This document summarizes the auditor's report on the consolidated financial statements of Adani Properties Private Limited for the period of April 1, 2016 to March 31, 2017. The auditor issued a qualified opinion because one of the subsidiaries, Adani Infrastructure and Developers Private Limited, did not recognize a loss of Rs. 22,27,50,000 in the year ended March 31, 2013 related to cancellation of property sale agreements. The auditor also draws attention to the fact that some subsidiaries have ongoing losses and negative net current assets, as well as issues regarding the negative net worth of Delhi Golf Link Properties Private Limited.

![ADANI PROPERTIES PRIVATE LIMITED

Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

[700300] Disclosure of general information about company

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2014

to

31/03/2015

Name of company

ADANI PROPERTIES PRIVATE

LIMITED

Corporate identity number U45201GJ1995PTC026067

Permanent account number of entity AABCA3182H

Address of registered office of company

S H I K H A R N R A D A N I

HOUSEMITHAKHALI SIX ROAD

, NAVRANGPURA , Ahmedabad

, Ahmedabad , GUJARAT ,

INDIA - 380009

Type of industry

C o m m e r c i a l a n d

Industrial

Date of start of reporting period 01/04/2016 01/04/2015 01/04/2014

Date of end of reporting period 31/03/2017 31/03/2016 31/03/2015

Nature of report standalone consolidated Consolidated

Content of report Financial Statements

Description of presentation currency INR

Level of rounding used in financial statements Actual

Type of cash flow statement Indirect Method

[700400] Disclosures - Auditors report

Details regarding auditors [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Auditors [Axis] 1

01/04/2016

to

31/03/2017

Details regarding auditors [Abstract]

Details regarding auditors [LineItems]

Category of auditor Auditors firm

Name of audit firm

Dharmesh Parikh &

Co

Name of auditor signing report

GOTHI KANTILAL

GOVABHAI

Firms registration number of audit firm 112054W

Membership number of auditor 127664

Address of auditors

303/304,

"Milestone", Nr.

Drive-in-Cinema,

Opp. T.V. Tower,

T h a l t e j ,

Ahmedabad-380

054.

Permanent account number of auditor or auditor's firm AAGFD1279G

SRN of form ADT-1 S34828939

Date of signing audit report by auditors 05/09/2017

Date of signing of balance sheet by auditors 05/09/2017](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/75/Adani-Properties-Annual-Report-2017-pdf-1-2048.jpg)

![2

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

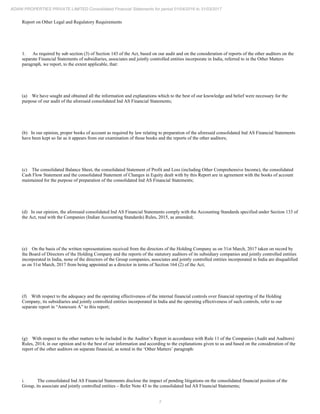

Disclosure in auditor’s report explanatory [TextBlock]

Textual information (1)

[See below]

Whether companies auditors report order is applicable on company No

Whether auditors' report has been qualified or has any reservations or

contains adverse remarks

No](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-2-320.jpg)

![3

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Textual information (1)

Disclosure in auditor’s report explanatory [Text Block]

To the Members of Adani Properties Private Limited

Report on the Consolidated Ind AS Financial Statements

We have audited the accompanying consolidated Ind AS Financial Statements of Adani Properties Private Limited (hereinafter referred to as “the

Holding Company”), its subsidiaries (the Holding Company and its subsidiaries together referred to as “the Group”), its associates and jointly

controlled entities, comprising of the consolidated Balance Sheet as at 31st March, 2017, the consolidated Statement of Profit and Loss including

other comprehensive income, the consolidated Statement of Cash Flows and the consolidated Statement of Changes in Equity for the year then

ended, and a summary of significant accounting policies and other explanatory information (hereinafter referred to as ‘the consolidated Ind AS

Financial Statements’).

Management’s Responsibility for the Consolidated Ind AS Financial Statements

The Holding Company’s Board of Directors is responsible for the matters stated in Section 134(5) of the Companies Act, 2013 (“the Act”) with

respect to the preparation of these consolidated Ind AS Financial Statements that give a true and fair view of the consolidated financial position,

consolidated financial performance including other comprehensive income, consolidated cash flows and consolidated changes in equity of the

Group, its associates and jointly controlled entities in accordance with accounting principles generally accepted in India, including the Accounting

Standards specified under Section 133 of the Act, read with the Companies (Indian Accounting Standards) Rules, 2015, as amended. The

respective Board of Directors of the companies included in the Group and of its associates and jointly controlled entities are responsible for

maintenance of adequate accounting records in accordance with the provisions of the Act for safeguarding the assets of the Group, its associates

and jointly controlled entities and for preventing and detecting frauds and other irregularities; selection and application of appropriate accounting

policies; making judgments and estimates that are reasonable and prudent; and design, implementation and maintenance of adequate internal

financial controls, that were operating effectively for ensuring the accuracy and completeness of the accounting records, relevant to the

preparation and presentation of the consolidated Ind AS Financial Statements that give a true and fair view and are free from material

misstatement, whether due to fraud or error, which have been used for the purpose of preparation of the consolidated Financial Statements by the

Directors of the Holding Company.

Auditor’s Responsibility

Our responsibility is to express an opinion on these consolidated Ind AS Financial Statements based on our audit.

While conducting the audit, we have taken into account the provisions of the Act, the accounting and auditing standards and matters which are

required to be included in the audit report under the provisions of the Act and the Rules made thereunder.

We conducted our audit in accordance with the Standards on Auditing, issued by the Institute of Chartered Accountants of India, as specified

under Section 143(10) of the Act. Those Standards require that we comply with ethical requirements and plan and perform the audit to obtain

reasonable assurance about whether the consolidated Ind AS Financial Statements are free from material misstatement.](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-3-320.jpg)

![11

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

[110000] Balance sheet

Unless otherwise specified, all monetary values are in INR

31/03/2017 31/03/2016 31/03/2015

Balance sheet [Abstract]

Assets [Abstract]

Non-current assets [Abstract]

Property, plant and equipment 183,85,15,055 166,03,53,677 122,04,12,798

Capital work-in-progress 94,67,18,602 72,25,24,060 2,16,88,815

Investment property 310,53,76,092 254,97,75,660 232,35,32,434

Other intangible assets (A) 354,25,96,430 (B) 354,42,87,917 (C) 318,73,35,253

Non-current financial assets [Abstract]

Non-current investments 8,612,11,61,068 5,965,20,37,526 6,349,41,16,236

Loans, non-current 1,039,22,25,878 734,26,56,016 23,50,52,679

Other non-current financial assets 7,10,72,740 5,19,04,932 6,46,48,746

Total non-current financial assets 9,658,44,59,686 6,704,65,98,474 6,379,38,17,661

Deferred tax assets (net) 13,30,06,851 11,61,44,047 6,43,92,110

Other non-current assets (D) 200,06,15,850 (E) 195,97,03,764 (F) 167,16,22,192

Total non-current assets 10,815,12,88,566 7,759,93,87,599 7,228,28,01,263

Current assets [Abstract]

Inventories 5,017,58,25,266 4,658,63,44,763 4,475,26,62,808

Current financial assets [Abstract]

Current investments 57,60,84,967 17,67,56,741 35,30,00,670

Trade receivables, current 27,39,17,424 554,07,32,589 57,19,04,813

Cash and cash equivalents 33,74,61,850 31,13,39,243 10,27,48,660

Bank balance other than cash and cash equivalents (G) 30,13,69,315

69,57,75,587 33,23,75,104

Loans, current 2,265,40,12,855 2,410,07,12,306 122,16,02,110

Other current financial assets 299,18,92,713 383,55,99,080 267,43,61,051

Total current financial assets 2,713,47,39,124 3,466,09,15,546 525,59,92,408

Other current assets 328,90,61,256 223,28,84,682 119,54,51,657

Total current assets 8,059,96,25,646 8,348,01,44,991 5,120,41,06,873

Total assets 18,875,09,14,212 16,107,95,32,590 12,348,69,08,136

Equity and liabilities [Abstract]

Equity [Abstract]

Equity attributable to owners of parent [Abstract]

Equity share capital 12,90,17,850 12,90,17,850 12,90,17,850

Other equity (H) 7,408,43,77,339

7,732,09,55,615 8,216,03,89,765

Total equity attributable to owners of parent 7,421,33,95,189 7,744,99,73,465 8,228,94,07,615

Non controlling interest 2,548,23,92,653 73,20,38,556 8,43,99,301

Total equity 9,969,57,87,842 7,818,20,12,021 8,237,38,06,916

Liabilities [Abstract]

Non-current liabilities [Abstract]

Non-current financial liabilities [Abstract]

Borrowings, non-current 1,935,07,91,369 2,263,87,24,844 567,38,01,062

Other non-current financial liabilities 142,27,61,582 87,69,78,407 72,22,49,303

Total non-current financial liabilities 2,077,35,52,951 2,351,57,03,251 639,60,50,365

Provisions, non-current 11,61,81,914 11,21,56,451 3,26,34,046

Other non-current liabilities 44,10,86,453 17,05,85,405 22,74,47,206

Total non-current liabilities 2,133,08,21,318 2,379,84,45,107 665,61,31,617

Current liabilities [Abstract]

Current financial liabilities [Abstract]

Borrowings, current 4,342,97,90,920 3,692,28,59,979 2,297,70,35,024

Trade payables, current 222,07,52,014 412,08,91,051 192,44,23,636

Other current financial liabilities 1,152,53,47,358 831,42,91,451 618,62,31,044

Total current financial liabilities 5,717,58,90,292 4,935,80,42,481 3,108,76,89,704

Other current liabilities 1,049,57,17,349 970,71,87,870 335,59,38,857

Provisions, current 5,08,54,066 3,32,22,570 1,33,41,042

Current tax liabilities 18,43,345 6,22,541 0](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-11-320.jpg)

![13

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

[210000] Statement of profit and loss

Earnings per share [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classes of equity share capital [Axis] Equity shares 1 [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Statement of profit and loss [Abstract]

Earnings per share [Abstract]

Earnings per share [Line items]

Basic earnings per share [Abstract]

Basic earnings (loss) per share from continuing operations [INR/shares] -27.14 [INR/shares] -2.35

Basic earnings (loss) per share from discontinued operations [INR/shares] 0 [INR/shares] 0

Total basic earnings (loss) per share [INR/shares] -27.14 [INR/shares] -2.35

Diluted earnings per share [Abstract]

Diluted earnings (loss) per share from continuing operations [INR/shares] -27.14 [INR/shares] -2.35

Diluted earnings (loss) per share from discontinued operations [INR/shares] 0 [INR/shares] 0

Total diluted earnings (loss) per share [INR/shares] -27.14 [INR/shares] -2.35](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-13-320.jpg)

![14

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Statement of profit and loss [Abstract]

Income [Abstract]

Revenue from operations 1,320,08,73,790 1,430,65,97,413

Other income 352,55,83,658 155,64,62,646

Total income 1,672,64,57,448 1,586,30,60,059

Expenses [Abstract]

Cost of materials consumed (A) 550,25,95,430 (B) 567,02,32,294

Purchases of stock-in-trade (C) 505,70,20,772 (D) 734,36,86,818

Changes in inventories of finished goods, work-in-progress and

stock-in-trade

-5,40,135 0

Employee benefit expense 121,32,32,522 51,90,94,143

Finance costs 419,91,09,995 135,83,21,266

Depreciation, depletion and amortisation expense 5,23,60,132 3,20,89,808

Expenditure on production, transportation and other expenditure

pertaining to exploration and production activities

0 0

Other expenses (E) 77,94,16,904 (F) 75,85,71,785

Total expenses 1,680,31,95,620 1,568,19,96,114

Profit before exceptional items and tax -7,67,38,172 18,10,63,945

Total profit before tax -7,67,38,172 18,10,63,945

Tax expense [Abstract]

Current tax (G) 15,84,90,539 (H) 11,29,89,416

Deferred tax -2,17,25,356 -40,49,280

Total tax expense 13,67,65,183 10,89,40,136

Total profit (loss) for period from continuing operations -21,35,03,355 7,21,23,809

Share of profit (loss) of associates and joint ventures accounted for

using equity method

-15,53,57,922 -13,05,15,923

Total profit (loss) for period -36,88,61,277 -5,83,92,114

Profit or loss, attributable to non-controlling interests -1,11,68,582 32,45,461

Comprehensive income OCI components presented net of tax [Abstract]

Whether company has other comprehensive income OCI components

presented net of tax

No No

Other comprehensive income net of tax [Abstract]

Components of other comprehensive income that will not be

reclassified to profit or loss, net of tax [Abstract]

Other comprehensive income, net of tax, gains (losses) on

remeasurements of defined benefit plans

76,01,579 3,12,63,932

Total other comprehensive income that will not be reclassified

to profit or loss, net of tax

76,01,579 3,12,63,932

Total other comprehensive income 76,01,579 3,12,63,932

Total comprehensive income -36,12,59,698 -2,71,28,182

Comprehensive income OCI components presented before tax [Abstract]

Whether company has comprehensive income OCI components presented

before tax

No No

Other comprehensive income before tax [Abstract]

Total other comprehensive income 76,01,579 3,12,63,932

Total comprehensive income -36,12,59,698 -2,71,28,182

Earnings per share explanatory [TextBlock]

Earnings per share [Abstract]

Basic earnings per share [Abstract]

Diluted earnings per share [Abstract]](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-14-320.jpg)

![15

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Footnotes

(A) Finished Goods : 32229747 Material at site : 1584294141 Work-in-Progress : 42512522067 Add: Construction Cost incurred during

the year Construction Expenses : 4331682165 Cost of Land Purchased : 552636888 Depreciation : 15039274 Personal Expenses :

370290148 Finance Cost : 1889729515 Other Expenses : 789638855 : 0 Finished Goods : 0 Work-in-Progress : -47028657579 Material

at site : -476010291 Finishing Cost Reversed(Refer below Note: a) : -217417933 Add: Other Operating Expenses : 405916288 Refund

paid back reversed(Refer below Note: b) : 740702145 Note: (a) SEMPL : Note (1) : As per MOU signed with Adani Township & Real

Estate Company Private Limited (" ATRECO ") as on 1st April, 2016, Company has reversed cost of villa construction related to

Finishing cost, the same is reduced from the Inventory and transferred to ATRECO. Note 2 : As per Development right cancellation

agreement dated 24th September, 2016 entered into with Adani Township & Real Estate Company Private Limited ( " ATRECO " ), the

Company has paid consideration for cancellation of Development right to ATRECO for which rights were given as per original

Development right agreement dated 9th March, 2011. Note: (b) ADPL: The Company vide Development Agreement (the Agreement)

entered into with Housing Development and Infrastructure Limited ("HDIL" or "Transferor") has obtained Development Rights in

respect of land owned by HDIL (as defined in the Agreement) for development and subsequent commercial exploitation of the proposed

complex. Pursuant to the Agreement, in consideration of the Company obtaining Development Rights, the Company has paid a sum of

Rs. 10,650,000,000 towards consideration for obtaining Development Rights. During the year 2011-2012, the Company had received

refunds of Rs. 5,81,82,63,476 from the Transferor of Development Rights pursuant to the Supplementary Agreement dated 20th March,

2012. During the current year an amount of Rs. 74,07,02,145 (31st March, 2016 : Rs. 21,86,00,000) has been repaid to the Transferor on

performance by it of its obligations as per the revised timeframes.

(B) Finished Goods : 32229747 Material at site : 621145343 Work-in-Progress : 41210991686 Add: Construction Cost incurred during

the year Construction Expenses : 4452048474 Cost of Land Purchased : 1151534721 Depreciation : 12636485 Personal Expenses :

352710118 Finance Cost : 1353506098 Other Expenses : 393875577 : 0 Finished Goods : -32229747 Work-in-Progress : -42447691553

Material at site : -1649124655 Finishing Cost Reversed(Refer below Note: a) : 0 Add: Other Operating Expenses : 0 Refund paid back

reversed(Refer below Note: b) : 218600000

(C) Purchases of Traded Goods : 3926794956 Purchases of Material and Services : 1130225816

(D) Purchases of Traded Goods : 2166111801 Purchases of Material and Services : 5177575017

(E) Operation and Maintenance Expenses : 20755164 Other Expenses : 758661740

(F) Operation and Maintenance Expenses : 22289969 Other Expenses : 736281816

(G) Current Tax : 155521500 Mat Credit Utilization : 1635056 Short/(Excess) Provision for Tax of earlier years : 1333983

(H) Current Tax : 114569957 Mat Credit Utilization : 44809 Short/(Excess) Provision for Tax of earlier years : -1625350

[400200] Statement of changes in equity

Statement of changes in equity [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis] Equity [Member]

Equity attributable

to the equity

holders of the

parent [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period -36,88,61,277 -5,83,92,114 -36,88,61,277

Changes in comprehensive income components 1,87,70,160 2,80,18,471 0 1,87,70,160

Total comprehensive income -35,00,91,117 -3,03,73,643 0 -35,00,91,117

Other changes in equity [Abstract]

Other additions to reserves -288,64,87,159 -480,90,60,507 0 -288,64,87,159

Total other changes in equity -288,64,87,159 -480,90,60,507 0 -288,64,87,159

Total increase (decrease) in equity -323,65,78,276 -483,94,34,150 0 -323,65,78,276

Other equity at end of period 7,408,43,77,339 7,732,09,55,615 8,216,03,89,765 7,408,43,77,339](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-15-320.jpg)

![16

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Statement of changes in equity [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis]

Equity attributable to the equity holders

of the parent [Member]

Equity component of financial

instrument [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period -5,83,92,114 0 0 0

Changes in comprehensive income components 2,80,18,471

Total comprehensive income -3,03,73,643 0 0 0

Other changes in equity [Abstract]

Other additions to reserves -480,90,60,507 50,26,37,804 315,33,34,399

Total other changes in equity -480,90,60,507 50,26,37,804 315,33,34,399

Total increase (decrease) in equity -483,94,34,150 0 50,26,37,804 315,33,34,399

Other equity at end of period 7,732,09,55,615 8,216,03,89,765 1,581,34,22,503 1,531,07,84,699

Statement of changes in equity [Table] ..(3)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis]

Equity component

of financial

instrument

[Member]

Reserves [Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period 0 -36,88,61,277 -5,83,92,114 0

Changes in comprehensive income components 1,87,70,160 2,80,18,471

Total comprehensive income 0 -35,00,91,117 -3,03,73,643 0

Other changes in equity [Abstract]

Other additions to reserves -338,91,24,963 -796,23,94,906

Total other changes in equity -338,91,24,963 -796,23,94,906

Total increase (decrease) in equity 0 -373,92,16,080 -799,27,68,549 0

Other equity at end of period 1,215,74,50,300 5,827,09,54,836 6,201,01,70,916 7,000,29,39,465

Statement of changes in equity [Table] ..(4)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis] Capital reserves [Member]

Securities premium

reserve [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period 0 0 0 0

Total comprehensive income 0 0 0 0

Total increase (decrease) in equity 0 0 0 0

Other equity at end of period 200,45,02,500 200,45,02,500 200,45,02,500 503,77,73,061](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-16-320.jpg)

![17

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Statement of changes in equity [Table] ..(5)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis] Securities premium reserve [Member]

Debenture

redemption reserve

[Member]

General reserve

[Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2016

to

31/03/2017

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period 0 0 0 0

Total comprehensive income 0 0 0 0

Other changes in equity [Abstract]

Other additions to reserves 126,25,00,000

Total other changes in equity 126,25,00,000

Total increase (decrease) in equity 0 0 126,25,00,000 0

Other equity at end of period 503,77,73,061 503,77,73,061 126,25,00,000 1,675,07,84,097

Statement of changes in equity [Table] ..(6)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis] General reserve [Member] Other funds [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period 0 0 0 0

Total comprehensive income 0 0 0 0

Other changes in equity [Abstract]

Other additions to reserves (A) 30,95,46,728 (B) 59,36,89,851

Total other changes in equity 30,95,46,728 59,36,89,851

Total increase (decrease) in equity 30,95,46,728 0 0 59,36,89,851

Other equity at end of period 1,675,07,84,097 1,644,12,37,369 59,36,89,851 59,36,89,851

(A) On Account of Merger

(B) deemed equity

Statement of changes in equity [Table] ..(7)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis] Retained earnings [Member]

Other retained

earning [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period -36,88,61,277 -5,83,92,114 0 -36,88,61,277

Changes in comprehensive income components 1,87,70,160 2,80,18,471 1,87,70,160

Total comprehensive income -35,00,91,117 -3,03,73,643 0 -35,00,91,117

Other changes in equity [Abstract]

Other additions to reserves -126,24,82,617 -2,16,10,642 -126,24,82,617

Total other changes in equity -126,24,82,617 -2,16,10,642 -126,24,82,617

Total increase (decrease) in equity -161,25,73,734 -5,19,84,285 0 -161,25,73,734

Other equity at end of period 692,98,71,288 854,24,45,022 859,44,29,307 692,98,71,288](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-17-320.jpg)

![18

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Statement of changes in equity [Table] ..(8)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis] Other retained earning [Member] Other reserves [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period -5,83,92,114 0 0 0

Changes in comprehensive income components 2,80,18,471

Total comprehensive income -3,03,73,643 0 0 0

Other changes in equity [Abstract]

Other additions to reserves (A) -2,16,10,642 -338,91,42,346 -884,40,20,843

Total other changes in equity -2,16,10,642 -338,91,42,346 -884,40,20,843

Total increase (decrease) in equity -5,19,84,285 0 -338,91,42,346 -884,40,20,843

Other equity at end of period 854,24,45,022 859,44,29,307 2,569,18,34,039 2,908,09,76,385

Description of nature of other reserves

FVOCI - equity

investments

FVOCI - equity

investments

Footnotes

(A) On Account of Consolidation Adjustment 34714506 Ind AS Adjustments (56325149)

Statement of changes in equity [Table] ..(9)

Unless otherwise specified, all monetary values are in INR

Components of equity [Axis]

Other reserves

[Member]

31/03/2015

Other equity [Abstract]

Statement of changes in equity [Line items]

Equity [Abstract]

Changes in equity [Abstract]

Comprehensive income [Abstract]

Profit (loss) for period 0

Total comprehensive income 0

Total increase (decrease) in equity 0

Other equity at end of period 3,792,49,97,228

Description of nature of other reserves

FVOCI - equity

investments](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-18-320.jpg)

![19

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

[320000] Cash flow statement, indirect

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Statement of cash flows [Abstract]

Whether cash flow statement is applicable on company Yes Yes

Cash flows from used in operating activities [Abstract]

Profit before tax -7,67,38,172 18,10,63,945

Adjustments for reconcile profit (loss) [Abstract]

Adjustments for finance costs 419,90,16,250 135,82,83,692

Adjustments for decrease (increase) in inventories -169,97,50,987 53,44,39,157

Adjustments for decrease (increase) in trade receivables, current 526,68,15,165 -221,18,19,631

Adjustments for decrease (increase) in other current assets -105,48,74,365 -4,98,20,938

Adjustments for decrease (increase) in other non-current assets 1,17,38,963 -5,13,05,381

Adjustments for other financial assets, current 55,05,79,673 -21,36,57,491

Adjustments for increase (decrease) in trade payables, current -189,15,11,809 65,34,03,346

Adjustments for increase (decrease) in other current liabilities 79,00,27,978 540,65,48,101

Adjustments for depreciation and amortisation expense 5,23,60,132 3,20,89,807

Adjustments for provisions, current 1,58,98,452 -2,83,03,900

Adjustments for provisions, non-current 27,75,463 -75,28,286

Adjustments for other financial liabilities, current 502,10,56,244 24,47,42,664

Adjustments for other financial liabilities, non-current 60,24,71,100 -1,02,73,940

Adjustments for unrealised foreign exchange losses gains 90,47,784 -1,86,48,623

Adjustments for dividend income 42,250 33,41,38,281

Adjustments for interest income 328,75,78,228 111,41,41,890

Other adjustments to reconcile profit (loss) -5,26,68,062 -2,55,47,945

Other adjustments for non-cash items -3,56,80,743 75,15,510

Total adjustments for reconcile profit (loss) 849,96,80,760 417,18,35,971

Net cash flows from (used in) operations 842,29,42,588 435,28,99,916

Income taxes paid (refund) 19,72,60,425 26,61,13,899

Other inflows (outflows) of cash 0 0

Net cash flows from (used in) operating activities 822,56,82,163 408,67,86,017

Cash flows from used in investing activities [Abstract]

Proceeds from sales of property, plant and equipment -46,37,20,570 -76,42,21,278

Purchase of investment property 55,56,00,433 22,62,43,226

Dividends received (A) 42,250 (B) 33,41,38,779

Interest received 358,07,04,922 122,47,77,284

Other inflows (outflows) of cash (C) -681,11,60,697 (D) -2,111,75,53,035

Net cash flows from (used in) investing activities -424,97,34,528 -2,054,91,01,476

Cash flows from used in financing activities [Abstract]

Proceeds from issuing shares 3 0

Proceeds from issuing debentures notes bonds etc 50,26,37,800 315,33,34,400

Proceeds from borrowings 1,710,62,61,328 2,135,06,93,659

Repayments of borrowings 1,421,84,67,712 570,37,97,180

Interest paid 733,97,56,447 216,99,70,755

Other inflows (outflows) of cash (E) -5,00,000 (F) 4,06,45,918

Net cash flows from (used in) financing activities -394,98,25,028 1,667,09,06,042

Net increase (decrease) in cash and cash equivalents before effect of

exchange rate changes

2,61,22,607 20,85,90,583

Net increase (decrease) in cash and cash equivalents 2,61,22,607 20,85,90,583

Cash and cash equivalents cash flow statement at end of period 33,74,61,850 31,13,39,243 10,27,48,660](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-19-320.jpg)

![20

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Footnotes

(A) Dividend from Non Current investments : 42250 Dividend Income from Current Investments : 0

(B) Dividend from Non Current investments : 333704211 Dividend Income from Current Investments : 434568

(C) Non Current Financial Asset-Loan : -3049531545 Non Current Other Fiancial Assets : 24049582 Fixed Deposit with Bank :

362406272 Current Asset-Loan : 1445397242 Purchase of Non Current Investments : -6156888357 Sale of non Current Investments :

937154500 PurchaseSale of Current Investments(Net) : -373748391

(D) Non Current Financial Asset-Loan : -7107632858 Non Current Other Fiancial Assets : 19064965 Fixed Deposit with Bank :

-268708742 Current Asset-Loan : -7323297499 Purchase of Non Current Investments : -6638578799 Sale of non Current Investments :

15000 PurchaseSale of Current Investments(Net) : 201584898

(E) Add: Cash and Cash Equivalents of Acquired Companies : -500000

(F) Add: Cash and Cash Equivalents of Acquired Companies : 40645918

[610100] Notes - List of accounting policies

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of significant accounting policies [TextBlock]

Textual information (2)

[See below]

A s

Below

Description of accounting policy for foreign currency translation

[TextBlock]

Textual information (3)

[See below]

Textual information (2)

Disclosure of significant accounting policies [Text Block]

Corporate Information

Adani Properties Private Limited (“the Company” ‘APPL’). The company had been incorporated on 25th day of May, 1995 with

Corporate Identification Number (CIN) U45201GJ1995PTC026067. APPL along with its subsidiaries and other group companies (“the

Group”) has main object to let-out and/or lease immovable properties, wholesale trading of commodities and also engaged in the

business of construction, development and lease of properties and financial services and non banking financial services.](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-20-320.jpg)

![21

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Textual information (3)

Description of accounting policy for foreign currency translation [Text Block]

Foreign Currency Transactions

The Company’s financial statements are presented in INR, which is also the parent company’s functional currency. For each entity the

Company determines the functional currency and items included in the financial statements of each entity are measured using that

functional currency.

Transactions and balances

(i) Initial Recognition

Transactions denominated in foreign currencies are recorded at the exchange rates prevailing on the date of the transaction.

(ii) Conversion

At the year end, monetory items denominated in foreign currencies, if any, are converted into Indian Rupee equivalents at exchange rate

prevailing on the balance sheet date.

(iii) Exchange Differencies

Exchange differences arising on settlement or translation of monetary items are recognized in profit or loss.

Exchange differences arising on long-term foreign currency monetary items (including funds used for projects work in progress)

recognised in the financial statements for the year ended March 31, 2016 and related to acquisition of a fixed asset are capitalized and

depreciated over the remaining useful life of the asset.

Exchange differences arising on long-term foreign currency monetary items (including funds used for projects work in progress)

recognised in the financial statements for the year ended March 31, 2016 and related to Real Estate Project expenses are Inventorised

and charged to Profit & Loss Account based on Percentage of complition method.](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-21-320.jpg)

![22

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

[610200] Notes - Corporate information and statement of IndAs compliance

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of corporate information notes and other explanatory information

[TextBlock]

Statement of Ind AS compliance [TextBlock]

A s

provided

As provided

Whether there is any departure from Ind AS No No

Whether there are reclassifications to comparative amounts No No

Description of reason why reclassification of comparative amounts is

impracticable

not applicable not applicable

Description of nature of necessary adjustments to provide comparative

information

not applicable not applicable

Disclosure of significant accounting policies [TextBlock]

Textual information (4)

[See below]

A s

Below

Textual information (4)

Disclosure of significant accounting policies [Text Block]

Corporate Information

Adani Properties Private Limited (“the Company” ‘APPL’). The company had been incorporated on 25th day of May, 1995 with

Corporate Identification Number (CIN) U45201GJ1995PTC026067. APPL along with its subsidiaries and other group companies (“the

Group”) has main object to let-out and/or lease immovable properties, wholesale trading of commodities and also engaged in the

business of construction, development and lease of properties and financial services and non banking financial services.](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-22-320.jpg)

![23

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

[610300] Notes - Accounting policies, changes in accounting estimates and errors

Unless otherwise specified, all monetary values are in INR

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of changes in accounting policies, accounting estimates and errors

[TextBlock]

Disclosure of initial application of standards or interpretations

[TextBlock]

Whether initial application of an Ind AS has an effect on the

current period or any prior period

No No

Disclosure of voluntary change in accounting policy [TextBlock]

Whether there is any voluntary change in accounting policy No No

Disclosure of changes in accounting estimates [TextBlock]

Whether there are changes in acounting estimates during the year No No

[400600] Notes - Property, plant and equipment

Disclosure of additional information about property plant and equipment [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Land [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member] Owned assets [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

Refer to child

member

Refer to child member NA NA

Useful lives or depreciation rates, property,

plant and equipment

Refer to child

member

Refer to child member NA NA

Whether property, plant and equipment are

stated at revalued amount

No No No No

Disclosure of additional information about property plant and equipment [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Land [Member] Buildings [Member]

Office building

[Member]

Sub classes of property, plant and equipment [Axis]

Owned assets

[Member]

Owned and leased assets [Member]

Owned and leased

assets [Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

NA

Refer to child

member

Refer to child member

Refer to child

member

Useful lives or depreciation rates, property,

plant and equipment

NA

Refer to child

member

Refer to child member

Refer to child

member

Whether property, plant and equipment are

stated at revalued amount

No No No No](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-23-320.jpg)

![24

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of additional information about property plant and equipment [Table] ..(3)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Office building [Member]

Sub classes of property, plant and equipment [Axis]

Owned and leased

assets [Member]

Owned assets [Member]

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

Refer to child

member

SLM SLM SLM

Useful lives or depreciation rates, property,

plant and equipment

Refer to child

member

A S P E R

SCHEDULE II

A S P E R

SCHEDULE II

AS PER SCHEDULE

II

Whether property, plant and equipment are

stated at revalued amount

No No No No

Disclosure of additional information about property plant and equipment [Table] ..(4)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Plant and equipment [Member] Factory equipments [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member] Owned and leased assets [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

Refer to child

member

Refer to child member

Refer to child

member

Refer to child member

Useful lives or depreciation rates, property,

plant and equipment

Refer to child

member

Refer to child member

Refer to child

member

Refer to child member

Whether property, plant and equipment are

stated at revalued amount

No No No No

Disclosure of additional information about property plant and equipment [Table] ..(5)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Factory equipments [Member] Vehicles [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member] Owned and leased assets [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

SLM SLM

Refer to child

member

Refer to child member

Useful lives or depreciation rates, property,

plant and equipment

A S P E R

SCHEDULE II

AS PER SCHEDULE

II

Refer to child

member

Refer to child member

Whether property, plant and equipment are

stated at revalued amount

No No No No](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-24-320.jpg)

![25

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of additional information about property plant and equipment [Table] ..(6)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Motor vehicles [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member] Owned assets [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

Refer to child

member

Refer to child member SLM SLM

Useful lives or depreciation rates, property,

plant and equipment

Refer to child

member

Refer to child member

A S P E R

SCHEDULE II

AS PER SCHEDULE

II

Whether property, plant and equipment are

stated at revalued amount

No No No No

Disclosure of additional information about property plant and equipment [Table] ..(7)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis]

Motor vehicles

[Member]

Office equipment [Member]

Sub classes of property, plant and equipment [Axis]

Owned assets

[Member]

Owned and leased assets [Member]

Owned assets

[Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

01/04/2016

to

31/03/2017

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

SLM

Refer to child

member

Refer to child member SLM

Useful lives or depreciation rates, property,

plant and equipment

A S P E R

SCHEDULE II

Refer to child

member

Refer to child member

A S P E R

SCHEDULE II

Whether property, plant and equipment are

stated at revalued amount

No No No No

Disclosure of additional information about property plant and equipment [Table] ..(8)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Office equipment [Member] Computer equipments [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member] Owned and leased assets [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of additional information about

property plant and equipment [Abstract]

Disclosure of additional information about

property plant and equipment [Line items]

Depreciation method, property, plant and

equipment

SLM SLM

Refer to child

member

Refer to child member

Useful lives or depreciation rates, property,

plant and equipment

A S P E R

SCHEDULE II

AS PER SCHEDULE

II

Refer to child

member

Refer to child member

Whether property, plant and equipment are

stated at revalued amount

No No No No](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-25-320.jpg)

![26

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of additional information about property plant and equipment [Table] ..(9)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Computer equipments [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Disclosure of additional information about property plant and

equipment [Abstract]

Disclosure of additional information about property plant and

equipment [Line items]

Depreciation method, property, plant and equipment SLM SLM SLM

Useful lives or depreciation rates, property, plant and equipment

A S P E R

SCHEDULE II

A S P E R

SCHEDULE II

AS PER SCHEDULE

II

Whether property, plant and equipment are stated at revalued

amount

No No No

Disclosure of detailed information about property, plant and equipment [Table] ..(1)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Property, plant and equipment [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Carrying amount [Member]

Gross carrying

amount [Member]

31/03/2017 31/03/2016 31/03/2015

01/04/2016

to

31/03/2017

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

26,46,32,457

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

2,87,01,745

Total disposals and retirements,

property, plant and equipment

2,87,01,745

Total increase (decrease) in property,

plant and equipment

23,59,30,712

Property, plant and equipment at end of

period

183,85,15,055 166,03,53,677 122,04,12,798 194,29,09,789](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-26-320.jpg)

![27

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(2)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Property, plant and equipment [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying

amount [Axis]

Gross carrying amount [Member]

Accumulated depreciation and

impairment [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

50,96,74,651

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

6,33,38,875 4,66,25,400

Total Depreciation property plant and

equipment

6,33,38,875 4,66,25,400

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

2,31,08,372 55,69,541

Total disposals and retirements,

property, plant and equipment

2,31,08,372 55,69,541

Total increase (decrease) in property,

plant and equipment

48,65,66,279 0 5,77,69,334 4,66,25,400

Property, plant and equipment at end of

period

170,69,79,077 122,04,12,798 10,43,94,734 4,66,25,400](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-27-320.jpg)

![28

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(3)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis]

Property, plant and

equipment

[Member]

Land [Member]

Sub classes of property, plant and equipment [Axis]

Owned and leased

assets [Member]

Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Accumulated

depreciation and

impairment

[Member]

Carrying amount [Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

98,03,059 37,09,466

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

-27,14,693

Total Depreciation property plant and

equipment

-27,14,693

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

1,62,49,219

Total disposals and retirements,

property, plant and equipment

1,62,49,219

Total increase (decrease) in property,

plant and equipment

0 70,88,366 -1,25,39,753 0

Property, plant and equipment at end of

period

0 83,95,67,528 83,24,79,162 84,50,18,915](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-28-320.jpg)

![29

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(4)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Land [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Gross carrying amount [Member]

Accumulated

depreciation and

impairment

[Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

98,03,059 37,09,466

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

27,14,693

Total Depreciation property plant and

equipment

27,14,693

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

1,62,49,219

Total disposals and retirements,

property, plant and equipment

1,62,49,219

Total increase (decrease) in property,

plant and equipment

98,03,059 -1,25,39,753 0 27,14,693

Property, plant and equipment at end of

period

84,22,82,221 83,24,79,162 84,50,18,915 27,14,693](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-29-320.jpg)

![30

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(5)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Land [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member] Owned assets [Member]

Carrying amount accumulated depreciation and gross carrying

amount [Axis]

Accumulated depreciation and

impairment [Member]

Carrying amount [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

98,03,059 37,09,466

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

-27,14,693

Total Depreciation property plant and

equipment

-27,14,693

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

1,62,49,219

Total disposals and retirements,

property, plant and equipment

1,62,49,219

Total increase (decrease) in property,

plant and equipment

0 0 70,88,366 -1,25,39,753

Property, plant and equipment at end of

period

0 0 83,95,67,528 83,24,79,162

Disclosure of detailed information about property, plant and equipment [Table] ..(6)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Land [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Carrying amount

[Member]

Gross carrying amount [Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

98,03,059 37,09,466

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

1,62,49,219

Total disposals and retirements,

property, plant and equipment

1,62,49,219

Total increase (decrease) in property,

plant and equipment

0 98,03,059 -1,25,39,753 0

Property, plant and equipment at end of

period

84,50,18,915 84,22,82,221 83,24,79,162 84,50,18,915](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-30-320.jpg)

![31

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(7)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Land [Member]

Buildings

[Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member]

Owned and leased

assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Accumulated depreciation and impairment [Member]

Carrying amount

[Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

2,38,66,751

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

27,14,693 -73,20,555

Total Depreciation property plant and

equipment

27,14,693 -73,20,555

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

21,858

Total disposals and retirements,

property, plant and equipment

21,858

Total increase (decrease) in property,

plant and equipment

27,14,693 0 0 1,65,24,338

Property, plant and equipment at end of

period

27,14,693 0 0 61,68,94,346](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-31-320.jpg)

![32

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(8)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Buildings [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying

amount [Axis]

Carrying amount [Member] Gross carrying amount [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

43,87,37,914 2,38,66,751 43,87,37,914

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

-59,15,490

Total Depreciation property plant and

equipment

-59,15,490

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

67,88,450 1,00,000 67,88,450

Total disposals and retirements,

property, plant and equipment

67,88,450 1,00,000 67,88,450

Total increase (decrease) in property,

plant and equipment

42,60,33,974 0 2,37,66,751 43,19,49,464

Property, plant and equipment at end of

period

60,03,70,008 17,43,36,034 63,00,52,249 60,62,85,498](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-32-320.jpg)

![33

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(9)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Buildings [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Gross carrying

amount [Member]

Accumulated depreciation and impairment [Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

73,20,555 59,15,490

Total Depreciation property plant and

equipment

73,20,555 59,15,490

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

78,142

Total disposals and retirements,

property, plant and equipment

78,142

Total increase (decrease) in property,

plant and equipment

0 72,42,413 59,15,490 0

Property, plant and equipment at end of

period

17,43,36,034 1,31,57,903 59,15,490 0](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-33-320.jpg)

![34

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(10)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Buildings [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Gross carrying amount [Member]

Accumulated

depreciation and

impairment

[Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

2,38,66,751 43,87,37,914

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

73,20,555

Total Depreciation property plant and

equipment

73,20,555

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

1,00,000 67,88,450 78,142

Total disposals and retirements,

property, plant and equipment

1,00,000 67,88,450 78,142

Total increase (decrease) in property,

plant and equipment

2,37,66,751 43,19,49,464 0 72,42,413

Property, plant and equipment at end of

period

63,00,52,249 60,62,85,498 17,43,36,034 1,31,57,903](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-34-320.jpg)

![35

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(11)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Buildings [Member] Office building [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying

amount [Axis]

Accumulated depreciation and

impairment [Member]

Carrying amount [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

2,38,66,751 43,87,37,914

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

59,15,490 -73,20,555 -59,15,490

Total Depreciation property plant and

equipment

59,15,490 -73,20,555 -59,15,490

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

21,858 67,88,450

Total disposals and retirements,

property, plant and equipment

21,858 67,88,450

Total increase (decrease) in property,

plant and equipment

59,15,490 0 1,65,24,338 42,60,33,974

Property, plant and equipment at end of

period

59,15,490 0 61,68,94,346 60,03,70,008

Disclosure of detailed information about property, plant and equipment [Table] ..(12)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Office building [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Carrying amount

[Member]

Gross carrying amount [Member]

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

2,38,66,751 43,87,37,914

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

1,00,000 67,88,450

Total disposals and retirements,

property, plant and equipment

1,00,000 67,88,450

Total increase (decrease) in property,

plant and equipment

0 2,37,66,751 43,19,49,464 0

Property, plant and equipment at end of

period

17,43,36,034 63,00,52,249 60,62,85,498 17,43,36,034](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-35-320.jpg)

![36

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(13)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Office building [Member]

Sub classes of property, plant and equipment [Axis] Owned and leased assets [Member]

Owned assets

[Member]

Carrying amount accumulated depreciation and gross carrying amount

[Axis]

Accumulated depreciation and impairment [Member]

Carrying amount

[Member]

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

2,38,66,751

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

73,20,555 59,15,490 -73,20,555

Total Depreciation property plant and

equipment

73,20,555 59,15,490 -73,20,555

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and

equipment

78,142 21,858

Total disposals and retirements,

property, plant and equipment

78,142 21,858

Total increase (decrease) in property,

plant and equipment

72,42,413 59,15,490 0 1,65,24,338

Property, plant and equipment at end of

period

1,31,57,903 59,15,490 0 61,68,94,346](https://image.slidesharecdn.com/adanipropertiesannualreport2017-221116221847-d1261937/85/Adani-Properties-Annual-Report-2017-pdf-36-320.jpg)

![37

ADANI PROPERTIES PRIVATE LIMITED Consolidated Financial Statements for period 01/04/2016 to 31/03/2017

Disclosure of detailed information about property, plant and equipment [Table] ..(14)

Unless otherwise specified, all monetary values are in INR

Classes of property, plant and equipment [Axis] Office building [Member]

Sub classes of property, plant and equipment [Axis] Owned assets [Member]

Carrying amount accumulated depreciation and gross carrying

amount [Axis]

Carrying amount [Member] Gross carrying amount [Member]

01/04/2015

to

31/03/2016

31/03/2015

01/04/2016

to

31/03/2017

01/04/2015

to

31/03/2016

Disclosure of detailed information about property,

plant and equipment [Abstract]

Disclosure of detailed information about

property, plant and equipment [Line items]

Reconciliation of changes in property, plant

and equipment [Abstract]

Changes in property, plant and equipment

[Abstract]

Additions other than through business

combinations, property, plant and

equipment

43,87,37,914 2,38,66,751 43,87,37,914

Depreciation, property, plant and

equipment [Abstract]

Depreciation recognised in profit or

loss

-59,15,490

Total Depreciation property plant and

equipment

-59,15,490

Disposals and retirements, property,

plant and equipment [Abstract]

Disposals, property, plant and