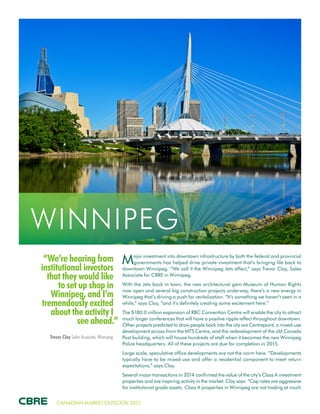

The 2015 Canadian market outlook highlights Vancouver's booming office development driven by demand from technology companies post-2010 Winter Olympics, alongside challenges in land scarcity for industrial projects. Calgary is experiencing growth despite fluctuations in the oil market, while Edmonton's economy benefits from low vacancy rates and high demand in the industrial sector. Winnipeg is seeing revitalization through major investments in infrastructure and mixed-use developments, attracting interest from institutional investors.