20 07-23 building blocks to eliminate the estate tax

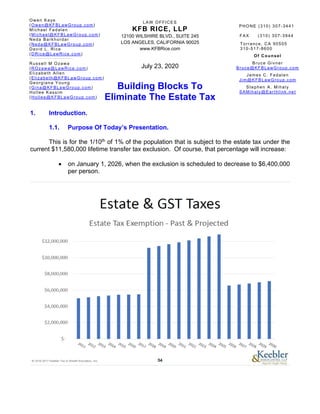

- 1. LAW OFFICES KFB RICE, LLP 12100 WILSHIRE BLVD., SUITE 245 LOS ANGELES, CALIFORNIA 90025 www.KFBRice.com Owen Kaye (Owen@KFBLawGroup.com) Michael Fedalen (Michael@KFBLawGroup.com) Neda Barkhordar (Neda@KFBLawGroup.com) David L. Rice (DRice@LawRice.com) _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ _ Russell M Ozawa (ROzawa@LawRice.com) Elizabeth Allen (Elizabeth@KFBLawGroup.com) Georgiana Young (Gina@KFBLawGroup.com) Hollee Kassim (Hollee@KFBLawGroup.com) 2780 Skypark Dr. #475 Torrance, CA 90505 310-517-8600 Of Counsel Bruce Givner Bruce@KFBLawGroup.com James C. Fedalen Jim@KFBLawGroup.com Stephen A. Mihaly SAMihaly@Earthlink.net PHONE (310) 307-3441 FAX (310) 307-3944 July 23, 2020 Building Blocks To Eliminate The Estate Tax 1. Introduction. 1.1. Purpose Of Today’s Presentation. This is for the 1/10th of 1% of the population that is subject to the estate tax under the current $11,580,000 lifetime transfer tax exclusion. Of course, that percentage will increase: on January 1, 2026, when the exclusion is scheduled to decrease to $6,400,000 per person.

- 2. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 2 of 16 If the Democrats take control of both the Senate and the presidency on November 3, 2020. 1.2. The Stakes. IRC §6662 20% accuracy-related penalty. IRC §6662(g) 40% substantial estate or gift tax valuation understatement penalty. IRC §6695A appraiser penalty – greater of 10% of the underpayment, $1,000, or 125% of the gross income received from preparing the appraisal. Internal Revenue Code §2036. (a) General rule The value of the gross estate shall include the value of all property to the extent of any interest therein of which the decedent has at any time made a transfer (except in case of a bona fide sale for an adequate and full consideration in money or money’s worth), by trust or otherwise, under which he has retained for his life or for any period not ascertainable without reference to his death or for any period which does not in fact end before his death— (1) the possession or enjoyment of, or the right to the income from, the property, or (2) the right, either alone or in conjunction with any person, to designate the persons who shall possess or enjoy the property or the income therefrom. Note #1: There are two different ways §2036 can apply. One is if the parent retains the income. Two is if the parent can designate who will enjoy the income. Note #2: That parenthetical about a transfer for fair market value is in all 3 “string” Code sections. That signals the importance of appraisals. 1.3. The History.

- 3. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 3 of 16

- 4. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 4 of 16

- 5. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 5 of 16 1.4. The Conflict. For wealthy families: Tax Rate Above Due Rate Note Estate 40% Exclusion 9 months after death Can be extended over 5-15 years under §6166 Capital Gains 33% or 37.1% Basis Never There are 12 to 21 ways to reduce, defer or eliminate the capital gains tax For everyone else: with no estate tax, we want the assets included in the parents’ estate to get a step-up in basis for the children’s benefit. 1.5. The Goals. No estate tax. No estate tax audit. 2. Maintaining Dictatorial Control. 2.1. The Mantra. Simon (“Stuffy”) Singer: “You want to control everything and `own’ nothing.” 2.2. A Children’s Trust. Bruce Givner: “Ask not what you can do for your children – ask what your children’s trust can do for you.” #1: Pick the trustee you trust to do whatever you tell him or her to do. #2: You can remove the trustee any time you want and name a new one.1 #3: Protector mechanism.2 The protector can: Remove a beneficiary. Add a beneficiary who is a: o Lineal descendant of you. o Spouse of your lineal descendant. o Charity. Change the manner of distribution the beneficiaries. 1 In theory limited by IRC §672(c) so you can’t name someone who is related or subordinate. But you can do so through the protector mechanism. 2 If you need a protector, your then CPA appoints one. Your protector resigns immediately after signing the document which makes the changes you wish made.

- 6. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 6 of 16 Change the allocation among the beneficiaries. #4: The children’s trust only owns an interest in an entity you otherwise control, e.g., non-voting stock in an “S” corporation or limited partnership interests in an FLP. #5: We do the “children’s trust” under the laws of Nevada or one of the other 13 states which allow domestic asset protection trusts so you can be added as a beneficiary3 after 10 years has passed.4 3. Discounts. 3.1. Entity. If the FLP’s assets are income producing real estate, the combined discount will be ≈ 40%: $1,000,000 X 80% 20% lack of control $ 800,000 X 75% 25% lack of marketability $ 600,000 If the FLP’s assets are stocks and bonds, the combined discount will be ≈ 30%: $1,000,000 X 84% 16% lack of control $ 840,000 X 84% 16% lack of control $ 705,600 3.2. Tiered Entities. Roy O. Martin, Jr., T.C. Memo 1985-424 (August 14, 1985): “Both parties agree that discounts are appropriate in this case to reflect the fact that the gifted Arbor shares at issue represent only minority interests in a closely held corporation which, in turn, owns minority interests in seven other closely held corporations. ” See also Jane Z. Astleford, T.C. Memo 2008-128 (May 5, 2008). 3 Givner and Singer, “The Completed Gift Asset Protection Trust,” Journal of Financial Service Professionals, September, 2011 p. 60. 4 Bankruptcy Code §548(e) brings into the bankruptcy estate any “self settled trust or similar device” funded within 10 years of the bankruptcy proceeding.

- 7. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 7 of 16 Rabe, “The Application of Multi-Level Valuation Discount In The Gift or Estate Valuation of a Tiered Entity – A Review Of Relevant Judicial Precedent,” Willamette Insights (Winter 2010). 3.3. GSD. 3.3.1. Ideal Estate Tax Planning. 85 year old parent gives the 55 year old son a 30 year, interest only note, at the current long-term AR of 1.12%. Parent dies at 95. Appraiser opines the note is subject to an 80% discount due to the long remaining term at a below-market interest rate. 3.3.2. The Problem With This Ideal Estate Tax Planning. IRC §2036: parent can’t give a note for longer than life expectancy. 3.3.3 The Solution. Sprinkle pixie-dust on it and call it something else. 3.3.4. Conventional GSD. 3.3.5. Supercharged GSD. 3.3.6. The Cases.

- 8. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 8 of 16

- 9. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 9 of 16 4. Structures That Eliminate The Estate Tax. 4.1. The Lifetime Exclusion. 4.1.1. Reasons To Use It. May be gone due to the results of the November 3, 2020, elections. Get appreciation out of the client’s estate. Uncertainty of client’s continued life. 4.1.2. Reasons To Save It. To use against assets the client won’t want to transfer, e.g., the principal residence and a certain amount of liquid assets. To use against assets the client can’t easily transfer, e.g., an IRA or other retirement plan asset. To include assets in the estate so they get a step-up in basis.

- 10. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 10 of 16 4.2. GRATs. Primarily for “S” corporations. Client says the business is worth $10,000,000. Why? Because his profit is $1,000,000 per year and the client wouldn’t sell it for less. We know it will appraise for 4, 5 or 6 times EBITDA. Assume $6,000,000. Assume 40% combined discounts for lack of marketability and lack of control get it to $3,600,000. Assume the client is comfortable with a $700,000 per year dividend. $700,000 ÷ $3,600,000 = 19.44%. Gifts Term Of Years 0 6 $142,370 5 $828,424 4 $1,517,136 3 $2,208,648 2 Assume the client is only comfortable with a $500,000 per year dividend. $500,000 ÷ $3,600,000 = 13.89% Gifts Term Of Years 0 8

- 11. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 11 of 16 $155,074 7 $641.313 6 $1,129,502 5 $1,619,692 4 $2,111,781 3 4.3. SCIN-GRATs. One Page SCIN-GRAT Diagram Mom (75) and Dad (77) Children’s Trust #1 #1 transfer $5,000,000 LP interests #2 pay with 15 year SCIN 5.072% interest LLC #3 Contribute SCIN and other (assets) Children’s Trust #2 #4 Transfer interests in LLC for a 11 or 12 year GRAT Dynasty Trust #5 buys contingent remainder interest

- 12. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 12 of 16 1. Mom and Dad have $8,333,000 of income producing real estate generating 3.05% ($254,167). 2. They contribute it to a family limited partnership in which it is subject to a 40% combined discount for lack of marketability and lack of control, resulting in a value of $5,000,000 earning 5.08%. 3. They transfer the LP interests to the heirs’ trust #1 in exchange for a 15 year SCIN at 5.072%. 4. They contribute the SCIN to an LLC which, with other assets, entitles it to a 30% discount. At the new ($5,000,000 X 70% = ) $3,500,000 value it has a cash flow percentage of 7.26%. 5. The following GRAT terms at 7.26% producing gifts as follows: 14 years ($96,677); 13 years ($331,373); 12 years ($566,466); 11 years ($802,957); and 10 years. (1,040,857). 6. Once the GRAT transaction is complete, Mom and Dad will either (i) die before the end of the SCIN term or (ii) survive the GRAT term, in either case with a zero taxable estate. 7. The sale of the contingent remainder interest to the Dynasty Trust is simply a more elegant solution (to remove the value even from the children’s trust). 4.4. Private Annuity. 4.4.1. The §7520 Rate. August, 2020 0.4% July, 2020 0.6% June, 2020 0.6% May, 2020 0.8% April, 2020 1.2% March, 2020 1.8% February, 2020 2.2% January, 2020 2.0% December, 2019 2.0% November, 2019 2.0% October, 2019 1.8% September, 2019 2.2% August, 2019 2.2% July, 2019 2.6% June, 2019 2.8% May, 2019 2.8% April, 2019 3.0% March, 2019 3.2% February, 2019 3.2% January, 2019 3.4% December, 2018 3.6%

- 13. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 13 of 16 November, 2018 3.6% October, 2018 3.4% September, 2018 3.4% August, 2018 3.4% July, 2018 3.4% June, 2018 3.4% May, 2018 3.2% April, 2018 3.2% March, 2018 3.0% February, 2018 2.8% January, 2018 2.6% December, 2017 2.6% November, 2017 2.4% October, 2017 2.2% September, 2017 2.4% 4.4.2. The Mortality Component. IRS Regulation §25.7520-3 Limitation on the application of §7520. (b) Other limitations on the application of §7520 - (3) Mortality component. The mortality component prescribed under §7520 may not be used to determine the present value of an annuity, income interest, remainder interest, or reversionary interest if an individual who is a measuring life dies or is terminally ill at the time the gift is completed. For purposes of this paragraph (b)(3), an individual who is known to have an incurable illness or other deteriorating physical condition is considered terminally ill if there is at least a 50% probability that the individual will die within 1 year. However, if the individual survives for eighteen months or longer after the date the gift is completed, that individual shall be presumed to have not been terminally ill at the date the gift was completed unless the contrary is established by clear and convincing evidence.

- 14. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 14 of 16 4.4.3. The Exhaustion Test. * Regular. Results From Brentmark Estate Planning Tools 2020 Age LE Approximate Exhaustion Annuity Ratio

- 15. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 15 of 16 Rate 60 23.7 5.16% 107% 61 22.8 5.34% 62 22.0 5.52% 63 21.1 5.72% 64 20.3 5.93% 65 19.5 6.16% 127% 66 18.7 6.40% 67 17.9 6.66% 68 17.1 6.94% 69 16.3 7.24% 70 15.5 7.56% 153% 71 14.8 7.90% 72 14.1 8.28% 73 13.4 8.68% 74 12.7 9.11% 75 12.0 9.58% 186% 76 11.4 10.08% 77 10.7 10.62% 78 10.1 11.20% 79 9.5 11.82% 80 9.0 12.50% 227% 81 8.4 13.22% 82 7.9 14.01% 83 7.4 14.86% 84 6.9 15.77% 85 6.4 16.76% 273% 86 6.0 17.83% 87 5.6 18.98% 88 5.2 20.23% 89 4.8 21.58% 90 4.5 23.03% 319% 91 4.2 24.59% 92 3.9 26.27% 93 3.6 28.09% 94 3.4 30.04% 95 3.2 32.13% 348% * Reducing The Ratio. 85 year old Term Ratio Attained

- 16. LAW OFFICES KFB Rice, LLP Building Blocks To Eliminate The Estate Tax July 23, 2020 Page 16 of 16 Of Years Age 7 0 92 10 50% 95 15 130% 100 20 200% 105 25 273% 110 5. Conclusion. Benjamin Franklin: “If you fail to plan, you are planning to fail.”