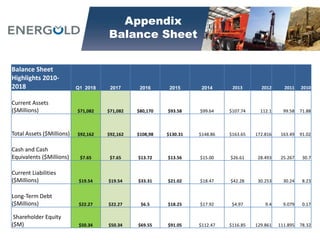

Energold Drilling Group is a global drilling solutions provider operating in 24 countries. The presentation discusses Energold's business segments including mining, energy, manufacturing, and water drilling. It provides an overview of Energold's financial performance, including increasing revenue and positive EBITDA in Q1 2018. The presentation also summarizes Energold's technology, customers, and investment in Impact Silver Corp.