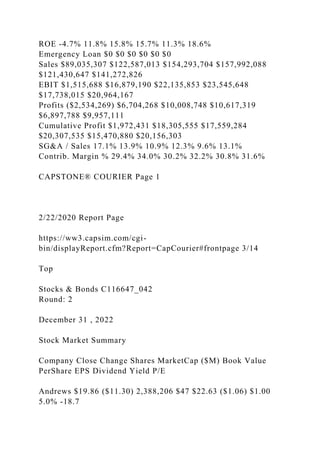

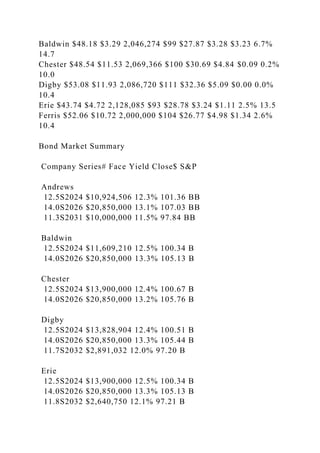

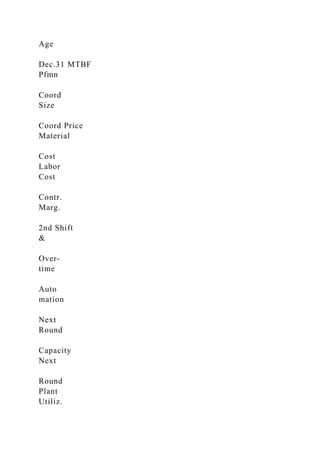

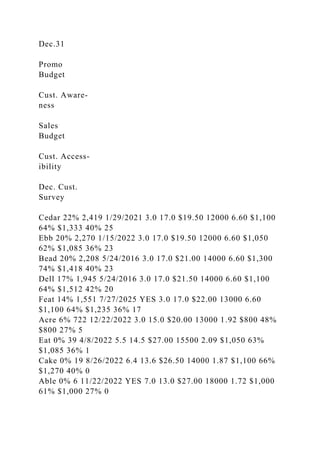

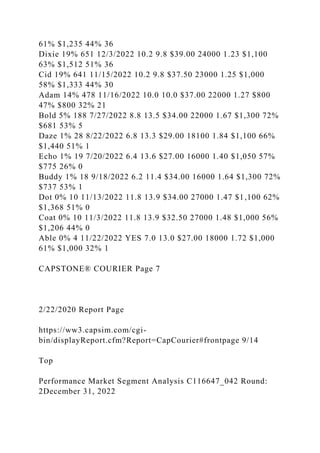

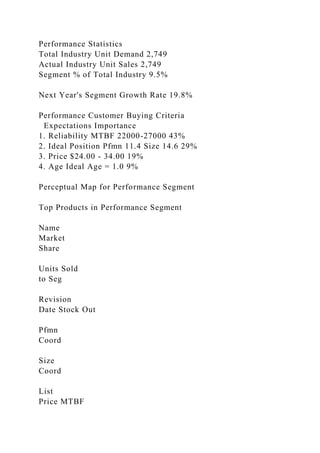

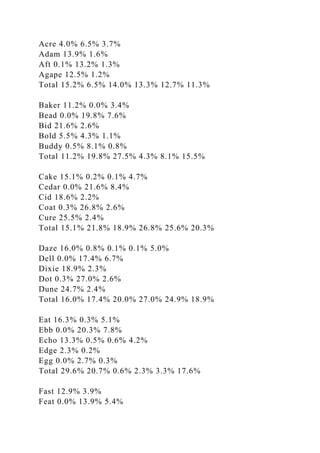

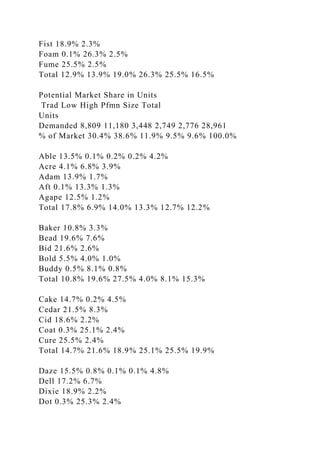

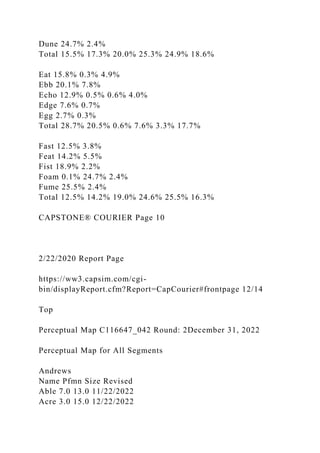

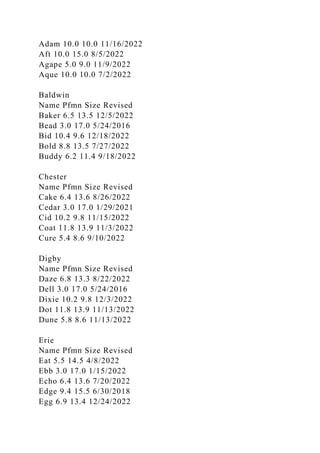

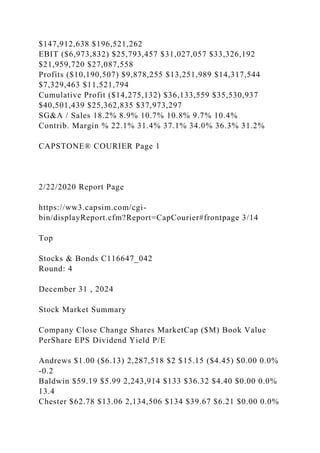

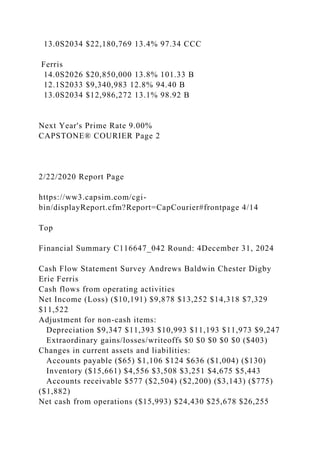

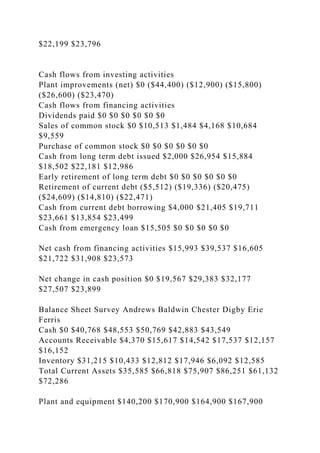

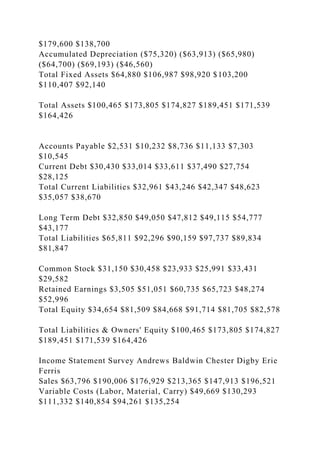

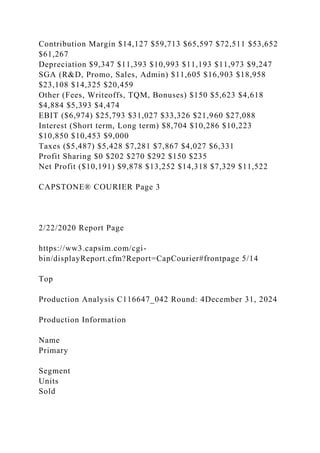

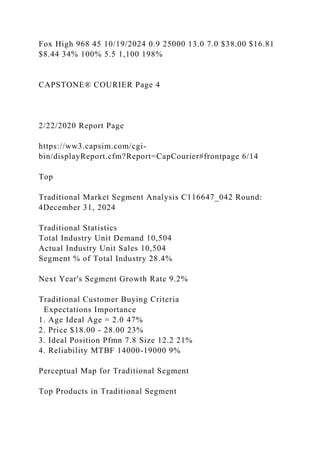

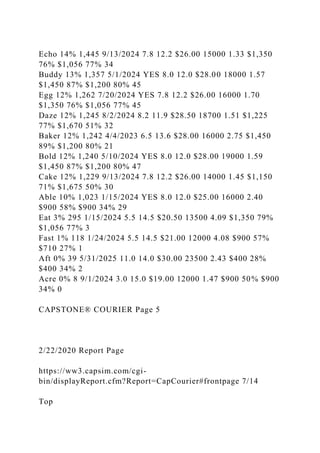

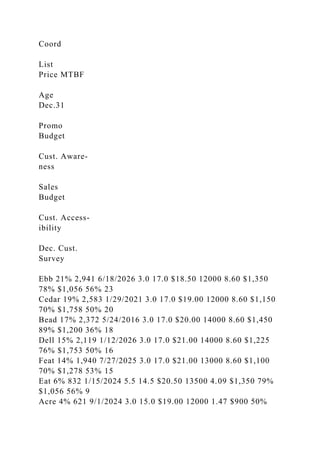

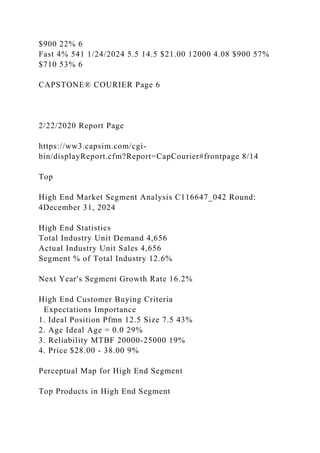

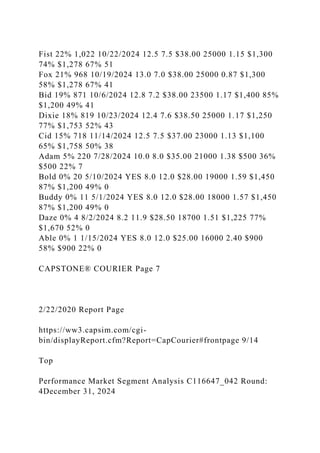

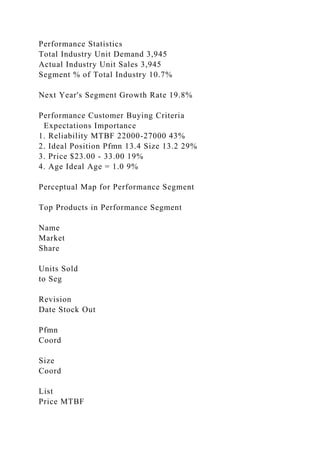

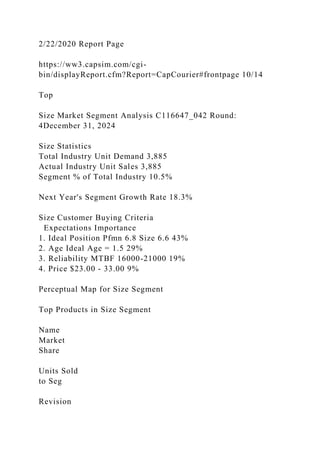

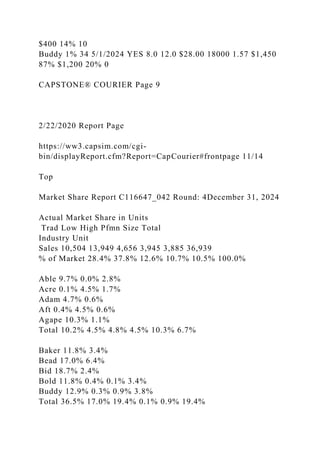

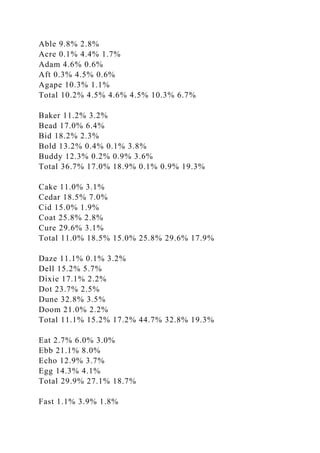

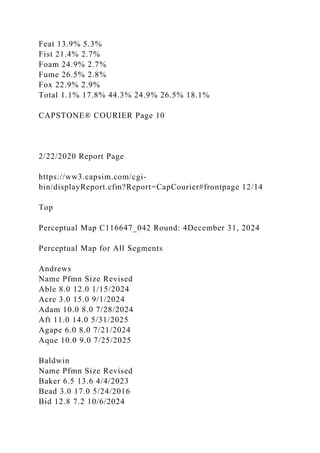

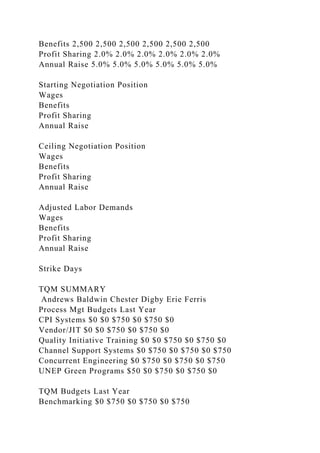

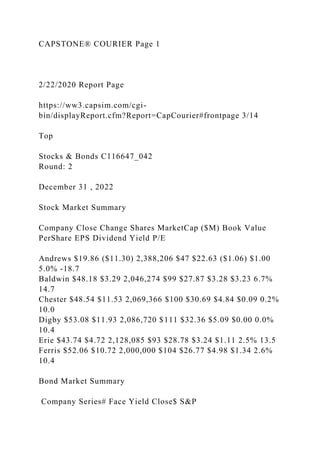

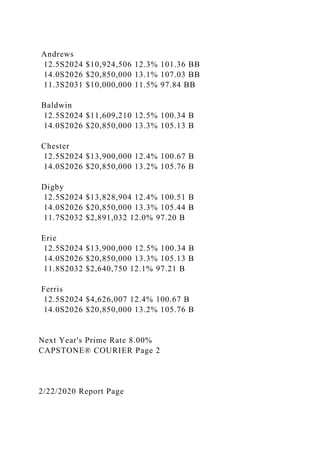

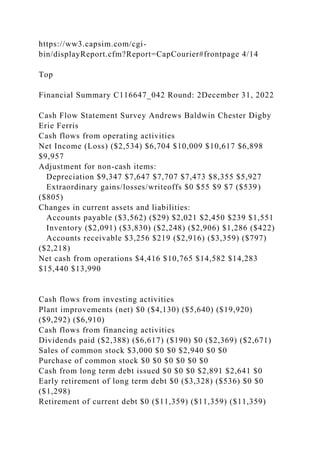

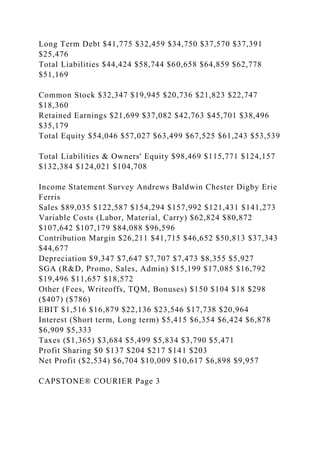

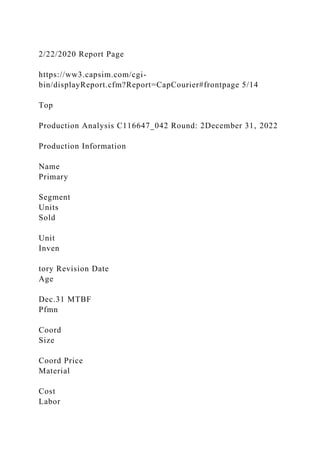

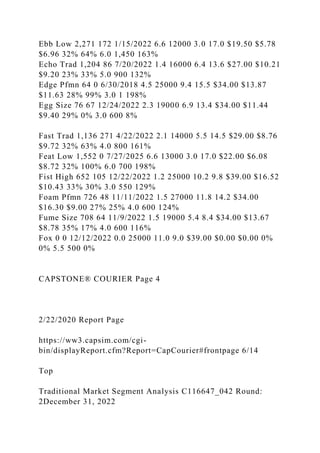

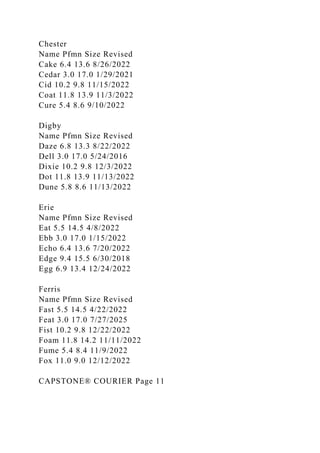

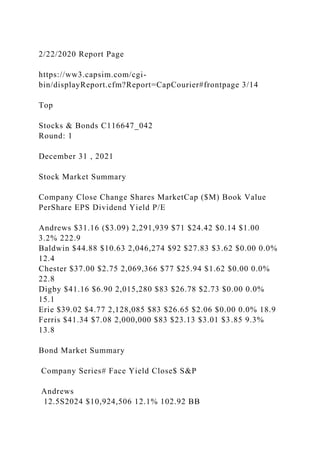

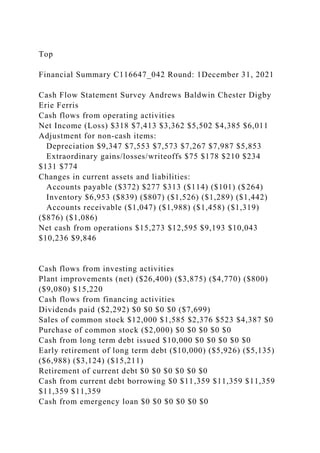

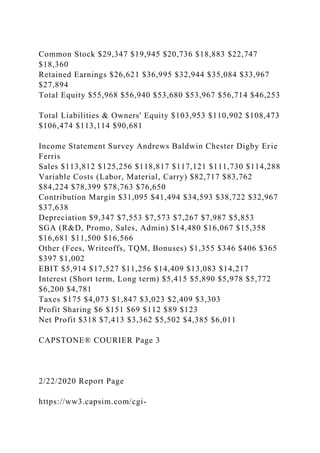

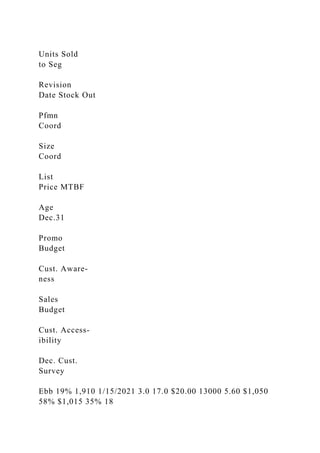

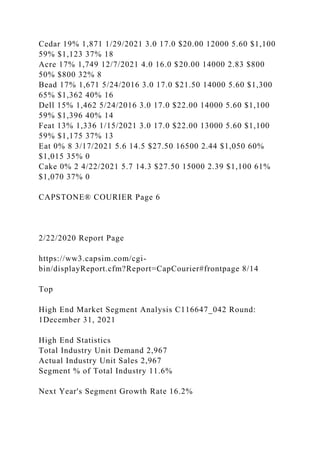

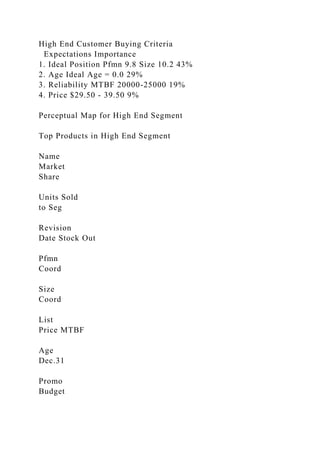

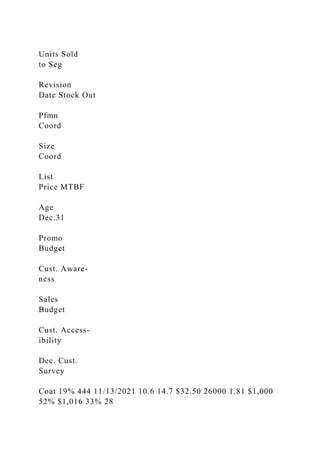

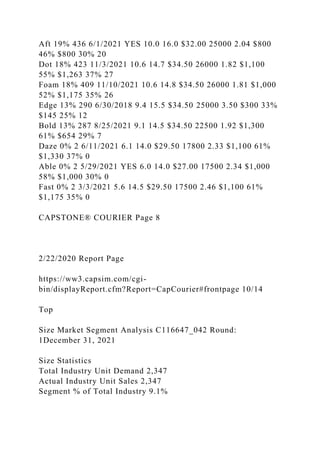

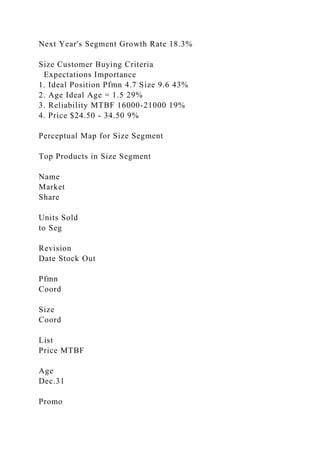

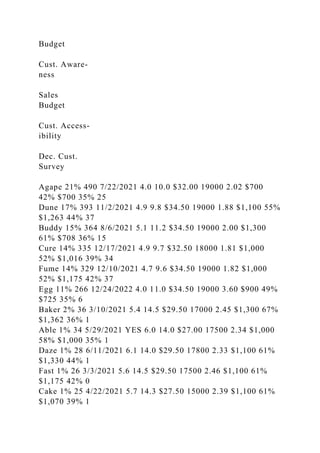

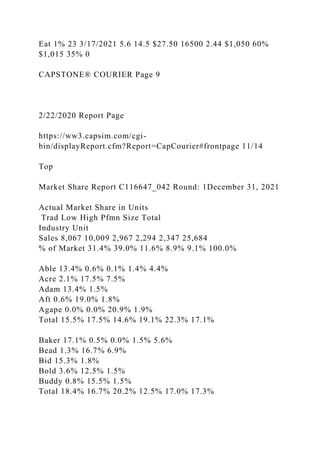

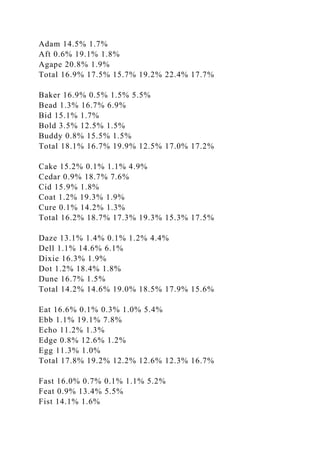

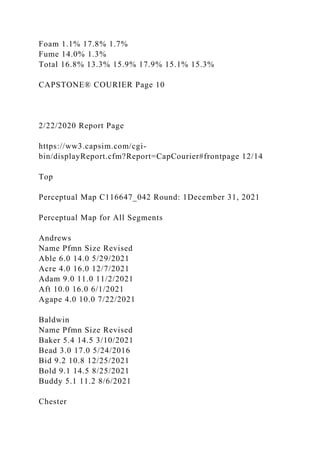

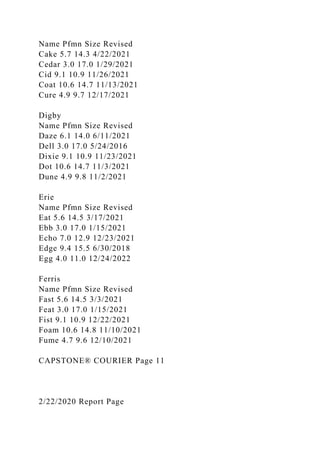

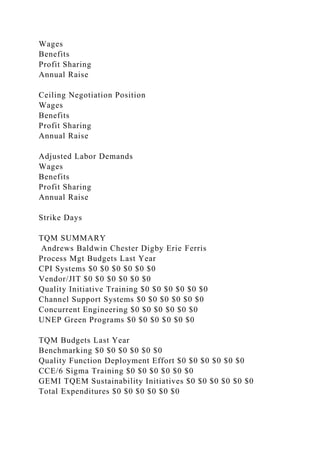

The document provides a detailed financial report for various companies as of December 31, 2022, including key statistics such as sales, profits, stock market performance, and cash flow statements. It also includes production analysis, stock and bond market summaries, and other essential financial data metrics for the companies listed. It highlights the performance of companies like Andrews, Baldwin, Chester, and others across different metrics to give a comprehensive overview of their financial health.