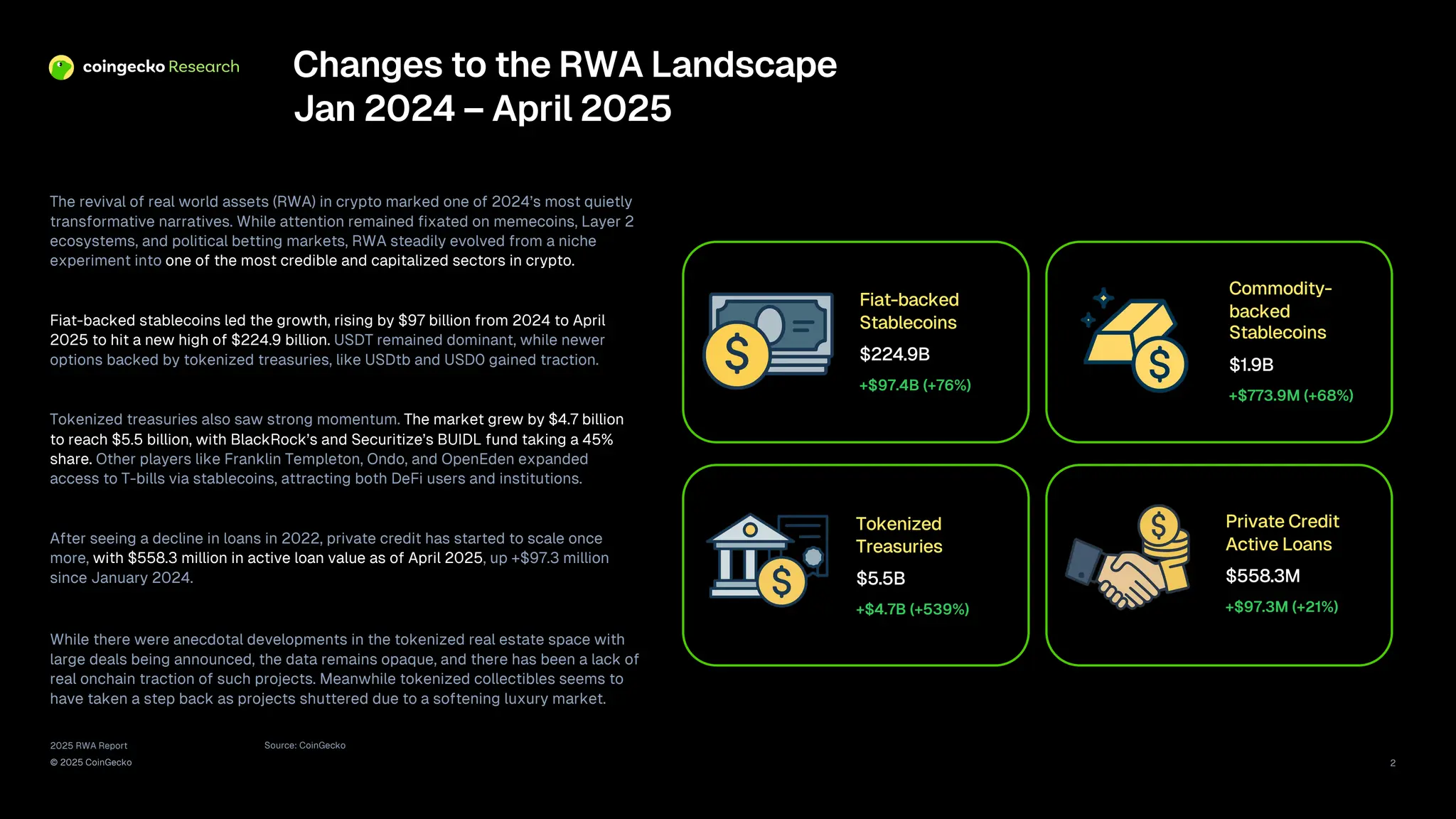

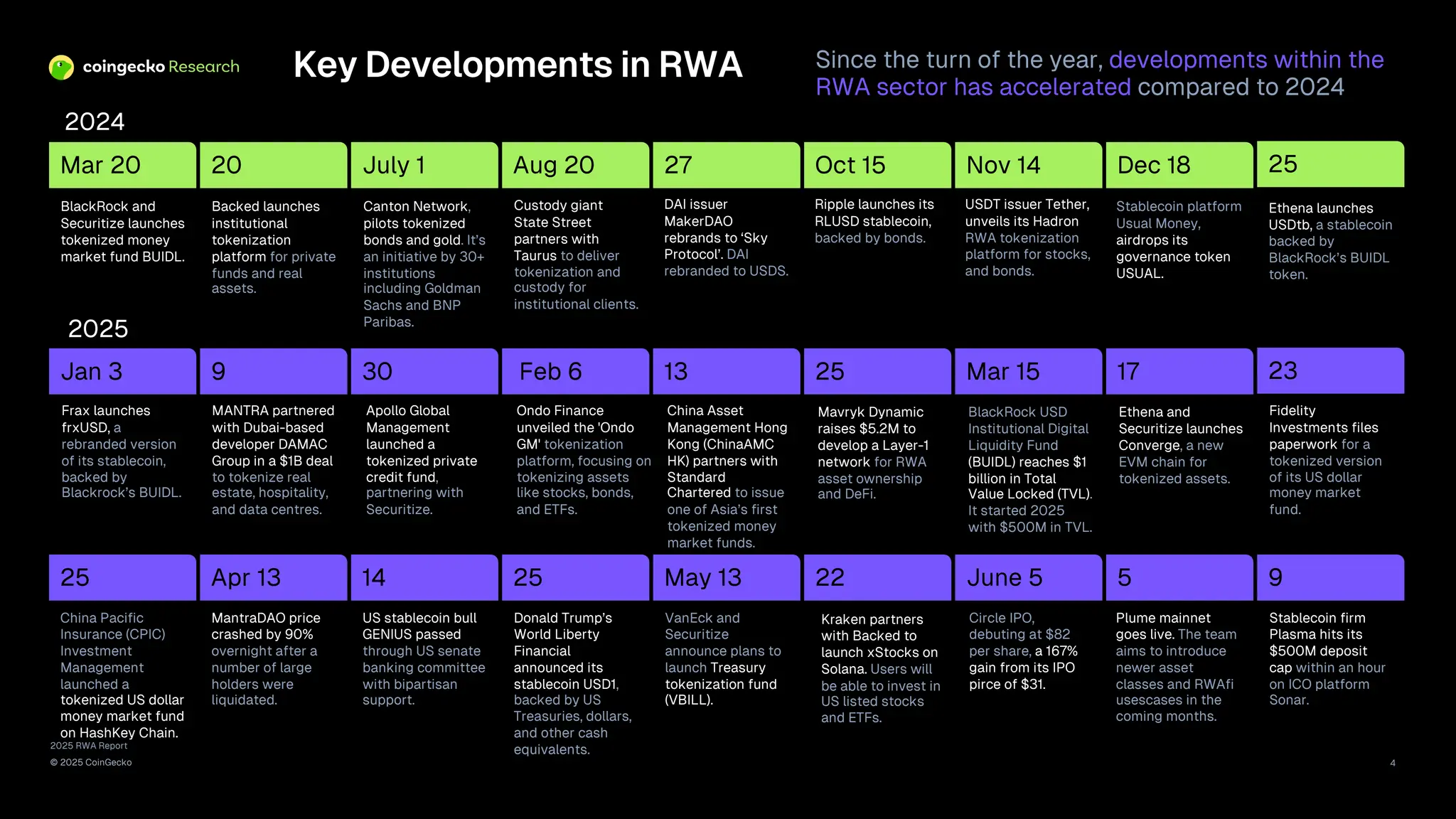

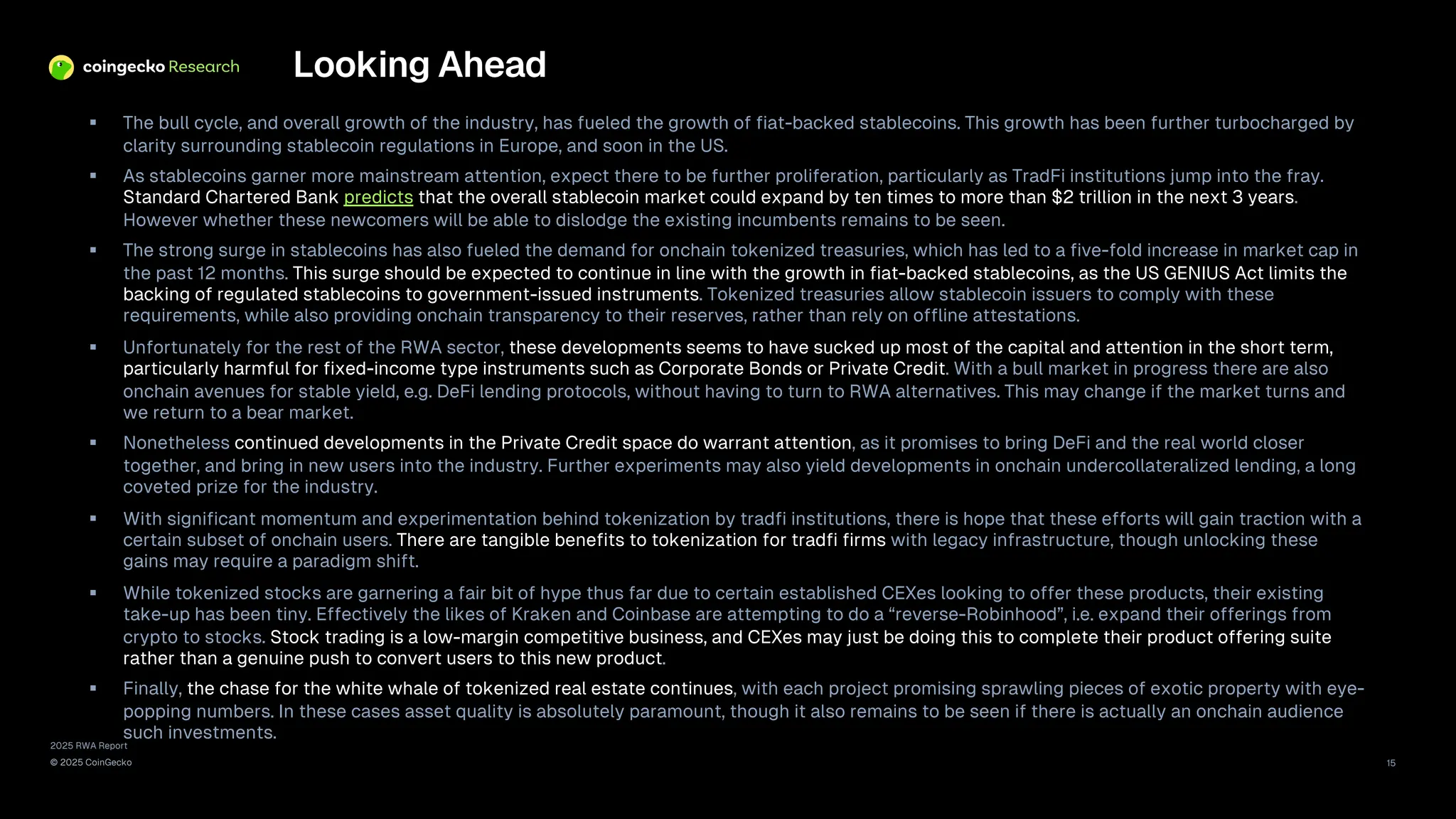

The revival of real world assets (RWA) in crypto marked one of 2024’s most quietly transformative narratives. While attention remained fixated on memecoins, Layer 2 ecosystems, and political betting markets, RWA steadily evolved from a niche experiment into one of the most credible and capitalized sectors in crypto.

So, how far have the core RWA verticals come since the start of 2024?

We’ve summarized the key highlights, but be sure to dig into the full 18 slides below.