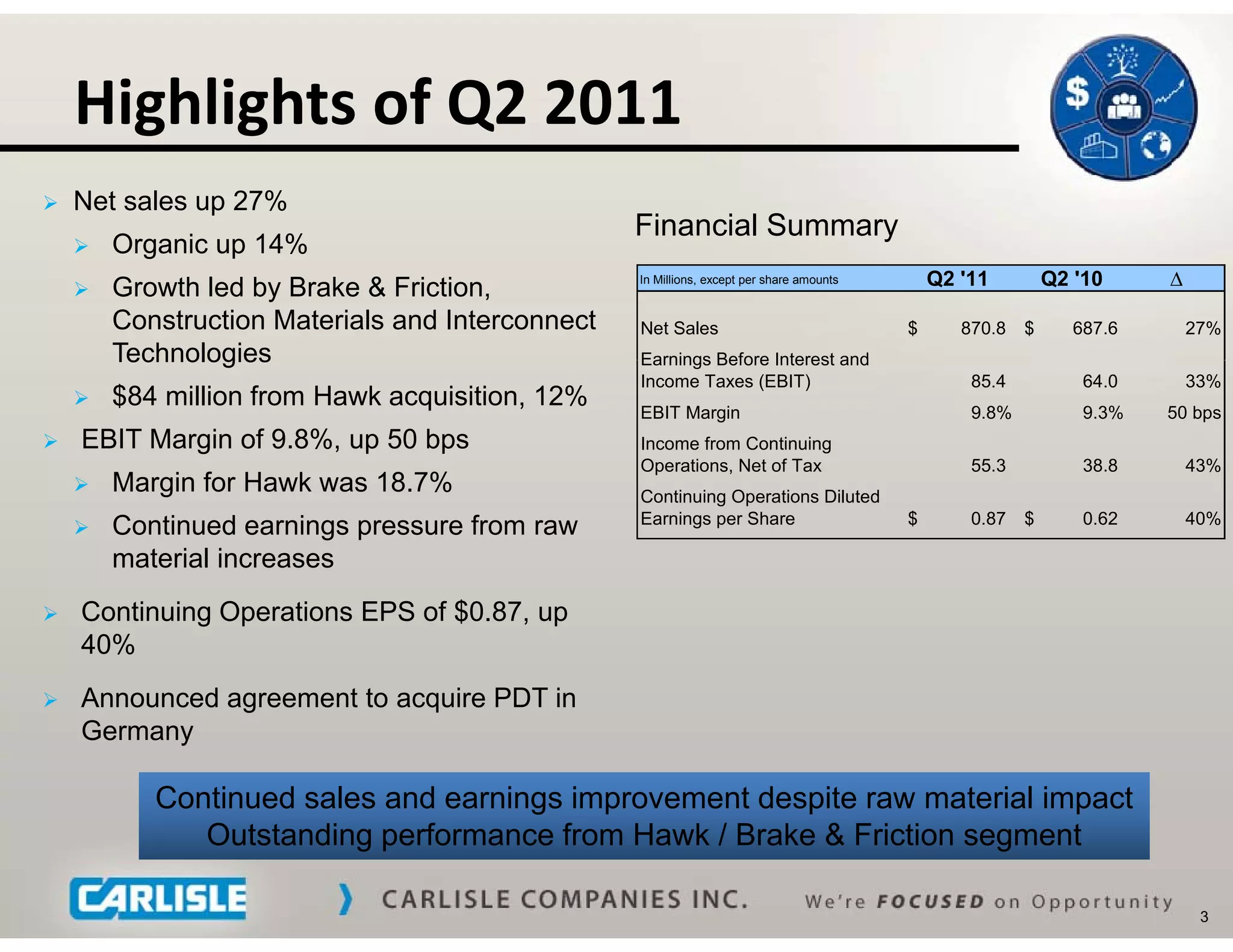

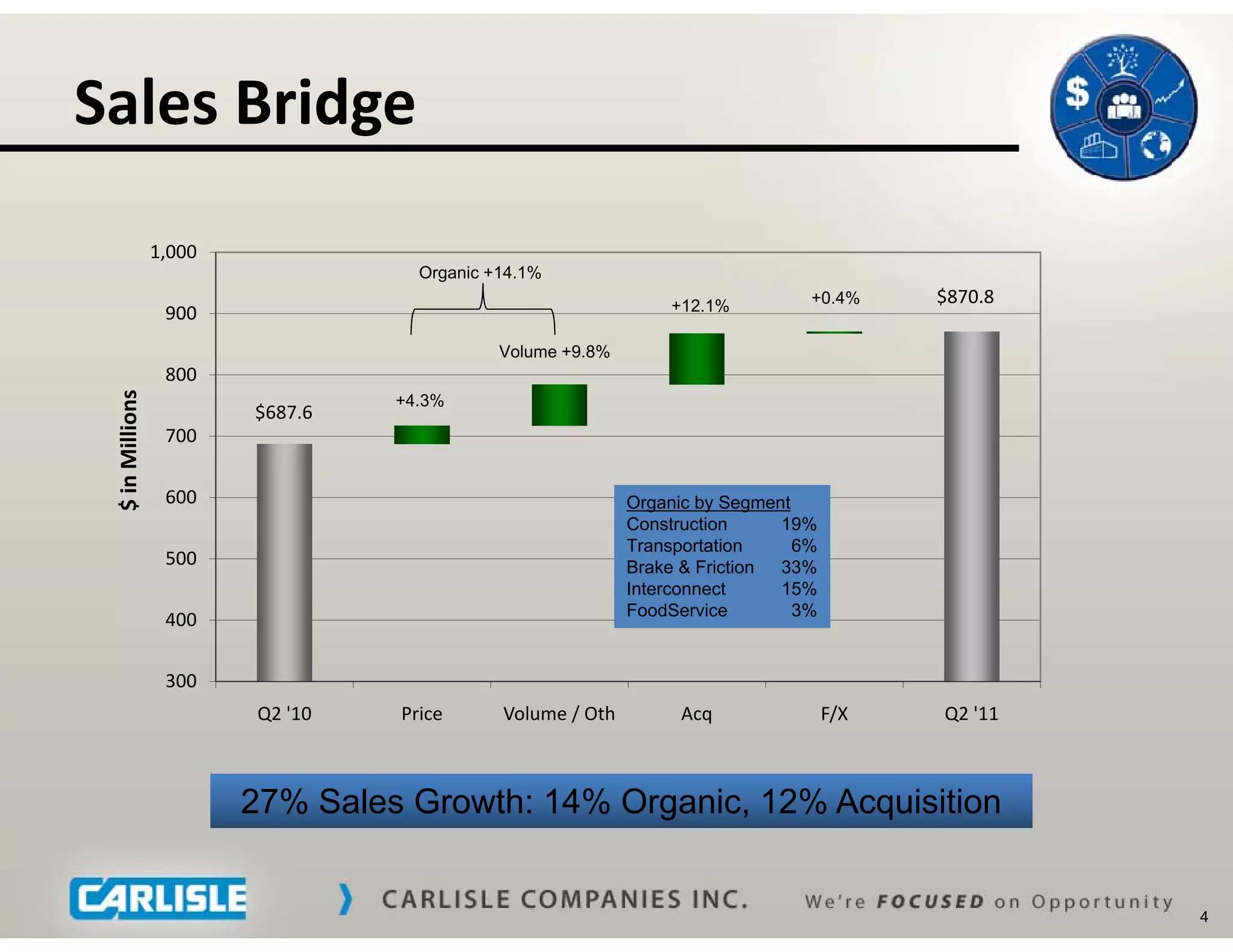

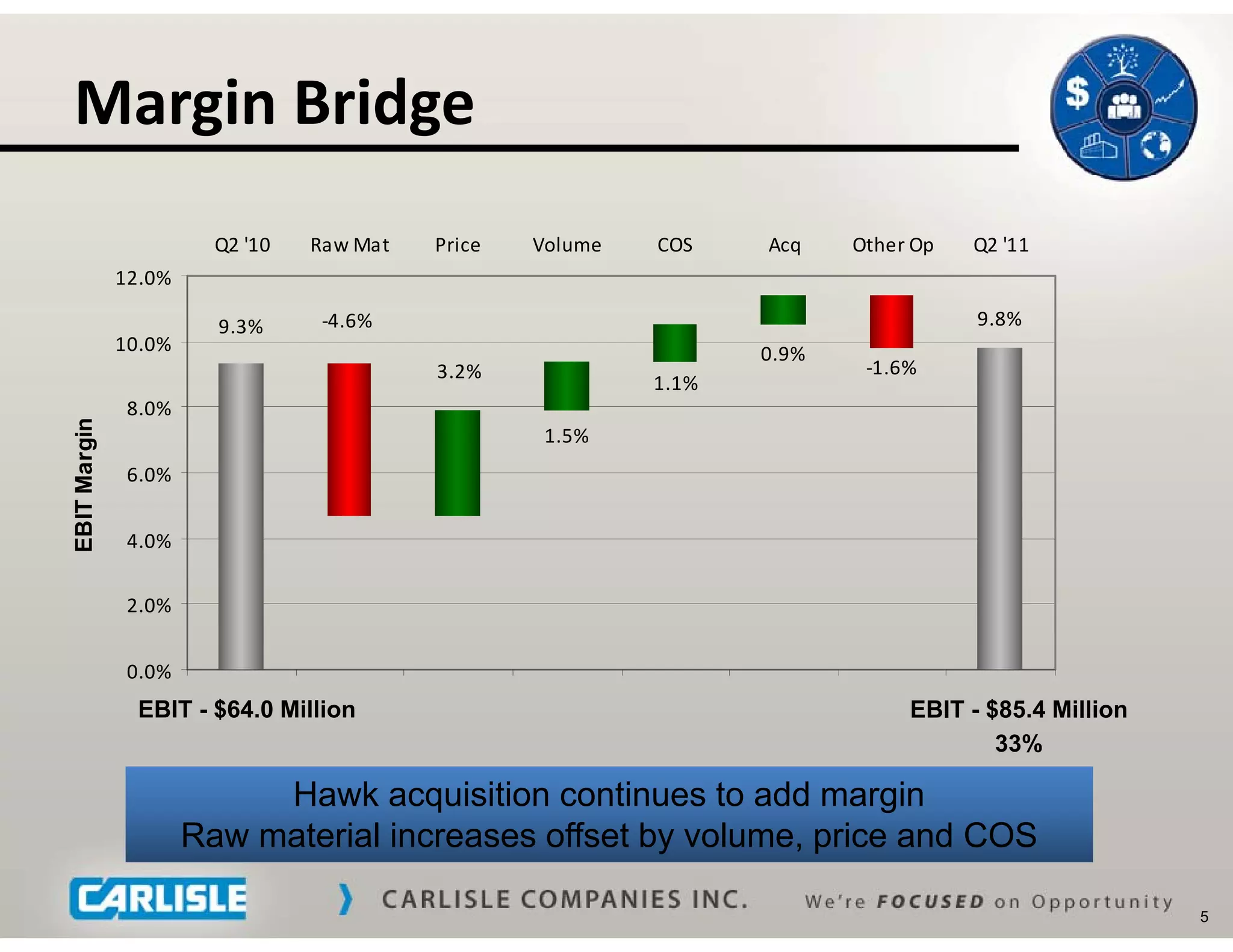

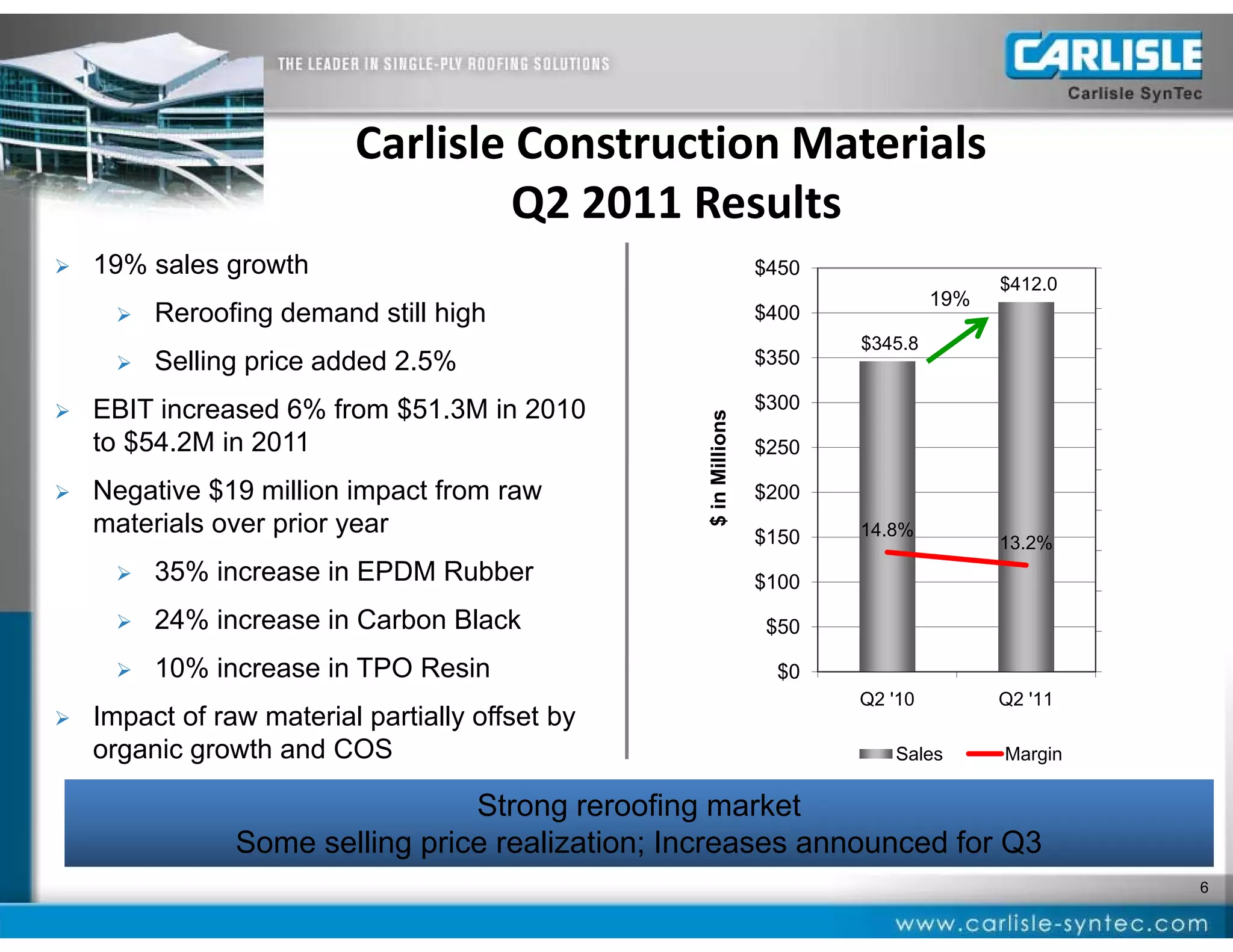

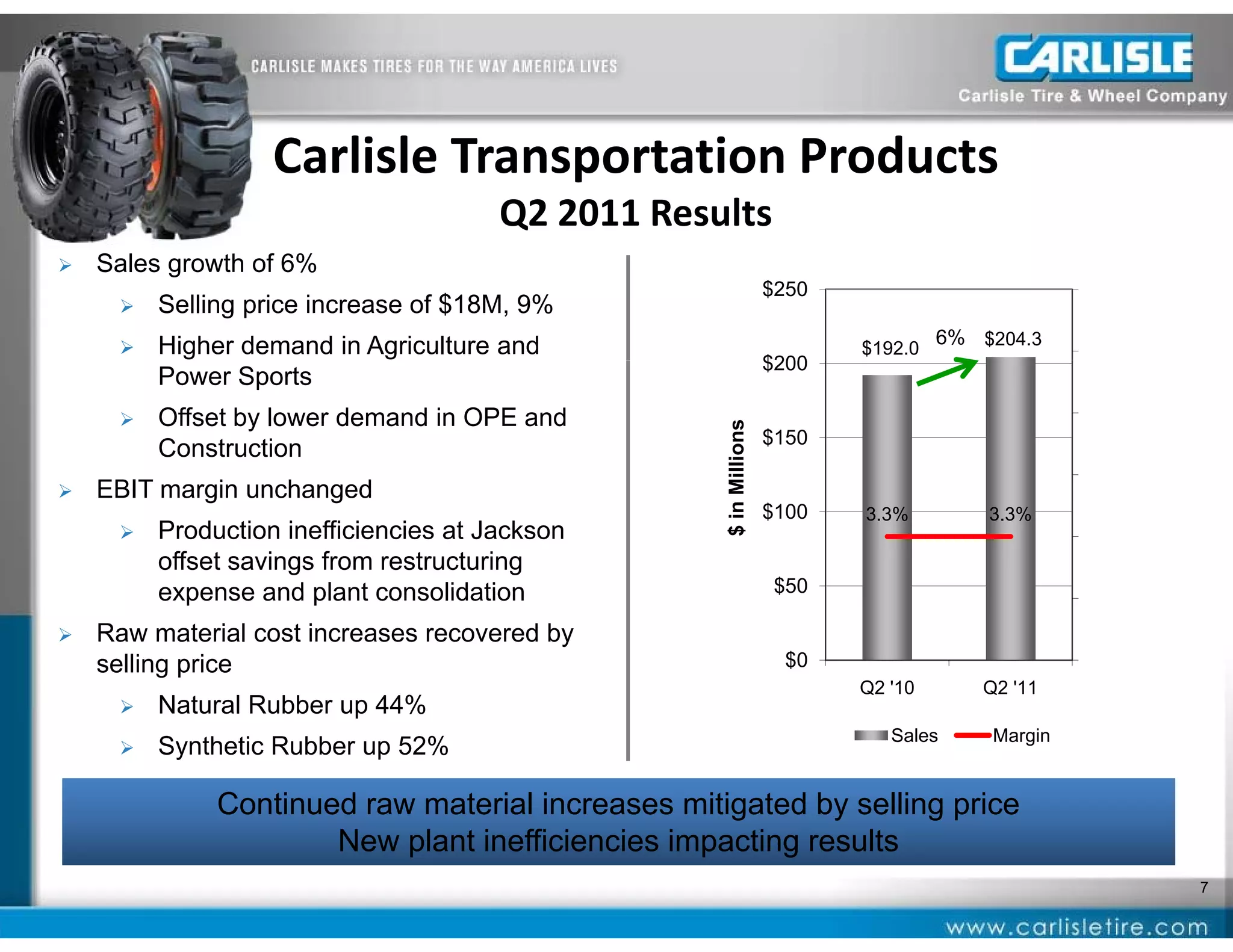

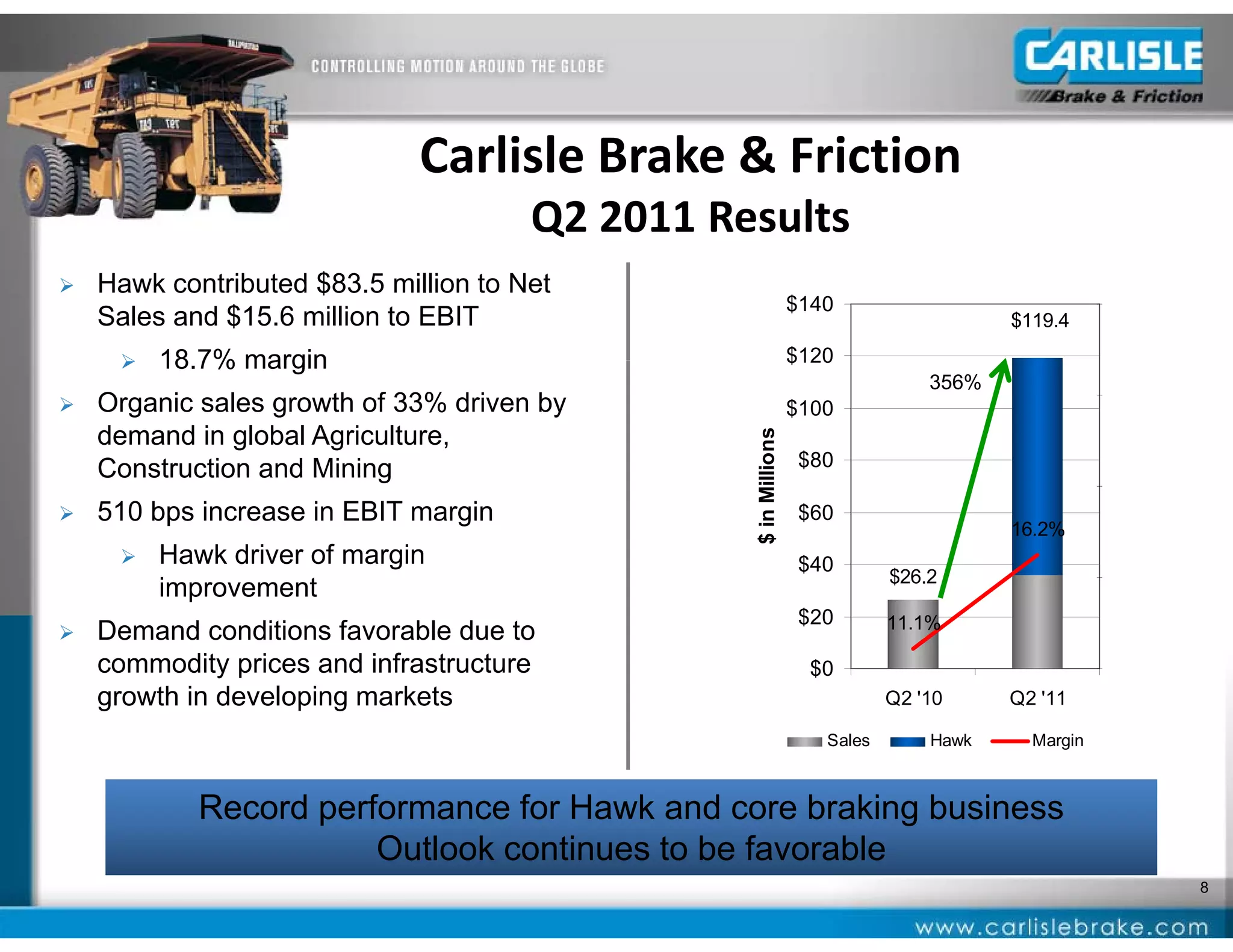

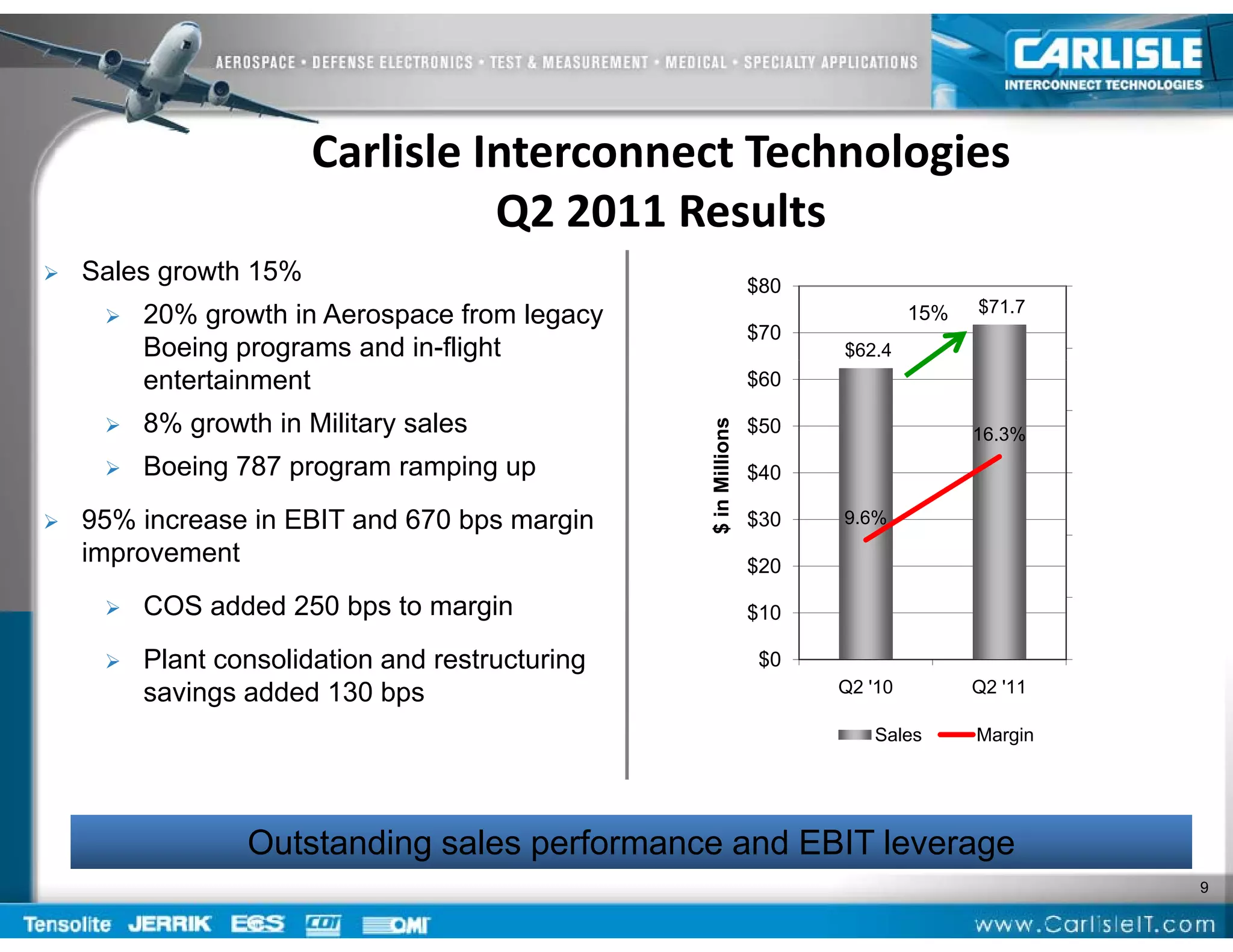

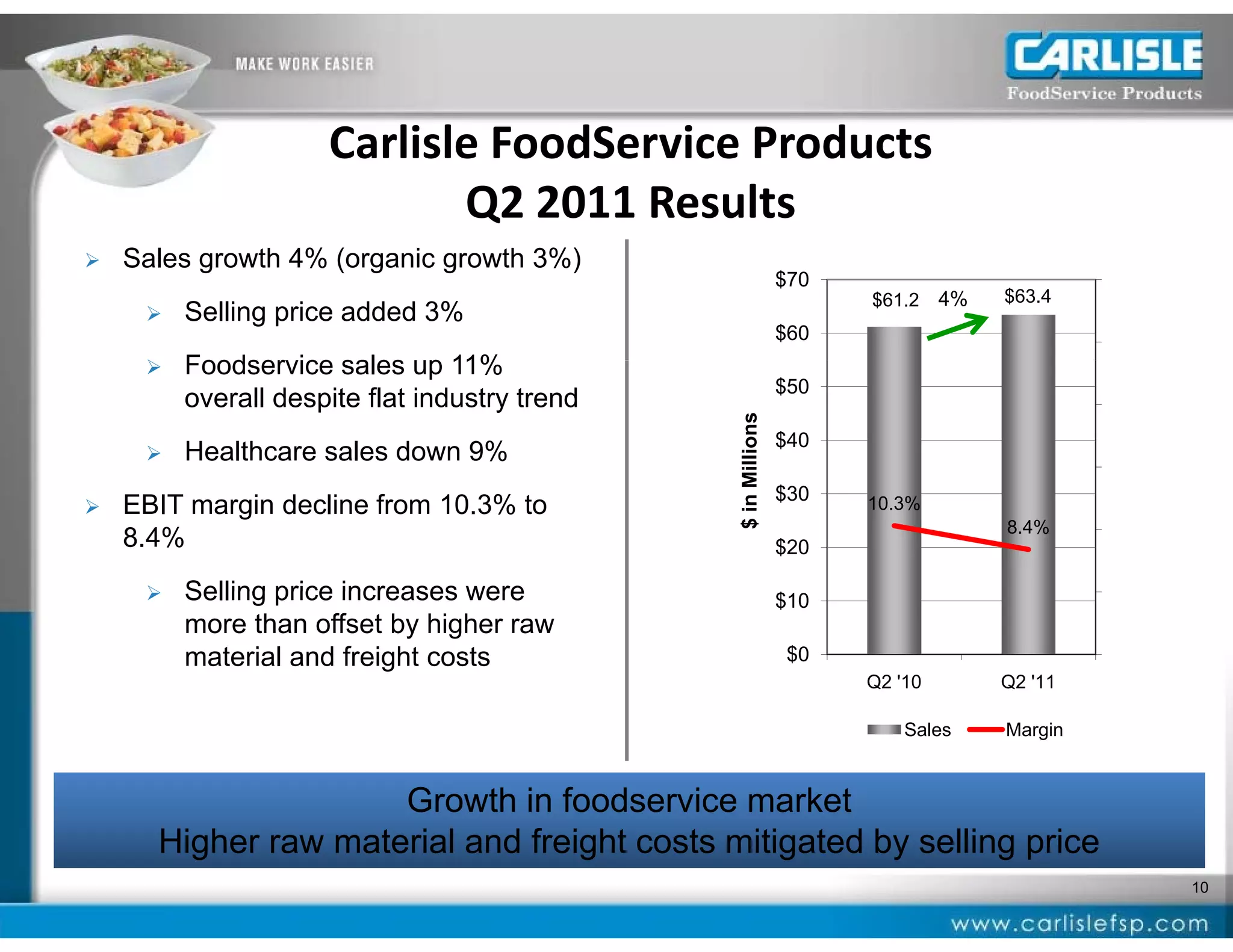

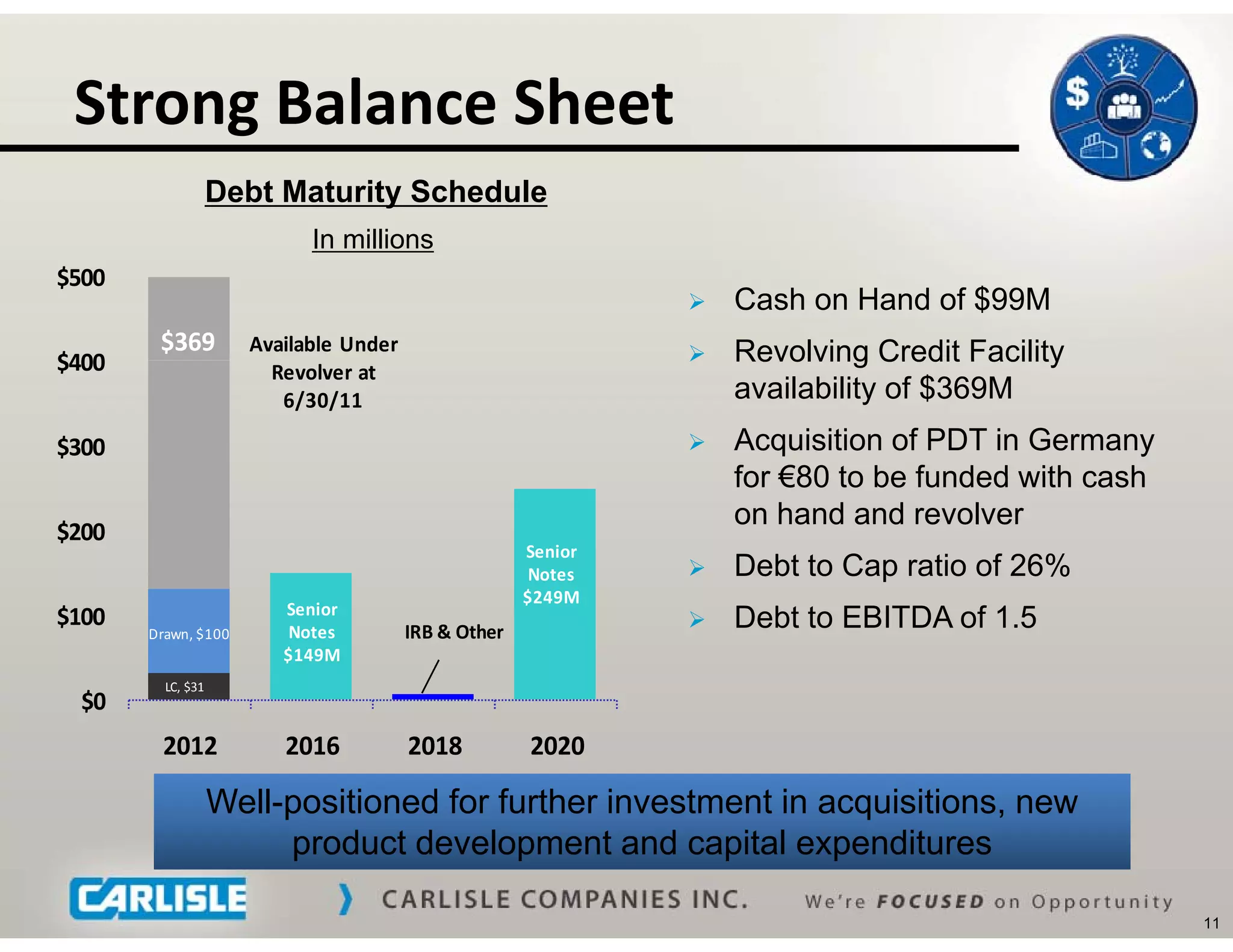

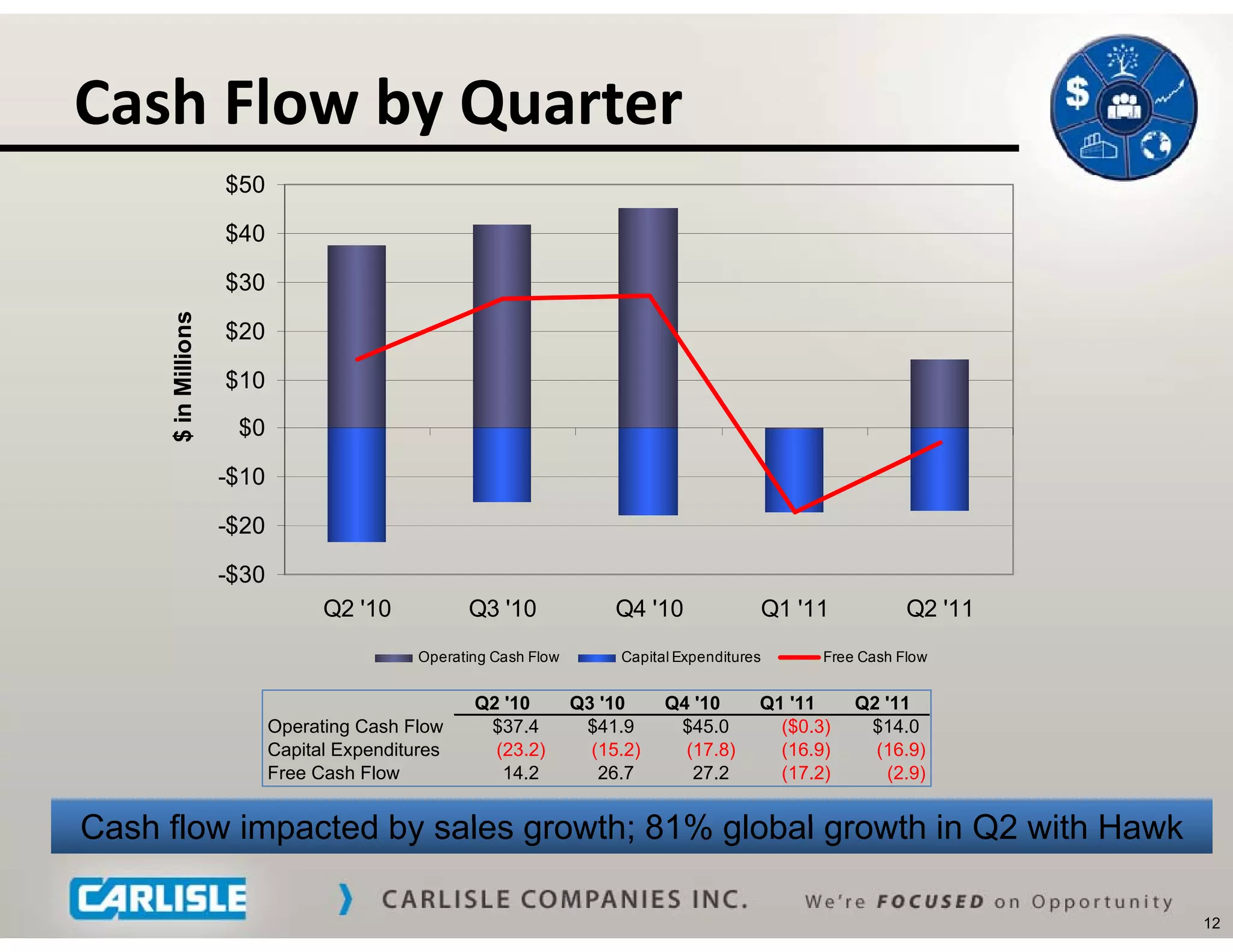

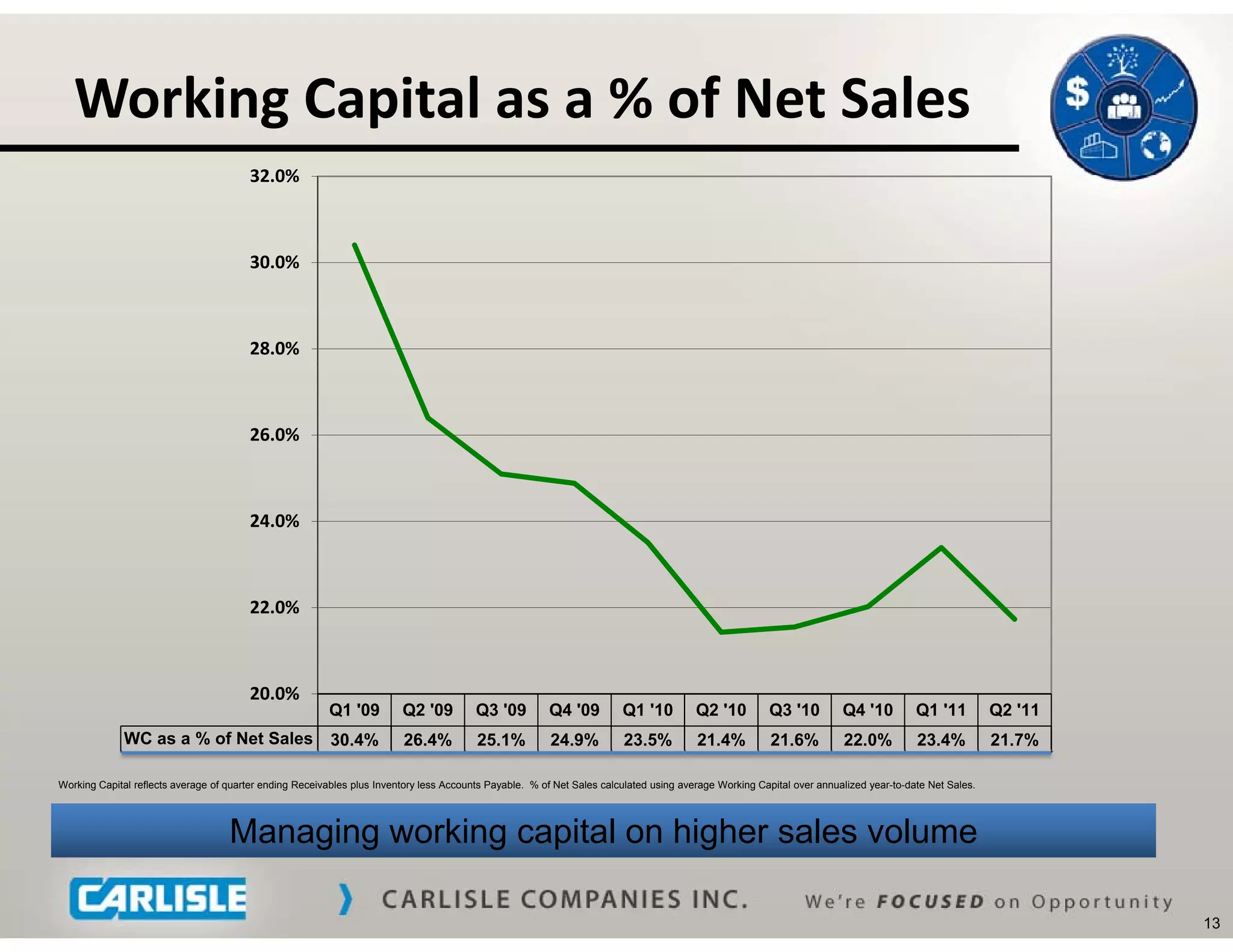

Carlisle Companies reported strong financial results for the 2nd quarter of 2011. Net sales increased 27% to $870.8 million, driven by a 14% increase in organic sales and a 12% contribution from acquisitions. Earnings before interest and taxes grew 33% to $85.4 million, with margins expanding 50 basis points to 9.8%. Continued sales and earnings growth was achieved despite pressure from rising raw material costs. The results reflected outstanding performance from the Brake & Friction segment, which saw a 356% increase in sales and 510 basis point expansion in margins due to the Hawk acquisition. Carlisle remains well positioned for further growth through investments in acquisitions, new product development and