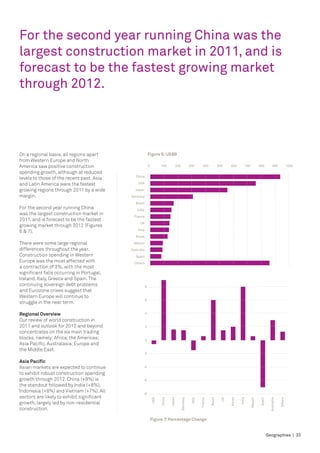

The document provides an annual review of the Irish construction industry in 2012. It summarizes projections for construction output, noting that output is expected to decline further in 2013 before showing low single-digit growth in subsequent years. Even with ambitious growth targets, the industry would not reach sustainable output levels until 2020 or later. Construction costs are expected to increase modestly in the coming years, while public sector construction faces challenges such as low-cost tendering and risk transfers that make it difficult for contractors and consultants.