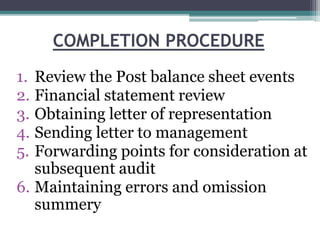

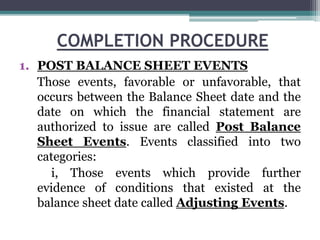

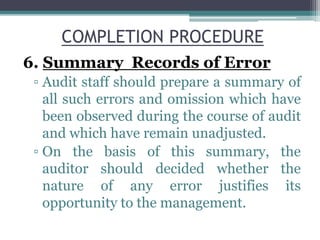

The completion stage of an audit involves final steps before issuing an audit report. It includes reviewing post-balance sheet events and the financial statements, obtaining a management representation letter, sending a letter to management, noting items to follow up on in the next audit, and preparing a summary of any unadjusted errors. The auditor seeks to identify any necessary adjustments to the financial statements, ensure compliance with standards and regulations, and communicate areas for improvement to management.