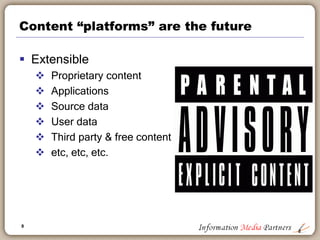

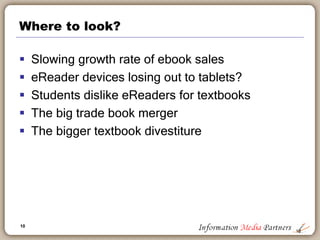

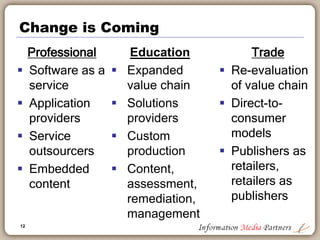

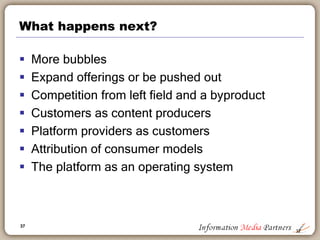

Michael Cairns is a publishing and media executive who established Information Media Partners in 2006. The consulting firm works with clients in the information and education sectors on strategies like product development, corporate development, and reorganizations. Cairns predicts that in 2013, more combinations will occur in the trade publishing sector, challenges may come from unexpected places, and the business model for education technology could face issues as an innovation bubble forms. Platforms that integrate content, applications, and workflows will be important going forward as customers demand improved access and experience across the information industry.