This document provides an overview of funding options for startups and developers in Norway, including:

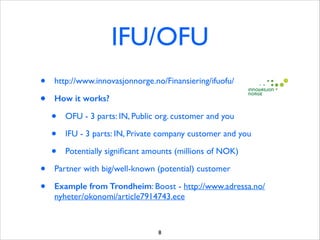

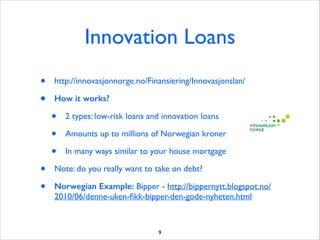

1. R&D tax deductions, innovation grants, and research grants that are available from the Norwegian government to support new projects and businesses.

2. Private funding sources like angel investors, accelerators, and venture capital that can provide seed funding, training, networking and larger investment rounds.

3. Alternative funding models like crowdfunding, customer pre-sales, and loans that may also be options to explore depending on the needs and stage of the startup.