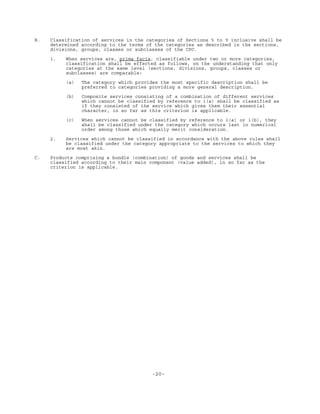

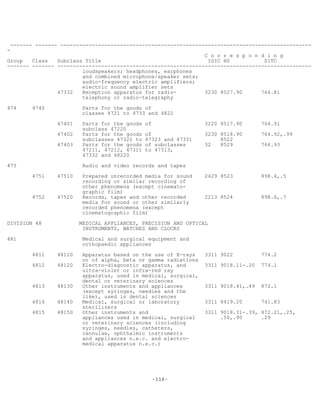

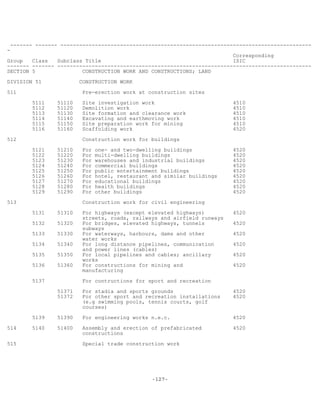

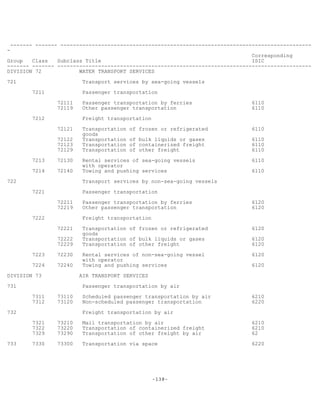

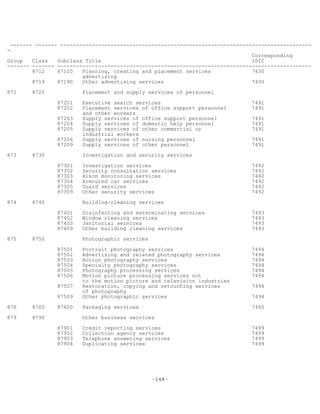

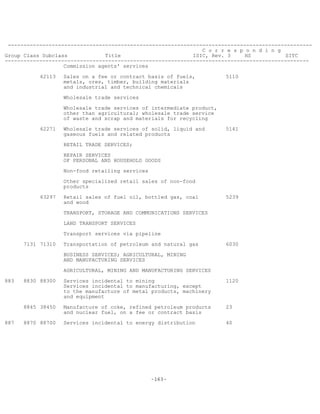

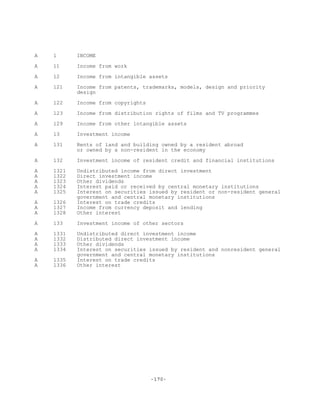

This document provides historical background on the development of the Provisional Central Product Classification (CPC). Key points include:

1) There was a recognized need in the 1970s to improve harmonization among various international economic classifications. This led to the development of the Harmonized Commodity Description and Coding System (HS) and a program to harmonize classifications.

2) The CPC was developed as part of this harmonization program to provide a classification covering both goods and services. It was intended to use HS subheadings for goods and reflect categories of economic supply and use from the UN's System of National Accounts (SNA).

3) A Joint Working Group on World Level Classifications was formed

![-v-

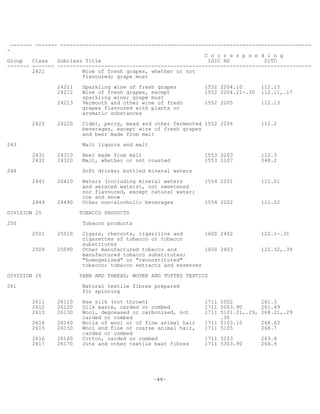

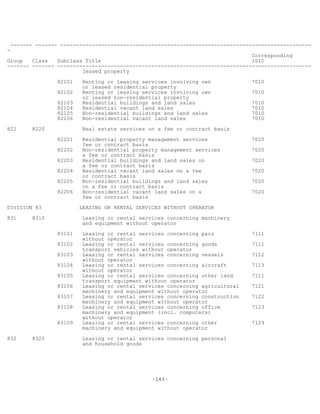

PREFACE

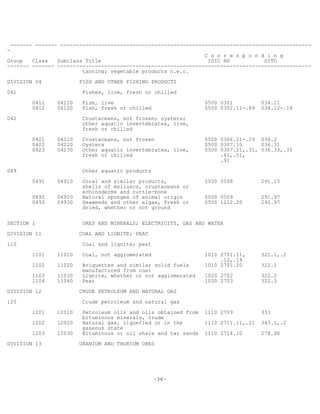

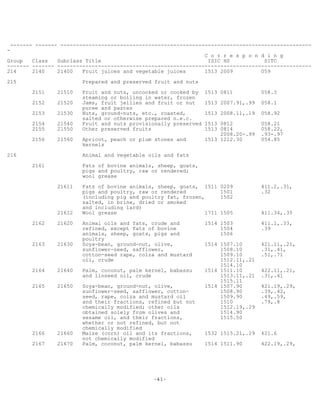

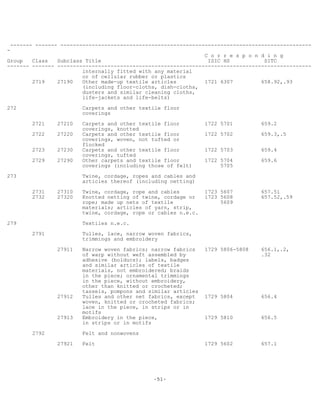

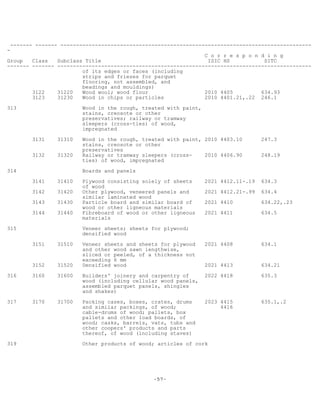

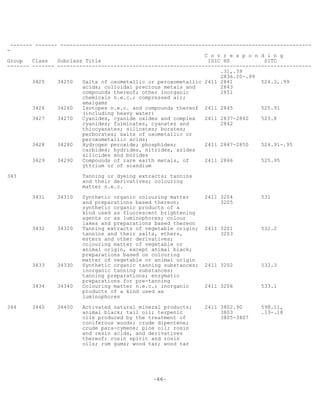

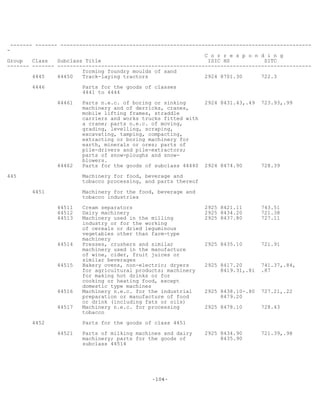

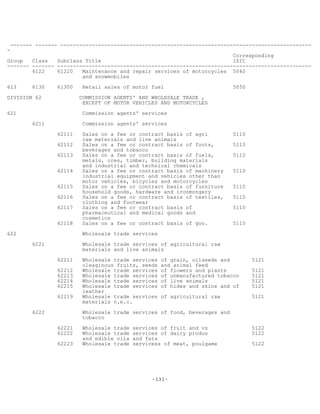

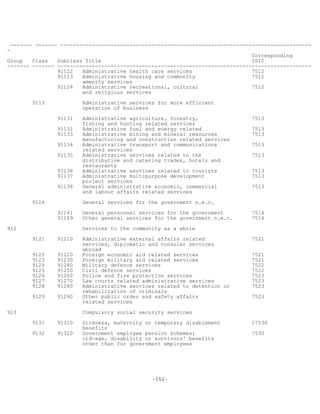

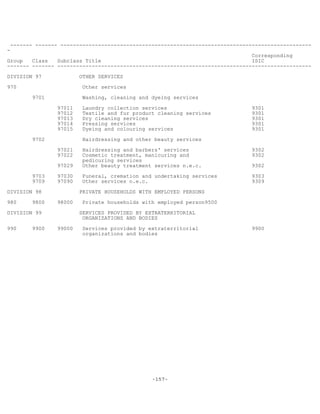

The newly developed provisional Central Product Classification (CPC) constitutes a

complete product classification covering goods and services. In developing CPC, the

main intention was to provide a general framework for international comparison of data

from various types of statistics that present data by kinds of product. Therefore, one

of the main characteristics of CPC as a general-purpose classification is that it

provides less detail than the other specific classification systems in areas or for

applications for which such systems are available.

The final draft of the provisional Central Product Classification was considered

and approved by the Statistical Commission at its twenty-fifth session in February

1989./1/ In approving the final draft of the provisional CPC, the Statistical

Commission recommended to the Economic and Social Council that the Council adopt the

following resolution, which the Council, then adopted on 22/May/1989, as its resolution

1989/3. It is reproduced below in its parts relevant to CPC.

"The Economic and Social Council,

Recalling resolution 4/(XV) adopted by the Statistical Commission at its

fifteenth session, in 1968,

Considering:

...

(g) The proposed new Central Product Classification, as described in the

report of the Secretary-General, to be known as the provisional Central Product

Classification,

1. Recommends that Member States:

...

(b) Make use of the provisional Central Product Classification in order to

gain experience in obtaining international comparability for data classified

according to goods and services;

2. Requests the Secretary-General:

...

(b) To prepare a publication on the provisional Central Product

Classification, together with the explanatory notes for the services part of the

Classification, based on the provisional text before the Statistical Commission at

its twenty-fifth session and in the light of the conclusions of the Commission;

(c) To publish and circulate/... the provisional Central Product

Classification and to bring [it] to the attention of States Members of the United

Nations or members of the specialized agencies for adoption."](https://image.slidesharecdn.com/11-150220130625-conversion-gate02/85/11-cpc-provisional-1990-3-320.jpg)