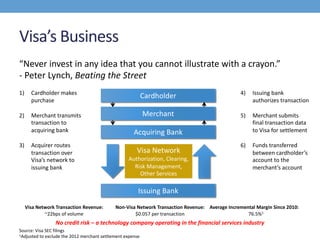

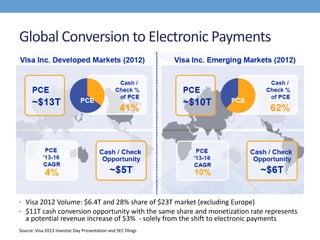

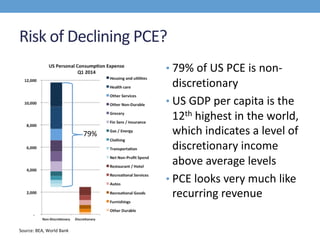

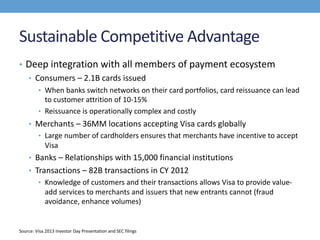

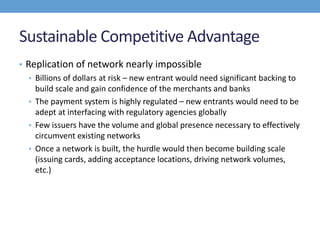

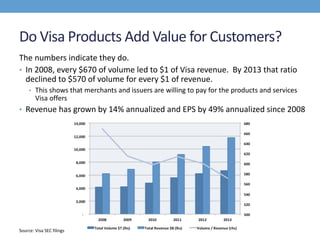

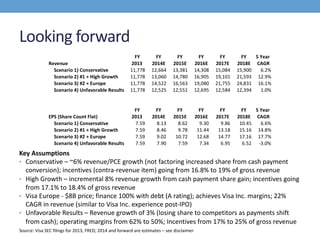

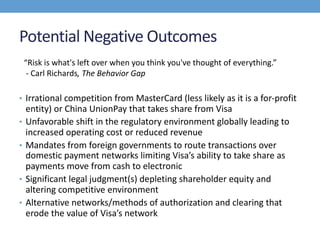

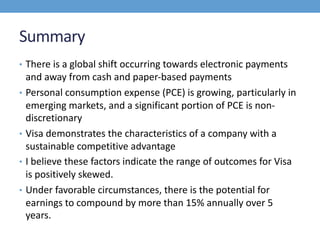

Visa operates the largest electronic payments network globally. It has no credit risk and earns revenue primarily from small transaction fees. Visa has a large opportunity to grow as the world shifts from cash to electronic payments. It has strong network effects and integration with banks and merchants that represent significant barriers to entry. Under favorable conditions like continued global economic growth and cash conversion, Visa's earnings could compound over 15% annually over the next 5 years. However, risks include increased regulation, new technologies, and irrational competition that could pressure margins.