Embed presentation

Download to read offline

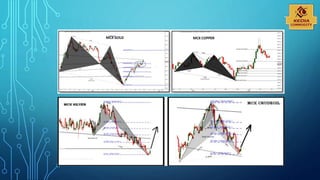

Harmonic patterns use Fibonacci ratios to identify key turning points and retracement levels in markets. They construct geometric patterns from swing highs and lows that adhere to Fibonacci sequences. These patterns provide trading opportunities through potential price movements and trend reversals. Harmonic patterns aim to give traders highly reliable entry, stop, and target price information, unlike other indicators. Common harmonic patterns include Gartley, Butterfly, and Bat patterns that can be bullish or bearish.