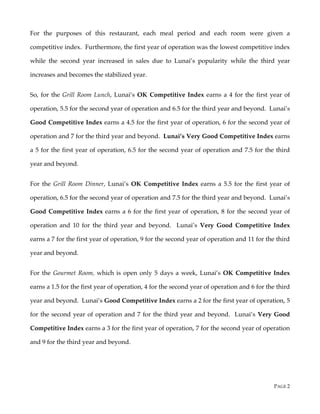

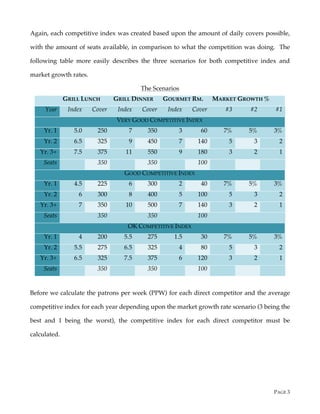

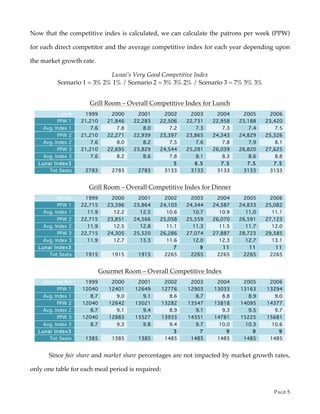

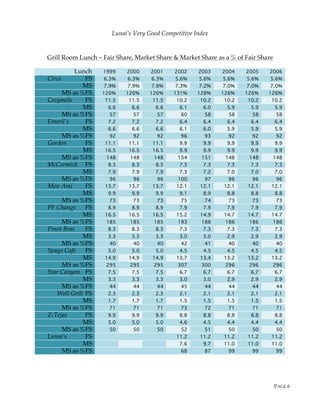

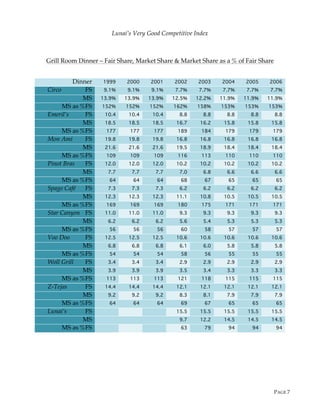

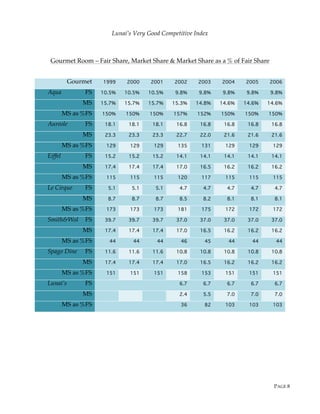

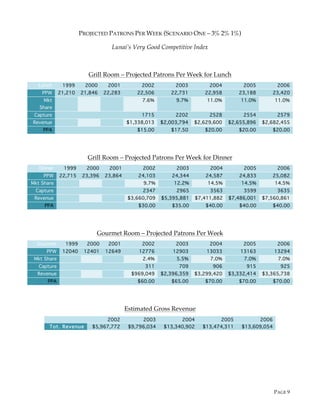

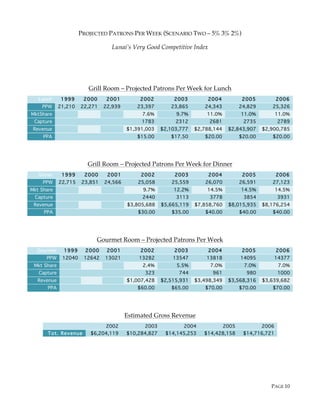

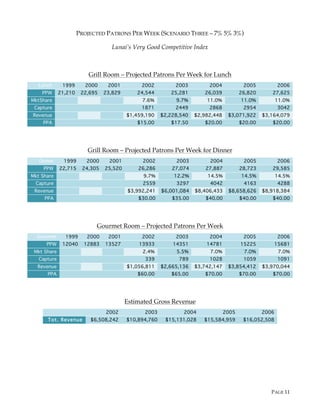

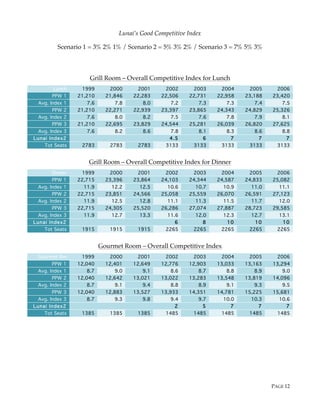

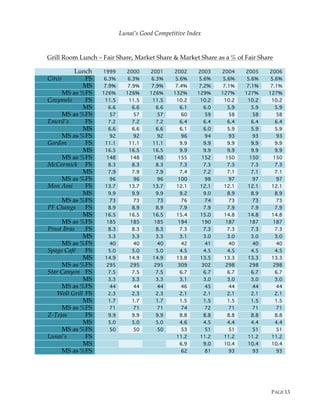

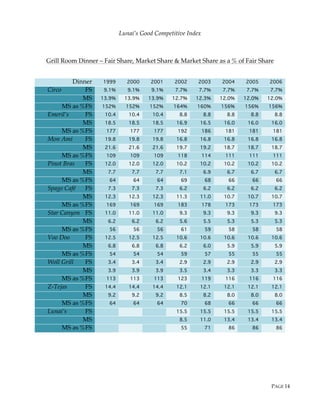

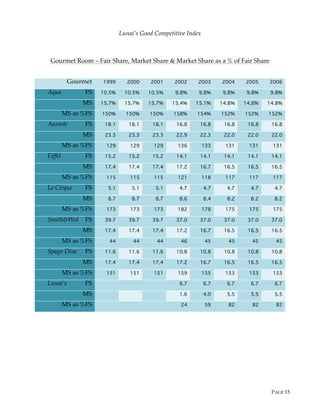

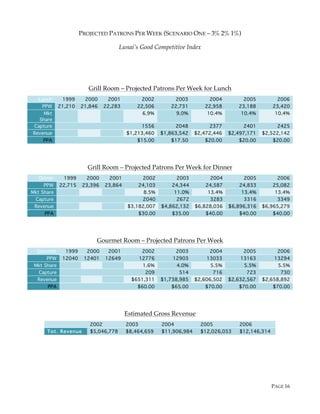

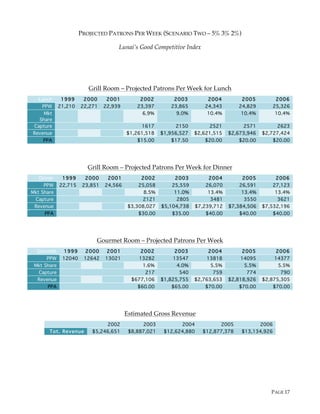

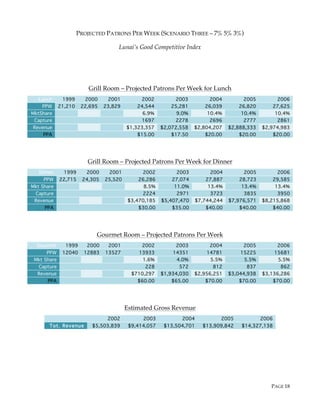

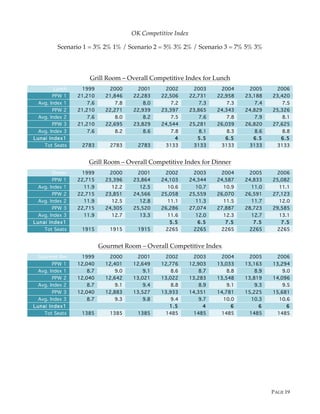

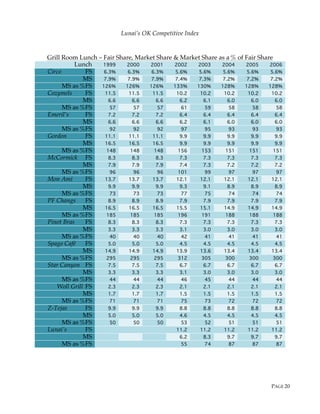

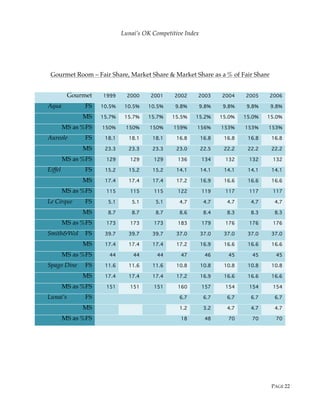

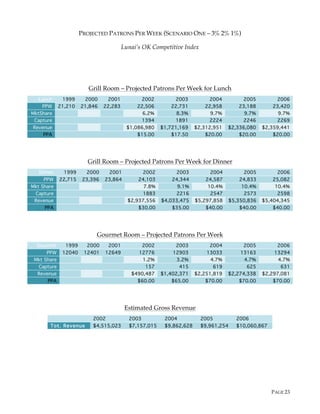

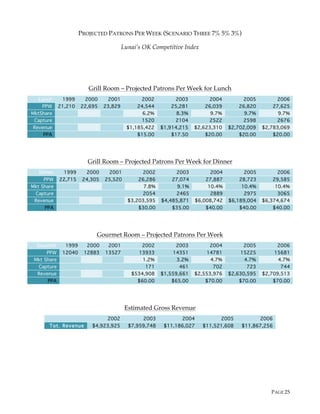

Infinity Hospitality & Entertainment will use a build-up approach to forecast revenue by analyzing competitors' restaurant activity, utilizing a competitive index based on patrons per seat. The analysis considers three market growth scenarios and competitive index scenarios to develop nine different income statements. The forecast aims to assess productivity and popularity, projecting revenue growth over three years of operation.