The Return of Real Estate Signals Turnaround

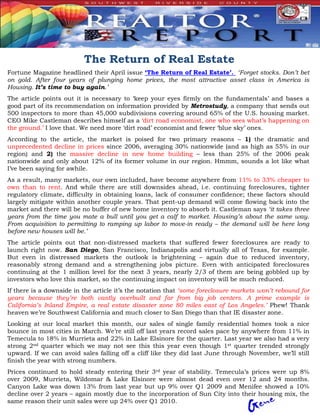

- 1. The Return of Real Estate Fortune Magazine headlined their April issue ‘The Return of Real Estate’. ‘Forget stocks. Don’t bet on gold. After four years of plunging home prices, the most attractive asset class in America is Housing. It’s time to buy again.’ The article points out it is necessary to ‘keep your eyes firmly on the fundamentals’ and bases a good part of its recommendation on information provided by Metrostudy, a company that sends out 500 inspectors to more than 45,000 subdivisions covering around 65% of the U.S. housing market. CEO Mike Castleman describes himself as a ‘dirt road economist, one who sees what’s happening on the ground.’ I love that. We need more ‘dirt road’ economist and fewer ‘blue sky’ ones. According to the article, the market is poised for two primary reasons – 1) the dramatic and unprecedented decline in prices since 2006, averaging 30% nationwide (and as high as 55% in our region) and 2) the massive decline in new home building – less than 25% of the 2006 peak nationwide and only about 12% of its former volume in our region. Hmmm, sounds a lot like what I’ve been saying for awhile. As a result, many markets, our own included, have become anywhere from 11% to 33% cheaper to own than to rent. And while there are still downsides ahead, i.e. continuing foreclosures, tighter regulatory climate, difficulty in obtaining loans, lack of consumer confidence; these factors should largely mitigate within another couple years. That pent-up demand will come flowing back into the market and there will be no buffer of new home inventory to absorb it. Castleman says ‘it takes three years from the time you mate a bull until you get a calf to market. Housing’s about the same way. From acquisition to permitting to ramping up labor to move-in ready – the demand will be here long before new houses will be.’ The article points out that non-distressed markets that suffered fewer foreclosures are ready to launch right now. San Diego, San Francisco, Indianapolis and virtually all of Texas, for example. But even in distressed markets the outlook is brightening – again due to reduced inventory, reasonably strong demand and a strengthening jobs picture. Even with anticipated foreclosures continuing at the 1 million level for the next 3 years, nearly 2/3 of them are being gobbled up by investors who love this market, so the continuing impact on inventory will be much reduced. If there is a downside in the article it’s the notation that ‘some foreclosure markets won’t rebound for years because they’re both vastly overbuilt and far from big job centers. A prime example is California’s Inland Empire, a real estate disaster zone 80 miles east of Los Angeles.’ Phew! Thank heaven we’re Southwest California and much closer to San Diego than that IE disaster zone. Looking at our local market this month, our sales of single family residential homes took a nice bounce in most cities in March. We’re still off last years record sales pace by anywhere from 11% in Temecula to 18% in Murrieta and 22% in Lake Elsinore for the quarter. Last year we also had a very strong 2nd quarter which we may not see this this year even though 1st quarter trended strongly upward. If we can avoid sales falling off a cliff like they did last June through November, we’ll still finish the year with strong numbers. Prices continued to hold steady entering their 3rd year of stability. Temecula’s prices were up 8% over 2009, Murrieta, Wildomar & Lake Elsinore were almost dead even over 12 and 24 months. Canyon Lake was down 13% from last year but up 9% over Q1 2009 and Menifee showed a 10% decline over 2 years – again mostly due to the incorporation of Sun City into their housing mix, the same reason their unit sales were up 24% over Q1 2010.

- 2. 250 Southwest California Chart #1 Unit Sales 200 Single Family Residential 150 100 50 0 3/09 6/09 9/09 12/09 3/10 6/10 9/10 12/10 Temecula Murrieta Lake Elsinore Menifee Wildomar Canyon Lake $350,000 $300,000 $250,000 $200,000 $150,000 $100,000 $50,000 Southwest California Median Price $0 Chart #2 3/09 6/09 9/09 12/09 3/10 6/10 9/10 12/10 Temecula Murrieta Lake Elsinore Menifee Wildomar Canyon Lake

- 3. 5 600 5 3 Southwest California 1 3 4 7 Chart #3 4 1st Quarter Sales Chart 5 5 500 4 1 3 6 1 3 3 9 3 2 3 3 6 6 4 7 4 5 400 3 3 3 7 0 4 2 2 0 2 0 2 9 5 7 2 4 2 1 300 2 9 4 2 2 5 1 3 1 1 1 6 2 1 1 3 9 4 3 8 8 1 0 8 1 8 5 5 1 1 3 4 4 4 200 1 3 9 1 2 0 9 9 9 1 9 9 8 7 9 8 8 8 7 4 7 6 6 3 7 4 5 5 2 5 9 5 5 9 0 4 1 1 100 0 2 3 7 5 0 5 0 2004 2005 2006 2007 2008 2009 2010 2011 Temecula Murrieta Lake Elsinore Menifee Wildomar Canyon Lake $ $ $ $ $ $ $700,000 $ $ $ 5 5 $ 5 5 5 6 4 4 4 1 3 $ 4 9 0 4 $ 2 Southwest California 6 6 7 $ 4 4 $ 1st Quarter Median Price Chart $ $ 4 3 $ 6 1 1 0 $ 4 2 2 3 4 3 $ 4 4 $600,000 $ , , 4 0 , , , , 3 3 $ 3 , , $ , 1 8 8 8 0 , 2 5 5 3 3 5 9 0 $ $ $ Chart #4 9 9 3 $ 7 9 , 3 7 7 7 3 6 2 6 , 1 6 5 9 4 8 5 5 3 3 1 2 6 3 , 2 5 $ 5 $ $ $ 3 3 3 5 0 4 7 8 , 9 9 4 7 1 0 , 4 5 $ $ $500,000 , , 3 2 1 8 8 , 1 $ 3 7 3 2 , 2 2 5 9 8 , 2 3 0 $ 2 $ $ $ 3 8 2 , 3 2 0 9 , 4 0 5 4 2 0 , , 2 2 2 8 6 1 7 , 8 $ 8 2 $ $ $ 8 4 7 2 , 5 6 9 7 0 0 4 5 3 1 2 6 $ 2 $ 9 6 6 6 2 3 5 8 4 3 7 2 1 $ 2 , $ 2 2 8 5 2 , 3 4 $ 2 2 $ 5 $400,000 , 0 1 5 8 2 , 1 1 2 1 $ 2 2 , 4 , 1 1 2 0 , 8 7 7 , 1 0 0 1 , , 1 5 2 8 8 0 , 9 5 6 8 7 9 2 3 8 8 5 8 9 , 7 1 0 8 8 1 7 5 7 2 6 , , , 2 0 0 , , 1 3 9 7 4 7 7 4 5 0 4 6 6 3 8 9 , , $300,000 3 5 , 6 5 , 5 8 , 1 3 9 8 8 9 0 3 7 1 3 0 6 8 7 2 1 6 0 5 2 1 6 6 0 3 2 $200,000 4 $100,000 $0 2004 2005 2006 2007 2008 2009 2010 2011 Temecula Murrieta Lake Elsinore Menifee Wildomar Canyon Lake

- 4. Chart 1: Unit sales of single family homes got a nice bounce in March in Temecula, Murrieta and Lake Elsinore, smaller increases in Wildomar and Canyon Lake and about even in Menifee. That marked two months of increasing sales following the January dip showing a positive trend for our 1st quarter. Of the two prior years, in 2009 we had a weak 1st half followed by a strong 2nd, whereas 2010 had a great 1st half but a weak 2nd. Why was that? The impact of the federal first time homebuyer program – which removed some 1.5 million homes from the market nationwide and helped prices stabilize from their free-fall. While the program may well have borrowed from future sales, that impact has worn off now and our demand is returning to a more sustainable pace. If we can maintain this sales rate through yearend we will still post strong sales numbers for 2011. Just look at the yellow trendline which marks a steady growth pattern from January of 2009 predicated on our regional sales. Chart 2: The trendline for median price is also up but so slightly you almost have to look at the page from the side to discern the variation. Canyon Lake posted the strongest increase of 9% Q1 ‘09 to Q1 ‘11 followed by Temecula with an 8% bump over ‘09 and 5% over ‘10. Murrieta median was up 2% over ‘10 but virtually even with ‘09 while Lake Elsinore and Wildomar showed declines of 2% and 1% over 24 months respectively. Menifee posts a 4% drop from ‘10 and 10% from ‘09 only because Menifee volumes now include Sun City sales. Sun City core properties traditionally sell anywhere from ½ to 2/3 the price of comparable Menifee homes. Charts 3 & 4: These are the charts that suck the life out of you if you do the math. While strong sales numbers and stable prices are all well and good, it’s the gap between good and great that tells the tale for our city coffers. I’ve taken the liberty of running some of the numbers for you. If you’re squeamish you can stop reading here ( I know some of you stopped back on page 1). For example, in 2005 Temecula sold 363 homes during the 1st quarter at a median price of $462,732 for a total sales volume of $167,971,715. This year they sold 394 homes @ $300,124 dropping revenue to $118,248,856, a decline of $49,722,859 or 30%. Isn’t this fun? Ehhh, not so much. City Peak Year Q1 2011 Q1 % decline Temecula 2005 $ 167,971,716 $ 119,848,102 29% Murrieta 2005 $ 141,133,260 $ 120,929,832 14% Lake Elsinore 2006 $ 81,187,250 $ 50,887,170 37% Wildomar 2006 $ 42,844,914 $ 19,267,970 55% Canyon Lake 2006 $ 41,388,130 $ 16,847,590 59% Particularly hard hit are the smaller cities with revenue drops of anywhere from 55% to nearly 60% of anticipated (and probably budgeted) revenue. And while the impact from these declining sales is significant, annual tax revenue from the decimated property values is far more devastating. If there’s any good news to be gleaned from this, it’s that with stable prices, Larry Ward probably won’t need to make further wholesale reductions to property values this year. From here on out, values could actually start to increase again, maybe, hopefully, and your revenue pictures will improve. More local jobs would speed that process.

- 5. 700 6 1 0 600 5 0 4 500 3 9 7 400 3 2 1 9 2 2 9 7 300 3 1 9 1 1 1 2 5 7 5 200 1 1 1 5 9 1 1 0 0 9 9 8 9 9 6 6 9 7 8 7 1 5 3 3 6 6 100 4 5 9 9 1 5 5 4 7 5 5 3 9 3 3 3 3 3 5 4 3 2 2 5 . . . . . . 3 6 6 2 6 3 0 1 0 On Market Pending Closed (Demand) Days on Market % Selling Months Supply (Supply) Murrieta Temecula Lake Elsininore Menifee Canyon Lake Wildomar Properties on the market dropped nearly 10% February to March while pending and sold properties remained almost even. Days on market increased from 76 days in January to 86 days in March and months inventory has dropped back to 3.8 months across the region from 4.3 months in February. Mirroring the national trend toward fewer foreclosures, bank owned homes now represents only 17% of active listings on the market. Don’t get too excited, they’ll be with us for at least a couple more years. But moratoriums, and an indication by lenders that they have finally figured out the short sale process may continue to reduce REO’s. Stabilizing housing prices and a strengthening jobs market will also mean fewer foreclosures going foreword. Standard non-distressed sales made up a full 30% of our market in March. March Market Activity by Sales Type Active Closed Failed In Escrow % Activity Bank Owned 17% 42% 6% 36% 25% Short Sales 48% 30% 65% 42% 45% Standard Sales 35% 29% 29% 22% 30% Other 1% 1% 1% 1% 1%

- 6. Since most of the figures I post in these reports concerns single family home sales and prices, a friend asked me to do a comparison of local condo prices from their peak to current. It was an interesting exercise but not for the faint of heart and definitely not fun reading for anybody that bought a condo a few years ago. So here is a comparison of condo prices in several of our better known communities: Location Size Br/Ba Q1 2006 (73 sold) Q1 2011 (93 sold) % Arboretum 730 1/1 $235,000 $70,000 -70% Madison 854 1/1 $220,000 $68,000 -69% Bucaneer Bay 961 2/2 $295,000 $104,000 -65% Anchor Bay 1,016 2/2.5 $305,000 $105,000 -65% Madison 1,159 2/2 $285,000 $90,000 -68% Arboretum 1,246 2/2 $314,977 $135,000 -57% Pelican Bay 1,387 3/2.5 $337,900 $128,000 -62% Socorro 1,508 3/2.5 $345,000 $133,600 -61% Arboretum 1,745 3/2.5 $365,000 $175,000 -52% All I can tell you for sure is that a lot of first-timers lost a lot of money during the past 5 years. BUT, if you're in a position to buy into one right now, your timing couldn't be better. There's almost nowhere for these prices to go but up. The problem right now is that investors have been scooping these up as fast as they can so the ratio of owner occupied properties has dropped so far most first timers can no longer get FHA financing in these developments. But for an investor is there any question? You can generate a positive cash flow from day one, hold onto it for 3 - 5 years and turn a tidy little profit. Finally, Notice of Default filings in California rose to their highest level since October 2010, up 17.3 percent month-over-month to 26,615 filings, but only increased 3.2 percent on a daily average basis. Notice of Trustee Sale filings fell for the third consecutive month, down 3.3 percent overall from February, and 25.2 percent on a daily average basis. Year-over-year foreclosure filings were down with Notice of Default filings falling 19.7 percent and Notice of Trustee Sale filings dropping 31.0 percent from March 2010. After a slow February foreclosure sales rose with sales Back to Bank (REO) up 28.6 percent and properties Sold to 3rd Parties, typically investors, jumping 61.5 percent. On a daily average basis those increases were just 5.0 percent for sales Back to Bank (REO) and 24.3 for properties Sold to 3rd Parties. The average Time to Foreclose continues to climb, up 4.1 percent month-over- month to 302 days, a significant 83.4 percent increase year-over-year, and a new record.

- 7. The following pages are excerpted from President Obama’s recent proposal to eliminate the secondary financing markets of Fannie & Freddie along with the response from the National Association of Realtors® and other concerned parties. Clicking on any paragraph heading will take you to the original report or source remarks. As you have questions, please contact me. What about Fannie Mae & Freddie Mac? • 10 year wind-down (accelerate if possible) • Increase guarantee fees • Increase down payments to at least 10% • Increase private capitol cushion (MI & other fees) • Lower loan limits • Reduce portfolio – at least 10% per year • Continue backing of U.S. MBS guarantees & debt obligations • Private mortgage lenders will step up to fill the gap Administration Offers Three Options 1. Privatize system with government insurance limited to FHA, VA & USDA low/mod borrowers 2. Adds a backdrop guarantee mechanism for ‘times of crisis’. 3. Adds catastrophic reinsurance of private mortgage guarantee companies. Taxpayers protected by g-fees & private capital taking first risk.

- 8. National Association of Realtors® Message to the Hill Restructure the secondary mortgage market to ensure a reliable source of mortgage lending for consumers, in all types of markets, to avoid major disruption to the nation’s economy that would result from the total collapse of the mortgage market. Key Points & Principles • An efficient & adequately regulated secondary market is essential to proving an affordable mortgage to consumers • We cannot have a restoration of the old GSE model – private profits with taxpayer losses • Reforms should ensure a strong, efficient financing environment for homeowners and rental housing • The government must clearly and explicitly guarantee the issuance of these entities • The new entities should guarantee or insure a wide range of safe, reliable mortgage products.

- 9. GSE Reform – Issues That Will Impact Your Business Center for Responsible Lending • Significant difference between low down-payment & subprime loans • Between 1990 and 2009 more than 27 million mortgages were made with low down payments. These loans DID NOT carry the risky features found in the subprime market • Increasing down payment requirements would materially shrink the mortgage market without a corresponding increase in loan performance (chart 1) • Based on the current median U.S. home price ($172,100) it would take the average family 14 years to save enough for a 20% down payment (chart 2) • Homeownership remains a key driver of personal and national economic prosperity and is fostered by responsible low down payment loans Low down payment loans have been originated safely for decades Eliminating or limiting low down payment loans will close the door to homeownership for millions of middle class families