likelihood of labor disputes, unusual losses, and potential tax claim recoveries. It emphasizes that the disclosure principle requires all relevant data to be communicated to stakeholders, with specific guidelines for different scenarios. For instance, labor disputes typically do not require disclosure, while unusual losses and contingent assets must be documented based on their financial implications.