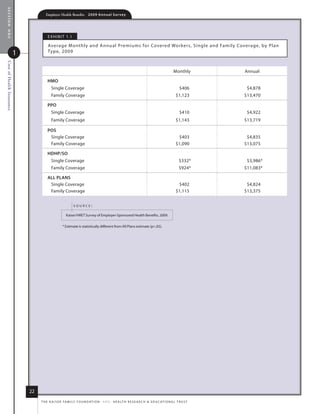

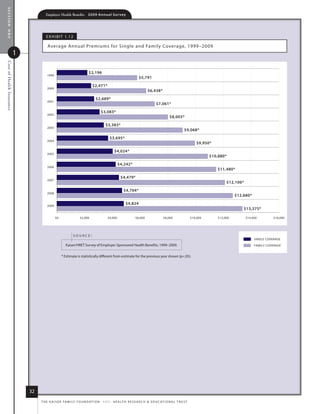

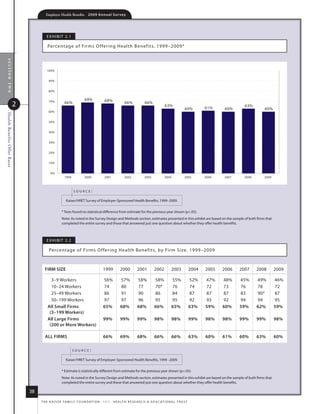

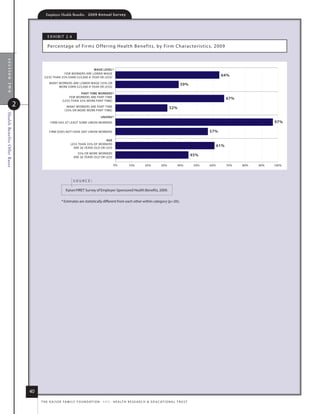

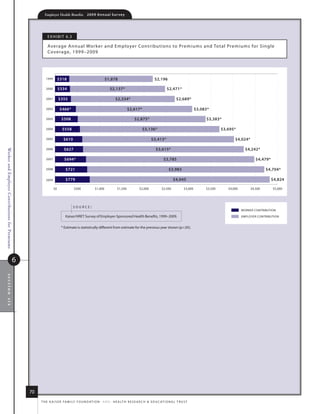

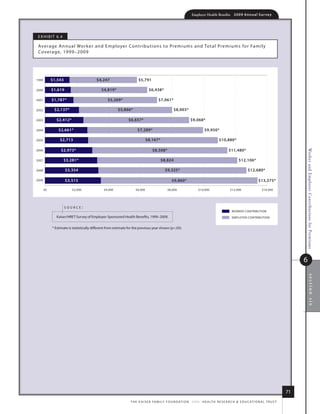

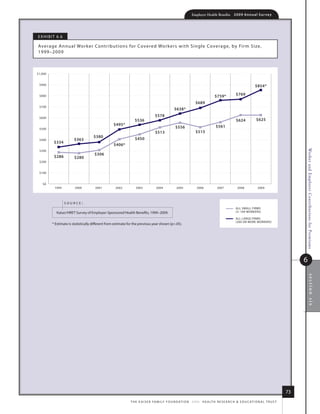

This document provides an overview and summary of the 2009 Kaiser Family Foundation/Health Research & Educational Trust Employer Health Benefits Annual Survey. The survey collected data from over 2,000 small and large employers on health benefits offered, costs of coverage, worker and employer contributions, plan design, and other topics. Key findings include that average annual premiums for family coverage in 2009 were $13,375, with workers contributing on average $3,515 toward their premiums. Large firms on average pay higher premiums than small firms. The percentage of firms offering health benefits has remained stable at around 60% since 1999.

![Survey Design and Methods

Employer Health Benefits 2 0 0 9 An n u a l s u r ve y

a few variables that Kaiser/HRET has decided should This year we created a new weight to correct for a very

not be imputed; these are typically variables where slight bias in our estimates of the take up rate. This

“don’t know” is considered a valid response option (for new weight reflects all workers in the firm who are

example, firms’ opinions about effectiveness of various eligible for health benefits. In the past, our estimates

strategies to control health insurance costs). were a function of all workers in the firm, whether they

W e i g h T i N g A N D s TAT i s T i C A l s i g N i f i C A N C e were eligible for health benefits (and could thus take

up) or not. Historical take-up estimates have likewise

Because Kaiser/HRET selects firms randomly, it

been updated to reflect only those workers eligible for

is possible through the use of statistical weights to

extrapolate the results to national (as well as firm size, health benefits.

regional, and industry) averages. These weights allow We continue to ask firms whether or not they offer

Kaiser/HRET to present findings based on the number a conventional health plan and, if so, how many

of workers covered by health plans, the number of

of their covered workers are enrolled in that plan

total workers, and the number of firms. In general,

and whether it is self-funded or underwritten by an

findings in dollar amounts (such as premiums, worker

insurer. However, due to the declining market share

contributions, and cost sharing) are weighted by

covered workers. Other estimates, such as the offer of conventional health plans, in 2006, we stopped

rate, are weighted by firms. Specific weights were asking respondents additional questions about the

created to analyze the HDHP/SO plans that are offered attributes of the conventional plans they offer. As of

with an HRA or that are HSA-qualified. These weights 2009 our primary covered worker weight no longer

represent the proportion of employees enrolled in each includes those workers with conventional coverage.5

of these arrangements. Therefore, premium and cost-sharing levels are

Calculation of the weights follows a common estimated among workers covered by an HMO, PPO,

approach. First, the basic weight is determined, POS plan, or HDHP/SO. Removing workers covered

followed by a nonresponse adjustment. As part of this by conventional health insurance from the covered

nonresponse adjustment, Kaiser/HRET conducted worker weight has little impact on the estimates

a small follow-up survey of those firms with 3 to 49 reported for “All Plans,” such as the average single or

workers that refused to participate in the full survey. family premium. In cases where a firm offers only

We applied an additional nonresponse adjustment to conventional health plans, no information from that

the weight to reflect the findings of this survey. respondent is included in “All Plan” averages. The

Next, we trimmed the weights in order to reduce exception is for whether or not the plan is self-funded,

the influence of weight outliers. First, we identified for which we have information. For enrollment

common groups of observations. Within each group, statistics, we weight the statistics by all covered

we identified the median and the interquartile range of workers, including those in conventional insurance.

the weights and calculated the trimming cut point as the

median plus six times the interquartile range The survey contains a few questions on employee cost

(M + [6 * IQR]). Weight values larger than this cut sharing that are asked only of firms that indicate in a

point are trimmed to the cut point. In all instances, less previous question that they have a certain cost-sharing

than one percent of the weight values were trimmed. provision. For example, the copayment amount for

prescription drugs is asked only of those that report

Finally, we applied a post-stratification adjustment.

they have copayments for prescription drugs. Because

We used the U.S. Census Bureau’s 2006 Statistics

of U.S. Businesses as the basis for the stratification the composite variables (using data from across all

and the post-stratification adjustment for firms in plan types) are reflective of only those plans with the

the private sector, and we used the 2007 Census of provision, separate weights for the relevant variables

Governments as the basis for post-stratification for were created in order to account for the fact that not all

public sector firms. covered workers have such provisions.

note:

5 in 2009, 1% of covered workers are enrolled in a conventional plan.

13

t h e k a i s e r fa m i ly f o u n d at i o n - a n d - h e a lt h r e s e a r C h & e d u C at i o n a l t r u s t](https://image.slidesharecdn.com/2009erhealthstudy-12706873402167-phpapp01/85/2009-Kaiser-Employer-Health-Study-27-320.jpg)