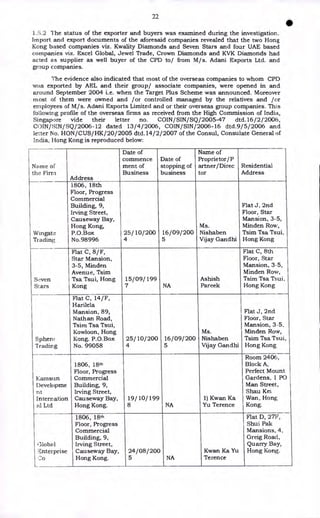

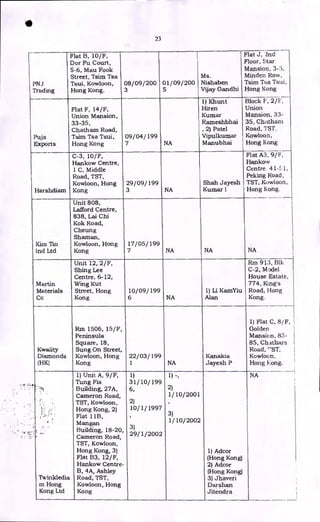

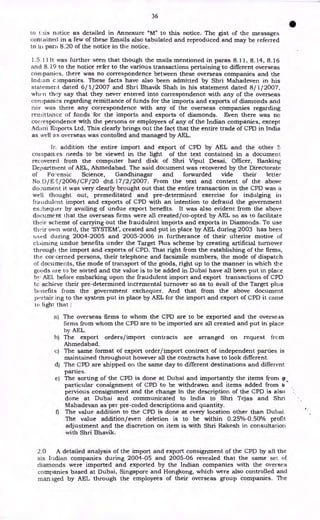

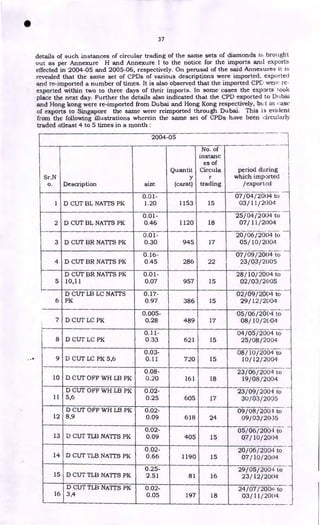

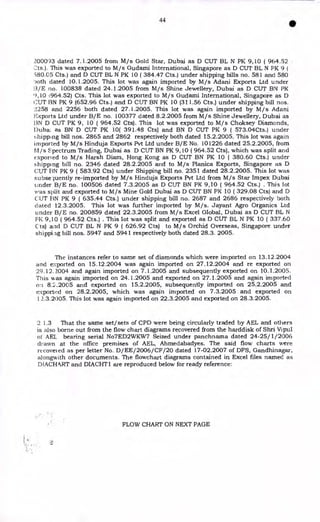

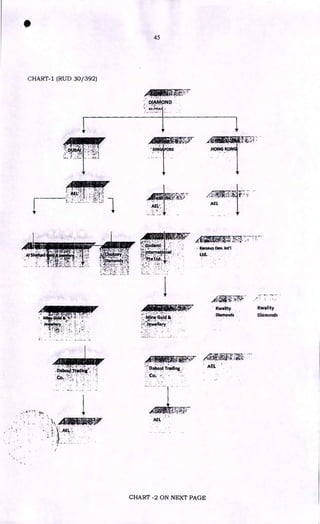

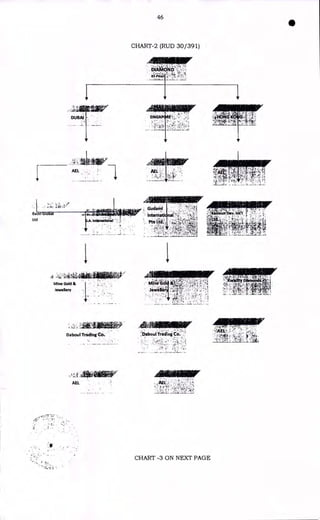

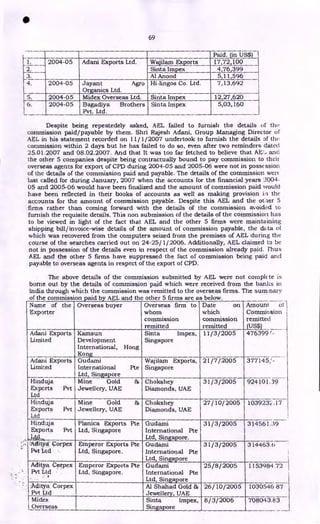

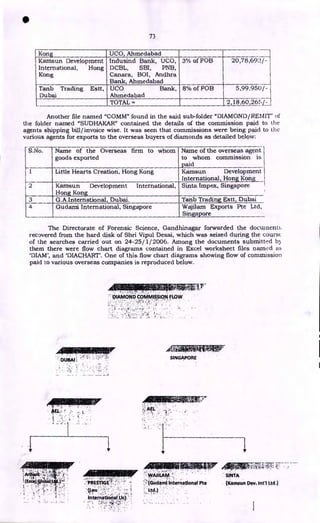

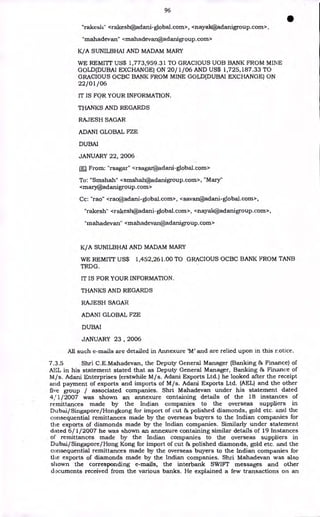

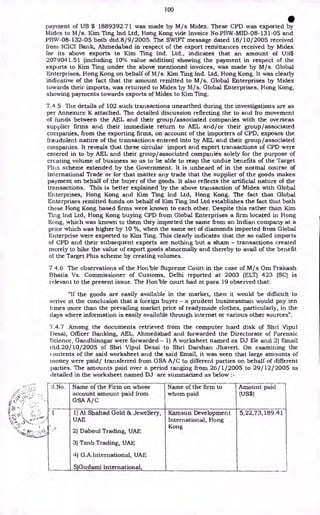

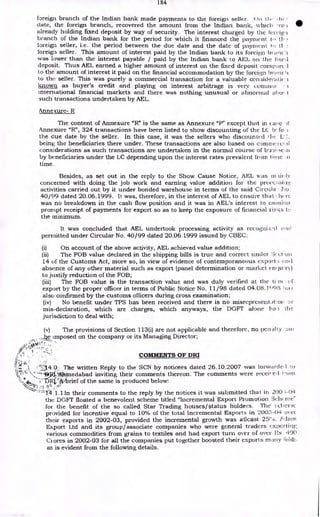

This document summarizes an investigation conducted by the Directorate of Revenue Intelligence (DRI) into alleged misdeclaration of export values of cut and polished diamonds by six companies between 2004-2005 and 2005-2006. The DRI analyzed import/export trends and found a large spike in diamond imports from and exports to specific countries that coincided with new export promotion schemes. One company, Adani Exports Ltd., saw its diamond exports increase over 500% while other major exporters did not see similar growth. Simultaneous searches were conducted at several company premises. The document outlines background information found on the six noticed companies, including Adani Exports Ltd. which saw its exports rise from Rs. 377 crores to over Rs. 7

![27

Mr. Ka Yu Terence (1) M/s Global Enterprise Co

(2) M/s Kamsun Development

International Ltd.

The details above clearly show the inter-relationship between the Singapore

based firms. It also brings out clearly the common interests shared by the Directors of

the above firms, with AEL and its group companies as..

(a) Shri Joseph Selvamalar, the Director of M/s. Orchid Overseas Pte Ltd,

Singapore, M/s.Emperor Exports Pte Ltd, Singapore and M/s.Gudami International

Ftc Ltd, Singapore is also a Director of M/s.Adani Global Pte Ltd, Singapore as per the

r.solution of the Directors of Adani Global Pte Ltd.

(b) Further, the contracts between M/s Gudami International, Singapore with

AEL and other 5 companies have been signed by this Ms.Mary Jopseph in the

capacity of Director. Ms. Mary Joseph, the employee of Adani Global Pte, Singapore is

also the Director of M/s. Gudami International.

(c) Further, as seen from the document recovered under panchnarna

dtcl.22/ 12/2005 from the premises of AEL, Shikhar Building, Ahmedabad [RUD-25]

Shri Chang Chung Ling, the Director of M/s Gudami International, Singapore is also a

Shareholder Director of M/s Adani Global Ltd, Mauritius and M/s Adani Global Pte,

Singapore which are the wholly owned subsidiary of AEL.

(d) Also the fact that Shri Joseph Selvamalar and Shri Chang Chung Ling are

the directors of M/s Adani Global Pte, Singapore arid /or Adani Global Ltd,

Mauritius is also evident from the balance Sheet of AEL for the year 2000-2001, for

the year 2004-05 and the balance sheet of AEL for the year 2005-2006 wherein Shri

Joseph Selvamalar and Shri Chang Chung Ling are shown as the directors of M/s

Adani Global Pte, Singapore, along with Shri Vinod Shantilal Shah, brother of the

Chairman and the Managing Director of AEL. Moreover in the said Balance Sheet for

2000-2001 Shri Chang Chung Ling is shown to be the director Adani Global Ltd,

Mauritius alongwith Shri Vinod Shantilal Shah and others. Further as per the

balance sheet for the year 2000-2001, M/s Adani Global Ltd., Mauritius is the wholly

owned subsidiary of AEL, Ahmedabad and Adani Global Pte Ltd. and Adani Global

FZE are the wholly owned subsidiaries of Adani Global Ltd, Mauritius.

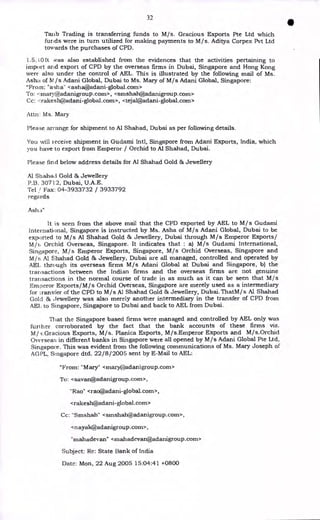

It was also seen from the Email dtd.23/ 1/2006, that Ms.Mary, an employee of

M/s Adani Global Pte, Singapore was also the authorized person, or rather the Director

as is discussed in paragraph 8.5 (b) above, of M/s.Gudami International, Singarpore.

"From: " Hiren Padhya" <hiren@adanigroup.com>

To: "'Sunil Shah' <smshah@adanigroup.com>

Cc: "'Ashish Chauudhary'" <ashishc@adanigroup.com>,

"mukesh" <mukesh@adanigroup.com>

Subject: AEL GUDAMI CONTRACTadvance payment

Date: Mon, 23 Jan 2006 16:08:03 +0530

Dear Sunilbhai,

As per our teletalk, pl get this agreement signed by Gudami's authorised

person (may be Ms. Mary) and send me signed scanned copie to me and

Ashish so that another signature can be made from AEL.

IIiren Padhya"

It was said to have established that M/s. Gudami International, Singapore was

directly/indirectly owned by AEL only. Therefore, all the transactions between AEL

and the other 5 companies and Gudami International would require to be treated as

transactions between related firms wherein one has interest in the other.

Consequently, the transactions of AEL and the other 5 companies with Gudami

International cannot be termed as transactions in the normal course of international

trade.

1.5.6 Apart from the Hong Kong and Singapore based firms, the import and export of

C PD also involved firms based in UAE. Though the Directors/Partners/Proprietors of

these firms were mainly persons of UAE origin, the activities relating to the trade in

C PD with AP_I_ and group companies of these firms were controlled by AEL through the

•](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-19-320.jpg)

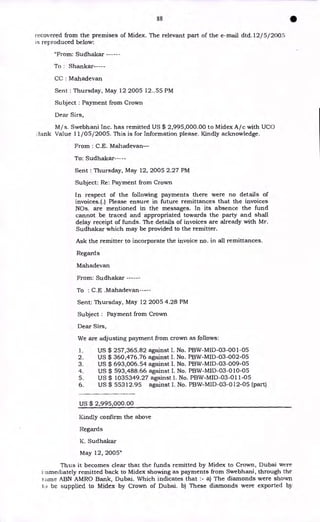

![30

the Show Cause Notice however for the sake of brevity the same are not bcii ig

reproduced here. However the gist of these e mails is:

The user ID and Password for GOLD STAR FZE,User ID : 361428 ay d

Password : 496990 was forwarded by mail, which made it quite obvious that the biu-.k

account of M/s. Gold Star FZE was controlled and operated by AEL through the

personnel of its overseas subsidiary Adani Global, Dubai and Singapore. This fact d

also been confirmed by Shri Bhavik Shah, Senior Vice President of M/s.Adani Agro Pvt

Ltd, Ahmedabad and Incharge of Treasury Desk of AEL in his statement recorded (_,n

8/1/2007. In his statement he stated that the aforesaid e mail was about Intein:q

banking sent by Ms. Mary Joseph of M/s. Adani Global Pte Limited, Singapore .o

Rakesh. Shah, Dubai, Bhavik and others and copy was marked to him and others.

The same was forwarded by Ms. Mary to facilitate the banking transaction of Gold Star

FZE by the staff of Adani Global FZE / Adani Exports Ltd. Further messages as suer.

(I) "Now Gold remittance is over at our end. We will start diamond documents

remittance, we will start with Excel global' dubai from Hinduja. This is for

your information only" - Vipul Desai"

(II) "Please transfer daily 3 to 4 mio to RAK Excel A/c and STOP remitting to

UAB A/C" - Savan

(III) " Please note A/c number of Excel Global Limited's A/c with RAK Bank

0012-765195-USD AED This is for your information please - K

Sudhakar

(IV) Subject: NO FUNDING OF SHINE JEWELLERY TO BE DONE IN BANK OF

BARODA, DUBAI

With regard to the subject matter we would like to inform you that no

further payment should be made TO THE ACCOUNT OF SHIT E

JEWELLERY FZE, WITH BANK OF BARODA, DUBAI, until further

instructions regarding the same is received from our end. In case of any

emergency please consult Mr.Rakesh Shah for any decision regarding the

same -manoj"

(V) "With reference to following message, Absa Bank has asked us to

some alternative arrangement for financing our trade transaction as they

will not be able to take up transactions after one month from now. They

will also not be able to do any back to back transaction for Gudami Intl

for capital goods Also we have to open A/c of Gudami Intl with other

bank for our Diamond transactions

(VI) "This mail is with respect to opening of Daboul Trading a/c at UBS for

transfer of shares.

I have raised certain queries for UBS people (Andrew Cumming) to answer. It

would be better if we are doubly sure about the structure of transaction My

personal assessment is that we will be able to open the a/c by 30th

November (date as promised to you by Bhavikbhai and me). Coming to the

cost front, if 4.99 % of holding is shifted to Daboul i.e 10978 cr shares of Rs

60 each or Rs 65.868 crs or $14.6 million (@ Rs 45.10), then the cost would

be

a. 1.5% on the first $10 million = $0.15 million

b. 1% on the remaining $4.6 million = $0.046 miilion

So the total cost would be $0.196 miilion or Rs 90 lakhs plus brokerage

costs. Another important point is that the charge would be levied at the e]id

of every quarter and on the market value of the shares held. i had a tLlk

with Rajiv Maheshwari yesterday and if you could put in a word about the

cost reduction in charges.

Regards

Kaushal"

To summarise, the above mails : -

a. The bank account of M/s. Gold Star FZE, UAE who is shown to be

supplier of CPD to AEL and group companies is under the control and being](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-22-320.jpg)

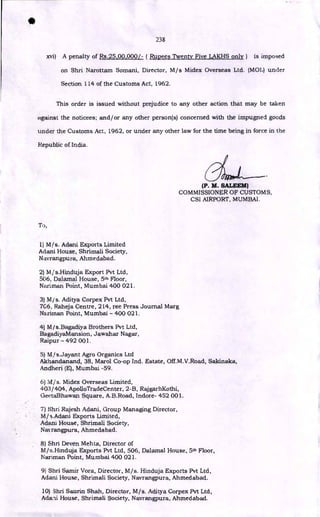

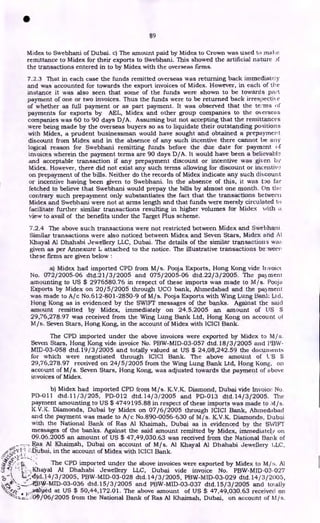

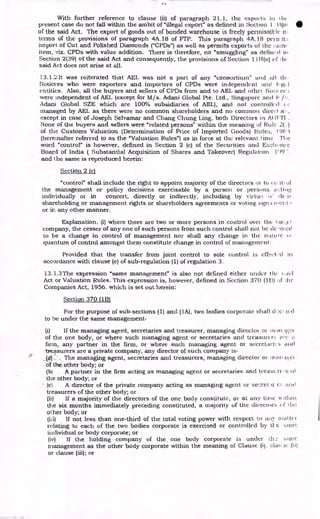

![56

•

LTD.,

6.5

PNJ 030991

25/09/2

004

D CUT LB

NATTS PK

0.01-

0.45

2288.

01

PNJ Trading

6.5.1

AEL/PBW/PD/5

06/2004-2005

30/09/2

004

D CUT LB

NATTS PK

0.14-

0.45

649.2

0

M/S. GUDAMI

INTERNATIONA

L PTE. LTD.

6.5.2

AEL/ PBW/ PD / 5

07/2004-2005

30/09/2

004

D CUT LB

NATTS PK

0.01-

0.14

1638.

81

M/S. GUDAMI

INTERNATIONA

L PTE. LTD.

6.6

873-

DBL/PD/2004

03/10/2

004

D CUT LB

NATTS PK

0.01-

0.45

2306.

29

DABOUL

TRADING Co.

(L.L.C.)

6.6.1

AEL/PBW/PD/5

27/2004-2005

06/10/2

004

D CUT LB

NATTS PK 0.10-

0.45

1251.

16

M/S. KAMSUN

DEVELOPMENT

INTERNATIONA

L LTD.,

6.6.2

AEL/ PBW/ PD / 5

28/2004-2005

06/10/2

004

D CUT LB

NATTS PK 0.01-

0.12

1055.

13

M/S. KAMSUN

DEVELOPMENT

INTERNATIONA

L LTD.,

6.7

PNJ 030995

08/10/2

004

D CUT LB

NATTS PK

0.01-

0.45

2310.

3

PNJ Trading

13.7.1

AEL/PBW/PD/5

53/2004-2005

12/10/2

004

D CUT LB

NATTS PK

0.01-

0.12

1392.

03

CHOKSEY

DIAMONDS

(L.L.C.)

1).7.2

AEL/PBW/PD/5

52/2004-2005

12/10/2

004

D CUT LB

NATTS PK

0.12-

0.45

918.2

7

AL SHAHAD

GOLD 86

JEWELLERY

1).8

PNJ 031012

12/11/2

004

D CUT LB

NATTS PK

0.01-

0.45

2306.

21

PNJ Trading

0.8.1

1).8.2

AEL/PBW/PD/7

44/2004-2005

23/11/ 2

004

D CUT LB

NATTS PK 0.10-

0.45

1125.

27

M/S. KAMSUN

DEVELOPMENT

INTERNATIONA

L LTD.,

AEL/ PBW/ PD / 7

38/2004-2005

23/11/2

004

D CUT LB

NATTS PK 0.10-

0.45

1180.

94

M/S. KAMSUN

DEVELOPMENT

INTERNATIONA

L LTD.,

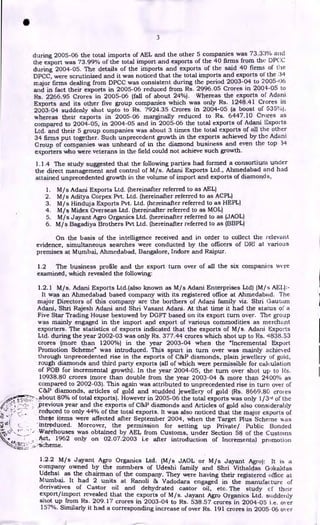

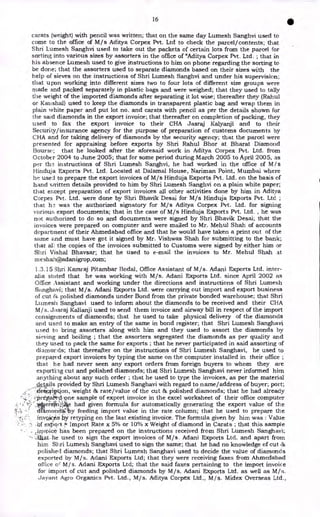

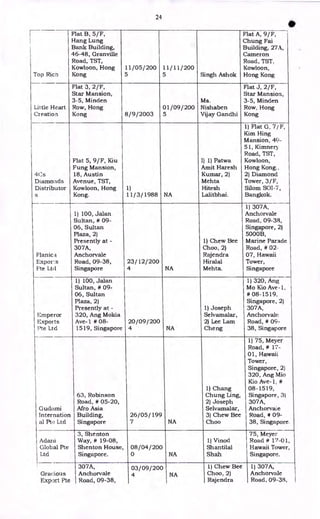

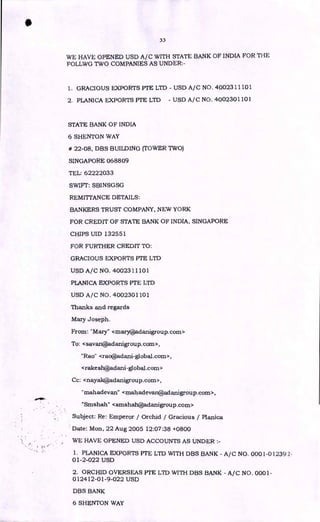

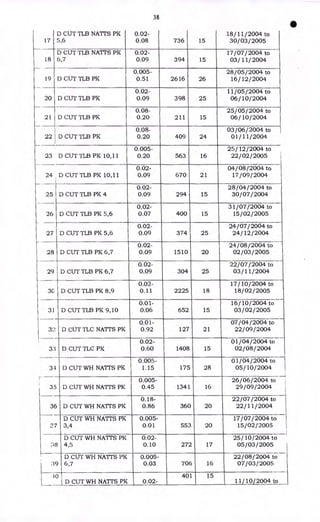

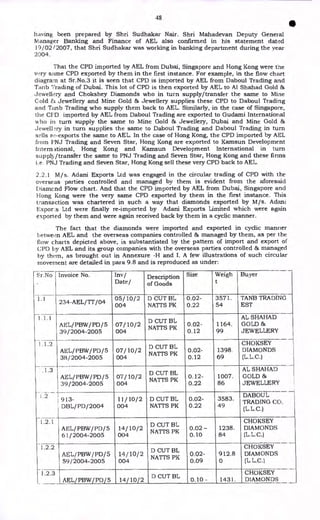

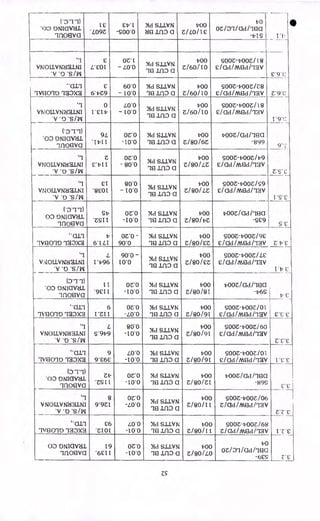

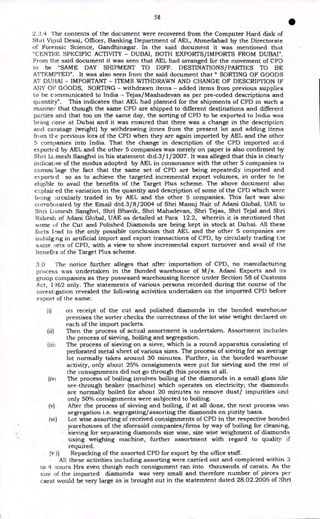

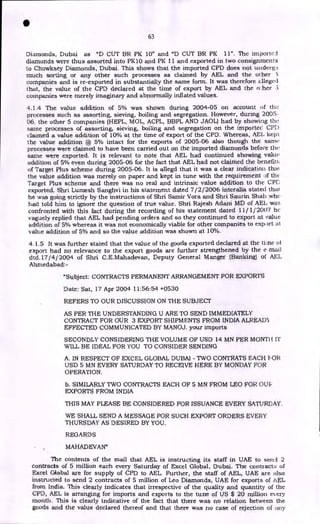

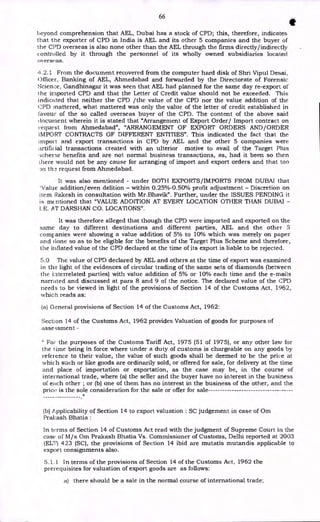

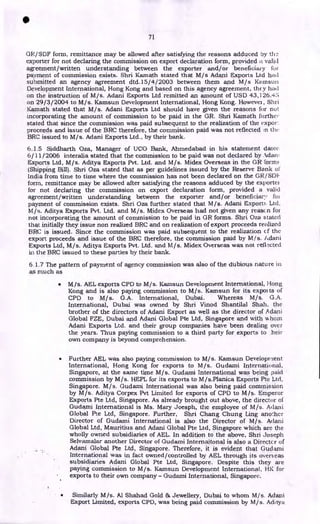

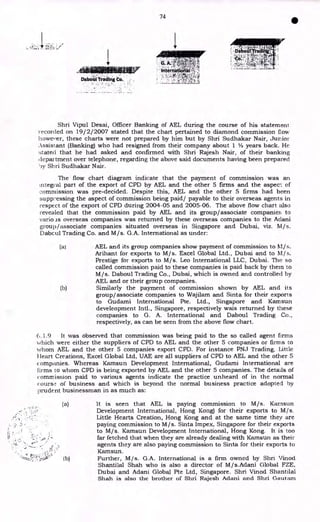

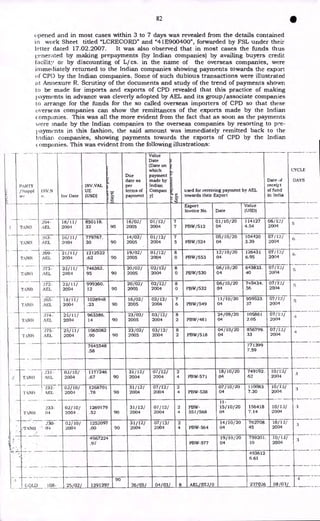

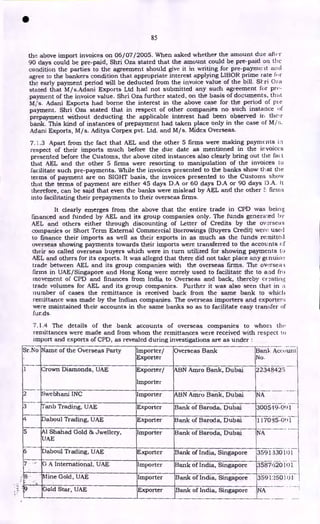

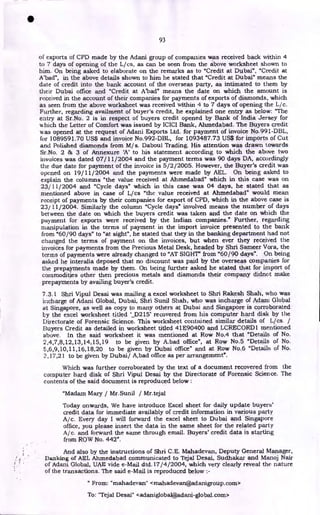

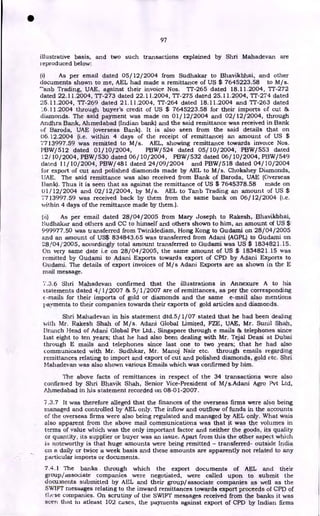

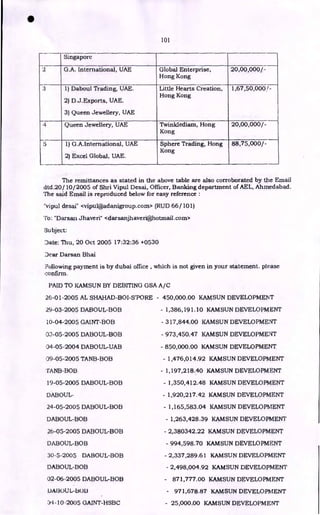

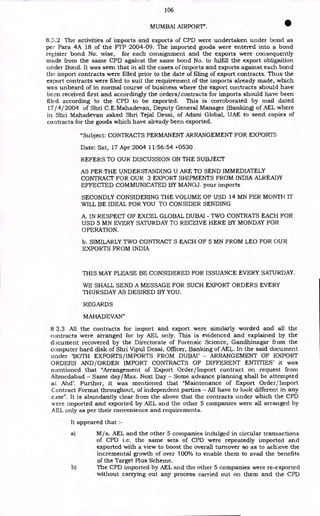

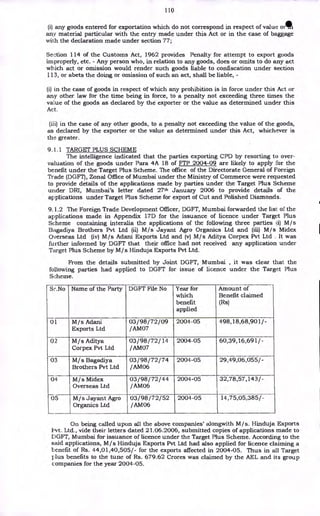

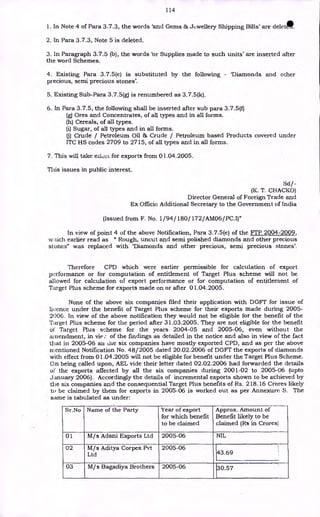

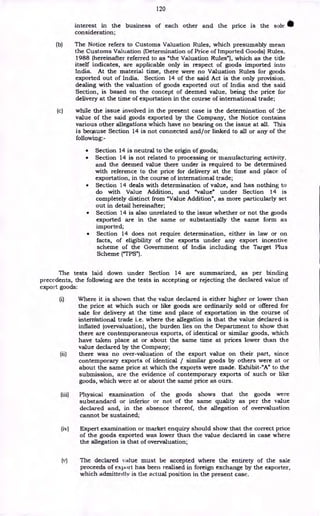

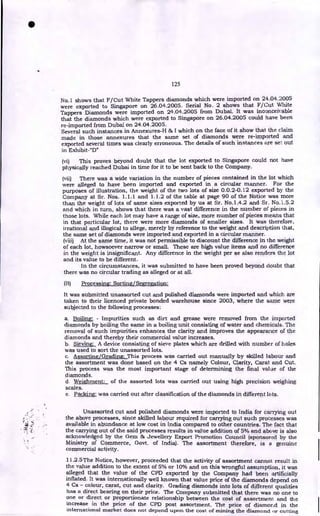

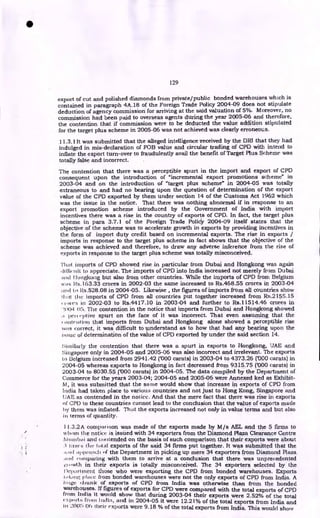

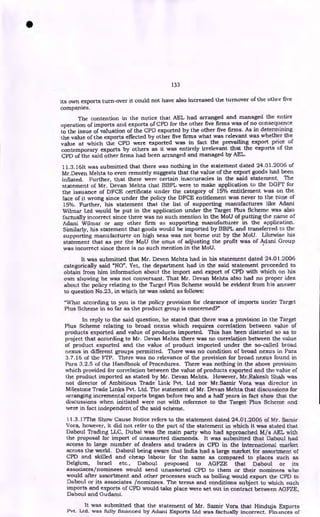

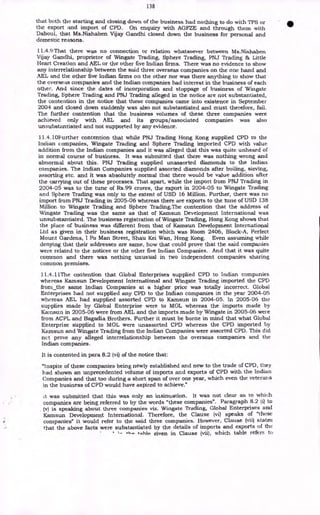

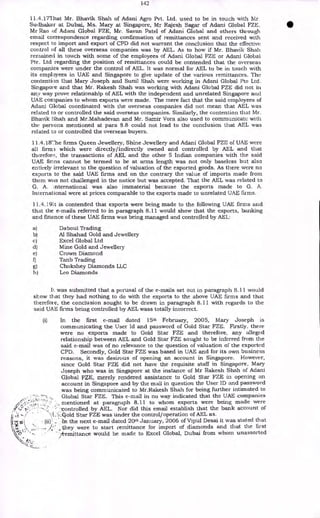

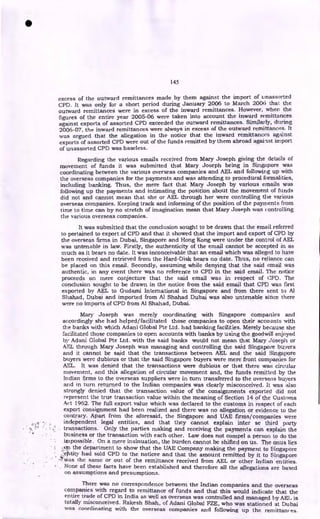

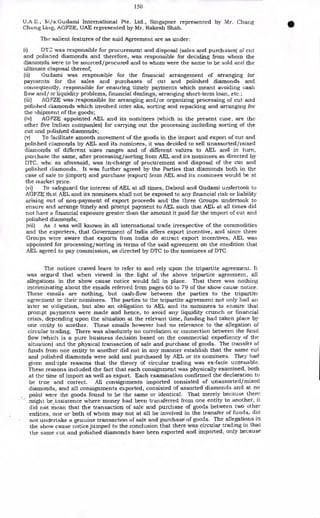

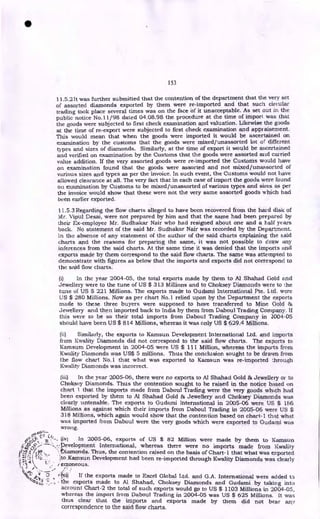

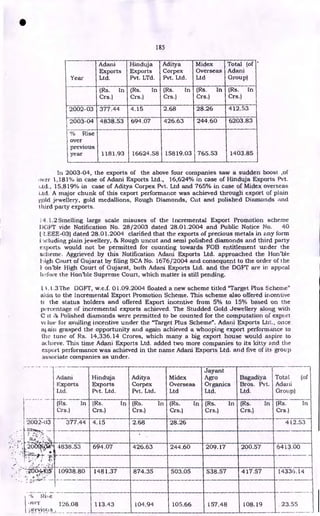

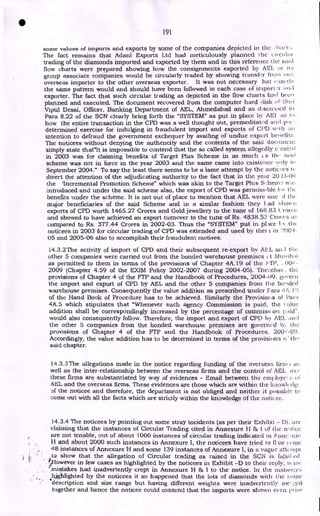

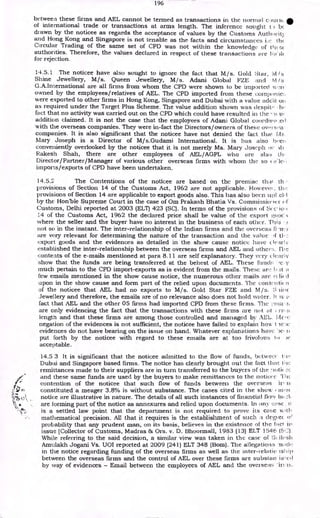

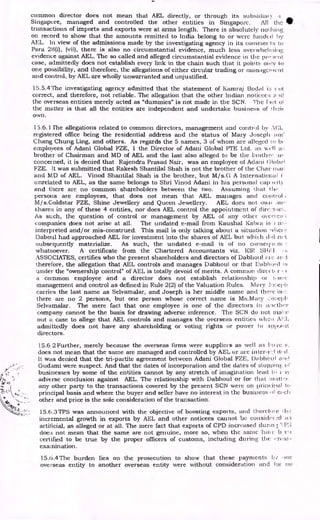

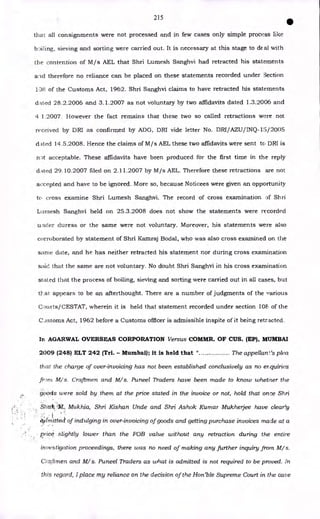

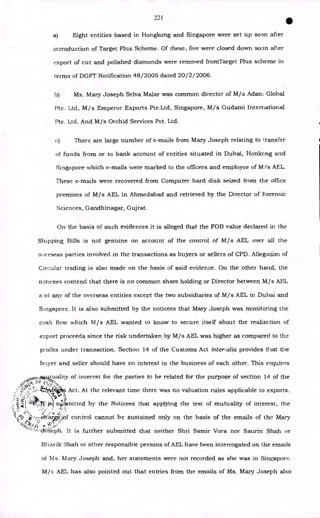

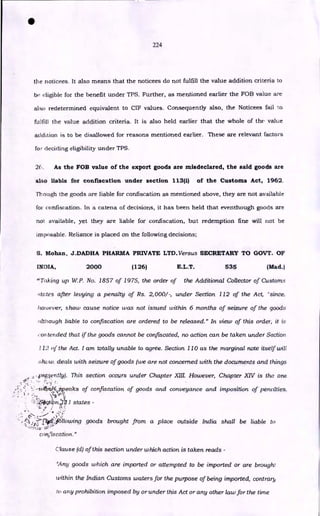

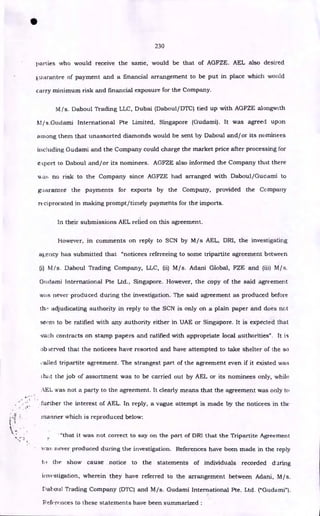

lote:• In the above table the first row 1.1, 1.2,; 2.1, 2.2. and so on represents imports

.ind the subsequent rows 1.1.1, 1.1.2, ; 2.1.1, 2.1.2 and so on represents exports.

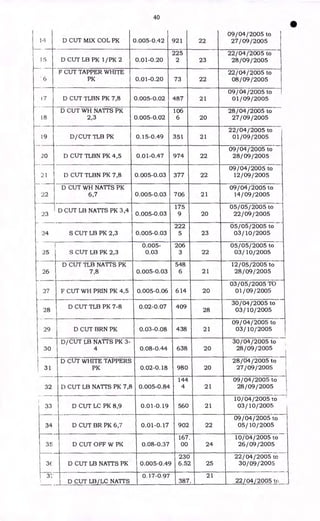

For illustration the transaction shown at Sr. No. 1 pertains to the variety " D

(:,

'ut Natts PK". As per sr.no. 1.1 , D Cut Natts PK variety with size 0.02 - 0.22 and

Iota] carats 3571.54 were imported by AEL from Tanb trading, UAE vide invoice No.

234-AEL/11/2004 dated 05/10/2004. These CPD were exported by AEL to Al Shahad

crold & Chokshey Diamonds, both of U.A.E., vide export invoice no.

AEL/PBW/PD/539/2004-05 dated 05/10/2004 & invoice no.

AEL/PBW/PD/538/2004-05 dated 07/ 10/2004, respectively. Again, as shown against

Sr.no 1.2, the same variety of CPD with same size and weight 3583.49 carats were

imported from Daboul Trading, UAE vide import invoice no. 913/DBL/PD/2004 dated

[1/ 10/2004 and then exported to Choksy Diamonds, U.A.E. vide export invoice no.

AEL/PBW/PD/559/2004-05 & AEL/PBW/PD/561/2004-05 dated both dated

4/10/2004. Again, as per sr.no. 1.3 the same variety of CPD with same size and

weight 3567.54 carats were imported from Tanb Trading, UAE vide import invoice no.

24l-AEL/ 11/2004 dated 18/10/2004 and then exported to Choksy Diamonds and Al

5hahad Gold of U.A.E. vide export invoice no. AEL/PBW/PD/573/2004-05 dated](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-48-320.jpg)

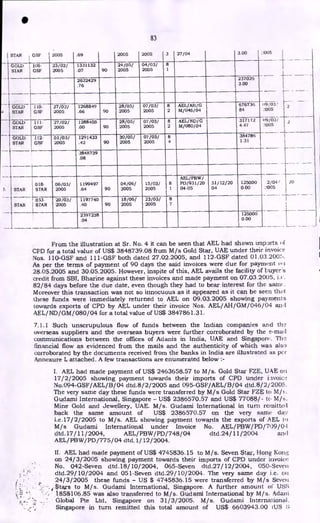

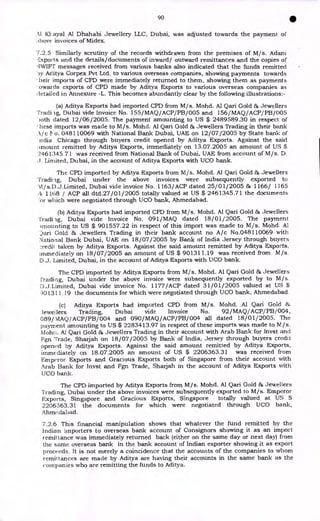

![•

77

Brothers Pvt Ltd Exports, Hong Kong. Ltd, Singapore

9

Hinduja Exports

Pvt Ltd

Mine Gold &

Jewellery, Dubai

Chokshey

Diamonds LLC,

Dubai 24/12/2004

I--

10

Hinduja Exports

Pvt Ltd

Planica Exports Pte

Ltd, Singapore.

Gudami

International,

Singapore 20/12 / 2004

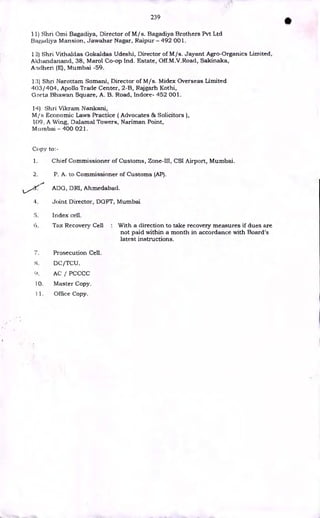

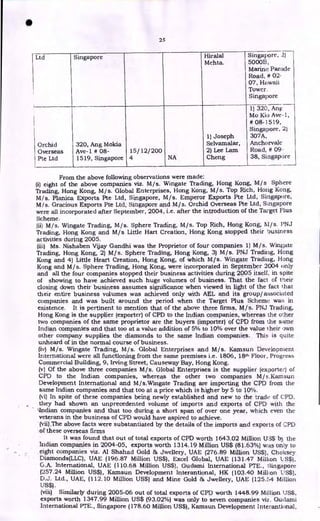

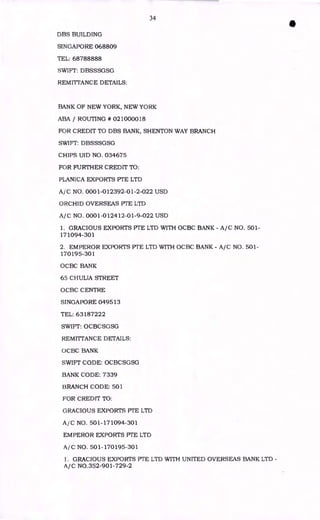

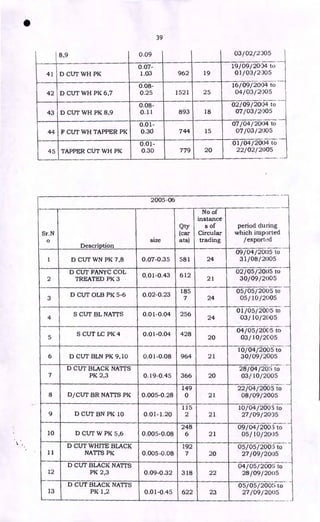

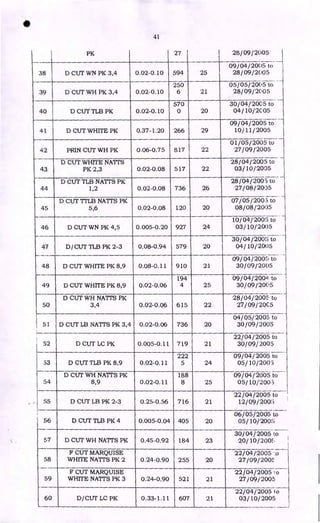

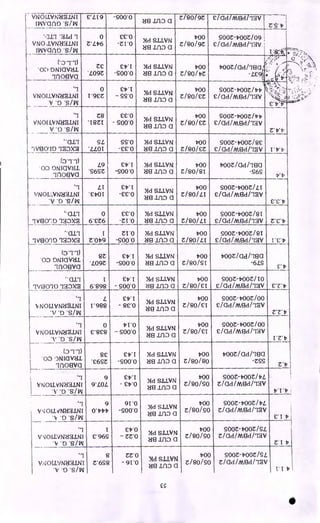

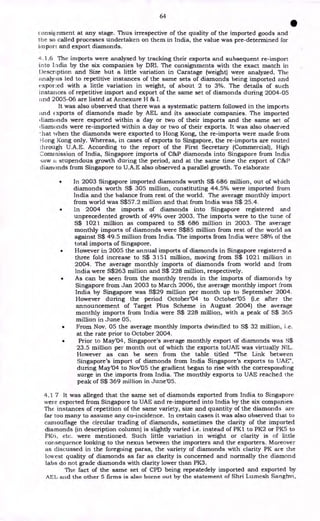

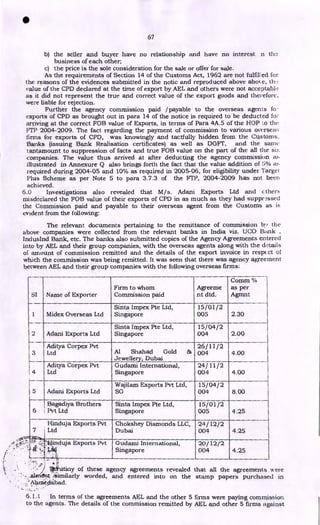

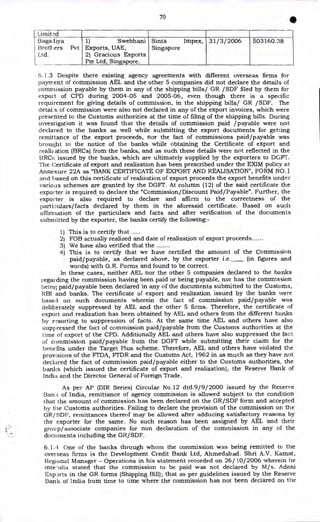

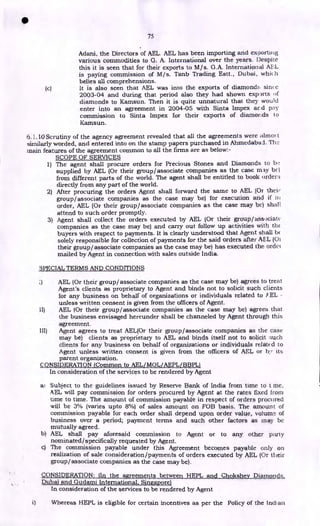

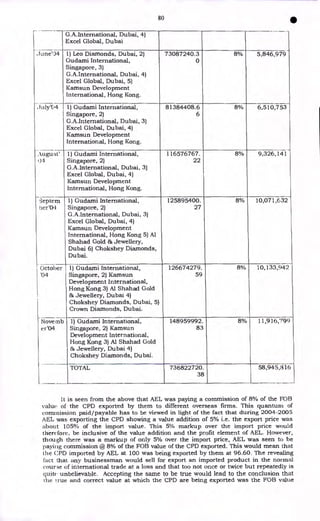

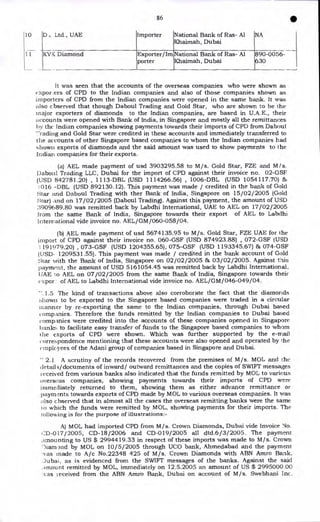

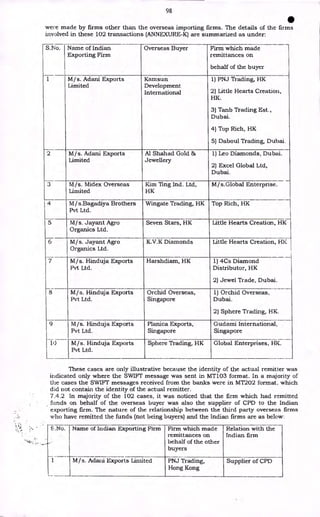

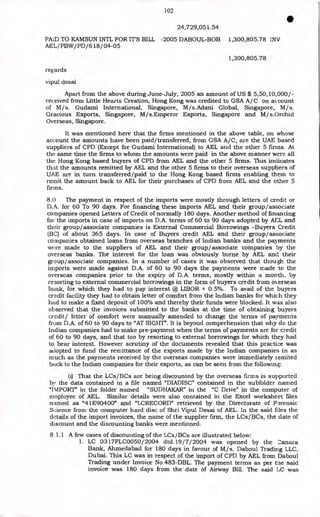

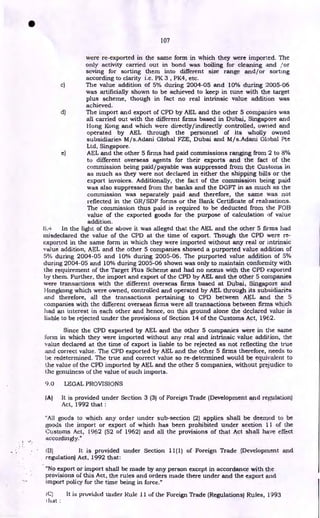

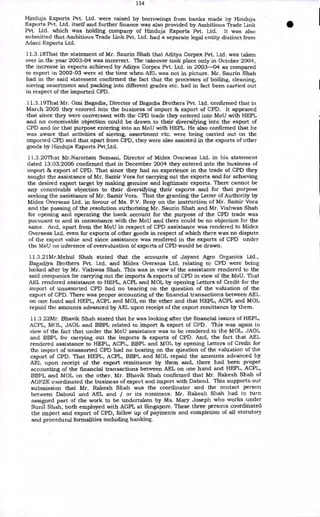

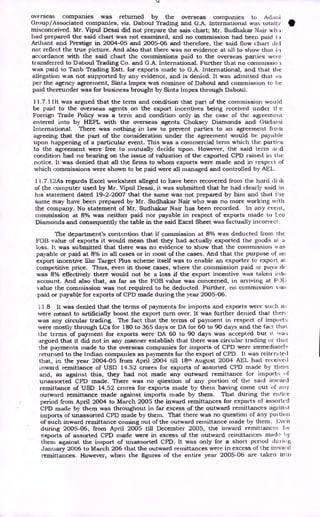

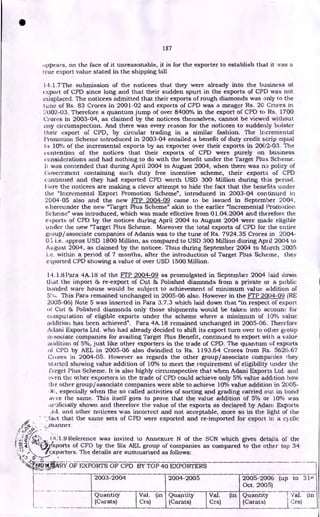

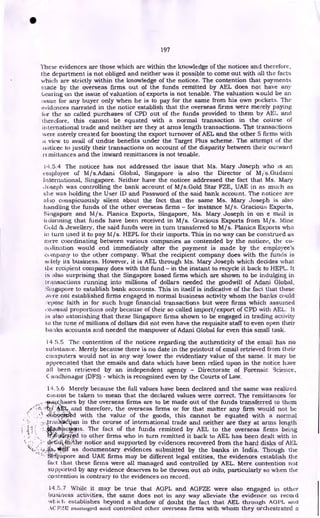

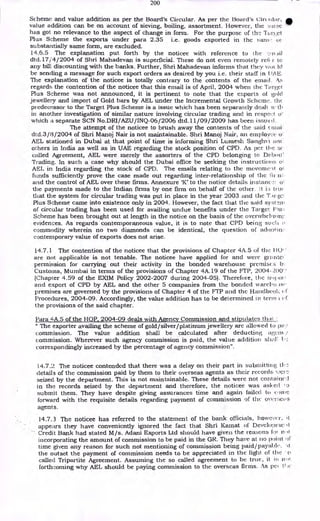

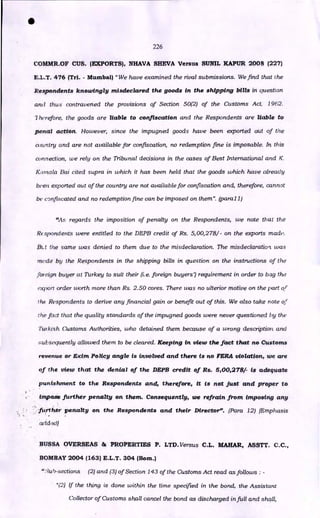

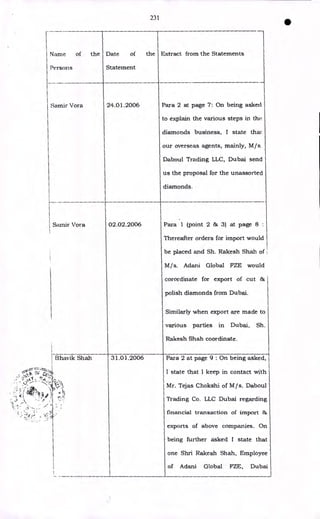

In terms of the agreement between AEL and the other 5 firms with the overseas

agents, it evolves that commission was payable by AEL and the other 5 li--ms

respect of the so called clients brought by these agents. The amounts of commission

payable as per the terms of the contracts have been worked out (Details as Per

Arinexure Q attached) and are as summarised as below:-

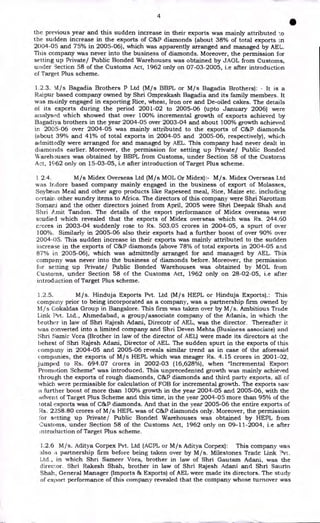

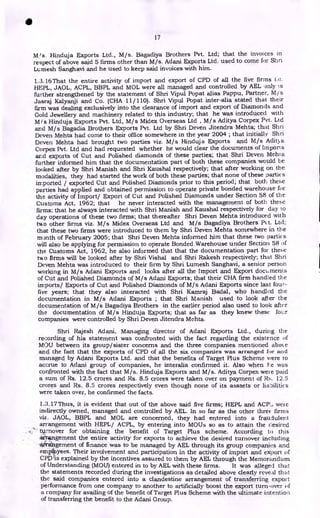

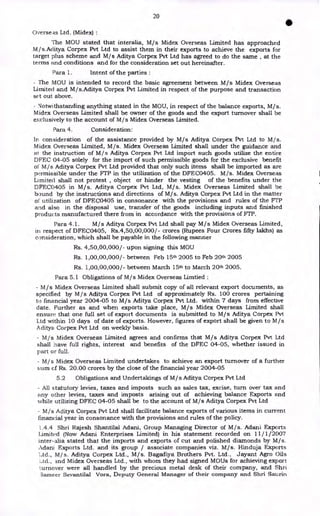

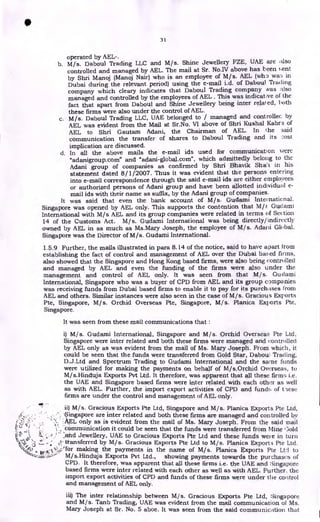

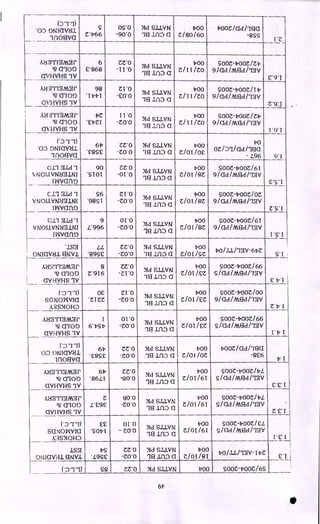

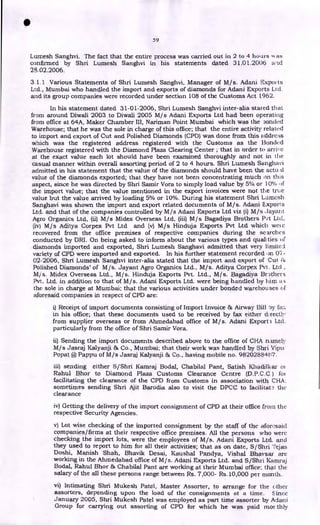

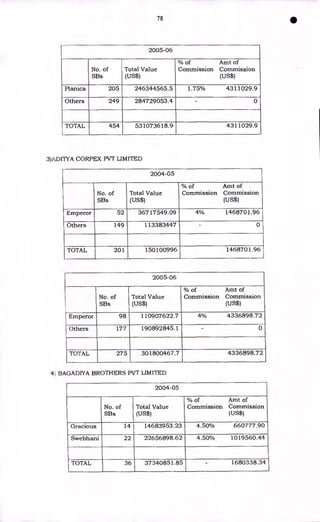

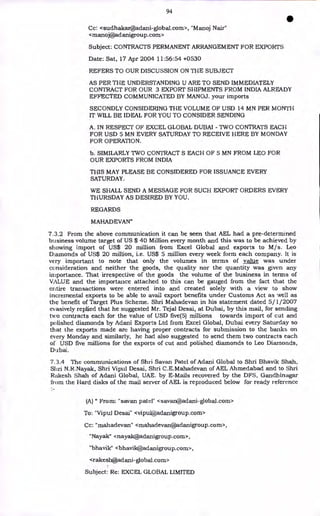

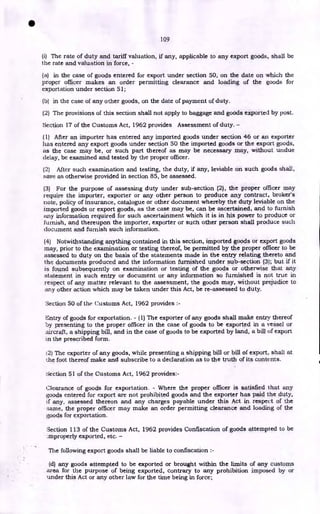

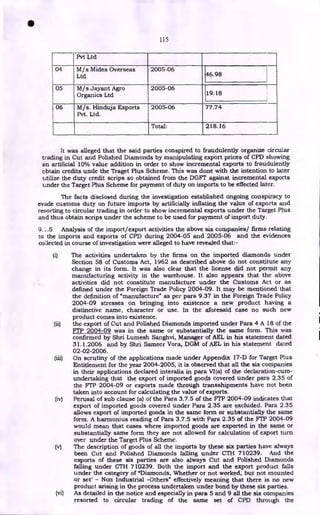

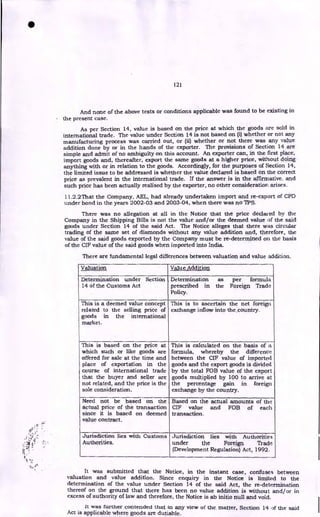

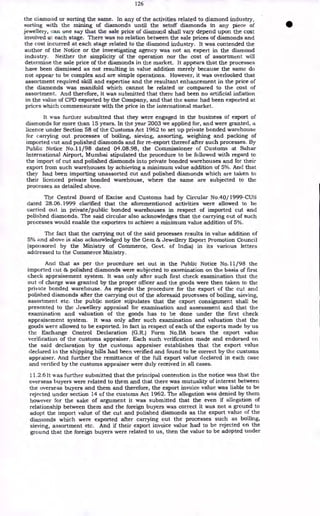

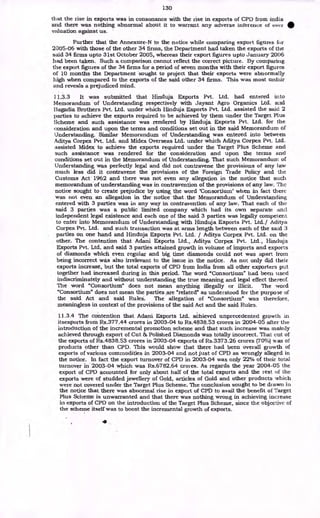

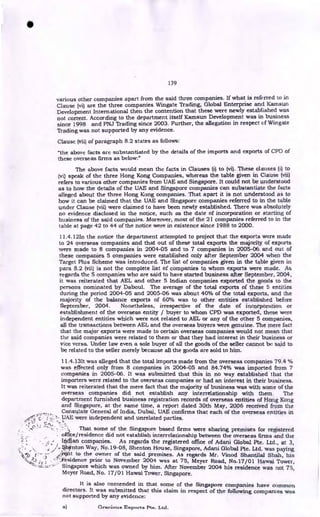

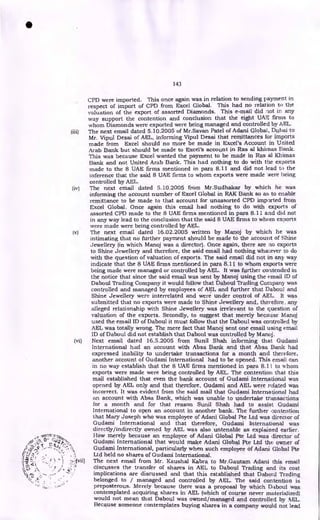

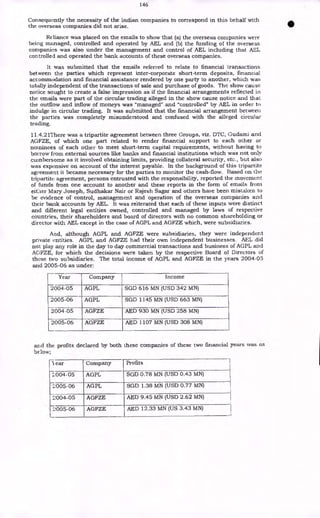

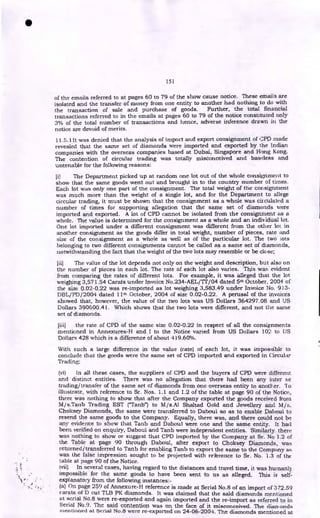

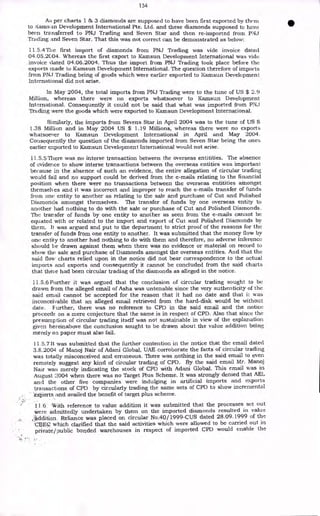

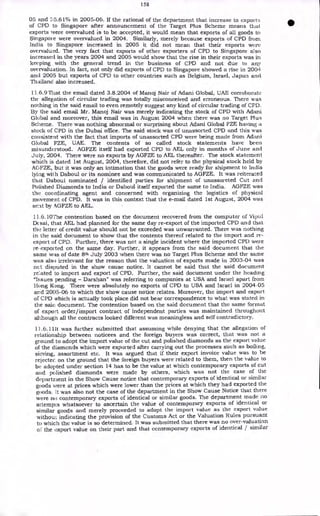

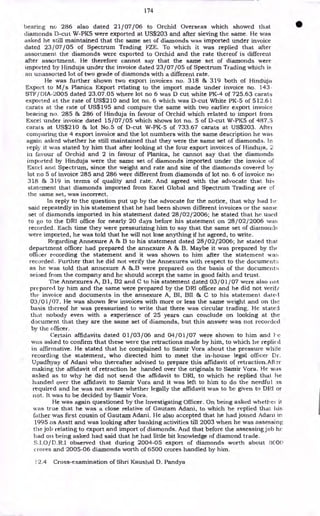

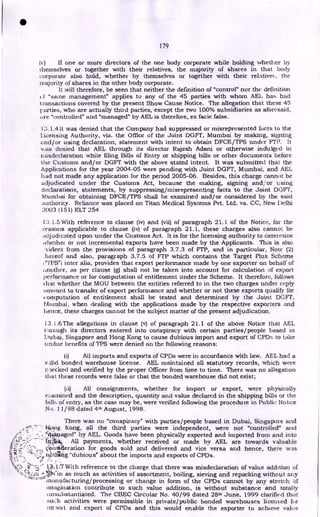

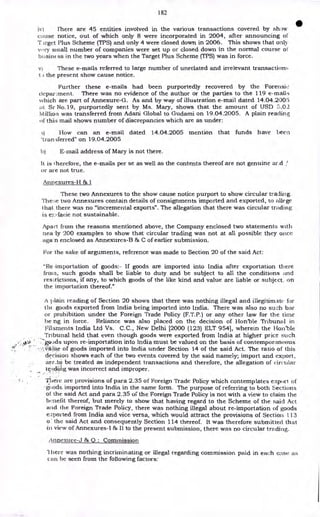

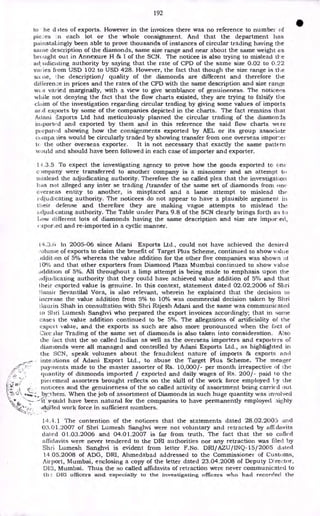

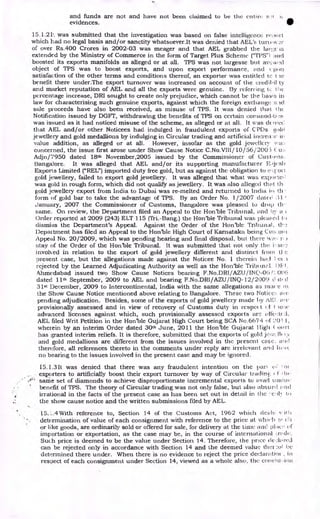

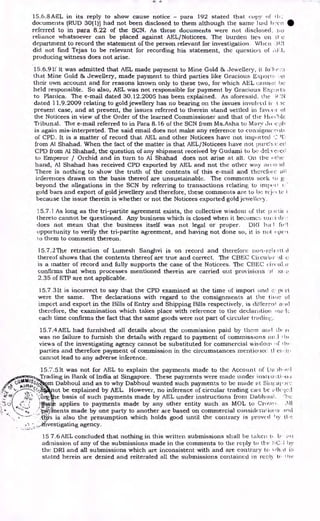

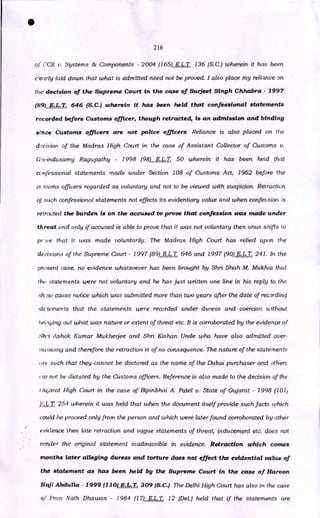

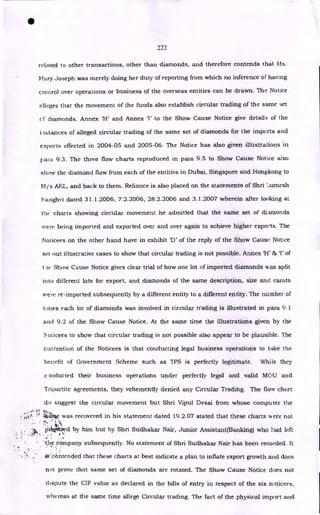

1)ADANI EXPORTS LIMITED:

2004-05

No. of

SBs

Total Value

of exports

(US$)

% of Amt of

Commission Commission

(US$]

Gudami 276 280373944.5 3% 8411218.34

Kamsun 114 111109553.5 2% 2222191.07

Others 822 859135437 0

TOTAL 1212 1250618935 10633409.41

2005-06

No. of

SBs

Total Value

(US$)

% of Amt of

Commission Commission

(US$)

Gudami 191 186984436.5 3% 5609533.09

Kamsun 82 81597587.38 2% 1631951.75

Others 3 994294.68 - 0

TOTAL 276 269576318.5 7241484 .84

2) HINDUJA EXPORTS PVT LIMITED

2004-05

No. of

SBs

Total Value

(US$)

% of Amt of

Commission Commission

(US$)

Mine

Gold 145 147856590.7

1.75%

2587490.34

Planica 57 56150154.03 1.75% 982627.70

Others 69 40210924.59 - 0

TOTAL 271 244217669.3 3570118.04](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-69-320.jpg)

![•

79

6 2.2 Shri Omi Bagadiya, Director of M/s. BBPL in his statement dtd.7/3/2006 after

seeing Schedule 12 regarding Direct Expenses for the financial year 2004-200,5 which

reflected payment of Rs.6,93,96,987.00 as Brokerage, Rs.1,92,020.00 as Expense s.

Rs.9,24,719.00 as Insurance expenses and Rs.7,992.00 as Supervision charges in

respect of Diamond Trade, stated that the brokerage was to be paid to Sinta Impex

Pte Ltd, Singapore however, the same had not yet been paid. Shri Bagadiya further

stated that this amount was to be paid as per the instructions of Shri Devcn Mehta of

HEPL as export brokerage in respect of CPD. Shri Bagadiya also stated that it was for

HEPL to arrange and send the said amount to the party in Singapore.

Similarly, Shri Narottam Somani, Director of M/s. Midex Overseas Limited

tendered, among other documents, journal voucher dtd.31/3/ 2005 in respect of their

Ahmedabad branch which showed an amount of Rs. 7,60,03,380/- debited to the

account of M/s. Sinta Impex Pte Ltd, Singapore as being 'brokerage and commission

(foreign)'. He stated that he had no idea about the said entries as no brokerage and

commission (foreign) had been paid from the account of Midex overseas Ltd., lndorc.

This amount had been paid from the account of Midex Overseas Ltd., Ahmedabad

which was absolutely under the control of Shri Samir Vora.

It was also evident that the commission was being paid subsequent to the export

of the CPD and therefore, provision was being made in the books of account ;or the

amount of commission payable. These facts corroborate the details of the commission

payable as shown above at table No. 1 to 6.

Thus from the above it is evident that in case of the exports by the India

companies to the aforesaid overseas companies where agency agreements 1% ere

existence the commission was paid /payable and therefore the same has to be

deducted from the FOB value of exports (which have also been shown on the higher

side by fraudulantely showing value addition of 5% / 10%) to arrive at the actual value

addition. Thus as detailed in Annexure Q the value addition was not achieved as far

as exports to (i) Kamsun Development international, HK., (ii) Gudami Internadonal,

Singapore, (iii) G.A.International, Dubai, (iv) Emperor Exports Pte Ltd. HK, (A )

Swebhani Inc, Dubai, (vi) Gracious Exports, Hong Kong, (vii) Mine Gold & Jeweller} ,

Dubai, (viii) Planica Exports Pte Ltd, Singapore.

6.2.3 It was also seen that commission was being paid by AEL and group companies

in respect of their exports to M/s. Kamsun Development International, M/s. Gudarni

International, M/s. G.A.International, M/s.Emperor Exports Pte Ltd, M/s. Graciotv;

Exports, M/s. Mine Gold and Jewellery and M/s. Planica Exports Pte Ltd. and that the

commissions were also being paid to, among others, M/s. Gudami International, M/s.

Kamsun Development International, M/s. Al Shahad Gold and Jewellery an(

Chokshey Diamonds. However, all the firms to whom the exports were being made and.

in respect of which the commissions are shown to paid were managed and controlled

by AEL only, as detailed above. Therefore, the very nature of the so called commission

is doubtful.

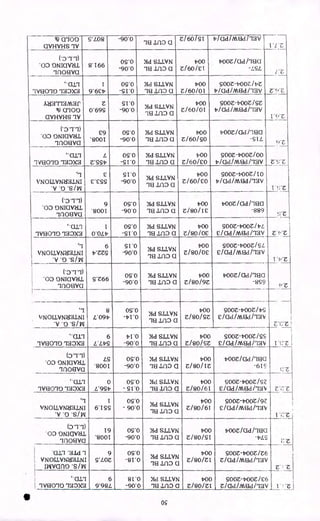

6.2.4 Among the data retrieved by the DFS from the hard disc of the computer i use

with Shri Vipul Desai of AEL which was seized during the course of the search of the

office premises of AEL, "Shikhar", Navrangpura, Ahmedabad on 24/1/2006 was

Excel worksheet file named "DIA_FOB". Scrutiny of the data contained in the said file

revealed that the same contained the month wise details of Commission paid/pavab]c

by AEL towards their exports of CPD during April, 2004 to November, 2004. The

summary of the details contained in the said file are as below:

Month Buyer Total FOB

Value of

Export (US$)

% of

Commission

payable

COMIlliS3i0/1

payable / pai

d (US$)

April'04 1) Leo Diamonds, Dubai, 2)

Gudami International,

Singapore, 3)

G.A.International, Dubai, 4)

Excel Global, Dubai 23181690.0

7

8% 1,854.53

May:04 1) Leo Diamonds, Dubai, 2) 41062941.4 8% 3,285,03

Gudami International,

Singapore, 3)

4

5

5](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-71-320.jpg)

![•

81

less the amount of commission paid/payable. The commissionwa being deducted fro; n

the FOB value only for the purpose of ascertaining the true and correct value of the

export goods and the deduction of commission is not in any way an attempt to rc-

determine the export benefits, if any, sought to be claimed by AEL. Further, it has

already been explained at para 11 of the notice that how the value addition of 5% to

10% as shown by AEL and its group /associated companies was artificially shown 0

paper only.

6.2.5 It was alleged that the value addition claimed in respect of the CPD exported by

AEL and the other 5 firms was required to be re-determined by deducting the amount

of commission paid/payable from the FOB value of the CPD exported. Consequently,

the amount of commission, ranging from 1.5% to 4.5% of the FOB value, being

paid/payable by AEL and the other 5 firms when deducted from the declared FOB of

the exported CPD would clearly result in the value addition being less than 3"/0 as

required under the bonded warehousing conditions as well as under the Target Plus

scheme.

7.0 From the documents seized during the search and those obtained from banks,

etc. it was observed that the terms of payments in respect of the imports were most] st

through letters of credit issued for 180 to 365 days or shown to be D.A. for 60 to 90

days. Whereas the terms of payments for exports are D.A. for 60 to 90 days. As

brought out in para 8 to the notice most of the companies to whom AEL and its group

companies had exported CPD were established in and around September 2004 and

were new to the business, however the Indian companies did not insist for L/cs from

them or payment against documents and instead the terms of payments were settled

at D.A. for 60 to 90 days, even though each export consignment was worth crores of

rupees which establishes the nexus between the Indian companies and the oversew.;

companies. For imports, AEL and their group/associate companies opened Len ers of

Credit of normally 180 days or 365 days. Another method of financing for the import:;

in case of imports on D.A. terms of 60 to 90 days adopted by AEL and thei:-

group/associate companies was External Commercial Borrowings -Buyers Credit (BC)

of about 365 days. In case of Buyers credit AEL and their group/associate companies

obtain loans from overseas branches of Indian banks and the payments are made to

the suppliers of AEL and their group/associate companies by the overseas bank:;. The

interest for the loan was obviously borne by AEL and their group/associate

companies. Prima facie this mode of payments seems to be innocous. Howeve - in a

number of cases it was observed that though the imports are made against D.A. of 60

to 90 days, the payments were made to the overseas companies prior to the expiry oc

D.A. terms, mostly within a month of imports, by resorting to external commercial

borrowings in the form of buyers credit from overseas bank, for which the India].

companies had to pay interest @ LIBOR + 0.5%. To avail of the buyers credit facility.

they had also to obtain letter of comfort from the Indian banks, for which they Fad tc

pay the bank charges for the same as well as make a fixed deposit of 100'' and

thereby their funds are blocked. It was also observed that the invoices for imports

submitted to the Indian Customs at the time of imports are showing terms of

payments as D.A. for 60 to 90 days, however while submitting these invoices to the

banks at the time of obtaining buyers credit/ letter of comfort, they were manually

manipulated to change the terms of payments from "D.A. of 60 to 90 days" t) "Al

SIGHT" by overwriting the original terms of payments. It is beyond comprehension

that why the Indian companies had to make pre-payment when the terms of payments

are for credit of 60 to 90 days, and that too by resorting to external borrowings for

which they had to bear interest. The details of such instances where the payments

for ..mports are made much before the credit period of 60 to 90 days had expired is as

per Annexure P. From the details as mentioned in Annexure P it was evident that in

most of the cases where the terms of payments are "D.A. of 60 to 90 days" pre-

payments are made within one month of the date of invoice/imports and in many

cases even within a couple of days from the date of invoice/ imports. Similarly in case

..... . where the imports were against L/cs. for say 180 days or 365 days it was also

observed that in most of the cases the overseas companies in whose favour the L/cs

,..'4•,

",- 2.___

•-• were opened, discounted the same immediately. There seems nothing wrong in the

..).1

%/ / . beneficiaries discounting the L/cs for making funds available to their company, but

.'

.5.

. it:;:,

-,-, at appears apparently wrong in the present arrangement between the Indian

t 4:-.,. i .

..:

,,?c . pries and the overseas companies was the fact that as per the terms of the Lies.

(

;..... '...the interest for discounting of the L/cs. was borne by the Indian companies, which in

•

:.' fad should have been borne by the overseas companies in the normal courie of

business, as the terms of payment for the Indian companies is 180 days or 365 days

by Lie. The details of instances where L/cs. are discounted immediately after the 7 are](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-73-320.jpg)

![105

and conditions which proves that these terms and conditions were merely on paper

and it was for AEL to decide and make payments as per their convenience. Which

shows the dubious nature of the transaction, created by AEL with intent to generate

high export turnover and to avail benefit of Target Plus scheme.

8.3. The contracts under which the CPD were being imported and exported by AEL

tip the other 5 companies were also examined. All the exports of CPD by all the six

firms were purportedly under a contract with the overseas firms of Dubai, Hong Kong

and Singapore. The contracts were all similarly worded and for sake of illustration, the

contract No. GIPL/AEL/PD/ 13/2004-05 dated 10/11/2004 between AEL and M/s.

Gudami International Pte Ltd, Singapore [RUD- 50] is reproduced below :-

"Purchase Order No .GIPL/AEL/ PD / 13L2004-05

Agents

1. Description

2. Rate

3. Total Quantity

4. Total Amount

5. Terms of Payment

6. Shipments

7. Partial Shipment

8. Insurance

: Cut & Polished Diamonds.

: US $ 25 to US $ 2000 per carat

: 30 to 100,000 Carats (+ / - 5 %)

: US $ 15,000,000.00 (+ / - 5 %)

: Up to 180 days D.A. (CNF Basis)

: November/ December 2004

: Allowed

: Covered by Brinks/Carrier's

9. Collection bank charges outside India at importer's account

10. A set of non-negotiable documents to accompany with the air

consignment.

The contract is for supply of Cut and Polished Diamonds by AEL to M/s

Kamsun. However, the contract does not in any manner indicate anything about the

quality, size or variety of the diamonds which are to be supplied by AEL. Whereas in

so far as Cut and Polished Diamonds are concerned the most important aspect of the

diamonds based on which they are normally transacted are the cut of the diamond,

the colour of the diamond, the clarity of the diamond, the size of the diamond etc. for

the reason that the value of the diamond is based on these parameters. Even the rate

at which the CPD are to be supplied by AEL to Kamsun as well as the terms of

payment are also very vague. As is seen that the contract is for a total amount of US$

50 lakhs (+/- 5%) against which the total quantity to be exported was in the range of

.3000 to 50,000 carats (+/- 5%). Thus any quantity between 3000 to 50,000 carats can

'ae exported but the total value would remain US$ 50 lakhs. Such terms are vague and

reflect the absence of any requirement of quality and at the same time it shows that

only the value of the export was important in as much as the same was necessary for

achieving quantum of exports so as to be eligible for the benefits of target plus

scheme.

:3.3.1 The contracts under which the CPD were imported by AEL and the other 5

companies were also similar in their contents. Contract

No.20/4/DTCP/DIAMONDS/04 dtd.20/4/2004 between AEL and Daboul Trading Co

I'LLC), Dubai:

"PRODUCTS: CUT AND POLISHED DIAMONDS

Q UANTITY IN CARAT RATE/ PER CARAT AMOUNT IN USD

,..,.

ra TO 65000 Us $ 10 TO us $ 2800 US $ 8,000,000.00

SHIPMENT : BY AIR ON OR BEFORE 30.06.2004

PARTIAL SHIPMENT PERMITTED.

TERMS OF PAYMENT : BY AN IRREVOCABLE LETTER OF CREDIT

PAYABLE AT UPTO 180 DAYS FROM BILL OF

EXCHANGE/AIRWAY BILL DATE.

CHARGES : OUTSIDE INDIA TO OUR ACCOUNT.

SHIPMENT FROM/TO ANY HONG KONG/DUBAI AIRPORT TO

•](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-97-320.jpg)

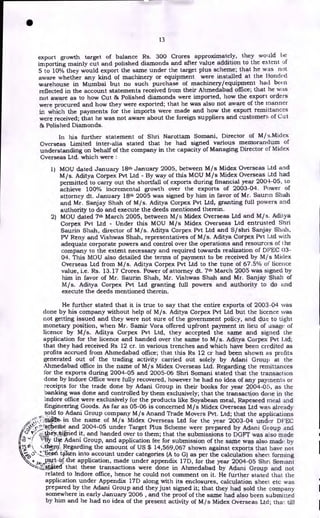

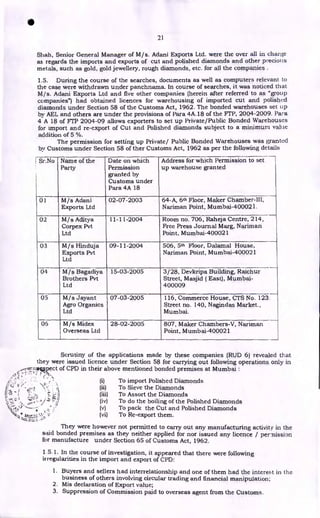

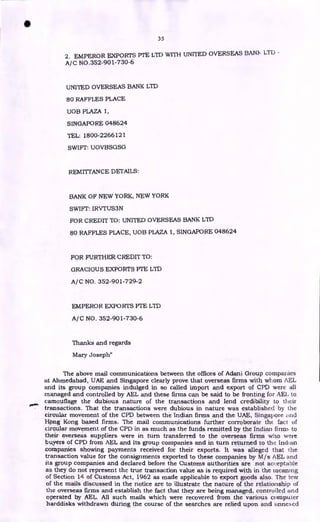

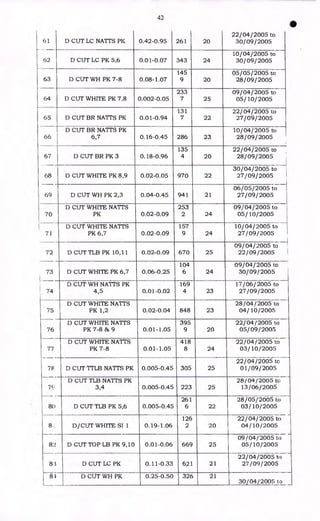

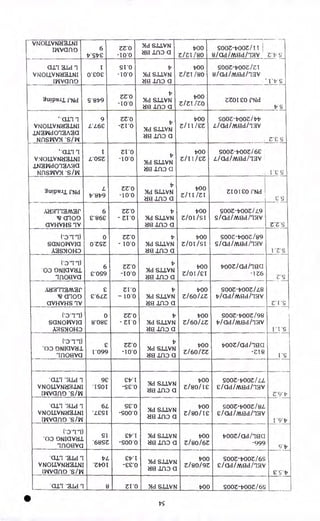

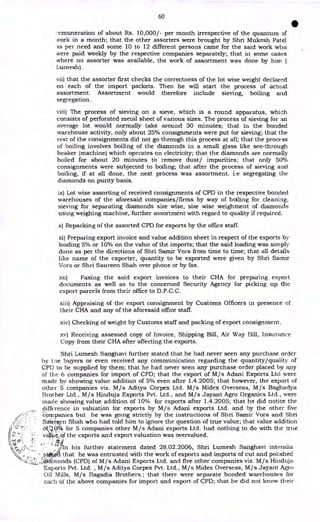

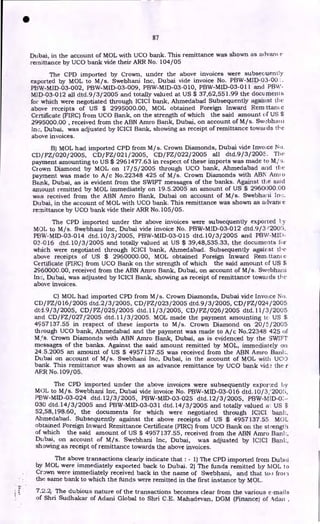

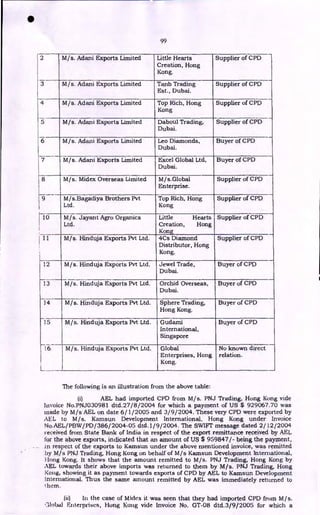

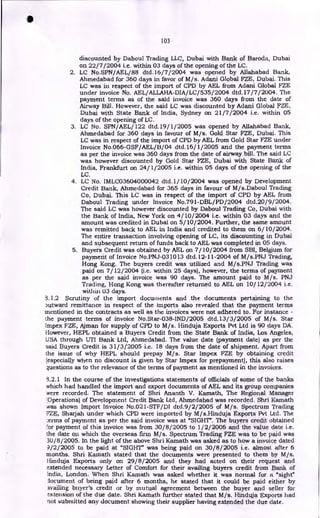

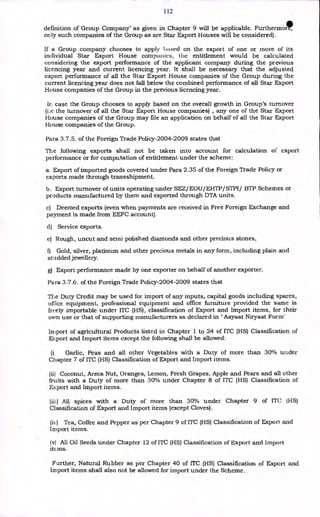

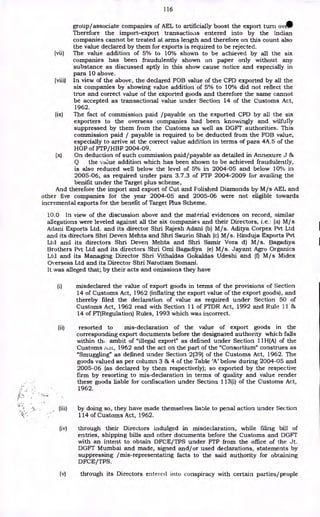

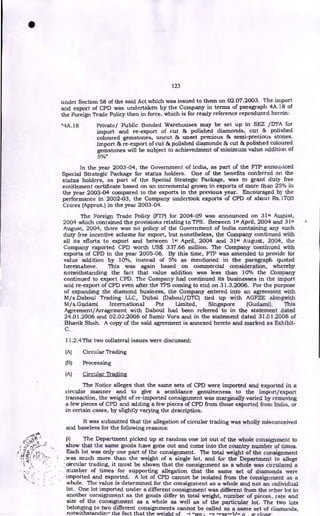

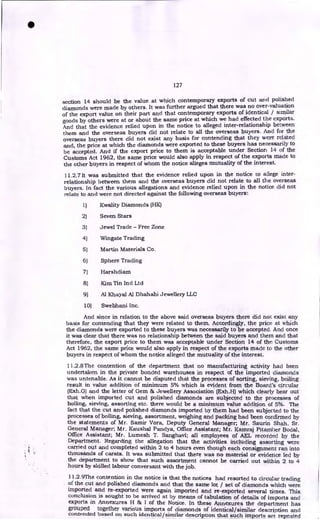

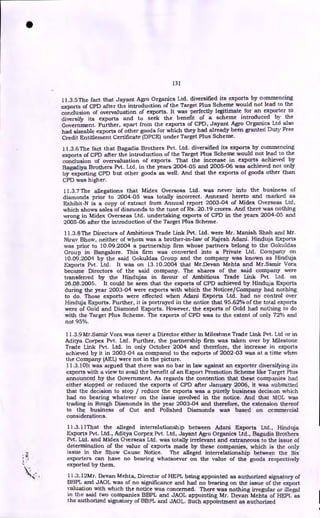

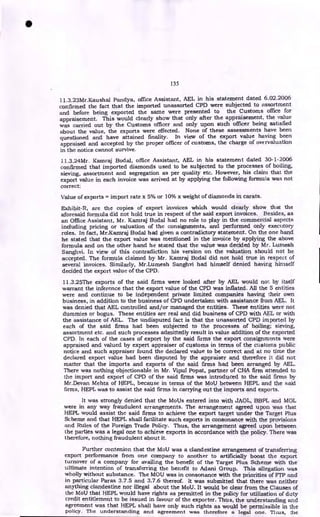

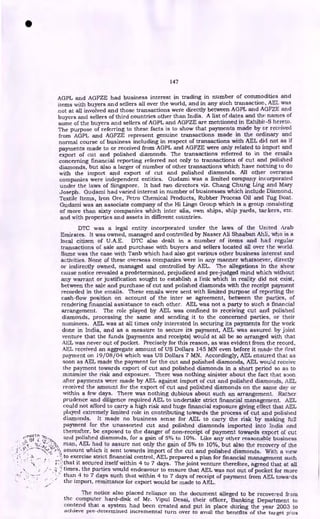

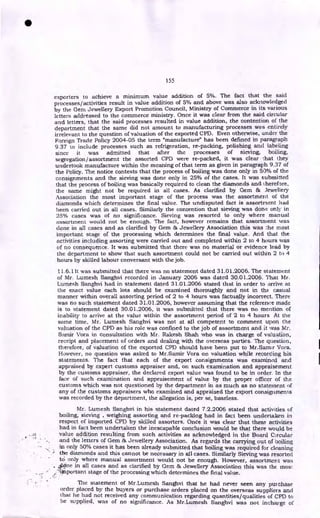

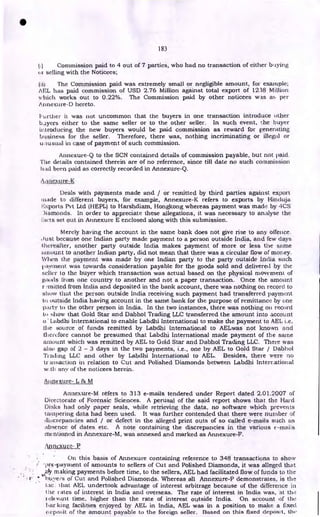

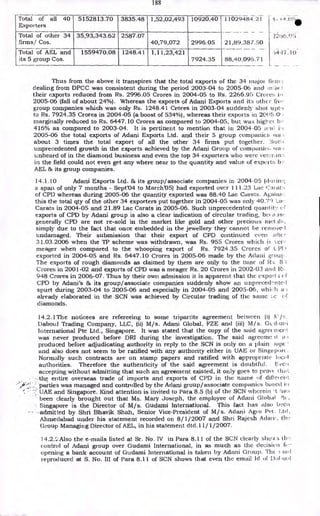

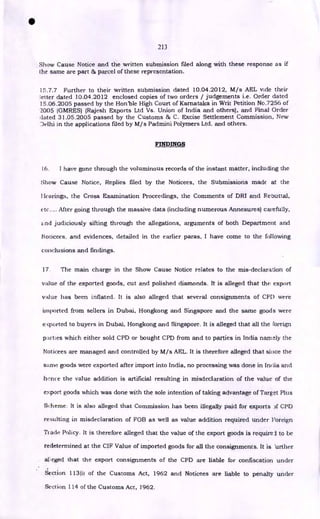

![Percentage incremental growth Duty Credit Entitlement (as a

°A) of the incremental growth)

20% and above but below 25%

25% or above but below 100%

5%

10%

15% (of 100%)

100% and above

111

Scrutiny of the applications made by the parties indicated that these parties

had applied for grant of Licence under the Target Plus Scheme, including, the exports of

Cut and Polished Diamonds for the relevant year.

9.] .3 The export of Cut and Polished Diamonds by these parties was not eligible

towards the FOB value of the eligible exports due to the exclusions given in Para 3.7.5

read with Para 3.7.3 of the Target Plus Scheme . The relevant provisions of the FTP

2004-09 are discussed below:

Para 3.7.1. of the Foreign Trade Policy-2004-2009 states that:

"The objective of the scheme is to accelerate growth in exports by rewarding Star Export

Houses who have achieved a quantum growth in exports. High performing Star Export

Houses shall be entitled for a duty credit based on incremental exports substantially

higher than the general annual export target fixed (Since the target fixed for 2005-06 is

17 %, the lower limit of performance for qualifying for rewards is pegged at 20% for the

current year)."

Para 3.7.2. of the Foreign Trade Policy-2004-2009 states that

"All Star Export Houses (including Status Holders as defined in para 3.7.2.1 of Exim

Policy 2002-07) which have achieved a minimum export turnover in free foreign exchange

of Rs 10 crores in the previous licencing year are eligible for consideration under the

Target Plus Scheme."

Para 3.7.3. of the Foreign Trade Policy-2004-2009 states that

The entitlement under this scheme would be contingent on the percentage incremental

growth in FOB value of exports in the current licencing year over the previous licencing

year, as under:

NOTES:-

(1) Incremental growth beyond 100% will not qualify for computation of duty credit

entitlement.

12) For the purpose of this scheme, the export performance shall not be transferred to or

transferred from any other exporter. In the case of third party exports, the name of the

supporting manufacturer/ manufacturer exporter shall be declared.

,3) Exporters shall have the option to apply for benefit either under the Target Plus

Scheme or under the Vishesh Krishi Upaj Yojana, but not both in respect of the same

exported product/s. Provided that in calculating the entitlement under Para 3.7.3 the

..otal eligible exports shall be taken into account for computing the percentage

ncremental growth but the duty credit entitlement shall be arrived at on the eligible

exports reduced by the amount on which the benefit is claimed under para 3.8.2.

;4) All exports including exports under free shipping bill verified and authenticated by

Customs and Gems& Jewellery shipping bills but excluding exports specified under

para 3.7.5, shall be eligible for benefits under the Target Plus Scheme

(5) In respect of export of Cut & Polished diamonds only those shipments would be

taken into account for computation of eligible exports under the scheme where a

minimum of 10% value addition has been achieved.

Para 3.7.4. of the Foreign Trade Policy-2004-2009 states that

Companies which are Star Export Houses as well as part of a Group company shall

have an option to either apply as an individual company or as a Group based on the

growth in the Group's turnover as a whole. (For the purpose of this scheme the

•](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-103-320.jpg)

![117

based in Dubai, Singapore and Hong Kong etc. to cause dubious import and

export of Cut and Polished Diamonds, to take undue benefits of the Target

Plus Scheme under Foreign Trade Policy.

entered into a MOU ( through their group company or on their own with

other noticee company) or arranged to transfer their export performance

knowingly and with ulterior motive of obtaining undue benefit accruing to

other company.

(I) entered into a MOU ( through their group company or on their own with

other noticee company) by virtue of which, it was agreed that the benefits of

Target Plus Scheme accruing on account of incremental exports would be

gassed on to M/s Adani Exports Ltd or their group company. The ultimate

beneficiary of the DFCE/TPS would be the Adani Group of companies. The

confidentiality clause in the MOU's clearly bring out the clandestine nature

of arrangement right from the stage of physical activities of import and

export till the actual availment of benefits on the issue of license.

(viii) mis-declared the value addition of 5% and 10% in as much as activities of

the Assortment, Boiling, Sieving and Repacking without any manufacturing/

processing or change in form of the CPD cannot by any stretch of

imagination contribute to such value addition. Further, even these

processes too were not carried out on all the CPD imported and re-exported

by them. The CPD were exported in the same form in which they were

imported and thereby mis-declared and inflated FOB value of the CPD and

at the same time they have failed to declare the correct FOB value of

exports.

(ix) resorted to circular trading activity in the import and export of CPD by re-

importing the same lot on more than one occasion to artificially boost export

turnover and despite the existing agency agreements with different overseas

firms for payment of commission by M/s AEL and their group of companies

failed to declare the details of commission payable by them in any of the

shipping bills/GR/SDF filed by them to the Customs for export of CPD

during 2004-05 and 2005-06 resulting in mis-declaration of the FOB value

to tile emelt' of the commission payable which is otherwise required to be

deducted. him' the export value for arriving at the correct FOB value of the

exported goods amid therefore have made themselves ineligible for the

benefits of Target Plus scheme, if claimed by them amounting to a sum

detailed to column I; 0 of the Table 'A, above.

(x) The' ai live 1)ireetors were alleged to have indulged personally in the

11..11.11dent and manipulative practice and entered into the criminal

-.pit at v with :several person of India and overseas to cause import and

l'N.11.+Cl. of L• ri ), involved themselves into mis-declaration of export value of

) durilig the iteriod 2004-05 and 2005-06; indulged into dubious imports

:111([ expo. is to take itiulite brnefits of the Target Plus Scheme under Foreign

trade y It was known to them and they had reasons to believe that for

the sap] < ot aventioti of %,ariotts provisions of Customs Act, 1962 and FTDR

Act/1•11'. Hie CH-) exported by them were liable to confiscation under

Sec !too 113 of Customs Act, 1962 and thereby made themselves liable to

per wider Section i 1.1 of Customs Act, 1962.

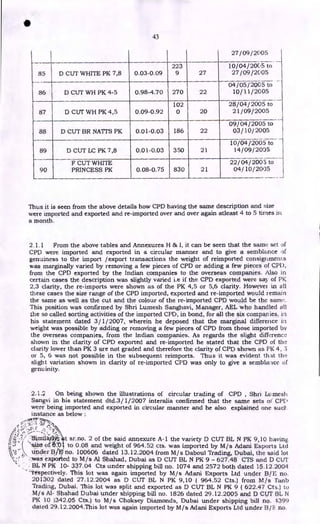

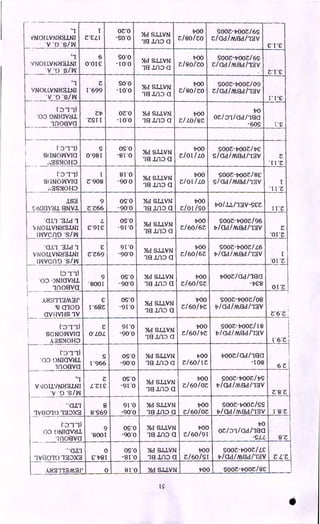

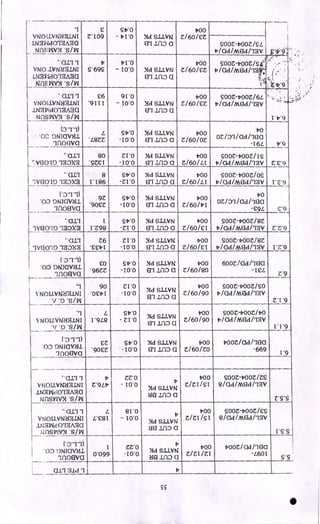

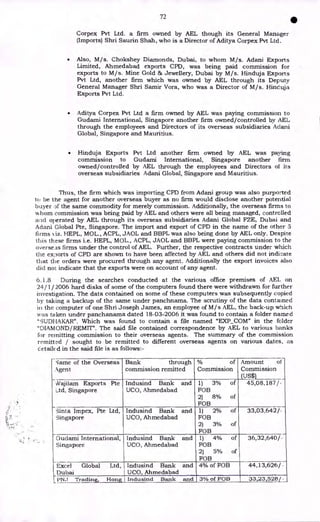

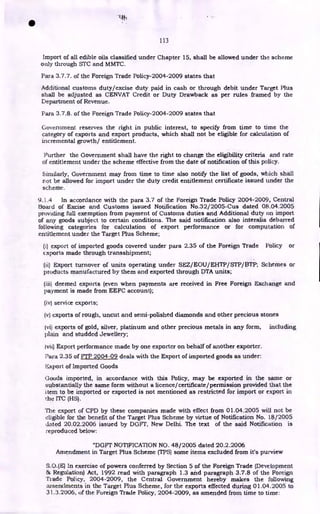

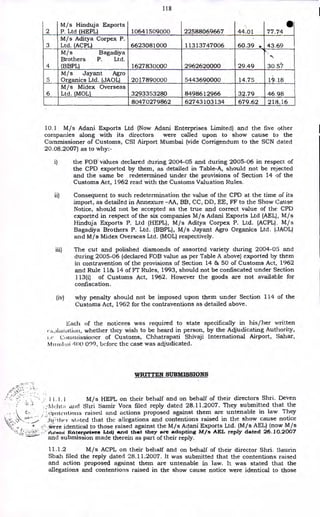

Table 'A'

Benefit

Benefit if

claimed claimed

I ilitFk ilib iiii iiii,

1

Pat I y Mont( 1 .)tio.i M.

• -

M/s Achim 1,:xix.rts

I

I

1 Ltd 01_':i.) . ;. f,.6266616582 t 11936363495

•

Declared crores) crores)

2004-

05

2005-06 2005-06

498.19 0.00](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-109-320.jpg)

![122

"'dutiable goods' means any goods which are chargeable to duty and on which

duty has not been paid"

The Hon'ble Supreme Court in Associated Cement Companies Limited vs.

Commissioner [2001 (128) ELT 21 (SC)] held that where goods are exempted from duty

of customs, the same are non-dutiable goods.

And in the present case, CPD exported by the Company are not dutiable goods

as the same do not appear in the Second Schedule to the Customs Tariff Act, 1975

("CTA"). It was submitted that where the goods were non-dutiable, the provisions of

Section 14 shall not apply. In case of goods exported from bonded warehouse, this is

also clear from the provisions of Section 69 of the said Act whereunder a proper Officer

has the power to determine the rate of duty, and therefore, consequentially the value,

but where there is no rate of duty prescribed, there is no independent power for

determining the value of the goods exported from bonded warehouse. Admittedly,

there is no duty of customs levied on export of CPD and therefore, there is no power to

determine the value thereof under Section 14 read with Section 69 of the said Act.

The Notice is, therefore, without jurisdiction and violation of Section 14 o the said Act.

11.2.3 It was submitted that the Company AEL, was a merchant exporter and engaged

in the business of trading in agro-products, petroleum and petrochemicals, vegetable

oils, coal & coke trading, Iron Ore, Textile Products, Ferrous and Non Ferrous Metals

and precious metals including diamonds. The Company was recognised as an Export

House by the Government of India in 1991. The Company had been awarded prizes

for being the highest foreign exchange earner in the private sector in the country.

Various other awards were also granted to the company for its export performance.

The Company had grown from export house to the highest category amongst status

holders, as a "Premier Trading House", which requires the minimum export turnover

of Rs. 10,000 Crores.

In the year 1997, the Company set up a 100% subsidiary in Mauritius called

Adam Global Ltd., which in turn set up two 100% subsidiaries called Adani Global

FZE, UAE and Adani Global PTE Ltd., Singapore (hereinafter respectively referred to as

"AGFZE" and "AGPL"). Being 100% subsidiaries, these entities support the Company

in its international business. The function of AGFZE and AGPL was to look after its

own international business and also work in coordination with the Company in the

Company's International businesss. The Company had diversified in various

businesses and promoted Mundra private port and SEZ at Mundra, gas distribution,

power generation, trading and transmission, ICDs, handling and logistical support to

Agro industry, Real estate, Coal mining, Retail, Ship Owning and Chartering, Ship

Breaking and Repairs, etc. The total. turnover (sales) of the Company during the last

three financial years has been as under:

Year Turnover (Rs. In Crores)

200()-07 9742.33

2005-06 9156.43

2004 -05 13417.80

The Group turnover of all the businesses reached Rs.15355.35 Crores in the year

2006-07.

The Company being a merchant exporter explored new markets and new

commodities depending on the opportunities available in the global trade. Based on

commercial considerations and commercial expediency, the Company at different

times focused on different products so as to achieve maximum growth and profits. The

details of new products started and exited are as per Exhibit-B. The economic policies

of the Government is an important factor which world over influences business

decisions. Whenever the Central Government had announced the export-import

policies, the objective had been, to provide impetus to export and boost exports

particularly by status holders, such as Premier Trading House. The Company started

export of CPD in 1994 and had been a Member of the Gem and Jewellery Export

Promotion Council (GJEPC) since 2001. In 2001-02, the Company re-entered the

diamond business and exported rough diamonds worth Rs.83 Crores. In the year,

2002-03, the Company also exported CPD to the tune of Rs.20 Crores. Thus the

Company was familiar with the diamond business, and did not entere into the same

for the first time in 2003-04. Company obtained a License for bonded warehouse](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-114-320.jpg)

![year

% Rise

over

2002-03 2798.15 35,595.66 35525.00 1680.07

Adani Exports Ltd. managed to achieve over 100% incremental Exports in 200.1-4

over the exports of 2003-04 for all the five companies to achieve the maximum belie iit

of 15% incentive as prescribed under the Target Plus Scheme for incremental exi

over 100%. The figures for the increase in exports in 2004-05 when compared witli tl le

exports of 2002-03 as above, the % increase in the exports is all the more T T (d

boggling.

14.1 4Again DGFT, on being brought to notice of the misuse of the scherw, vi lc

notification No. 27/2004-09 dated 23.02.2005 amended Para 3.7.5 (f) to read I hi's:

"Gold, Silver, Platinum and other precious metals in any form including plain and

studded jewellery". Thus excluding the export of Studded gold jewellery f, on. di:

-

purview of Target Plus Scheme. Further vide Notification No. 48/2005 d:d

20/02/2006, the exports of diamonds and other precious, semi precious stones wT

also removed from the list of export items entitled for Target Plus scheme. Ancl vi Jc

Notification No. 57/2005 dtd. 31/03/2006 the "Target Plus Scheme" was abolished le;

all the exports with effect from 01.04.2006. Thus the genesis of the fraudulent c.xport!:

of cut and polished diamonds, gold jewellery and gold Medallions by AEL a; d

group/associate companies by indulging in circular trading and artificial Mem. 3( II

the value addition, to artificially boost their export turnover dates back to the yrar

2003-04, when the Incremental Promotion Scheme was introduced and therefore h"

defence of the noticees, at any stage, that the figures or the mails or the amount.

the parties referred to does not pertain to the period of the Target Plus Schema or

to gold/gold jewellery and not cut and polished diamonds, should be vievced

in this perspective. It was also mentioned that the case as a whole is to be viev,,c.1

from the perspective of the fraudulent intention of the exporters to artificially beD:.4

their export turn over by way of circular trading of the same sets of dial-non:Is. to

achieve disproportionate incremental exports to avail undue benefits of Target 1 'Ins

Scheme,

14.1.5The unprecedented volume and value of imports and exports by the Not; :c. ns

compared to the value of exports by the other top 35 exporters, also needs to be gi t)

a consideration while arriving at a conclusion that the importers and exporters v (*Ye

interrelated and were hand in glove in the fraudulent design of the Noticec to ;wail

undue Target Plus benefits. Ample evidences had been adduced in the SCN tt. slow

that the overseas importers and the exporters were interrelated and hand in glo

the Indian companies and that there was circular trading of CPD between then'. 1'w-a

8 & 9 of the SCN refers.

14.1.6It was submitted that looking to the huge size of the individual

consignments running into thousands of Carats, no contemporaneous exports by kin3

other exporter, having the same volume of consignment could have been to ip.1 to

draw a comparison. Moreover the stray instances brought forwarded by the lo!iece

to show comparable prices, vide Exhibit A to their reply, also cannot be decnieJ bc

contemporaneous in view of the fact that the "Range Converted" shown in 5 O-

dle Exhibit A has no basis. Therefore the range of diamonds shown to be c:(pi Tied

could not be said to be comparable with the size (range) of diamonds expoTtc,1 11

----them. Also the Noticees have not drawn any reference to their export consig)inient:.

•

,-- w.ith which they were attempting to compare the said prices. Moreover in the

',411ibit A there is no reference to the quantum of exports per consignincin. an,

- country to which the same were exported, to draw any comparison. Thus a Trier:

talw,lation giving some instances of prices without any reference to the size t ,'• the

diarrionds exported, quantum of exports, country to which the exports were li taidc,

cannot make them comparable prices.

Their contentions that Section 14 is also not applicable in this case as th( (21)1)

exported by them as the same are not dutiable. Various courts, including the 1+ rible

Apex court have held in a number of cases that in case of export fraud, :5( ctionli

comes into play and is applicable. The Honble Apex court's judgment in case t ,f (tit)

Prakash Bhatia [ 2003 (155) ELT 423 (SC)] is aptly applicable in this case, wire, cili it

is held that, mode for determining the value of the goods provided under Section 14 of

the Customs Act, 1962 is required to be followed even if no duty is payable. INIcy cover

in the said judgment the Honble court has also held that, when mat gin1.)f pi °lit](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-170-320.jpg)

![194

mentioned that the major exports by Adani group in 2004-05 was after ti

announcement of Target Plus Scheme in September 2004, whereas the other e.,.po-; el s

had been exporting from the beginning of 2004-05. Further, it was incorrect te

that in Annexure "N" the export figures for 2005-06 of Adani group are taken t 11

January 2006 whereas those of other 34 exporters are up to 31.10.2005. The fiv or(

for exports for Adani group are also taken only up to 31.10.2005.

14.4.5 The noticees also wrongly state that the export of Studded Gold Jewellery

not covered under the Target Plus Scheme. In fact when the Target Plus Scheme was

introduced in September 2004 Studded Gold Jewellery was included in the

permissible for exports. It was only in February 2005 when the DGFT came 1 o 1;•icw

about the large scale misuse, by way of Circular Trading of Gold in the guise of exports

of studded jewellery, it by Notification No. 27/2004-09 dated 23.02.2005 arnenclecl

Para 3.7.5 (1) to read thus: "Gold, Silver, Platinum and other precious metals in ai'y

form including plain and studded jewellery". It is also to mention that all the hottec,.'s

in their applications made to the DGFT for obtaining DFCE certificates tinder the

Target Plus Scheme have included the value of exports of studded jewellerir i.t the

value of their total exports and have also contended that since their exports of stud&d

jewellery was prior to the issue of the notification, they have not excluded these fig, ir.:s

from their total export figures. That out of total exports of Rs. 10938.80 Crore:.

Aclani Exports Ltd. in 2004-05 the exports of CPD and studded jewellery togl!ilier

account for Rs. 7787.25 Crores, i.e. 71%. Similarly the other noticees have also

achieved the major chunk of their export turn over through export of CPD

jewellery.

14.4.6 It is not the case of the department that an exporter cannot diversify its c x port

products. Adani Exports Ltd. with intent to misuse the Target Plus benefits entered

into a secret MOU with these three companies, through its associate companie.i, in

which companies also the relatives/employees of Ada.n.is were the directors. The :.re.-et

MOU (i) provided for entire operations of exports to achieve the desired growth in tic

export turn over to enable them to claim the benefit of the target plus scheme, to lx

handled by Adani Group; (ii) benefit of Target Plus scheme to accrue to Aclani Groilp o'

Companies and (iii) these three firms would be paid commission @ 2% to 2.5% of 1:C.T3

Admittedly the entire incremental growth in the exports of these three companies wa:.

achieved by exports of CPD and studded Jewellery. Thus AEL, right from the ince] aka ,

of the scheme had fraudulent intentions and had planned to achieve unprecedent ed

export turn over by circular trading of CPD and therefore also roped in

companies into their fraudulent scheme. It was admitted by the notices thai

"Apparently, it would have not been possible for M/s Adani Exports Ltd. to achieve 111-

required increase in turnover to approx. Rs. 22000 crores in 2005-06 in order le

the benefit of Target Plus Scheme. Therefore, M/s. AEL appeared to have achieve, ' • h,

desired turn over in 2005-06 by means of a rise in the export of C&P diarioncl

through its other five group / associate companies".

14.4.7 The little inconsistency in the statement of Shri Samir Vora or any SI iti Cie •et

Mehta attempted to be highlighted does not turn the tables against the show calls

notice. Further, various averments made by the noticees only lead to the conch

that admittedly the entire business of so called import & export of CPD in the

all the six companies, including the financial arrangements was managed. eonti-o lc I.

and handled by AEL through its Indian as well as overseas group/associate corn panic::

and its employees.

14.4.E, The contention in the notice that the FOB value of exports was artificially fiN.e, 1

by adding 5% or 10% over the value of the imports, as mentioned in the statemim t r f

Shri kamraj Bodal, who prepared the export invoices, is attempted to be folsiiicC 1.

bringing about some stray instances of some invoices as per Exhibit R. At the cots( I

the instances quoted in Exhibit R are far too few and far apart when compared to tl

total number of export consignments. Further the value addition of 5% or

artificially shown to be achieved as per the instructions given by Shri Sarnir Vora ae 1

has also been admitted by Shri Lumesh Sanghvi who handled the entire import

export of CPD from the bonded premises of all the companies. It is also not displitri

by the noticee that in all cases of export, the value addition of 5% or 10% as Lb,-

may be had been shown to be achieved.

The noticees have no option but to admit that so called import and e:.liort it

CPD for all the six companies was managed, handled and controlled by "1.'bc](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-178-320.jpg)

![206

us the proposal for the unassorted

diamonds.

S arnir Vora 02.02.2006 Para 1 (point 2 & 3) at page 8 :

Thereafter orders for import would

be placed and Sh. Rakesh Shah of

M/ s. Adani Global FZE would

corordinate for export of cut 86

polish diamonds from Dubai.

Similarly when export are made to

various parties in Dubai, Sh.

Rakesh Shah coordinate.

13havik Shah 31.01.2006 Para 2 at page 9 : On being asked,

I state that I keep in contact with

Mr. Tejas Chokshi of M/s. Dabhol

Trading Co. LLC Dubai regarding

financial transaction of import &

exports of above companies. On

being further asked I state that

one Shri Rakesh Shah, Employee

of Adani Global FZE, Dubai

coordinates for the business of

import & exorts of gold, gold

jewellery &articles & Cut &

Polished diamonds with dabhol

trading co. & also keep in contact

with him.

And merely because one person is a common director between Adani Global Pte. Ltd.,

Singapore and Gudami, does not make them or with AEL a related person within tae

meaning of Rule 2(2) of the Customs Valuation Rules, 1988 (hereinafter referred to as

the "Valuation Rules"). This legal position is well settled in the following amongst

other, cases:

(i) 2008 (222) ELT 84 (Tri.-Mumbai)-Lloyds Metals & Engineers Ltd. Vs. CC E.

Nagpur

(ii) 2004 (164) ELT 191 (Tri.-Chennai)-Prasiddha Trading Corporation Vs;. (.'C.

Coimbatore

(iii) 2002 (143) ELT 244 (SC)-Alembic Glass Industries Ltd. Vs. CCE & Cus.

(iv) 2000 (115) ELT 489 (Tribunal)-Daewoo Motors India ltd. Vs. CC, I c‘x

Delhi

(v) 2002 (150) E.L.T. 1144 (Tri. - Mumbai)- Commr. of C. Ex. & Gus.

Aurangabad Vs. Pinnacle Exports Pvt. Ltd. - Maintained in Suprcmc•

Court as reported in - 2008 (226) E.L.T. A142 (S.C.)]

As such,.merely because Merry Joseph was a common Director, it does not mean that

Gudami is a "related person" since AEL does not hold any shares in Gudami.

15.2.1 References to the email dated 16th June, 2005 sent by Sunil Shah, emails dated

• 16th February, 2005 and another undated mail from Kaushal Kabra merely give

information regarding closing down of Absa Bank and therefore. Sunil Shah was

▪ rlit.ely sharing information that Absa Bank had asked Adani to make alterm tive

arrangement and temporary instructions not to make the payment in the accour.t

Shine Jewellery FZE with Bank of Baroda, Dubai respectively. The contents of the

email dated 16th June, 2005 are not inculpatory and it does not in any manner snow

any "control" by AEL over Gudami. Further, the email sent by "Manoj" of Dabhol OTC

and there was no reason to infer that said "Manoj" was Manoj Nair, who Wi.IS the

employee of Adani Global. Manoj is a common name in India, and hence no adverse

inference can be drawn. The contents of undated email of Kaushal Kabra have been.](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-190-320.jpg)

![•

207

misunderstood. DTC wanted to acquire shares of AEL, but being a listed Company,

AEI, advised DTC that it could transfer only less than 5% of the shares. To the

question by DTC whether AEL could introduce DTC to bankers for financing this

purchase of 4.99% shares of. AEL, in view of the longstanding relations AEL had with

various bankers, Kaushal Kabra was seeking to inform the Company of its

implications, so that in turn, DTC could be informed about the offer of UBS. Neither

the email dated 16th February, 2005 nor the undated email, in any manner

whatsoever, prove that the exports or imports made by AEL and other Noticees are not

genuine. The allegation that DTC was controlled and managed by AEL is meaningless

since AEL had only imported goods from DTC and the CIF Value of all such imports

has riot been questioned or challenged.

15.2.2 it was argued that the instances set out in Exhibit-D were not stray incidences.

Annexure-H to the show cause notice covers approx 1000 lots and Annexure-I thereto

covers approx 2000 lots. Exhibit-D, which is also now resubmitted with reasons and

reinarks as Annexures-II and III to the Written Submissions, shows that in respect of

48 lots of Annexure-H and 139 lots of Annexure-I, the charge of Circular trading, on

the face of it, do not survive. Even if Entry 11 is removed and placed on page 3 of

A nnextire-1, after Serial No. 9, the charge of Circular trading must stay. The

contention that there are only 13 lots which were split (separated) into different lots is

also incorrect. The reliance on Statement dated 6th February, 2006 of Kaushal Pandya

is inappropriate inasmuch as none of the examination reports revealed that imported

diamonds were wrapped lot-wise in different packets of plain white paper and each

such packet had an endorsement of the nos. 1, 2, 3, etc. as per the invoice and carats

lw eight) written with pencil. The conclusion, therefore, based on the Statement of

Kaushal Pandya that the imported CPDs did not require sorting before export is

incorrect and false. The statement of none of the sorters has been recorded. Lumesh

Sarighvi in his Statement dated 28.02.2006 also refers to engaging of sorters. This

clearly shows that sorting was done, and undertaken by sorters who were engaged by

Noticees. The further contention that one import consignment would be exported as

two different consignments, and upon receipt of such export consignments, the

`overseas employees" of Adani Group would again merge them into different lots is a

aire conjecture and surmise. Except for the bold statement, there is nothing on

record to establish or show including amongst the series of emails relied upon in the

:•;liow Cause Notice, that employees of AEL/Adani Group outside Indian split or merge

Cl]) consignments. The allegation of Circular trading is based on further assumption

tlmt the weight was varied marginally by adding or removing a few pieces from each

lot. There is absolutely not an iota of evidence to this effect, but a mere suspicion,

which cannot take the place of proof. Instead of treating lots with different weights as

different consignments altogether, it is being presumed that the weight is being

marginally varied by adding or removing a few pieces from each lot. It is denied that

the Department has painstakingly been able to prove thousands of instances of

Circular trading having the same description of the diamonds, same size range and

',ear about the same weight as brought out in Annexures-H and I, which as aforesaid,

and in the reply as well as in the Written Submissions, full of discrepancies, errors

and mistakes which ex facie render the story of Circular trading unbelievable.The

Statement of Lumesh Sanghvi dated 3rd January, 2007 also does not support the case

of Circular trading. Lumesh Sanghvi, in his cross-examination on 25th March, 2008,

admitted, upon looking at the documents (invoices) that there was no Circular Trading.

15.3. I The comments of DRI that the rate varies because of the difference in the

description/quality of the diamonds amount to an admission of the fact. The following

almissions on the part of DRI all of which have been sought to be camouflaged by

Y .fit leging that these factors have been created to give a semblance of genuineness for

of E:F leia*It of an answer on merits: -

s•s::t

r There is a difference in the weight of different lots;

.:-! • 4a) There is a difference in the clarity of the different lots;

• t

4- r )

' '

ts* ; There is a difference in the rate, and thereby the value of different lots;

4r/ * There is a difference in the description/quality of the diamonds and

-

therefore, the variation in the rate of CPDs.

•

...13.:W •

15.3.2The statement that "to expect the investigating agency to prove how the goods

ea poctect to one company were transferred to another company is a clear admission of

a serious fact. The very essence and fundamental fact of circular trading is to show a

cc.mplete chain of the same goods passing from one hand to another and ultimately,](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-191-320.jpg)

![landing up in the same hands. It is absurd to suggest that without the chain i)1+,,

established, circular trading can be established. By its very concept and definition, •

circular trading requires every link in the chain to be proved and/or establisqe0. To

say that the investigating agency cannot prove how goods exported by one corni,a iy

were transferred to another, is a clear and unequivocal admission of failure to 1:reec

circular trading without showing that the same goods exported by one comortny rc

transferred to another company, there is no circular trading. As such, the atle{-,ation

of circular trading is based only on assumptions and presumptions. Further the

admission of errors on the part of DRI once again totally demolishes the thetry o

circular trading. A new and a desperate case to cover up the absence of evidence o.

circular trading is sought to be made out in the comments to the reply. The Hof )1(

Supreme Court in Oryx Fisheries Private Limited V/s Union of India reported in I!()]

(266) ELT 422 (S.C.) held that SCN is the basic document for the charges klgaill I h(

Noticee and therefore the new and fresh charges outside the SCN cann.::t 13,

entertained at this stage.

15.4.1The reference to e-mail from Asha to Mary is inappropriate for the followtri:

reasons :

(i) The e-mail is undatedThere is no reference to Asha in any n 1.h

statements relied upon in the SCN, and no one from .AEL ha:: I2,!c,

questioned about who is Asha and what was her relationship to IVA, (--

its subsidiaries

(ii) There is no proof of actual communication or transmission of this i lad

from Asha to Mary or any other person

(iii) There is no proof of reply to this e-mail

(iv) There is no proof to establish the truth of the contents Ma:amt.:11 t.

having got the data in relation to all the exports and imports. DI-:I in ;

not been able to show whether at all AEL made any shipments of C1'1)1

Gudami and thereafter contemporaneously imported the same 01 i ..1

Shahad, Dubai. As a matter of record, there is no import of CPD a:.

from Al Shahad by AEL or any other Noticee, and therefore, the cot t, m

of email are on the face of it unreliable and false.

It was submitted that, for reasons aforesaid, the e-mail under reference it; n,,t

at all admissible in evidence and/or has no evidentiary value. The quantum of or t

of AEL and other Noticees does not establish circular trading as alleged or at :ill. ail)

the allegation to this effect, is based on conjectures and surmises.

15.4.2Para 4A.6 of VIP (2004-2009) contains the formula for calculation el al, to

addition. The only two elements for determining value addition are F013 price a

CIF price. The Noticees have entered into transactions in accordance with I'ara 'IA. ' :;

of the FTP where the value addition prescribed was 5% in 2004-2005 and 10 in

2005-2006. To attribute value addition as a function of cost or the manufacturilig of

processing activity is incorrect. FOB value is related to the price in the ce..trrie oi

international trade. As such, irrespective of the cost incurred by the export :r ci

irrespective of the nature and extent of processing or manufacturing octiN

undertaken by the exporter, there can be value addition. Para 4A.18 of the FIT (1 c:.

not prescribe the mode of achieving the value addition. As long as, the exporter

command a price in the international market, and actually realises the sank i , 1-ir•

form of FOB price, which is over and above the CIF price by at least 5% or 10°4.

case may be, the conditions of Para 4A.18 are satisfied. The Noticee:; has • tic

claimed that the value addition is attributable to the cost and/or the mrr:•reie

incurred by them in India. The Noticees have also not claimed that the value cl.lil on

is attributable only to the cost of undertaking the processing by them. Value .(',1

is only a condition precedent for doing business. It is a non-tariff barrier. In of

.words, if an exporter wants to operate under Para 4A.18 i.e. in the Private Bonded

Morehouse, it is a condition of this statutory compliance that he can only um:1,0:14e

,,such transactions where the exporter is able to command a price from the buyer in the

-ctitirse of international trade which ensures compliance with the condition of vAlje

addition. Value addition is therefore a condition of the transaction between the bt et

and the seller in the course of international trade, reflected in the form of F' )13 IT lie:,

and nothing to do with the actual costs and expenses incurred by the seller (es.r.oi ; et ).

Accordingly, to say that no value addition was achieved by relying on the :itatetlicilt of

Luinesh Sanghvi or any other person to show that no or miniscule proce:,sii g A:L:3

undertaken by AEL/Noticees, does not further the case of the investigating tigenr.:y.

Because the buyer agreed to pay a higher price to the seller after 1.4.2005,](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-192-320.jpg)

![211

...:ommercial reasons. This burden has not been discharged by the investigating agency.

It was legitimate to infer that 2 business entities between Dubai and Singapore may

have their own transactions and until and unless the investigating agency rules out

completely any such possibility, no adverse inference can be drawn against AEL. Some

of the buyers of the Noticee referred to in the e-mails are the recipients of funds from

some of the suppliers to the Noticee, does not mean that such buyers and such

suppliers cannot inter se have any transactions between themselves. Where the said

suppliers have made payments to the said buyers, it is presumed that the same have

been made in the normal course of business. The reliance on judgment of the Hot-Chic

Supreme Court in Collector V/s D.Bhoormull - 1983 (13) ELT 1546 is totally mis-

placed. In that case, the party relying on certain evidences / documents regarding

:acquisition of contraband and notified goods covered by Section 123 of the Customs

Act where the burden of proof is on the person and not the Department, was unable to

prove the authenticity or genuineness of such documents. In the present case,

;-;ection 123 is not applicable. The burden is therefore on the investigating agency and

hence assuming that mathematical precision may not be required, even then the

probability in case of circumstantial evidence must point only to one possibility of

c ommission of the crime. None of the e-mails referred to in the SCN unequivocally

establish "funding" by AEL or "control" by AEL. The statement that valuation Mould

he an issue for any buyer only when he is to pay for the same from his own pockets is

vithout substance inasmuch as there is not an iota of evidence on record that the

buyer had not paid of his own account for the goods exported by the Noticees / AEL.

li is denied that the overseas firms were paying for the CPD exported from India to

them out of funds provided by AEL and therefore such a transaction cannot be

equated with a normal transaction in the course of international trade as alleged or at

all. The payments made by AEL/Noticees are for goods actually bought and sold. Each

payment was valuable consideration for goods sold and delivered in accordance with

the contract between the parties and therefore, the allegation that buyers did not pay

from their own pocket is ex facie absurd.Each show cause notice is to be adjudicated

tat its own allegations and not with reference to another notice as held by the Hoit'bie

Supreme Court in GSFC Vs Collector of Central Excise [1997 (91) ELT 3 (S.C)].

15.6.5 It was denied that e-mail dated 30.12.2005 showed any control by AEL over the

funds. The allegation on the basis of the e-mail dated 30.12.2005 presumes many

things such as, Gracious Exports received money from Mine Gold and Jewellery

ivithout consideration and on the directions and under instructions of AEL, and

-;iitiilarly, the further assumptions that AEL directed Gracious Exports to transfer the

noney to Planica Exports without consideration. However, e-mail dated 30 12.2005

sssi merely to share and impart information regarding cash flow which was necessary

tOi AEL to monitor its own exposures in the CPD transaction. The discrepancies in the

e-mails have not been denied by DRI and therefore, the truth of the contents thereof

need to be independently proved. The Hon'ble Supreme Court in Narbada Devi Gupta

]3irendra Kumar [2003 (8) SSC 7451 held that the truth of the contents of a

document also need to be established. This is more so since the hard disk was sealed

enly by paper at the time of seizure. The report of the Directorate of Forensics is also

ague inasmuch as he does not identify the security software used for retrieving the

Ltda. There is nothing on record to rule out the tampering of the hard disk or the data

therein.

15.6.6 Bank Accounts were opened not on the basis of goodwill but on the basis of

introductions by an existing customer. Bank Accounts were not opened by employees

of Adani Global Pte Ltd. The word "we" had been mis-construed as the mail was

written as reporting on behalf of the parties who had opened the accounts and

therefore "we" did not mean Adani Global Pte Ltd. The Bank Accounts were indeed

0 wiled by each of the companies separately on their own and Mary Joseph was only

communicated the fact thereof.

1.5.6.7 Any party to the transaction would put forth its conditions before entering into

the transaction. After the parties have mutually agreed, each party is entitled to the

benefits (rights) and the obligations there under and hence there is no question of

benefit accruing only to AEL. There was no re-cycling of funds. All the transactions

wre normal and were undertaken in the usual course of business. AEL did not trust

the funds to remain with the overseas firms for more than the time required by AEL,

for large amounts and the fact that funds were remitted into foreign accounts over

waich AEL had no control shows that these transactions were independent and

undertaken in the normal course of business.

•](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-195-320.jpg)

![217

•

retracted by the petitioners such retraction is not determination of its involuntary

character. It may only be one of the factors to be considered along with other factors in

determining the question whether a statement was voluntary or not. In the present case,

there is a very vague suggestion of recording of statement under duress and coercion

that too alter two years from the date of statement and that also came in reply to show

cause notice. On the other hand there is sufficient evidence in the form of statements of

Shi i Kishan Unde and documentary evidence in the form of purchase/sale invoices of

11,1/ s. Metro Exporters Ltd., M/ s. Swikar Steel Products, M/s. Thapar Industnes and

N'/ s. Mongomery Saddle Works who has sold like or similar products to M/s. Metro

Exporters Ltd. for exports and the standard export quotation for bicycle spare parts

issued by M/ s. Metro Exporters Ltd. which shows that the procurement price was

heavily over-invoiced". (Para 20)[Emphasis added]

It was only in his reply to the show-cause notice that Shri Mukha

complained for the first time that his earlier statements had been recorded under

duress, threat etc. He stated that his earlier statements were not voluntary. I find that

no proof of duress, coercion or threat was produced by Shri Mukhia. Moreover, the

retraction made through reply to show-cause notice after more than two years from the

dote' of confessional statement is not a valid retraction " (Para 26)

Similar views were also taken in ALOK GUPTA Versus COMMISSIONER OF

CUSTOMS, NEW DELHI 2004 (170) E.L.T. 546 (Tri. - Del.) " In the statement

under Section 108 of the Customs Act, the appellant has disclosed several details about

the arrangements made for the import of the goods and under valuation. This shows

that the appellant is the main person behind the import and he has arranged all the

details, particularly, in regard to the under invoicing of the goods, by arranging for part

payment of the goods in Singapore through his Uncle. Thus, the under invoicing and

pajrnent of the differential value are appellant's arrangement. The later retraction of

statement does not appear to affect the credibility of the detailed disclosure. The

? etradtion appears to be only an effort to get out of liability as contended by the learned

SDR (Para 5)

ln DIPEN ENTERPRISES Versus COMMISSIONER OF CUSTOMS, MUMBAI 2004

(164) E.L.T. 470 (TA. - Mumbai), the following observations were made.,

These statements of Shri A.K. Sheth have been claimed to have been retracted by him.

i! was claimed that the statements dated 25-4-94 and 8-11-94 were retracted on 26-4-](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-201-320.jpg)

![225

being the force;"

Section 112 reads : -

"Any person -

(a) who, in relation to any goods, does or omits to do any act, with act or

omission would render such goods liable to confiscation under Section

111.. ....

(h) who acquires possession of or is in any way concerned in carrying,

removing, depositing, harbouring, keeping, concealing, selling or

purchasing, or in any other manner dealing with any goods which lie

knows or has reason to believe are liable to confiscation under Section

111.. ..." (Para 13)

"A careful reading of the sections would clearly show that it is the liability to

confiscation that is spoken to and not the actual confiscation. Therefore, it would mean

rhot the power to adjudicate upon for the imposition of penalty for improper importation,

springs from the liability to confiscate, and not actual confiscation. This is because not

,n/y Section 110 occurs under a different chapter, but the purpose of that section relates

urav ro seizure about which I have already noted. There again the words are "any goods

(ire liable to confiscation under this Act." Merely because the department by reason

of its inaction is not in a position to seize the goods, does not and cannot

disable it adjudicating upon the liability for action under Section 111 read with

'ec'iorz. 112 of the Act. In other words, the language of both the sections above referred

t, does not warrant the actual confiscation, but merely speaks of the liability of the

goods being confiscated, This is the plain and most unambiguous meaning of the

phraseology 'liable to confiscation' spoken to in these two sections". (Para 14)

1,, ;Dhasis added]

am fortified in my conclusion by referring to Collector of Customs and Central

Excise v. Arnrutalakshmi, AIR 1975 Mad., 43 and Munilalv. Collector, Central Excise,

.•; •-

•• Chandigarh, AIR 1975 Punj. and Haryana 130. In both these noses, though this line of

interpretation has not been adopted, it has been categorically found that having reaard

to the scope of these two sections viz. Section 110 on the one hand and Section 111 read

ivi!h Section 112 on the other, being independent of each other, seizure is not necessary

fol confiscation. This will be an added reasoning to any conclusion. Therefore, the

second point raised by the petitioner also has to be rejected". (Para 15)](https://image.slidesharecdn.com/diamondscamorder2013-221110143703-48245a2b/85/Diamond-Scam-Order-2013-pdf-209-320.jpg)

![•

228

11, or abets the doing or omission of such an act, is liable to a penalty. The power to

impose penalty can be exercised not only when the goods are available for confiscation

Eut when such goods are liable to confiscation. The expression 'liable to confiscation

c'early indicates that the power to impose penalty can be exercised even if the goods are

not available for confiscation. It is possible that the goods may be cleared for home

consumption without the Customs Authorities being aware that the clearance is sought

b.i 'suppressing the relevant facts or by producing documents which are not genuine. The

mere fact that the importers secured such clearance and disposed of the goods and

thereafter goods are not available for confiscation cannot divest the Customs Authorities

of the powers to levy penalty under Section 112 of the Act.Shri Chagla relied upon the

decision of Calcutta High Court reported in 2000 (123) E.L.T. 330 (Cal.) - 1976 Tox. L. R.

1E67 (Thomas Duff and Co. (India) Ltd. vs. Collector of Customs and others). The

Cc lcutta High Court took the view in a case of export where a show-cause notice was

is5ued as to why penal action should not be taken, that once the goods were exported

anlior not available for confiscation, then the Customs Authority had no jurisdiction to

iniliate the proceedings by issuance of show-cause notice for levy of penalty. It is not

possible to share the view taken by the Calcutta High Court. The power to levy penalty

7.-; 110r dependant upon availability of the goods imported or exported. The power to levy

per alty arises because the importer or exporter has done or omitted an act in relation to

floo(L- and which renders such goods liable for confiscation. The power, in our

judgment, to levy penalty is available once the Customs Authorities conic to the

conclusion that the goods imported or exported were liable to confiscation

because of act or omission on the part of the importer or exporter as the case

may be. The power is not dependant upon the availability of the goods. It is

ther4Ore not possible to accede to the submission of Shri Chagla that as the goods

1: .7

;0,-cogONd by 45 consignments were not available for confiscation under Section II I of the

Ay Li::

•