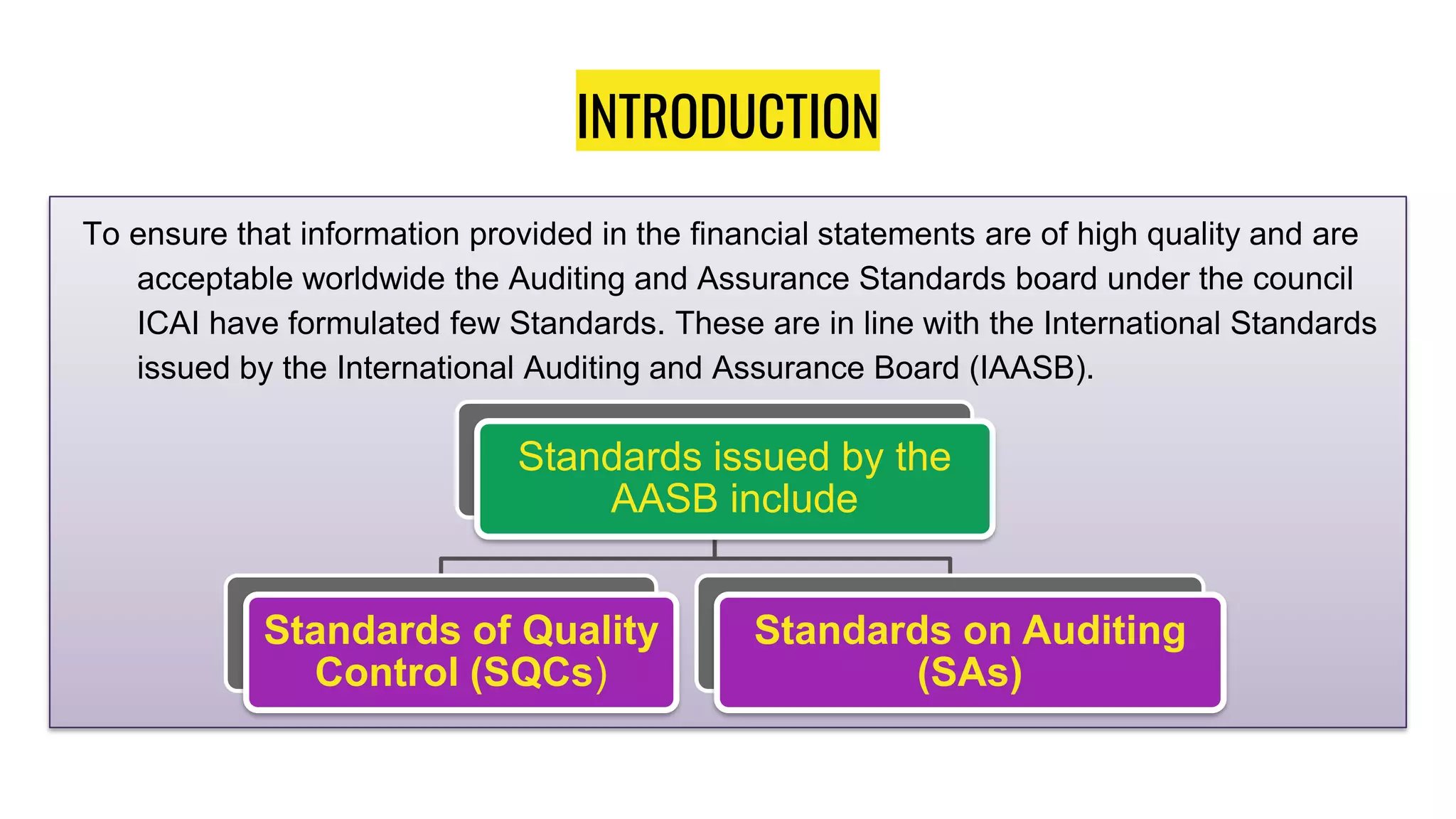

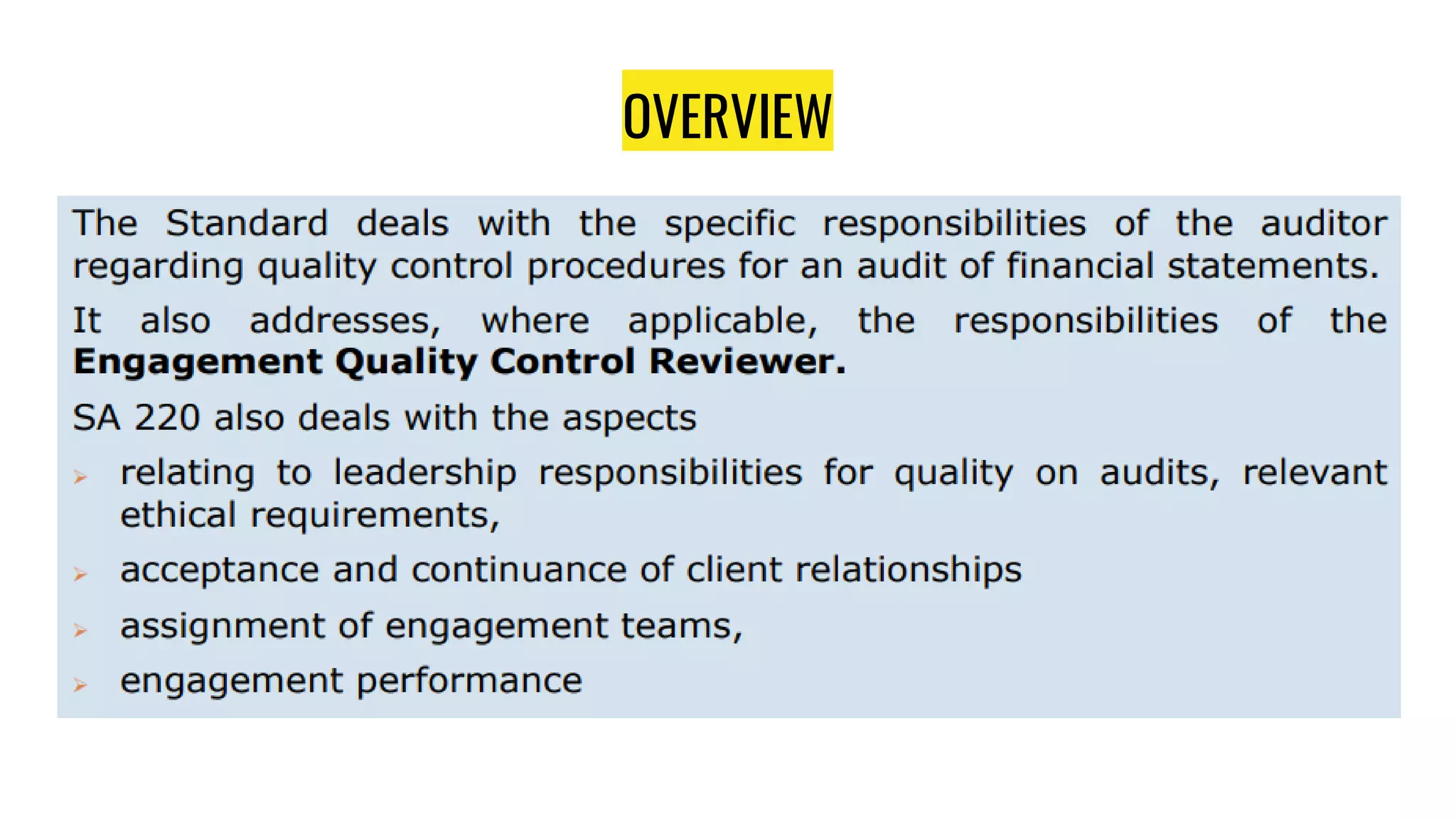

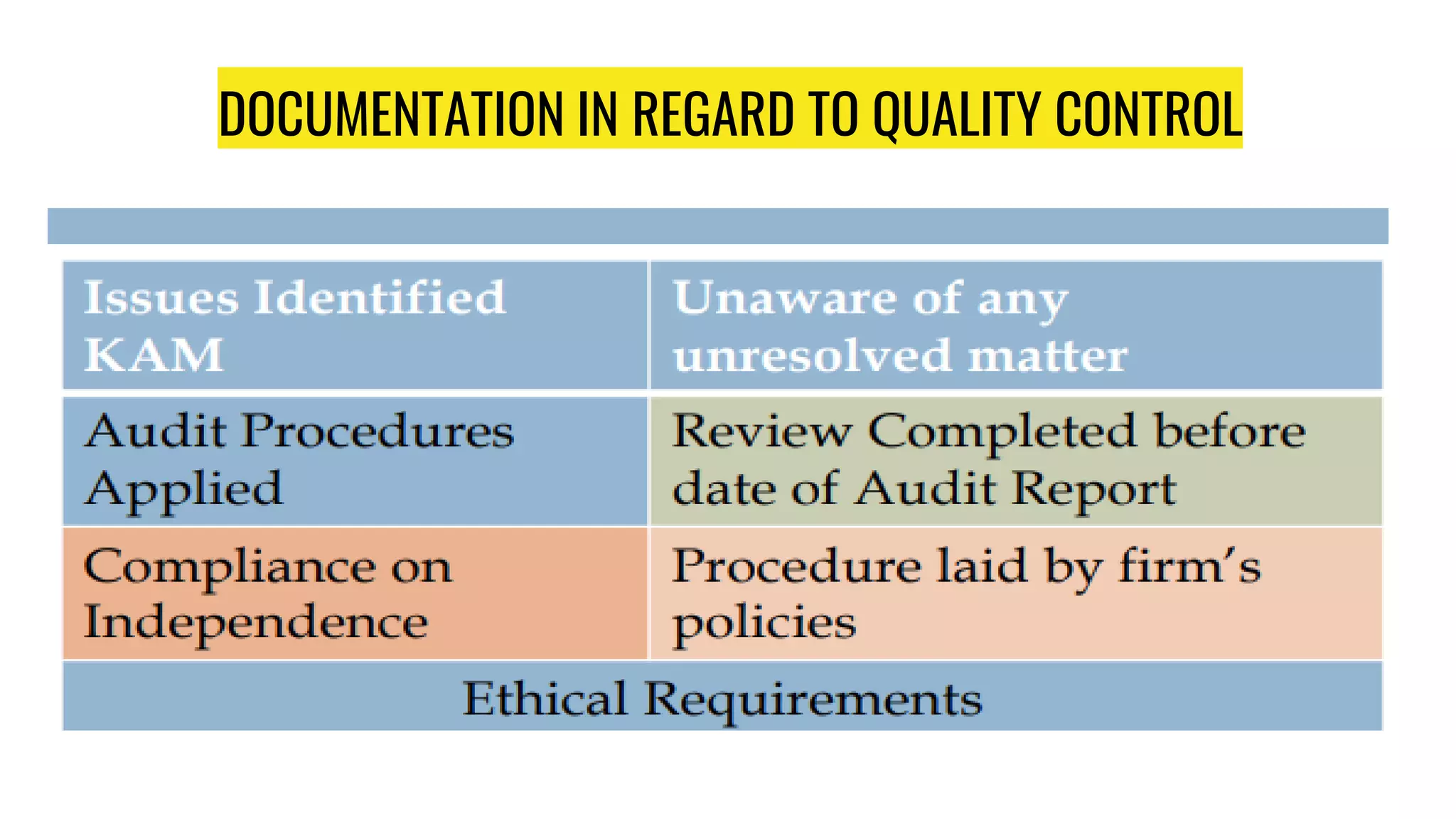

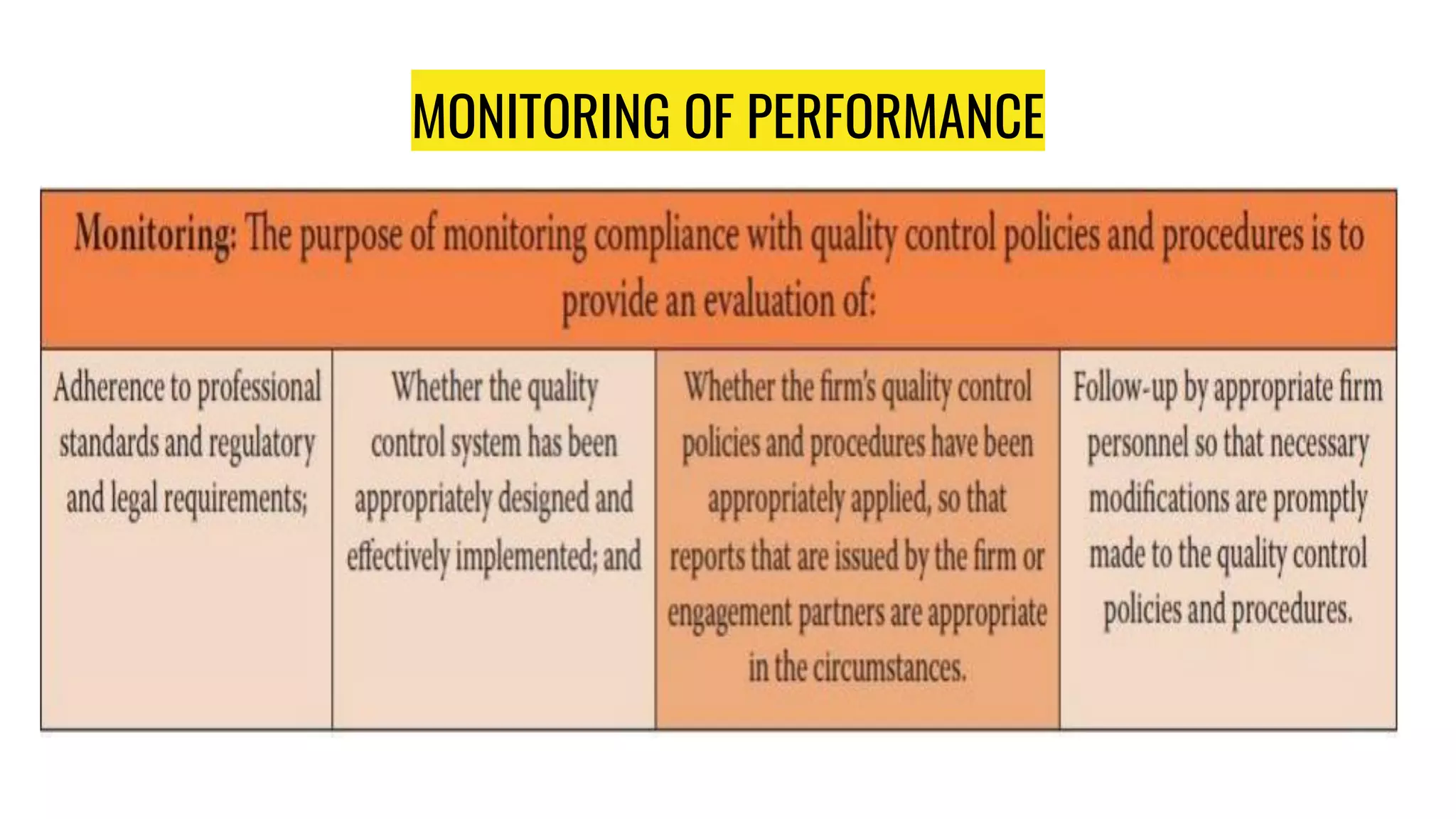

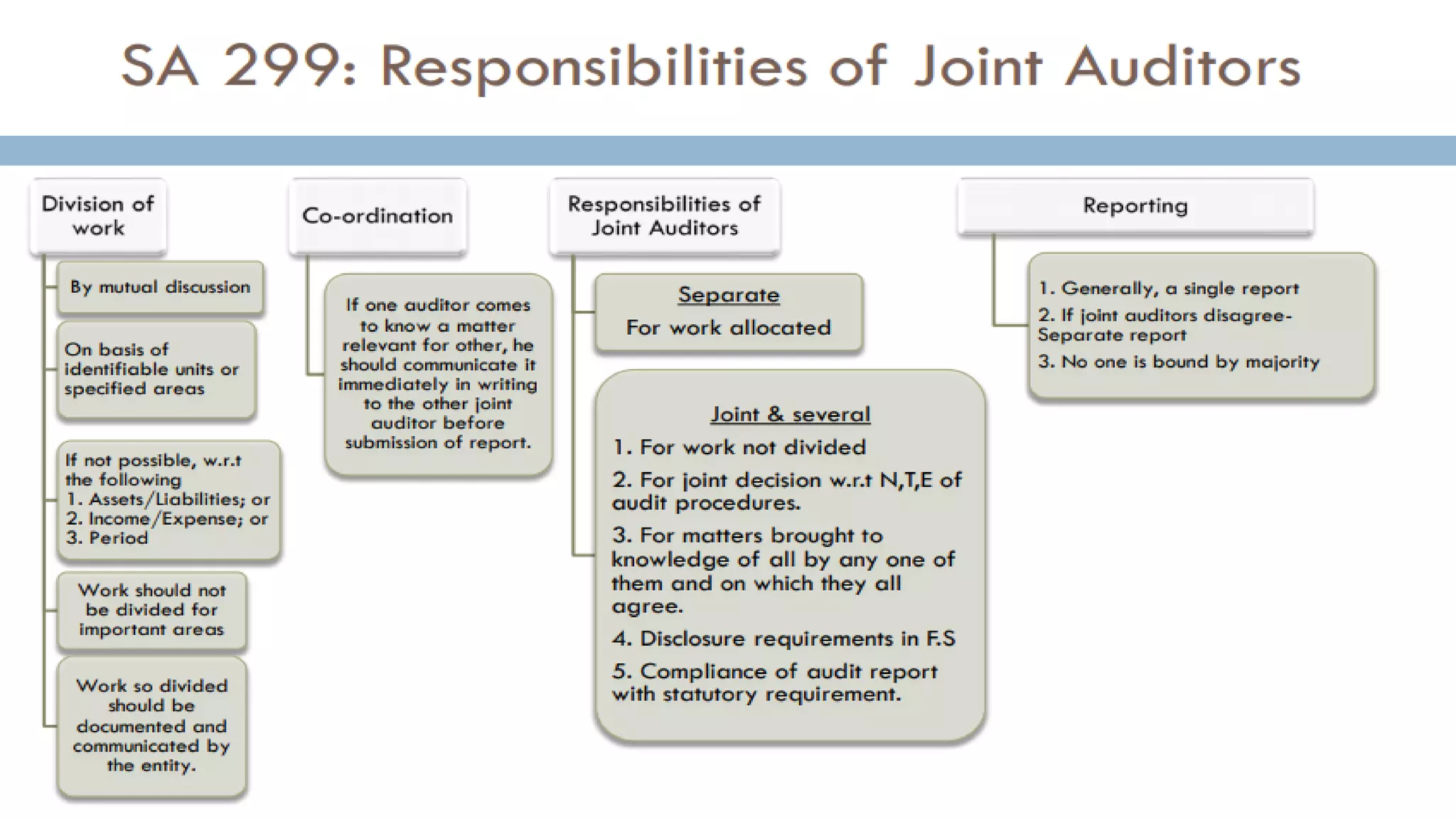

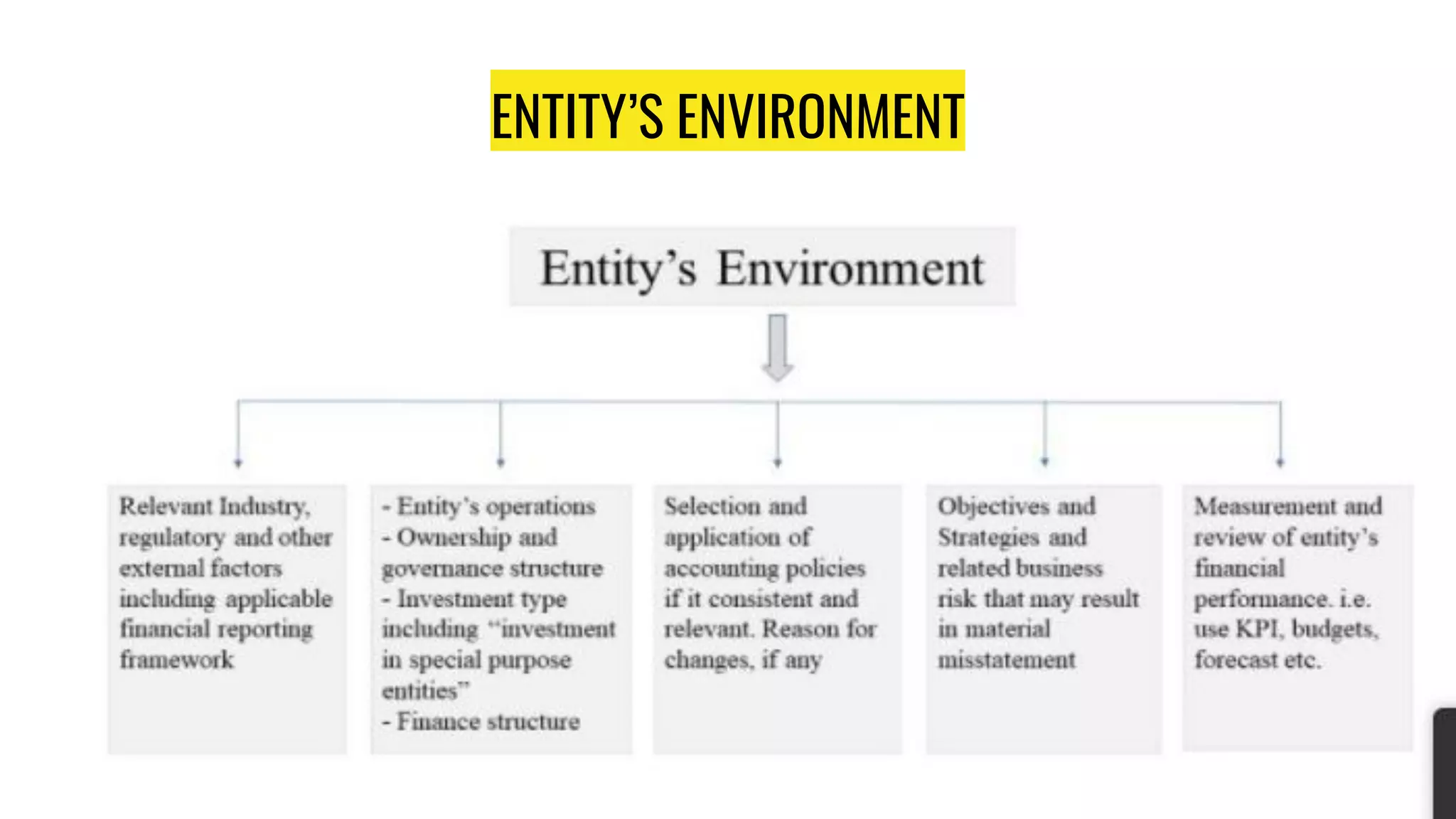

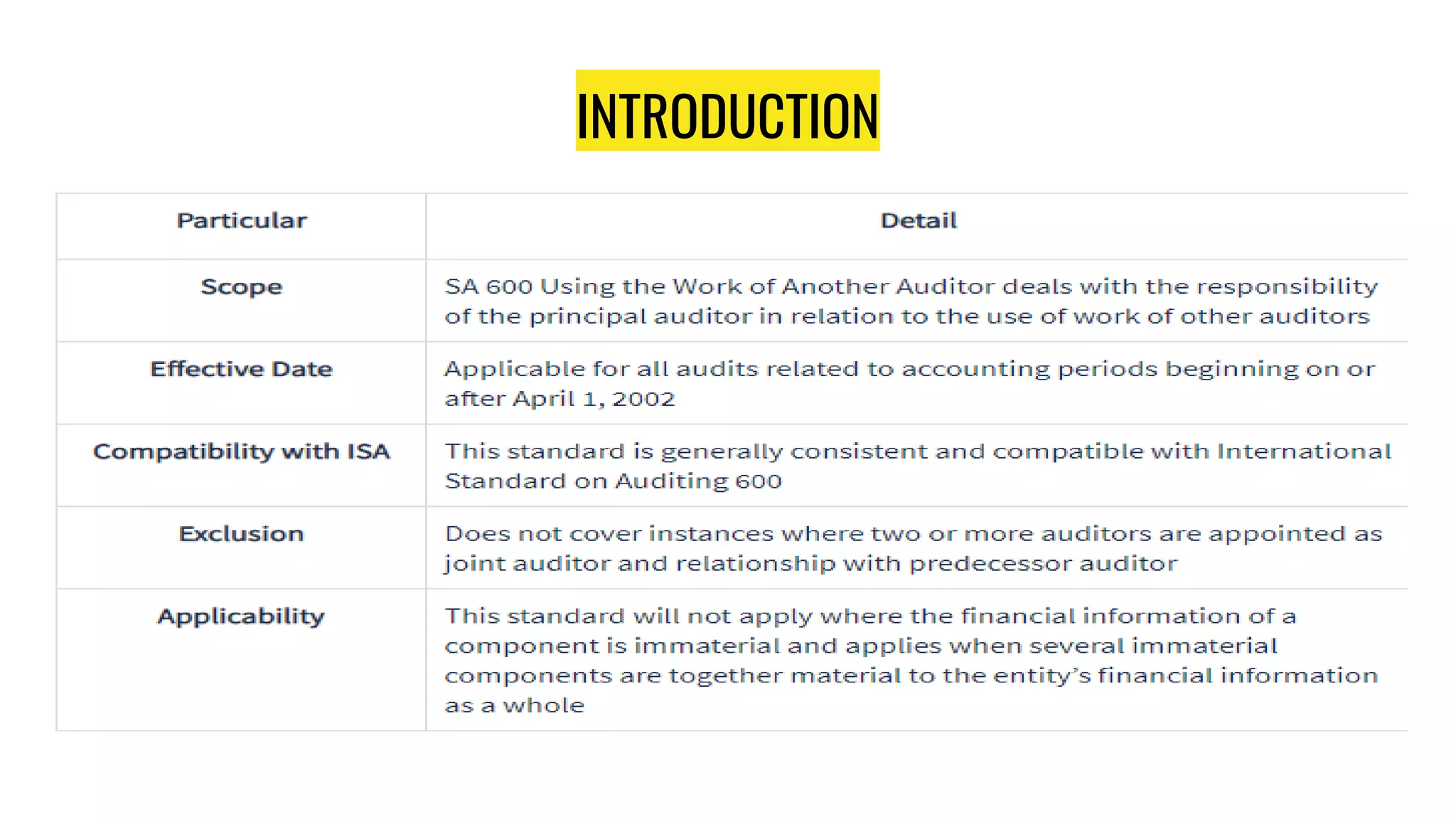

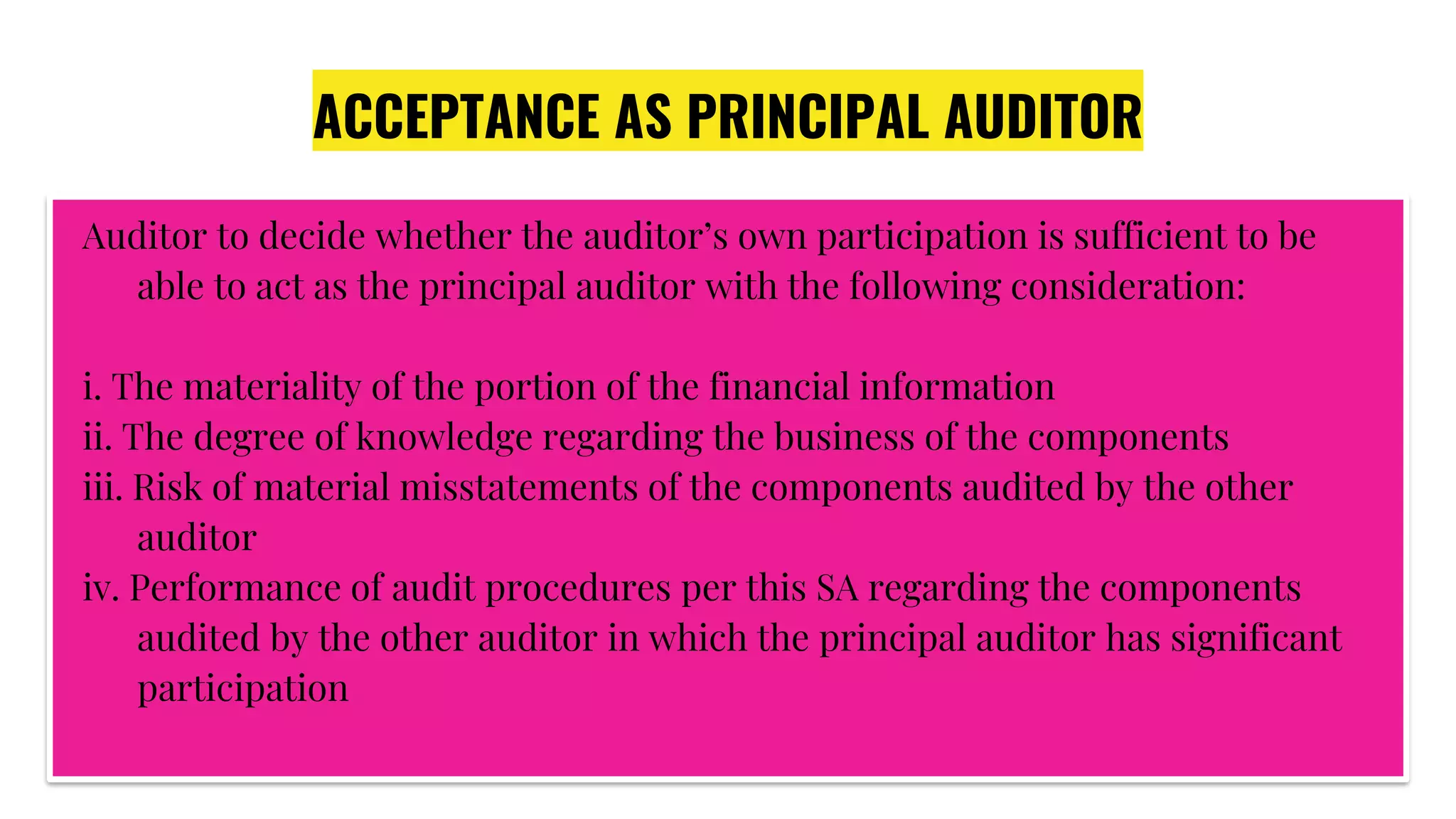

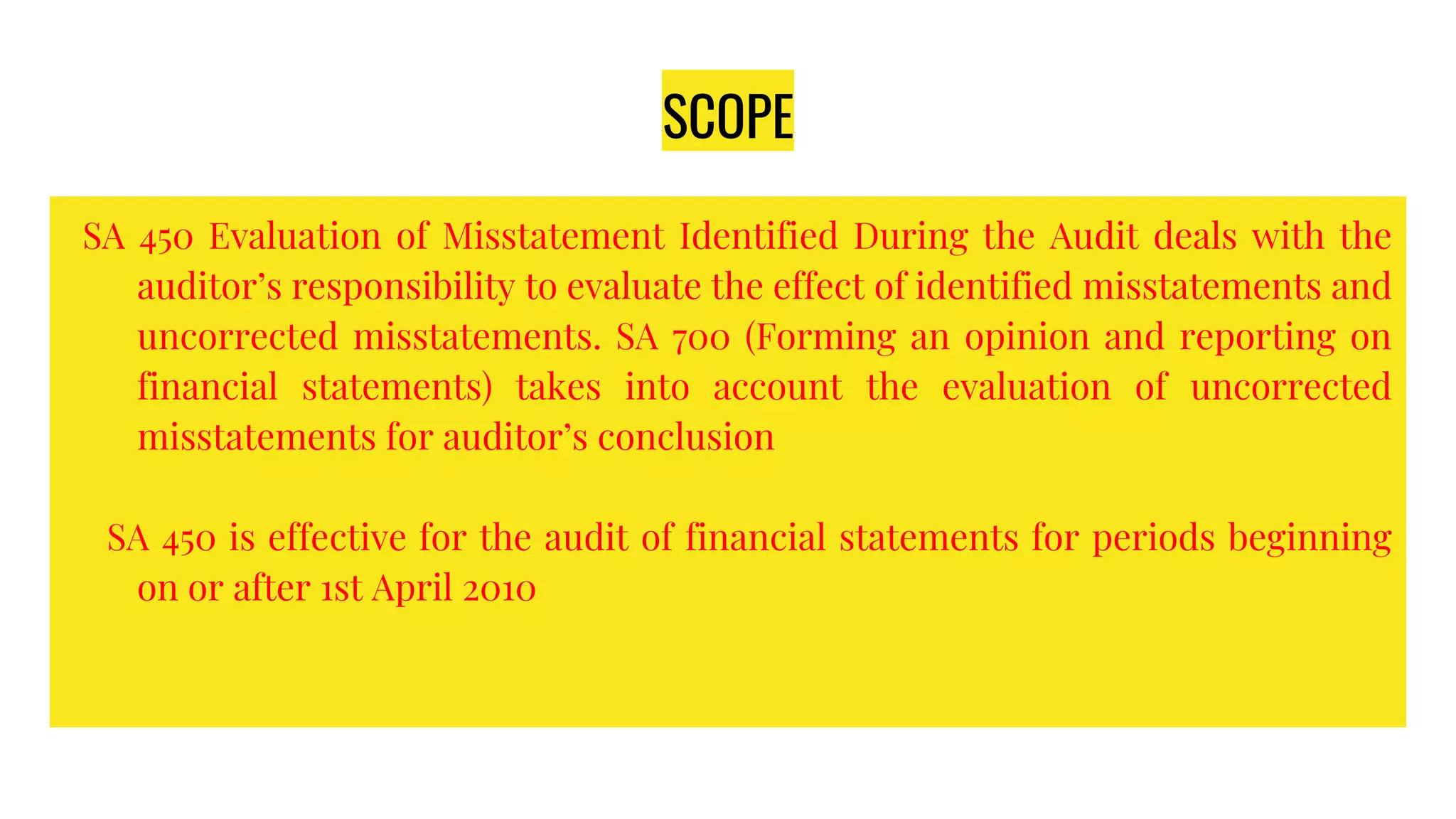

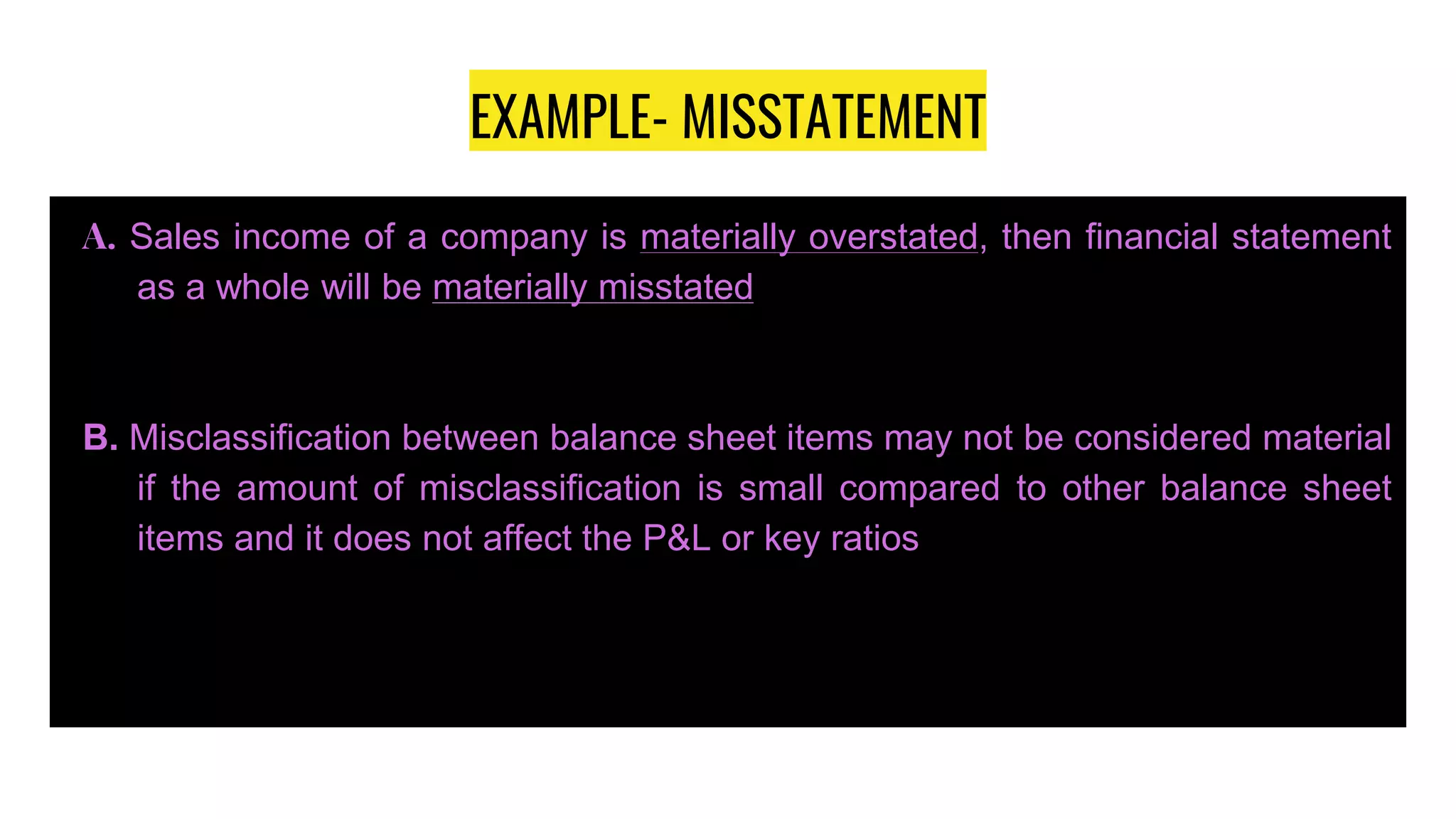

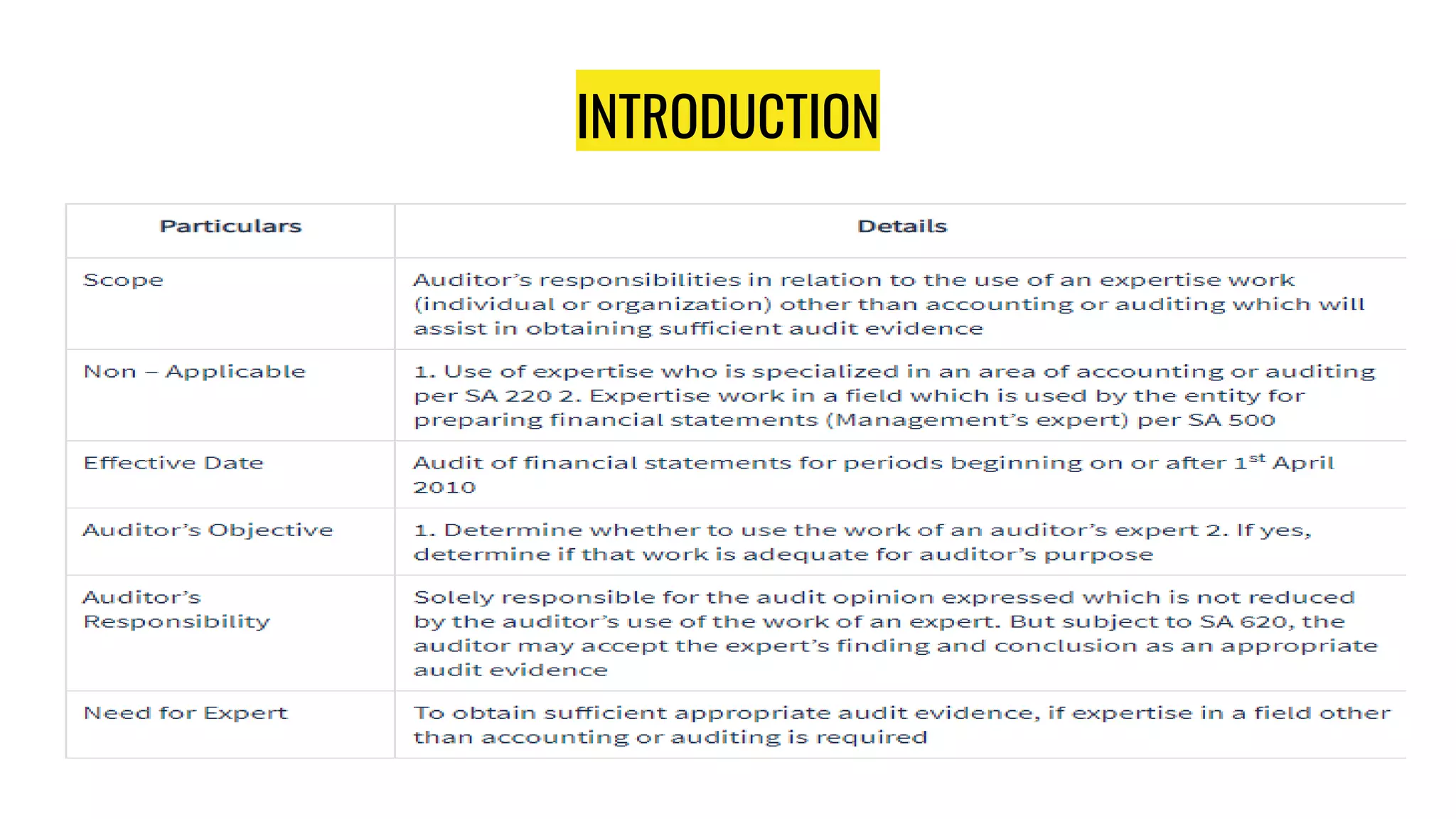

This document summarizes 10 Indian Standards on Auditing (SAs). It introduces each SA and provides an overview of its objective, scope, and key requirements. The SAs covered are SA 200, SA 210, SA 220, SA 300, SA 315, SA 330, SA 600, SA 450, SA 620, and SA 299. The document is intended to inform readers about the essential information in each SA regarding an auditor's responsibilities and compliance with quality standards.