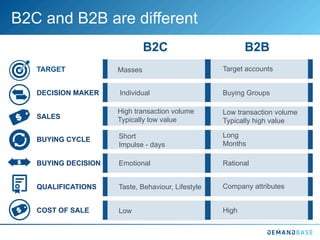

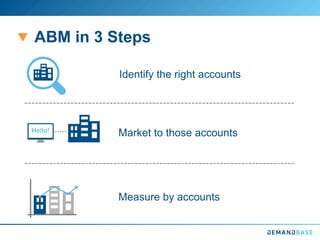

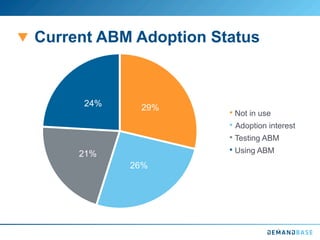

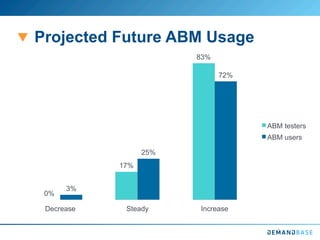

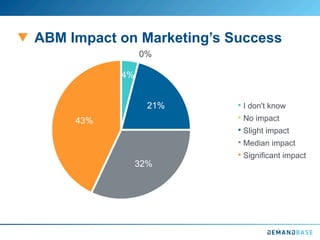

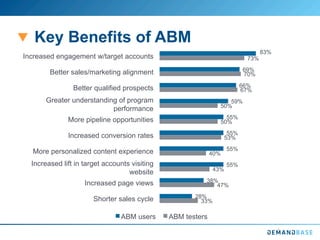

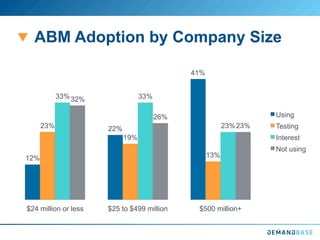

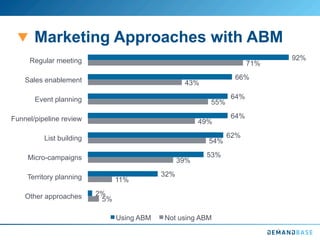

The document discusses the adoption and impact of account-based marketing (ABM) among B2B companies, highlighting that 29% of respondents are currently using ABM, with a significant projected increase in future usage. Key benefits of ABM include shorter sales cycles, increased website engagement, and better alignment between sales and marketing teams. The document also emphasizes the importance of evaluating current marketing strategies, starting small with testing, and measuring results for effective ABM implementation.