This document summarizes an HDFC ERGO Health Suraksha Top Up Plus insurance plan. Key points include:

- It provides additional health insurance coverage once a deductible amount is exceeded from claims in a policy year.

- Coverage includes hospitalization, pre-and-post hospitalization, day care procedures, domiciliary treatment and organ donor expenses.

- There are eligibility criteria for individuals and families to be covered on individual or floater basis.

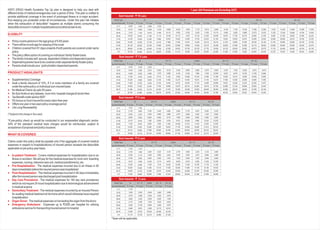

- Premiums vary based on sum insured, deductible amount, age and number of family members covered.