Embed presentation

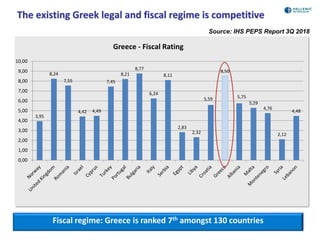

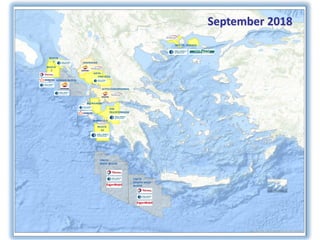

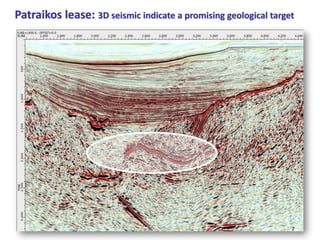

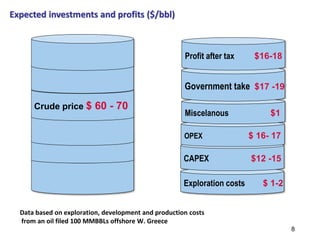

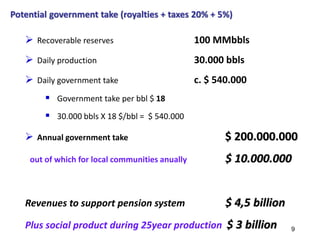

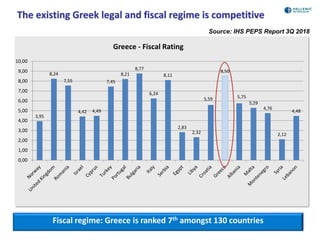

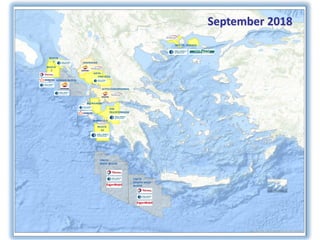

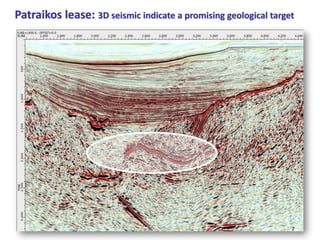

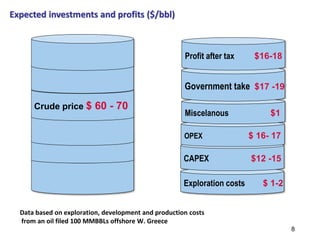

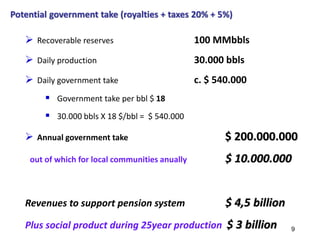

The document discusses the revitalization of Greek exploration and production (E&P) activities, highlighting Greece's favorable legal and fiscal environment, which ranks 7th among 130 countries. It outlines projections for investments and profits from oil extraction, estimating recoverable reserves at 100 million barrels and the potential annual government take at $200 million. Additionally, it emphasizes significant benefits for local communities and the pension system from these activities.