2017-05 Renaissance

•

0 likes•32 views

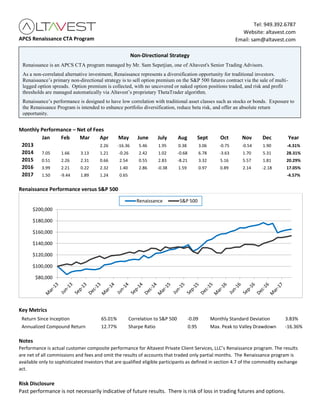

The document provides performance data and key metrics for the APCS Renaissance CTA Program from 2013 to 2017. The program achieved positive returns in most years with an annualized compound return of 12.77% and overall return since inception of 65.01%. As a non-directional strategy, Renaissance sells option premium on S&P 500 futures via option spreads to generate returns with low correlation (-0.09) to the S&P 500 and monthly standard deviation of 3.83%. The program is managed using a non-correlated alternative investment approach to offer portfolio diversification, reduced risk, and absolute returns.

Report

Share

Report

Share

Download to read offline

Recommended

Recommended

Case study of a comprehensive risk analysis for an asset manager

The following case study is an excerpt of a comprehensive risk analysis prepared for an asset manager client of Gateway Partners. This client is a medium-sized asset manager with offices in both the U.S. and abroad who needed assistance in both quantifying and fully understanding the risk profile of their multi-billion dollar portfolio. Additional risk concerns of this client include “worst case” risk scenario analysis and the use of derivative instruments to assist in the hedging of their portfolio. While this case study has been used with the permission of our client, specific securities and the amounts they represent in the client portfolio have been changed and reduced to protect the identity of the client. Gateway Partners is proud to present this case study as an example of the risk management services we provide to our clients.

Understanding the Financial Health of your Subscription Business

Industry leaders, Zuora and Totango, present which metrics truly give an accurate picture of the health of your subscription business. Which metrics should you calculate and optimize on - ARR, GEI, CRC or other ratios?

Chief Financial Officer, Tyler Sloat from Zuora shares 3 metrics they measure for their company and track against other best-in-class subscription companies. Chief Marketing Officer, Kaiser Mulla-Feroze from Totango, also presents a couple key metrics he finds missing from the boardroom discussions.

Visit totango.com to view the entire webinar and hear their insightful commentary that accompanies these slides and Q&A.

Prosper Keynote FintechRevolution NYC

Ron Suber shares his thoughts on the evolving Marketplace Lending Industry at the November 15 Fintech Revolution Symposium.

From Good to Great: How to Ace Your Marketplace Fundraise

At the Marketplace Conference Online December 2020, Battery Ventures' Justin Da Rosa teamed up with Speedinvest's Philip Specht on the core marketplace metrics investors evaluate during the fundraising process from seed to growth.

How to scale a health tech business to $100M and beyond

After studying over 100 venture-backed healthcare companies, we present the definitive benchmarks for what growing a health tech business should look like at every stage.

Read the full article here: https://www.bvp.com/atlas/how-to-scale-a-health-tech-business-to-100-million-arr-and-beyond

2 Enhanced Dynamic 1 Moderate Active Strategy Investment Performance Report 2...

Enhanced Investment Partners LLC

ENHANCED DYNAMIC® 1 MODERATE ACTIVE EQUITY STRATEGY

Sales Compensation in SaaS Companies Annual Survey 2018

The topic of salary compensation for sales professionals is a hotly debated one among SaaS companies, so to see how Israeli startups stack up against international benchmarks, we (Viola Ventures) surveyed some of our portfolio and non-portfolio companies about their sales compensation policies.

You can read the accompanying blog post here: http://www.viola-group.com/violanotes/sales-compensation-in-saas-companies-viola-ventures-annual-survey-2018/

FLG Partners SaaS talk 10.20.2018

For the annual FLG offsite, I gave this presentation on understanding SaaS metrics and using them for fundraising. Several people have DM'd me for the presentation, so I'm posting it here.

Five Tactical Considerations Well Before an IPO

Brian Truesdale, Managing Director at J.P. Morgan on tactical considerations for startup CEOs to consider well before an IPO.

Zuora's 2017 CFO Summit SaaS Benchmark Slides

The slides from the first session of Zuora's 2017 CFO Summit

How to account for customer success

Customer Success as a movement is so young even compared to other emerging tech sectors. But it's changing so fast it can be hard to justify it to your financial department. Scott Golden, Gainsight's Director of Customer Success Strategy, will deep dive into a data-driven webinar all about how you can account for Customer Success in such a rapidly-evolving industry.

Enhanced Dynamic 5 Maximum Passive S&P Strategy 20170630 on 20170801Performa...

Enhanced Dynamic 5 Maximum Passive S&P Strategy 20170630 on 20170801Performance Report 8P Gross

Osisko Development - Investor Presentation - June 24

Osisko Development - Investor Presentation - June 24

Snam 2023-27 Industrial Plan - Financial Presentation

ESTRATTO Strategic Plan - Powerpoint Presentation

More Related Content

Similar to 2017-05 Renaissance

Case study of a comprehensive risk analysis for an asset manager

The following case study is an excerpt of a comprehensive risk analysis prepared for an asset manager client of Gateway Partners. This client is a medium-sized asset manager with offices in both the U.S. and abroad who needed assistance in both quantifying and fully understanding the risk profile of their multi-billion dollar portfolio. Additional risk concerns of this client include “worst case” risk scenario analysis and the use of derivative instruments to assist in the hedging of their portfolio. While this case study has been used with the permission of our client, specific securities and the amounts they represent in the client portfolio have been changed and reduced to protect the identity of the client. Gateway Partners is proud to present this case study as an example of the risk management services we provide to our clients.

Understanding the Financial Health of your Subscription Business

Industry leaders, Zuora and Totango, present which metrics truly give an accurate picture of the health of your subscription business. Which metrics should you calculate and optimize on - ARR, GEI, CRC or other ratios?

Chief Financial Officer, Tyler Sloat from Zuora shares 3 metrics they measure for their company and track against other best-in-class subscription companies. Chief Marketing Officer, Kaiser Mulla-Feroze from Totango, also presents a couple key metrics he finds missing from the boardroom discussions.

Visit totango.com to view the entire webinar and hear their insightful commentary that accompanies these slides and Q&A.

Prosper Keynote FintechRevolution NYC

Ron Suber shares his thoughts on the evolving Marketplace Lending Industry at the November 15 Fintech Revolution Symposium.

From Good to Great: How to Ace Your Marketplace Fundraise

At the Marketplace Conference Online December 2020, Battery Ventures' Justin Da Rosa teamed up with Speedinvest's Philip Specht on the core marketplace metrics investors evaluate during the fundraising process from seed to growth.

How to scale a health tech business to $100M and beyond

After studying over 100 venture-backed healthcare companies, we present the definitive benchmarks for what growing a health tech business should look like at every stage.

Read the full article here: https://www.bvp.com/atlas/how-to-scale-a-health-tech-business-to-100-million-arr-and-beyond

2 Enhanced Dynamic 1 Moderate Active Strategy Investment Performance Report 2...

Enhanced Investment Partners LLC

ENHANCED DYNAMIC® 1 MODERATE ACTIVE EQUITY STRATEGY

Sales Compensation in SaaS Companies Annual Survey 2018

The topic of salary compensation for sales professionals is a hotly debated one among SaaS companies, so to see how Israeli startups stack up against international benchmarks, we (Viola Ventures) surveyed some of our portfolio and non-portfolio companies about their sales compensation policies.

You can read the accompanying blog post here: http://www.viola-group.com/violanotes/sales-compensation-in-saas-companies-viola-ventures-annual-survey-2018/

FLG Partners SaaS talk 10.20.2018

For the annual FLG offsite, I gave this presentation on understanding SaaS metrics and using them for fundraising. Several people have DM'd me for the presentation, so I'm posting it here.

Five Tactical Considerations Well Before an IPO

Brian Truesdale, Managing Director at J.P. Morgan on tactical considerations for startup CEOs to consider well before an IPO.

Zuora's 2017 CFO Summit SaaS Benchmark Slides

The slides from the first session of Zuora's 2017 CFO Summit

How to account for customer success

Customer Success as a movement is so young even compared to other emerging tech sectors. But it's changing so fast it can be hard to justify it to your financial department. Scott Golden, Gainsight's Director of Customer Success Strategy, will deep dive into a data-driven webinar all about how you can account for Customer Success in such a rapidly-evolving industry.

Enhanced Dynamic 5 Maximum Passive S&P Strategy 20170630 on 20170801Performa...

Enhanced Dynamic 5 Maximum Passive S&P Strategy 20170630 on 20170801Performance Report 8P Gross

Similar to 2017-05 Renaissance (20)

Case study of a comprehensive risk analysis for an asset manager

Case study of a comprehensive risk analysis for an asset manager

Understanding the Financial Health of your Subscription Business

Understanding the Financial Health of your Subscription Business

From Good to Great: How to Ace Your Marketplace Fundraise

From Good to Great: How to Ace Your Marketplace Fundraise

How to scale a health tech business to $100M and beyond

How to scale a health tech business to $100M and beyond

2 Enhanced Dynamic 1 Moderate Active Strategy Investment Performance Report 2...

2 Enhanced Dynamic 1 Moderate Active Strategy Investment Performance Report 2...

Sales Compensation in SaaS Companies Annual Survey 2018

Sales Compensation in SaaS Companies Annual Survey 2018

Principles of Modern Marketing at NetSuite - Rob Israch (TOPO Demand Generati...

Principles of Modern Marketing at NetSuite - Rob Israch (TOPO Demand Generati...

Enhanced Dynamic 5 Maximum Passive S&P Strategy 20170630 on 20170801Performa...

Enhanced Dynamic 5 Maximum Passive S&P Strategy 20170630 on 20170801Performa...

Recently uploaded

Osisko Development - Investor Presentation - June 24

Osisko Development - Investor Presentation - June 24

Snam 2023-27 Industrial Plan - Financial Presentation

ESTRATTO Strategic Plan - Powerpoint Presentation

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Recently uploaded (8)

Osisko Development - Investor Presentation - June 24

Osisko Development - Investor Presentation - June 24

Snam 2023-27 Industrial Plan - Financial Presentation

Snam 2023-27 Industrial Plan - Financial Presentation

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

Collective Mining | Corporate Presentation - May 2024

New Tax Regime User Guide Flexi Plan Revised (1).pptx

New Tax Regime User Guide Flexi Plan Revised (1).pptx

2017-05 Renaissance

- 1. APCS Renaissance CTA Program Monthly Performance – Net of Fees Jan Feb Mar Apr May June July Aug Sept Oct Nov Dec Year 2013 2.26 -16.36 5.46 1.95 0.38 3.06 -0.75 -0.54 1.90 -4.31% 2014 7.05 1.66 3.13 1.21 -0.26 2.42 1.02 -0.68 6.78 -3.63 1.70 5.31 28.31% 2015 0.51 2.26 2.31 0.66 2.54 0.55 2.83 -8.21 3.32 5.16 5.57 1.81 20.29% 2016 3.99 2.21 0.22 2.32 1.40 2.86 -0.38 1.59 0.97 0.89 2.14 -2.18 17.05% 2017 1.50 -9.44 1.89 1.24 0.65 -4.57% Renaissance Performance versus S&P 500 Key Metrics Return Since Inception 65.01% Correlation to S&P 500 -0.09 Monthly Standard Deviation 3.83% Annualized Compound Return 12.77% Sharpe Ratio 0.95 Max. Peak to Valley Drawdown -16.36% Notes Performance is actual customer composite performance for Altavest Private Client Services, LLC’s Renaissance program. The results are net of all commissions and fees and omit the results of accounts that traded only partial months. The Renaissance program is available only to sophisticated investors that are qualified eligible participants as defined in section 4.7 of the commodity exchange act. Risk Disclosure Past performance is not necessarily indicative of future results. There is risk of loss in trading futures and options. $80,000 $100,000 $120,000 $140,000 $160,000 $180,000 $200,000 Renaissance S&P 500 Tel: 949.392.6787 Website: altavest.com Email: sam@altavest.com Non-Directional Strategy Renaissance is an APCS CTA program managed by Mr. Sam Sepetjian, one of Altavest's Senior Trading Advisors. As a non-correlated alternative investment, Renaissance represents a diversification opportunity for traditional investors. Renaissance’s primary non-directional strategy is to sell option premium on the S&P 500 futures contract via the sale of multi- legged option spreads. Option premium is collected, with no uncovered or naked option positions traded, and risk and profit thresholds are managed automatically via Altavest’s proprietary ThetaTrader algorithm. Renaissance’s performance is designed to have low correlation with traditional asset classes such as stocks or bonds. Exposure to the Renaissance Program is intended to enhance portfolio diversification, reduce beta risk, and offer an absolute return opportunity.