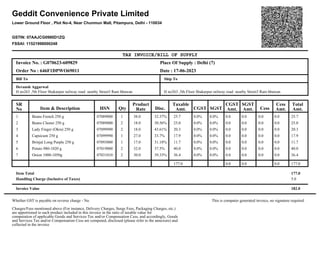

More Related Content Similar to 646F1DPWO69011.pdf (20) 1. Geddit Convenience Private Limited

Lower Ground Floor , Plot No-4, Near Chunmun Mall, Pitampura, Delhi - 110034

GSTIN: 07AAJCG0980D1ZQ

FSSAI: 11521998000248

TAX INVOICE/BILL OF SUPPLY

Bill To Ship To

Devansh Aggarwal

H no263 ,5th Floor Shakarpur railway road nearby Street3 Ram bhawan H no263 ,5th Floor Shakarpur railway road nearby Street3 Ram bhawan

Invoice No. : G070623-609829

Date : 17-06-2023

Order No : 646F1DPWO69011

Place Of Supply : Delhi (7)

SR

No Item & Description HSN Qty

Product

Rate Disc.

Taxable

Amt. CGST SGST

CGST

Amt.

SGST

Amt. Cess

Cess

Amt.

Total

Amt.

1 07089000 1 38.0 32.37% 25.7 0.0% 0.0% 0.0 0.0 0.0 0.0 25.7

Beans French 250 g

2 07089000 2 18.0 30.56% 25.0 0.0% 0.0% 0.0 0.0 0.0 0.0 25.0

Beans Cluster 250 g

3 07099990 2 18.0 43.61% 20.3 0.0% 0.0% 0.0 0.0 0.0 0.0 20.3

Lady Finger (Okra) 250 g

4 07099990 1 27.0 33.7% 17.9 0.0% 0.0% 0.0 0.0 0.0 0.0 17.9

Capsicum 250 g

5 07093000 1 17.0 31.18% 11.7 0.0% 0.0% 0.0 0.0 0.0 0.0 11.7

Brinjal Long Purple 250 g

6 07019000 2 32.0 37.5% 40.0 0.0% 0.0% 0.0 0.0 0.0 0.0 40.0

Potato 980-1020 g

7 07031010 2 30.0 39.33% 36.4 0.0% 0.0% 0.0 0.0 0.0 0.0 36.4

Onion 1000-1050g

177.0 0.0 0.0 0.0 177.0

Item Total 177.0

Handling Charge (Inclusive of Taxes) 5.0

Invoice Value 182.0

Whether GST is payable on reverse charge - No. This is computer generated invoice, no signature required

Charges/Fees mentioned above (For instance, Delivery Charges, Surge Fees, Packaging Charges, etc.)

are apportioned to each product included in this invoice in the ratio of taxable value for

computation of applicable Goods and Services Tax and/or Compensation Cess, and accordingly, Goods

and Services Tax and/or Compensation Cess are computed, disclosed (please refer to the annexure) and

collected in the invoice

2. Geddit Convenience Private Limited

Lower Ground Floor , Plot No-4, Near Chunmun Mall, Pitampura, Delhi - 110034

GSTIN: 07AAJCG0980D1ZQ

FSSAI: 11521998000248

Annexure

Handling Charge

Tax

Rate

Cess

Rate Taxable

Value

CGST SGST Cess

0.0% 0.0% 5.0 0.0 0.0 0.0

5.0 0.0 0.0 0

Total