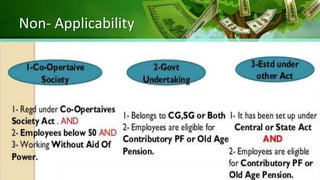

The document discusses various provisions of the Employees' Provident Funds Act, 1952 including:

- The objectives of establishing a compulsory contributory provident fund for employees.

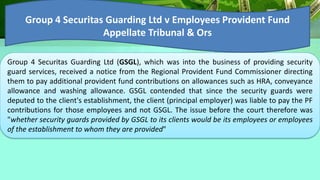

- Key definitions like basic wages, employee, and provisions around coverage of contractors' employees, home workers, directors etc.

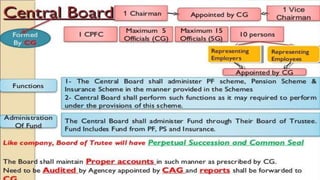

- Schemes under the Act including Employees' Provident Fund Scheme, Employees' Pension Scheme, and Employees' Deposit Linked Insurance Scheme.

- Contribution rates and benefits provided under the schemes.

- Provisions around recovery of amounts from principal employers in case of contract labor.