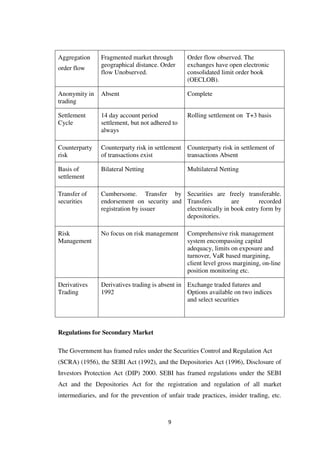

This document provides an overview of the secondary market in India. It discusses how the secondary market evolved to provide liquidity to investors and companies by allowing trading of already issued securities. It describes the key functions and importance of the secondary market in price discovery, facilitating capital allocation, and encouraging savings and investment. It also summarizes major reforms that modernized the Indian secondary market, including establishment of a securities regulator, dematerialization of shares, rolling settlements, and online trading systems.