Andhra Chamber of Commerce - E Bulletin

- 1. ANDHRA CHAMBER OF COMMERCE VOL. - LXXI May 2018 INFORMATION BULLETIN PROGRESS THROUGH COMMERCE AND INDUSTRY www.andhrachamber.com

- 2. C o n t e n t sShri Ch. Venkateswara Rao Vice-President Shri R.R. Padmanabhan Chairman, Skill Development Sub Committee Shri M.K. Anand Chairman IT and Telecom Sub-committee Shri V.V. Sampath Kumar Chairman,IndirectTaxesSub-Committee Shri K.N. Suresh Babu E.C. Member Shri V.S. Prasanth Kumar E.C. Member ------------------------------------------ Published by Shri. P. Nandagopal Secretary Andhra Chamber of Commerce ------------------------------------------ Printers RATHINAM PRINTERS New no 27, Old no 13, Angamuthu Street, Royapettah, Chennai - 600 014 Bulletin Advisory Board 1 1. President Desk........................................................................2 2. Eleventh J.V. Somayajulu Memorial Lecture.............................3 3. Presentation on Capital Raising for Smes Through Bse............5 4. Presentation Meeting on “Lessons of Management From Thirukkural”..............................................8 5. Foreign Trade........................................................................10 6. Start Up India Recognition For Accbi.....................................14 7. Stay of Demand For Collection of Income Tax at First Appeal – Mr. P.s. Kumar.......................16 8. My Tryst With Air India – Mr. R.R. Padmanabhan....................20 9. Recent Judgments in Vat Cst Gst – Mr. V.V. Sampathkumar..................................22 10. Valuation of Supply Under Gst – Mr. J. Purushothaman.........26 11. Age Backwards – Mr S. Prakash...........................................32 12. Andhra Pradesh Medtech Zone Ltd – A To Z Medical Technology – Mrs. Ramavenugopal.............34 13. Successful Entrepreneurial Competencies – Prof.C. Vasudevan.......................................41 14. A 24/7 True Consultant – Mr M K Anand................................42 15. Imbibing Process Driven Culture – A Necessity for Msmes – Mr. V. Chandrachudan....................44 16. Consumer Price Index Numbers............................................49

- 3. D e s k President 2 Dear Members, Countries all over the world have been looking towards India to take over China in manufacturing as the labour and input costs in China were on rising. With china losing its cost competitiveness to rising Labour and input costs, India can leverage the opportunity to strengthen its participation in the global manufacturing sector. Honourable Prime Minister launched “Make in India” initiative with the primary goal of making India a global manufacturing hub, by encouraging both domestic companies and as well as multi – nationals to manufacture their products within India. Multiple new initiatives were introduced duly promoting Foreign Direct Investment, implementing intellectual property rights and developing the manufacturing sector. The unorganized sector was also brought into main stream with the introduction of GST and demonetization. The Government should take all the steps towards focussing on filling the skill gap, requisite funding and integrating vocational training of the students to acquire employability skills to grab the opportunities that may arise due to the growth happening in the manufacturing sectors – MSME, Large Scale Industries as well as MNCS. It is assumed that by 2020, India will have 64% of its population in the working age group. In order to engage them towards socio-economic growth of the nation, the Government should liberalise all the bottle necks in establishing industries. A robust manufacturing sector is important for sustainable economic growth in India. Further, with a trade war like situation emerging between the US and China, many Multi- national Companies around the world are looking for alternate manufacturing locations. Time is opportune now to give a big push to the manufacturing sector in India. India should also focus on setting manufacturing eco system for various advantageous product groups. Dr. V.L. INDIRA DUTT PRESIDENT

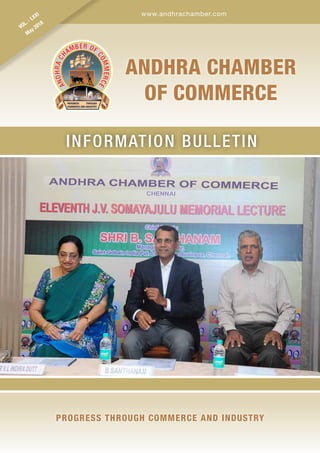

- 4. 3 C h a m b e r Eleventh J.V. Somayajulu Memorial Lecture The Eleventh J.V. Somayajulu Memorial Lecture organised under the auspices of the Chamber was held on May 9, 2018 at E-Hotel, Chennai. Shri B.Santhanam, Managing Director, Saint Gobain P.Ltd., was the Chief Guest. He delivered the Memorial Lecture on the topic “Revival of Manufacturing sector in India – Way forward”. Dr. V.L. Indira Dutt, President, Andhra Chamber of Commerce welcomed the chief Guest and the Member & Invitees present. In her welcome address Dr.V.L. Indira Dutt observed: “The Indian economy has reported rapid growth in the last two decades, transforming from primarily an agrarian economy to a services driven economy with developed manufacturing competence. Despite this favourable growth, India’s manufacturing sector contributes only16% to the GDP as compared to China’s 34%. The manufacturing sector in India continues to struggle to reach the expected level with all the supportive measures offered by the Government including Make in India policy measure. Some of the factors affecting manufacturing growth include inadequate infrastructure, stringent and outdated Labour Laws and non availability of efficient and skilled workforce”. Dr.V.L. Indira Dutt honoured the Chief Guest with flower bouquet. Dr. J.Venkataramana, former President of the Chamber honoured Shri B.Santhanam with shawl. Shri Santhanam in his presentation on Revival of Manufacturing Sector in India observed: “A true digital transformation requires more than merely investing in technology. Truly becoming digitized requires a cultural shift and companies striving to be successful need to be ready for it. These could include anything from purchasing and procurement to inventory management. We enter a digital era, leveraging Prime Minister’s thrust to a digital economy. As more and more disruptive technologies and processes emerge, it is the entities with farsightedness that will quickly adapt to the new order of business and be ready to take on the future. For Reimagining manufacturing through Digitalization the three Stakeholders -- Chambers & Industry Associations, Government, Individual Firms should take lead. Manufacturing continues to evolve from metal cutting to Additive Manufacturing / 3-D Printing from intensive manual Labour to Robots and Cobots from mass production to Mass Customization. Manufacturing is getting transformed by Disruptive Digital Technologies. There is an astonishing rise in data volumes, computational power and connectivity.

- 5. The Internet of Things creating Dynamic, Self- organizing, Real-time-optimized and Value-added connections within and across entities and effecting improvements in transferring digital instructions to the physical world, such as advanced robotics and 3-D printing. Plants are working on opportunities to Digitalize Operations there by Real-Time monitoring of Equipment and Processes to smarter Decisions are happening. Plant Maintenance assisted by e-Work Instructions, Check Sheets and Videos are empowering the employees to take smart decisions. Mobile Apps ensure Real-Time Updates in the Plants & Warehouses. Remote Monitoring Applications make Line Managers Proactive. It is Time for Reimagining Manufacturing through Digitalization with the support of Industry Associations and Chambers of Commerce. The growth of the internet has impacted profoundlyoneverydaylifeandtheglobaleconomy. It has evolved into a global, interconnected network of systems and information – cyberspace – that we know today, transforming the conduct of business and opening new markets”. Shri Santhanam answered the questions raised by the Members present. Dr.V.L. Indira Dutt, President presented a memento to Shri B.Santhanam. The Eleventh J.V. Somayajulu Memorial Lecture meeting concluded with a vote of thanks proposed by Dr. J. Venkataramana and that was followed by Dinner. 4

- 6. APresentation on “Capital raising for SMEs through BSE” organised by the Chamber with the support of Bombay Stock Exchange Limited was held on April 12, 2018 at E-Hotel, Chennai. Shri C. Gurunathan, Associate Manager – Business Development, BSE Limited was the Guest Speaker. Dr. V.L. Indira Dutt, President welcomed the speaker and the participants. Dr. Indira Dutt in her welcome address observed: “SMEs are the back bone of the economy and they are an engine of economic growth, promoting equitable development for all. SMEs are labour intensive than large corporates and provide tremendous employment potential at a low Capital cost. SMEs are also share a major portion of industrial production and exports in India and play a pivotal role in the development of country’s Industrial economy. The role of SMEs in the industrial sector is growing rapidly and they have become a thrust area for future growth. Various Small and Medium Industries in the sectors like food processing, textiles, garments, precision engineering, information technology, pharmaceuticals, agro and service sectors are flourishing. A stock market specialised in SMEs can be an important channel for the growth and financing of businesses. BSE – MSE platform provides a great opportunity to the entrepreneurs to raise the equity capital for the growth and expansion of SMEs. BSE helps to unleash the valuation of the companies and in the process create wealth for all the stake holders including investors. The first SME exchange in India “BSE – SME” has been developed after studying the best practices and business models of SME Exchanges globally. BSE plays a vital role in providing financial support to SMEs. It is evident and the fact that more and more SMEs are being listed on SME platform of BSE. The trend is expected to 5 Presentation on Capital raising for SMEs through BSE

- 7. scale up further since the prospective investors in the market are willing to explore new avenues of investment other than the conventional modes of finance. Awareness is the pivotal criteria for investments. Series of initiatives for promoting capital market for SMEs need to be taken including knowledge sharing programmes of this nature by Chambers of Commerce and professional institutions. I thank BSE Limited for coming forward to educate the SME sector to have major growth on the two pillars of the financial system ie. Banking and Capital Market. I wish similar programmes should be conducted at various chapters of our chamber like Hyderabad, Visakhapatnam and Vijayawada with the support of BSE Limited for the benefit of the trade and industry”. Shri Kailashmull Dugar, Chairman, Banking & Finance Sub-Committee addressed the gathering on the theme of the topic and introduced the Guest Speaker. In his address Shri Kailashmull Dugar observed:” Traditionally SMEs are unorganised sector. The operations and ownership of SMEs have been confined to the family or group of associates. The loans given to MSMEs are mainly under project Finance, Equipment Finance, Business Loan or Loan against properties. In the recent times with the help of Information technology NFBCS have become major source of working capital for small and midsized companies. In order to promote the development of SMEs and equip them with proper finance tools, the Government of India initiated the idea of a separate exchange for the SMEs for raising capital. At present, there are only two SME Exchanges in India i.e. BSE SME platform, Bombay stock Exchange and EMERGE Platform, National Stock Exchange. Both the exchanges have their own eligibility norms in addition to SEBI norms for listing. BSE SME Platform provides a great opportunity to the entrepreneurs to raise the equity capital for the growth and expansion of SMEs. It also provides immense opportunity to the investors to identify and invest in the good SME companies at an early stage. It helps unleash the valuation of the company and in the process create wealth for all the stakeholders including investors. Today’s Speaker Shri Gurunathan is an Economics graduate and Diploma holder in Business Management, Mass Communication and Export – Import Management. He has rich experience in Finance, Property, Industry and Consultancy fields for over 20 years. He held many key positions in Madras Stock Exchange and at present he is the Associate Manager – Business Development in Bombay Stock Exchange Limited”. ShriC.Gurunathaninhispresentationobserved:” World over, governments have recognised the role and importance of the SMEs in their economy which have become silent drivers of economic development. The biggest challenge being faced by these enterprises is access to capital. To overcome this, almost all major capital markets have realised the need for a separate exchange for SME segment. More than 20 countries operate separate SME bourses. These markets have tried to create a SME-friendly market architecture supported by effective institutions and forging links to policies that foster a new class of investable equities. SME – The term has been defined differently in different legislations and rule books. SMEs are categorised on the basis of turnover, loan size, investment in capital assets, capital base and number of employees. The company does not need to be a giant to be listed. If the institutional and market circumstances are right, a stock market specialized in SMEs can be an important channel for the growth and financing of businesses. Ease of access to capital & financing opportunities: SMEs, by virtue of the nature of their industry and working patterns were unable to tap markets to raise equity and debt to fund their projects. Some of these with viable greenfield projects are not able to implement or execute them for limited funds availability. With the easing of IPO norms for SMEs, these SMEs found a solution to raising funds. SME Listing provides an avenue to raise capital through equity infusion for growth oriented SME’s. 6

- 8. Less regulatory controls: As against an IPO on the main exchanges, for a SME IPO, there are multiple benefits in terms of regulatory supervision and controls – both at the time of the IPO and on routine compliance under the listing agreement and regulations. Enhanced visibility and credibility: Listing provides these SMEs with the benefit of greater credibility and enhanced financial status leading to higher valuation of the company on one hand and improved customer-client credibility on the other. Even banks and financial institutions prefer to fund listed SMEs as against an unlisted one. Unlocking hidden value: As there is no market available for trading of shares of an unlisted company, the fair market value of such companies is difficult to arrive at. Accordingly, listing helps to unravel real value through market-driven mechanism. Eased Tax Planning: Any share transaction through stock exchanges is exempt from the provisions of Long Term Capital Gains (LTCG). Rather, these transactions happen on payment of Securities Transaction Tax (STT), which acts as a major booster for share transactions. Encourages SME growth: Equity financing provides growth opportunities like expansion, mergers and acquisitions thus being a cost effective and tax efficient mode. Migration provisions: One of the major attractions for SME IPO remains the provision of migration to the main exchanges. Any company listed at the SME platform, after crossing the threshold of Rs 10 Cr Capital may migrate to the main exchange and upon crossing the threshold of Rs 25 Cr has to mandatorily migrate to the main exchange. For Shareholders/Investors: Easier liquidity and exit: Listing would provide liquidity to shareholders and at the same time would offer exit options to venture capital and private equity investors. No long-term capital gain tax: No long term capital gains tax will be applicable on transfer of shares through exchange, on payment of Securities Transaction Tax (STT). Well-organised risk distribution system: Capital markets strengthen in-built mechanism of risk transfer from one person to another through well-organised market forces”. More than 40 participants dream among the Members of the Chamber participated in the Meeting. Earlier Dr.V.L. Indira Dutt presented a memento to Shri C.Gurunathan. The Meeting concluded with a vote of Thanks proposed by Shri C. Nagendra Prasad, Vice- President and that was followed by Hi-tea sponsored by BSE limited. 7

- 9. PRESENTATION MEETING ON “LESSONS OF MANAGEMENT FROM THIRUKKURAL” Andhra Chamber of Commerce in association with Madras Management Association organised a presentation Meeting on “LESSONS OF MANAGEMENT FROM THIRUKKURAL” on April 25, 2018 at the Chamber’s Conference Hall. Shri Milton Rajasekar Senior Corporate Trainer was the Guest Speaker. Shri R.R. Padamanadhan, Chairman, Skill Development Sub-Committee of the Chamber welcomed the Guest Speaker and the Members present. In his welcome address Shri Padmanabhan observed: “This is the 77th event on the Management series programmes jointly organised with MMA. The earlier seventy six meetings were indeed interesting, thought provoking and well received by the participants. As regards the topic for discussion today -- “LESSONS OF MANAGEMENT FROM THIRUKKURAL” –Thirukkural is an ancient non-religious literature that guides people on better living. Though written over 2,000 years ago by Thiruvalluvar in Tamil, the way of life advised by Thirukkural is still relevant today. Business ethics have become one of the major topics for discussion around the world due to many of the business scandals that took place not only in the Indian context but also throughout the world. Thirukkural consists of several lessons for ethical business practices for effective business leadership in organisations. Although numerous studies on Thirukkural have made in Tamil language especially in Tamil Nadu, studies on Thirukkural in English and other languages are limited. The teachings from the Thirukkural do not conflict with Vedanta and are of no difference to the teachings from the Bible, the Koran, the philosophy of Buddha, Confucius and other philosophical schools of thought. Today’s Speaker Shri Milton Rajasekar studied is a Master of Arts in History and Master of Arts in Christian studies in Madras University. He is an MBA from Annamalai University. He worked in Lucas TVS for more than 30 years in managerial positions in Finance, Planning, Factory Production and Human Resources. 8

- 10. 9 He has Written two Books - Bharathi Gnanaguru Nivethitha and a Prayer Book. He has made two films in the internet and they are available in the You Tube – they are Pasumai, Kattrilalayum Kelvigal. He is passionate about Thirukural, The Bible and Poetry. He is a Member of Toast Masters Club for more than twenty five years from Royapettah. Out of the two persons who were awarded Life time Achievement Award from Toast Masters International – One is Mr. Ramakrishanan Senior MMA Member and another is Milton Rajasekar”. Shri Milton Rajasekar in his presentation observed: “Thirukkural is a treatise on ethical business leadership. Thirukkural advocates a consciousness and a spirit-centered approach to the subject of business ethics based on eternal values and moral principles that should govern the conduct of business leaders. The 1,330 couplets (Kural) of the Thirukkural are rich with several lessons on business ethics and leadership. The management section of Thirukkural has the functional aspects of planning, organising, conduct of affairs and control. Profit is needed to pay for attainment of the objectives of the business. Profit is a condition of survival. It is the cost of the future, the cost of staying in business. Thirukkural says “Never trust men without testing them, give each one of them the work for which they are fit.” Managers need to be resolute, decisive and action-oriented. Loyalty to the manage- ment and operating within the company policy paradigm are two of the several qualities they need to have. Management is all about getting things done. A smart manager would know what needs to be done, who is the best person for doing it, and the right time to get it done”. Shri Milton Rajasekar clarified the doubts expressed by the participants. Shri K.N. Suresh Babu, Member – Executive Committee of the Andhra Chamber of Commerce presented a memento to the Guest speaker. More than 50 participants drawn among the Member-group of Andhra Chamber of Commerce & MMA participated in the above Meeting. The Meeting concluded with a hearty vote of thanks proposed by Shri B. Gautham, Member, Executive Committee, ACC.

- 11. FOREIGN TRADE – STATISTICS India’s Foreign Trade (Merchandise): March 2018 I. MERCHANDISE TRADE EXPORTS (including re-exports) Exports during 2017-18 are at US $ 302.84 Billion registering a growth of 9.78 per cent in dollar terms vis-à-vis 2016-17. Exports during March 2018 were valued at US $ 29.11 Billion as compared to US $ 29.30 Billion during March 2017 exhibited negative growth of 0.66 per cent. In Rupee terms, exports were valued at Rs. 189271.16 crore as compared to Rs. 193028.91 crore during March 2017, registering a fall of 1.95 per cent. During March 2018, major commodity groups of export showing positive growth over the corresponding month of last year are 10

- 12. Cumulative value of exports for the period April-March 2017-18 was US $ 302.84 Billion (Rs 1952168.79 crore) as against US $ 275.85 Billion (Rs 1849428.76 crore) registering a positive growth of 9.78 per cent in Dollar terms and 5.56 per cent in Rupee terms over the same period last year. Non-petroleum and Non Gems & Jewellery exports in March 2018 were valued at US $ 22.42 Billion as against US $ 21.44 Billion in March 2017, an increase of 4.60%. Non-petroleum and Non Gems and Jewellery exports during April- March 2017-18 were valued at US $ 222.45 Billion as compared to US $ 200.89 Billion for the corresponding period in 2016-17, an increase of 10.73%. IMPORTS Imports during March 2018 were valued at US $ 42.80 Billion (Rs 278296.95 crore) which was 7.15 per cent higher in Dollar terms and 5.75 per cent higher in Rupee terms over the level of imports valued at US $ 39.95 Billion (Rs. 263155.49 crore) in March 2017. Cumulative value of imports for the period April-March 2017-18 was US $ 459.67 Billion (Rs. 2962897.70 crore) as against US $ 384.36 Billion (Rs. 2577665.59 crore) registering a positive growth of 19.59 per cent in Dollar terms and 14.94 per cent in Rupee terms over the same period last year. Major commodity groups of import showing high growth in March 2018 over the corresponding month of last year are: CRUDE OIL AND NON-OIL IMPORTS: Oil imports during March 2018 were valued at US $ 11.11 Billion which was 13.92 percent higher than oil imports valued at US $ 9.75 Billion in March 2017. Oil imports during April- March 2017- 18 were valued at US $ 109.11 Billion which was 25.47 per cent higher than the oil imports of US $ 86.96 Billion in the corresponding period last year. In this connection it is mentioned that the global Brent prices ($/bbl) have increased by 27.86 % in March 2018 vis-à-vis March 2017 as per World Bank commodity price data (The pink sheet). Non-oil imports during March 2018 were estimated at US $ 31.69 Billion which was 4.96 per cent higher than non-oil imports of US $ 30.20 Billion in March 2017. Non-oil imports during April- March 2017-18 were valued at US $ 350.56 Billion which was 17.88 per cent higher than the level of such imports valued at US $ 297.39 Billion in April- March, 2016-17. II. TRADE IN SERVICES (for February, 2018, as per the RBI Press Release dated 13th April 2018) EXPORTS (Receipts) Exports during February 2018 were valued at US $ 15.71 Billion (Rs. 101124.86 Crore) registering a negative growth of 3.84 per cent in dollar terms as compared to positive growth of 2.07 per cent during January 2018 (as per RBI’s Press Release for the respective months). 11

- 13. IMPORTS (Payments) Imports during February 2018 were valued at US $ 10.14 Billion (Rs. 65294.38 Crore) registering a positive growth of 3.10 per cent in dollar terms as compared to negative growth of 0.12 per cent during January 2018 (as per RBI’s Press Release for the respective months). III.TRADE BALANCE MERCHANDISE: The trade deficit for March 2018 was estimated at US $ 13.69 Billion as against the deficit of US $ 10.65 Billion during March 2017. SERVICES: As per RBI’s Press Release dated 13th April 2018, the trade balance in Services (i.e. net export of Services) for February, 2018 was estimated at US $ 5.57 Billion. OVERALL TRADE BALANCE: Taking merchandise and services together, overall trade deficit for April-March 2017-18 is estimated at US $ 87.17 Billion as compared to US $ 47.70 Billion during April-March 2016-17. (Services data pertains to April-February 2017-18 as February 2018 is the latest data available as per RBI’s Press Release dated 13th April 2018) MERCHANDISE TRADE EXPORTS & IMPORTS: (US $ Billion) (PROVISIONAL) MARCH APRIL-MARCH EXPORTS (including re-exports) 2016-17 29.30 275.85 2017-18 29.11 302.84 %Growth 2017-18/ 2016-17 -0.66 9.78 IMPORTS 2016-17 39.95 384.36 2017-18 42.80 459.67 %Growth 2017-18/ 2016-17 7.15 19.59 TRADE BALANCE 2016-17 -10.65 -108.50 2017-18 -13.69 -156.83 EXPORTS & IMPORTS: (Rs. Crore) (PROVISIONAL) MARCH APRIL-MARCH EXPORTS(including re-exports) 2016-17 193028.91 1849428.76 2017-18 189271.16 1952168.79 %Growth 2017-18/ 2016-17 -1.95 5.56 IMPORTS 2016-17 263155.49 2577665.59 2017-18 278296.95 2962897.70 %Growth 2017-18/ 2016-17 5.75 14.94 12

- 14. TRADE BALANCE 2016-17 -70126.58 -728236.83 2017-18 -89025.79 -1010728.92 SERVICES TRADE EXPORTS & IMPORTS (SERVICES) : (US $ Billion) (Provisional) February 2018 EXPORTS (Receipts) 15.71 IMPORTS (Payments) 10.14 TRADE BALANCE 5.57 EXPORTS & IMPORTS (SERVICES): (Rs. Crore) (Provisional) February 2018 EXPORTS (Receipts) 101124.86 IMPORTS (Payments) 65294.38 TRADE BALANCE 35830.48 Source: RBI Press Release dated 13th April, 2018 13

- 15. 14 Great News… ACC Business Incubator by Andhra Chamber of Commerce is recognized by Startup India…. Honorable Prime Minister of India Shri Narendra Modiji has unveiled a Startup Eco system by name Startup India in January 2016. An action plan is formulated for the purpose of creating an ecosystem for the startups and also for ease of doing business. Necessary amendments have been made in the business and environmental laws conducive to roll out their venture. An Inter ministerial board has been setup to avail the benefits and incentives through Startup India Action Plan 2016. By and large, Startup India is a flagship initiative by the Government of India intended to build an eco system for nurturing innovation & start-ups for sustainable economicgrowthandalsoforthegenerationoflargescaleemploymentopportunities. ACC Business Incubator by Andhra Chamber of Commerce is recognized as an Incubator by Startup India Hub. Please click the following Link to visit ACC Business Incubator in Startup India Hub h t t p s : / / w w w. s t a r t u p i n d i a h u b . o rg . i n / c o n t e n t / s i h / e n / s e a r c h . html?states=sih:location/india/tamil-nadu&roles=Incubator&page=0 Proposed Schemes & Incentives under Startup India Action Plan 2016: 1. Compliance Regime based on Self-Certification. 2. Startup India Hub 3. Rolling out of Mobile App & Portal: Ease of Doing Business 4. Legal Support and Fast-Tracking Patent Examination At Lower Costs:

- 16. 15 5. TheRelaxednormsofpublicprocurement for startup 6. The insolvency and Bankruptcy bill 2015 (IBB) 7. Provide funding support through Fund of Funds with a corpus of INR 10,000 Crore (INR 2,500 Crore over a period of 4 years) 8. Credit Guarantee Fund for Startups 9. Tax Exemption on Capital Gains 10. Tax Exemption to Startups for 3 years 11. Tax Exemption on Investment above fair market value 12. Industry – Academic partnership Incubators 13. Launch of Aral Innovation Mission (AIM) with self employment and Talent utilization (SETU) program 14. Harnessing private sector Enterprise for Incubator Set Up 15. Providing Innovation Centres at national Institutes 16. Setting Up of 7 New research parks modelled on IIT Madras Research Park 17. Promoting Start-ups in Bio Technology Sector 18. Launching of Innovation focused programme for students Definition of Startup – only to receive incentives from government 1. Not more than 5 years old registered firm or a Company registered in India 2. Turnover does not exceed 25 crores in any year of operations 3. Should have funded by Venture Capital 4. Fostering Innovation. A certification to inter-ministerial Board has to be obtained to get all the incentives. Any Startup Incubated at ACC Business Incubator will receive the above said benefits and the Incubator team will help and mentor the Startups to receive those benefits and Incentives by Startup India. We welcome you to incubate your Business Idea in to ACC Business Incubator. We will transform your Idea in to a Viable Business Entity. For further details please contact Prof. C. Vasudevan, Director, ACC Business Incubator # 23, Third Cross Street, West CIT Nagar, Nandanam, Chennai - 600 035 Tel:04424315279 EMail:accbusinessincubator @gmail.com

- 17. 16 Mr. P S Kumar, Senior Partner, Brahmayya& Co Introduction There are times when even those assessees who are careful in estimating their taxes on advance tax basis will have surprises when assessments are completed resulting in unexpected additions to income and the consequent tax demands. As a matter of natural justice, when assessees go on appeal, The Income Tax Act, 1961 (The Act) has provisions under which assessees are granted stay of proceedings with regard to the additional tax demands whereby the demands are kept in abeyance till the matters are resolved. This article deals with stay of collections as far as first appeals i.e. appeals before the Commissioner of Income Tax (Appeals) [CIT (Appeals)]are concerned. When any tax, interest, penalty fine or any other sum is payable in consequence of any order passed under The Act, as per section 156, the Assessing Officer (AO) will serve upon the assessee a notice of demand specifying the amount payable. The demand will be made out as per Rule 15 in Form No. 7. The Central Board of Direct Taxes There is a substantial change in the thinking of the Central Board of Direct Taxes (CBDT) vis-à-vis the manner of collection of disputed taxes. Where, previously, the matter was purely left to the discretion of the authorities (although at first appeal the authorities were required to be sympathetic to the assessees), now the matter is governed by Rules removing subjectivity to a great extent. There have been three important notifications on the subject which are as follows: 1. Instruction No. 1914, dated 2-2-1993 partially amended by 2. Office Memorandum F.No.404/72/93 – ITCC dated 29-2-2016 prescribing a minimum payment of 15% of the demand, 3. Office Memorandum F.No.404/72/93 – ITCC dated 31-7-2017 increasing the minimum payment to 20% of the demand. The sum and substance of the above instructions by the CBDT are as follows: Instruction no. 1914, dated 2-2-1993 • Demand may be kept in abeyance for valid reasons only in accordance with the guidelines. Stay petitions filed with the Assessing Officers must be disposed of within two weeks of the filing of petition by the taxpayer. The assessee must be intimated of the decision without delay. • The decision in the matter of stay of demand should normally be taken by AO / Tax Recovery Officer (TRO) and his immediate superior. A higher superior authority should for Collection of Income Tax at First Appeal Stay of Demand

- 18. 17 interfere with the decision of the AO/TRO only in exceptional circumstances e.g. where the assessment order appears to be unreasonably high pitched or where genuine hardship is likely to be caused to the assessee. • A few illustrative situations where stay could be granted are — (a) if the demand in dispute relates to issues that have been decided in assessee’s favour by an appellate authority or court earlier; or (b) if the demand in dispute has arisen because the Assessing Officer had adopted an interpretation of law in respect of which there exist conflicting decisions of one or more High Courts (not of the High Court under whose jurisdiction the Assessing Officer is working); or (c) if the High Court having jurisdiction has adopted a contrary interpretation but the Department has not accepted that judgment. • In granting stay, the Assessing Officer may impose such conditions as he may think fit including requiring the assessee to pay towards the disputed taxes a reasonable amount in lump sum or in instalments; • Since the phrase ‘stay of demand’ does not occur in section 220(6) of the Income-tax Act, the Assessing Officer should always use in any order passed under section 220(6) [or under section 220(3) or section 220(7)], the expression that occurs in the section viz, that he agrees to treat the assessee as not “being in default” in respect of the amount specified, subject to such conditions as he deems fit to impose. • While considering an application under section 220(6), the Assessing Officer should consider all relevant factors having a bearing on the demand raised and communicate his decision in the form of a speaking order. Office Memorandum F.No.404/72/93 – ITCC dated 29-2-2016 prescribing a minimum pay- ment of 15% of the demand. In order to streamline the process and standardize the quantum of lump sum required to be paid as a pre-condition for stay of demand, the CBDT issued the memorandum cited above. The key points are: The AO may demand that the assessee pay 15% of the disputed amount unless the case falls in the category discussed below: a) the nature of the addition in assessment is such that a lump sum higher than 15% is warranted. This would arise in situations such as where the same issue has been confirmed by appellate authorities in earlier years or there are precedents in favour of the Revenue etc. b) the AO is of the view that payment of lump sum lower than 15% is warranted as a result of circumstances in favour of the assessee such same issue has been deleted by appellate authoritiesinearlieryearsorthereareprecedents in favour of the assessee. The AO will have to refer the matter to the administrative Principal CIT or the CIT who will take a decision. c) if the assessee is aggrieved by the demand for payment of lump sum of 15% as a pre-condition, the assessee may approach the administrative Principal CIT or the CIT who will take a decision. Office Memorandum F.No.404/72/93 – ITCC dated 31-7-2017 prescribing a minimum payment of 20% of the demand. The matter was reviewed by the CBDT in the light of feedback received from field authorities. In view of the Board’s efforts to contain over pitched assessments through several measures resulting in fairer and more reasonable assessment orders, the standard rate of 15% of the disputed demand was found to be on the lower side and hence it was decided that the standard rate prescribed previously was revised to 20% of the disputed demand, where the demand is contested before CIT(A). Litigation The above marks the shift of the thinking of the CBDT to a rule based regime in so far as this touchy subject is concerned. While the guidelines are reasonably clear, the subject has also given rise to litigation. In Jagdish Gandabhai Shah v. Principal Commissioner of Income-tax, 81 Taxmann.

- 19. 18 com 45 (Gujarat), the High Court of Gujarat after considering - Instruction no. 1914, dated 2-2- 1993 and Office Memorandum F.No.404/72/93 – ITCC dated 29-2-2016 - prescribing a minimum payment of 15% of the demand held that any order of AO demanding 15% is against the scheme of things as per The Act. The AO has to examine the merits of request for stay of demand and refer the matter to the Principal CIT / CIT and then only can proceed to demand the payment. It should be noted that in this particular case income was determined at Rs. 1,97,76,53 as against the returned income at Rs. 4,64,554 and that, pursuant to the scrutiny assessment under Section 143 (3) of the Act, a demand notice of Rs. 91,38,400 was issued to the assessee-petitioner. In Flipkart India (P.) Ltd. v. Assistant Commissioner of Income-tax [2017] 79 taxmann.com 159 (Karnataka)/ [2017] 396 ITR 551 (Karnataka)/[2017], The Karnataka High Court had to consider a similar issue. The assessee-petitioner submitted its Income Tax Returns for the Assessment Year 2014- 15, declaring a loss of Rs.3,58,81,84,343 and for the Assessment Year 2015-16, loss of Rs.7,96,34,36,865. The assessments orders were passed in which for the Assessment Year 2014-15 an amount of Rs.5,01,86,62,282 was added, and for the Assessment Year 2015-16, an amount of Rs.12,04,67,98,537 was added. The balance tax payable by the petitioner was determined to be Rs.28,94,96,028 for the Assessment Year 2014- 15, and Rs.1,36,99,99,033 for the Assessment Year 2015-16. The petitioner was directed to deposit the said amount within a period of thirty days. The assessee-petitioner filed applications before the Assistant Commissioner for keeping the demand in abeyance. However, the Assistant Commissioner directed the petitioner to deposit 15% of the disputed demand amounting to Rs.3,37,11,514 for the Assessment Year 2014-15, andRs.22,92,02,561fortheAssessmentYear2015- 16. The High Court took the view in favour of the assessee-petitioner considering that, the Circular dated 29-2-2016 was only a partial modification of Instruction No.1914 of 2-2-1993 and that deposit of 15% was still subject to a consideration of a lower amount of deposit if the circumstances so warranted as provided in the Instruction. In yet another case decided in favour of the assessee, in the case of Vodafone India Ltd. v. Commissioner of Income-tax, TDS [2018] 89 taxmann.com 54 (Bombay), [2018] 400 ITR 516 (Bombay) the High Court of Bombay had to consider the case of an assessee who had surplus funds and who had deposited Rs.27.45 Crores i.e. almost 38% of the outstanding demand of Rs.71.16 crores. The High Court had this to say- “Prima facie, we also find that the impugned order dated 21st December 2017 of the Respondent No.1 has completely ignored the parameters laid down by this Court in KEC International Ltd. v. B.R. Balakrishnan [2001] 251 ITR 158/119 Taxman 974 (Bom.)., UTI Mutual Fund v. ITO [2012] 19 taxmann.com 250/206 Taxman 341/345 ITR 71 (Bom.), and MMRDA v. Dy. DIT [WP(L) No. 2348 of 2014, dated 29-10-2014], for deciding stay applications. Further as held by this Court mere having of funds i.e. no financial hardship would not itself justify the deposit where a prima facie case is made out. (See UTI Mutual Fund v. ITO [2013] 31 taxmann.com 222 (Bom.). The impugned order also nowhere even remotely attributes that the delay in disposal of the pending Appeals was on account of the Petitioner” Conclusion A word of warning though. Tax-payers are warned that application of stay of demand should not be considered on the basis that there would be savings on interest costs since an assessee would be prone to thinking that what is not paid to the Revenue Dept. would result in savings in interest cost. As The Act stands, sub-section (2) of section 220 provides for levy of interest at the rate of one per cent for every month or part of month for the period during which the default continues. Should the tax-payer ultimately fail in his/her appeal interest would start running from day 1 i.e. go back to the date of demand notice under section 156. Also to be considered is that interest paid to the Dept. is not a tax deductible expense. Therefore

- 20. 19 if one were to gross up the cost of interest, it would be much more than what one would save as finance cost. One should therefore consider the worst-case scenario i.e. cost in terms of appeal being unsuccessful. Readers should therefore obtain professional advice when considering costs and benefits in these situations rather than being influenced by a pure instinct to defer payments to the Dept. P.S.Kumar (The author is a former President of Andhra Chamber of Commerce) (The views expressed are the views solely of the author’

- 21. 20 Ihad to be Delhi in connection with a case coming before the Honorable Supreme court on behalf of my client. I had to brief the advocate appearing in the case. I was checking the availability of flights to Delhi from Chennai and back through Make my trip.com. The best combination of up and down flight schedule was from Air India (AI 143). Without any hesitation, I booked the tickets. There are many in my circle who would vouch that they would never choose Air India as their first option. But I did. Here I am enumerating my experience in flying Air India to the readers. Without adding any suspense, I should tell the readers my experience had been good and enjoying. The story is not without its share of hiccups here and there; but even those hiccups were caused by my casual attitude. Therefore, even these hiccups could have been avoided had I been little more careful. I did not know that nor did I check that aircraft from Chennai to Delhi was an international one. Thinking that it is a domestic flight I went to domestic departure, only to be told politely by the security that the flight was an international one and that I had to go to international terminal. In the meantime, I alighted from the car and sent the driver back. Imagine having to walk in the morning sun about 1 km (or may be less perhaps but the very thought of it was scary). Then help came from a good Samaritan, a taxi driver was just moving from the area. I requested him to drop me and he promptly obliged. In any case, one has to cross international terminal to exit the airport. But time was short. So, the taxi driver’s assistance was timely. I rushed to the counter and had my check in. Since it was a short trip, I had only one luggage. With clothes, books for study and files, it weighed more than 7 kgs. Only 7 kgs is allowed as hand baggage; otherwise it had to be checked in as cabin luggage. But looking at me, the counter staff politely obliged me to hand carry the luggage. Being the national carrier, Air India always gets the privilege of aero bridge and normally one does not have to ferry through a bus. I detest the very idea of boarding a bus to reach the aircraft. Of course, there is simply no reason for this. It is just like that. On the way to aircraft, one of private guard announced in a loud voice that all passengers must show their tickets along with their identity cards. I was a bit irritated. I asked him ‘how many times should I show my identity card’. He came closer to me and said “Sir, this is an international flight. Some people exchange their board cards here in this queue and try to avoid customs formalities. That is why we insist”. Now I could visualize the hanky-panky dealing that some people indulge in. R R Padmanabhan Chairman, Foreign Trade Sub Committee Andhra Chamber of Commerce My Tryst with Air India

- 22. 21 In the aircraft, the staff welcomed us warmly. There was genuineness in their greeting. After the flight ascended, we were served sumptuous break fast complete with South Indian delicacy and hot coffee. I must also mention here that aircraft commenced on time. We had absolutely neat flight right through our journey. The staffs were courteous and were caring for our requests for water and newspaper. On time, the aircraft landed in Delhi and the landing was silk and smooth. I sent message of thanks for smooth landing through the hostess to the captain. After this experience, I was brooding over the entire journey from Chennai to Delhi. Several myths were busted in this journey; that Air India’s service is not good, the staffs are not courteous and they do not maintain their timings. But on the other hand, here I am with the best of service being provided. Adding to cream was their food, so delicious and piping hot. I must confess here that in one of my flights through private airliner, the food served was cold and the hostess simply said that this was what she was having and that she felt sorry about it. It only meant that she could do nothing about it. Given a choice, hereafter, I would always choose Air India.

- 23. Recent Judgments in VAT CST GST GST Cess On COAL: Section 18 of the Constitution (101 Amendment) Act 2016 does not enable the Parliament to levy any cess which stood abolished in terms of the Third Schedule of the Taxation Laws (Amendment) Act, 2017. Hence the validity of levy of cess on Coal in the context of abolition of Clean Energy Cess with effect from 1st July 2017 is stayed- UNION OF INDIA Vs MOHIT MINERAL PVT LTD Input tax Credit: Mineral was sold by the Monitoring committee and the Court directed the Monitoring Committee to take necessary action to enable the lessee to claim and obtain input tax credit under the CGST Act, 2017 and that the GST payable on the sale value of the mineral purchased in the e-auction shall be paid by the buyer directly to the lessee and the lessee would be responsible for all compliances as may be required under Act. Further the Court directed that the Monitoring Committee to prepare appropriate proforma and also take steps for carrying proper TIN of the respective lessees on the invoices as may be required. SAMAJ PARIVARTANA SAMUDAYA Vs STATE OF KARNATAKA AAR: UPS and Battery sale, Composite supply? : What should be the tariff head when the UPS and the battery are supplied as separate goods, but a single price is charged for the combination of the goods supplied as a single contract? The West Bengal State Advance ruling authority clarified that the applicant insists that as the battery, being supplied as part of an integral contract, remains naturally bundled with UPS i.e. the principal supply is fallacious. Goods are naturally bundled in a supply contract if the contract is indivisible. The contract for the supply of a combination of UPS and battery, if not built as a composite machine, is not indivisible. The recipient can split it up into separate supply contracts if he chooses. The goods supplied in terms of such contracts are, therefore, no longer naturally bundled and cannot be treated as a composite supply though UPS and Battery are two different and independent items, they are billed together and a single price is quoted for the sale. The supply of UPS and Battery is to be considered as Mixed Supply within the meaning of Section 2(74) of the GST Act, as they are supplied under a single contract at a combined single price. Mr V.V. Sampathkumar 22

- 24. 23 SWITCHING AVO ELECTRO POWER LTD AAR: GST in import / High Sea Sales: The Kerala State Advance ruling authority clarified that integrated tax on goods imported into India shall be levied and collected at the point when duties of customs are levied on the said goods under Section 12 of the Customs Act, 1962 - The goods are liable to IGST when they are imported into India and the IGST is payable at the time of importation of goods. The applicant is neither liable to GST on the sale of goods procured from China and directly supplied to USA nor on the sale of goods stored in the warehouse in Netherlands, after being procured from China, to customers, in and around Netherlands, as the goods are not imported into India at any point. M/s SYNTHITE INDUSTRIES LTD AAR: Classification of skin care preparations: The Applicant argues that its skin care preparations are Ayurvedic Medicaments meant for therapeutic or prophylactic uses and put up in packaging for retail sale, therefore, said goods entirely correspond to the description of goods under HSN 3004 [serial no. 63 of Notification No. 1/2017-CT(Rate) dated 28/06/2017] and taxable under Schedule II of the GST Act. The West Bengal Advance ruling authority held that the Medicaments are not defined under the GST Act or in the First Schedule of the Customs Tariff Act, 1975, with which the GST Act has been aligned for the purpose of classification. The methods settled by the Apex Court for determining whether a product is to be classified as medicaments for fixing the tariff should be followed as the only lawful course and it is not sufficient that a skin care preparation, manufactured following a formula in an authoritative textbook of Ayurveda, helps in controlling skin disease. Its curative or preventive value must be substantial, and the product must be manufactured primarily to control or cure a skin-related disease. Only the products, Rupam (Pimple pack) and Pailab (Anti-crack cream) of the list of applicant’s 33 products are offered for treatment or prevention of specific skin disorders. The other products are either already specified under heading 3304 (like talcum powder, sunscreen, moisturising lotion etc.) and, therefore, cannot be considered for inclusion under heading 3004. The remaining products mentioned in the list submitted by them are not offered primarily as medicaments and, therefore, not to be included under heading 3004. AKANSHA HAIR SKIN CARE HERBAL UNIT PVT LTD AAR Supply of food to employees, taxable?:The Kerala State Advance ruling authority clarified that even though there is no profit as claimed by the applicant on the supply of food to its employees, there is “supply” and the applicant would come under the definition of “Supplier” - Since the applicant recovers the cost of food from its employees, there involves a ‘consideration’ as defined in Section 2(31) of the Act - recovery of food expenses from the employees for the canteen services provided by company would come under the definition of ‘outward supply’ as defined in Section 2(83) of the Act and therefore, taxable as a supply of service under GST. M/s CALTECH POLYMERS PVT LTD AAR Rate of tax of standing rubber trees: In this case, under the contract of supply, growing crops i.e., rubber trees are agreed to be severed before supply and hence, comes under the definition of ‘goods’. Thus, standing rubber trees no longer remain as such. Therefore, it can only be treated as ‘wood in rough form’. In GST, firewood is exempted as per HSN Code 4401. The Kerala State Advance ruling authority clarified that the rate of tax on rubber wood in the said transaction is 18% under the HSN 4403.SRI. N.C. VARGHESE, THRISSUR AAR Export of services or not?: In the case of Export of Services all the conditions as laid down under Section 2(6) of IGST Act is to be followed in totality without any violation, and that there is no scope of partial compliance of the conditions laid down therein. The Applicant is facilitating recruitment / enrolment of students to foreign Universities. If promotion of university courses were the principal supply, the applicant should have been remunerated for its promotional activity no matter whether it facilitates recruitment or not. If the Applicant receives ‘commission’ based on

- 25. recruitment / enrolment through it, the principal supply is clearly facilitating the foreign university in recruitment/enrolment with promotional services ancillary to the principal supply. The West Bengal State advance ruling authority states that being an intermediary service provider, the place of the Applicant’s supply shall be determined under section 13(8)(b) ofthe IGST Act and not under section 13(2) of the IGST Act. The place of supply under the above legal framework is the territory of India. As the condition under section 2(6)(iii) of the IGST Act is not satisfied, the Applicant’s service to the foreign universities does not qualify as Export of Services, and is, therefore, taxable under the GST Act. GLOBAL REACH EDUCATION SERVICES PVT LTD AAR, GST Registration : Applicants main income is the interest consideration received by way of interest on services like extending deposits, loans or advances. when the query whether applicant is liable for registration under any clause of Section 24 of the GST Act even if it is not making any taxable supply it was held by the West Bengal advance ruling authority that the Applicant is engaged exclusively in supplying goods and services that are wholly exempt from tax, and, therefore, not liable to be registered in accordance with the provisions under section 23(1) of the GST Act, subject to the condition that the Applicant is not otherwise liable to pay tax under the Reverse Charge mechanism under Section 9(3) of the GST Act or 5(3) of the IGST Act. JOINT PLANT COMMITTEE AAR, classification: “SIKA Block Joining Mortar” is to be classified under tariff item 3214 90 90 of the Customs Tariff Act, 1975 and taxable under serial no. 24 of Schedule IV vide Notification No. 01/2017-Central Tax (Rate) dated 28/06/2017 under CGST Act, 2017 and 1125-FT dated 28/06/2017 under WBGST Act, 2017 - As the Applicant’s product, namely ‘Sika Block Joining Mortar’ is already specified under tariff item 3214 90 90, heading 3824 does not come into the picture. SIKA INDIA PVT LTD AAR sale of goods to international passengers: Supply of goods to the International passengers going abroad by the applicant from the retail outlet situated in the Security Hold Area may be taking place beyond Customs Frontiers of India as defined under Section 2(4) of the IGST Act, 2017. However, the said outlet is not outside India but the same is within the territory of India as defined under Section 2(56) of the CGST Act, 2017 and Section 2(27) of the Customs Act, 1962 and hence the applicant is not taking goods out of India and hence the supply cannot be called “export” under Section 2(5) of the IGST Act, 2017 or “zero rated supply” under Section 2(23) and Section 16(1) of the IGST Act, 2017. Accordingly, the Delhi State advance ruling authority concluded that the applicant is required to pay GST at the applicable rates. M/s ROD RETAIL PRIVATE LIMITED GST Implementation: Petitioner cannot urge and/or seek directions to the respondents to postpone the decision to implement GST with effect from 1.7.2017, for simple reason that levy and collection of taxes on goods and services has sanction of law. Dr. KANAGASABAPATHY SUNDARAM PILLAI Vs UNION GOVT. OF INDIA [2017] (Bom) Legal services: If in fact all legal services are to be governed by the reverse charge mechanism then there would be no purpose in requiring legal practitioners and law firms to compulsorily get registered under the CGST, IGST and/or DGST Acts. Those seeking voluntary registration would anyway avail of the facility under Section 25 (3) of the CGST Act (and the corresponding provision of the other two statutes). There is therefore prima facie merit in the contention of Petitioner that the legal practitioners are under a genuine doubt whether they require to get themselves registered under the three statutes. In the circumstances, the Court directs that no coercive action be taken against any lawyer or law firms for non-compliance with any legal requirement under the CGST Act, the IGST Act or the DGST Act till a clarification is issued by the Central Government and the GNCTD and till further orders in that regard by this Court. 24

- 26. J K MITTAL COMPANY Vs UNION OF INDIA [2017] (Del) Applicability of GST on Legal Services: Whether the recommendations of the GST Council could be modified, clarified, amended etc by a notification/notice/circular of ‘press release’, the Court held that considering the Respondents are seeking more time to address the important legal and constitutional issues, the Court directs that till further orders (i) no coercive action would be taken against advocates, law firms of advocates (ii) Any registered advocate, law firm of advocates, LLPs of advocates will not be denied the benefit of this interim order (iii) In view of the Press Release issued by the MoF, the legal position that existed under the Finance Act, 1994 as regard legal services being amenable to service tax under the reverse charge mechanism continuing even under the GST Acts, till further orders, all legal services provided by advocates, law firms of advocates, or LLPs of advocates will be continued to be governed by the reverse charge mechanism unless of course any such legal service provider wants to take advantage of input tax credit and seeks to continue with the voluntary registration under CGST Act and the corresponding provision of IGST or DGST Act. J K MITTAL COMPANY Vs UNION OF INDIA [2017] (Del) 25

- 27. 26 INTRODUCTION One of the essential requirements of the GST Laws is the determination of value on which the tax is to be levied. This is governed by section 15 of the GST Act and Chapter IV and Rules 18 to 23 of GST Rules, 2017. In this article an attempt is being made to explain the various provisions relating to valuation in a simple and understandable manner. TRANSACTION VALUE Generally the value of a supply of goods or services or both shall be the transaction value i.e the price actually paid or payable for the said supply. However this is subject to the following two conditions: The supplier and the recipient of the supply are not related The price is not the sole consideration for the supply. There are special provisions in the Rules to determine the value of supply under the above two circumstance which. We shall discuss the same at the latter part of this article. SPECIFIC INCLUSIONS AND EXCLUSIONS The Law provides that the value of supply shall include––– a. any taxes, duties, cesses, fees and charges under any law. However the taxes charged under the following Acts need not be included if charged separately by the supplier: b. Central Goods and services Tax Act, c. the State Goods and Services Tax Act, d. the Union Territory Goods and Services Tax Act and the Goods and Services Tax (Compensation to States) Act Example: The value will not include CGST, SGST, UTGST and Compensation Cess if charged separately in the invoice. However Customs Duty paid shall be added to the value as the same has been paid under a different Act other than the above four specified Acts. OF SUPPLY UNDER GST VALUATION CA. Mr J. Purushothaman Purushothaman Bhutani Co,

- 28. 27 a. any amount that the supplier is liable to pay in relation to such supply, but which has been incurred by the recipient of the supply and not included in the price actually paid. Example: If as per the terms of the agreement the supply is FOR to recipient of supply and the recipient makes the payment for freight which is subsequently reimbursed by the supplier, then the freight charges paid by the recipient shall be included in the value of supply. b. incidental expenses including commission and packing, charged by the supplier and any amount charged for anything done by the supplier in respect of the supply at the time of or before delivery of goods or supply of services. c. interest or late fee or penalty for delayed payment of any consideration for any supply; and d. subsidies directly linked to the price excluding subsidies provided by the Central Government and State Governments. The amount of subsidy shall be included in the value of supply of the supplier who receives the subsidy. e. Treatment of discounts under GST: Discounts may be given either at the time of supply or after the supply has been effected. If the discount is given at the time of supply and if the same has been duly recorded in the invoice issued then the same need not be included in the value of supply. If the discount is given after the supply has been effected, (for example quantity discount/scheme discount etc.) the taxable person can take credit for the same if the following conditions are satisfied. i Such discount is in terms of an agreement entered into at or before the time of such supply ii Such discount is specifically linked to the relevant invoices iiiThe input tax credit attributable to the discount has been reversed by the recipient of supply. RULES FOR DETERMINATION OF VALUE OF SUPPLY UNDER SPECIAL CIRCUMSTANCES We have seen earlier that there are two exceptions for considering the transaction value as the value of supply. These are 1. The price is not the sole consideration for the supply. 2. Where The supplier and the recipient of the supply are not related Before proceeding to analyse the various provisions relating to the above, we should understand the meaning of two terms a) open market value and b) supply of goods or services or both of like kind and quality as these two terms are frequently used. “open market value” of a supply means the full value in money. The open market value shall not include the integrated tax, central tax, State tax, Union territory tax and the cess payable by a person in a transaction. The supplier and the recipient of the supply should not be related. The price is the sole consideration, to obtain such supply at the same time when the supply being valued is made. “supply of goods or services or both of like kind and quality” means any other supply of goods or services or both made under similar circumstancesthat,inrespectofthecharacteristics, quality, quantity, functional components, materials, and reputation of the goods or services or both , is the same as, or closely or substantially resembles, that supply of goods or services or both Determination of value of supply, where consideration is not wholly in money. a. If open market value is available , the value of the supply shall be the open market value of such supply; Example: Where a new phone is supplied for Rs.20000 along with the exchange of an old phone and if the price of the new phone without exchange is Rs.24000, the open market value of the new phone is Rs 24000. b. if open market value is not available, the value of supply shall be, the sum total of consideration in money and any such further amount in money as is equivalent to the consideration not in money if such amount is known at the time of supply;

- 29. 28 Example: Where a laptop is supplied for Rs.40000 along with a barter of printer that is manufactured by the recipient and the value of the printer known at the time of supply is Rs.4000 but the open market value of the laptop is not known, the value of the supply of laptop is Rs.44000. c. if the value of supply is not determinable under clause (a) or clause (b), the value of the supply shall be the value of supply of goods or services or both of like kind and quality; d. if value is not determinable under clause (a) or clause (b) or clause (c), above, Where the value of a supply is not determinable as above , the same shall be determined as provided in the following order. i Tthe value shall be one hundred and ten percent of the cost of production or manufacture or cost of acquisition of such goods or cost of provision of such services. ii. The value shall be determined using reasonable means consistent with the principles and general provisions of section 15 and the rules However the supplier of service may opt for method ii above disregarding method i. Determination of Value of supply of goods or services or both between distinct or related persons: Meaning of distinct person Section 25(4) and section 25 (5) defines a distinct person. Section 25 (4) A person who has obtained or is required to obtain more than one registration, whether in one State or Union territory or more than one State or Union territory shall, in respect of each such registration, be treated as distinct persons for the purposes of this Act. Section25 (5) Where a person who has obtained or is required to obtain registration in a State or Union territory in respect of an establishment, has an establishment in another State or Union territory, then such establishments shall be treated as establishments of distinct persons for the purposes of this Act. In short an entity which has taken independent registration in respect of its branches whether within the state or across various various states shall be treated as a distinct person. Meaning of Related persons In the following situations the supplier and recipient shall be deemed o be “related persons” (i) such persons are officers or directors of one another’s businesses; (ii) such persons are legally recognised partners in business; (iii) such persons are employer and employee; (iv) any person directly or indirectly owns, controls or holds twenty-five per cent or more of the outstanding voting stock or shares of both of them; (v) one of them directly or indirectly controls the other; (vi) both of them are directly or indirectly controlled by a third person; (vii) together they directly or indirectly control a third person; or (viii) they are members of the same family; (ix) persons who are associated in the business of one another in that one is the sole agent or sole distributor or sole concessionaire, howsoever described, of the other, shall be deemed to be related. Value of supply of goods or services or both between distinct or related persons, other than through an agent (a) Value shall be the open market value of such supply; (b) if open market value is not available, value shall be the value of supply of goods or services of like kind and quality; (c) if value is not determinable under clause (a) or (b), be the value shall be as determined by application of the following rule in that order: i Tthe value shall be one hundred and ten percent of the cost of production or manufacture

- 30. 29 or cost of acquisition of such goods or cost of provision of such services. ii. The value shall be determined using reasonable means consistent with the principles and general provisions of section 15 and the rules However the supplier of service may opt for method ii above disregarding method However where the goods are intended for further supply as such by the recipient, the value shall, at the option of the supplier, be an amount equivalent to ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer, who is not a related person to the recipient. Similarly where the recipient is eligible for full input tax credit, the value declared in the invoice shall be deemed to be the open market value of goods or services. Value of supply of goods made or received through an agent (i) shall be the open market value of the goods being supplied, or (ii) at the option of the supplier, be ninety percent of the price charged for the supply of goods of like kind and quality by the recipient to his customer. The customer to whom the agent supplies the goods should not be a related person to the agent. Illustration:Whereaprincipalsuppliesgroundnut to his agent and the agent is supplying groundnuts of like kind and quality in subsequent supplies at a price of Rs.5000 per quintal. Another independent supplier is supplying groundnuts of like kind and quality to the said agent at the price of Rs.4550 per quintal. The value of the supply made by the principal shall be Rs.4550 per quintal or where he exercises the option the value shall be 90% of the Rs.5000 i.e. is Rs.4500 per quintal. Where the value of a supply is not determinable as above, the same shall be determined as provided in the following order. i Tthe value shall be one hundred and ten percent of the cost of production or manufacture or cost of acquisition of such goods or cost of provision of such services. ii. The value shall be determined using reasonable means consistent with the principles and general provisions of section 15 and the rules DETERMINATION OF VALUE IN RESPECT OF CERTAIN SPECIFIED SUPPLIES: Special provisions in respect of certain categories of supplies: The Rule 6 provides for determination of value of supply in respect of certain categories of supplies. These categories of supplies are a. Lottery, betting,gambling and horse racing b. Services provided by Foreign exchange dealers c. Services provided by the Air travel agent for Booking of tickets for travel by air d. value of supply of services in relation to life insurance business e. Value of Supply by a person dealing in second hand goods i.e. used goods f. Value of Token, Voucher etc. g. Residuary provisions Now let us analyse provisions relating to the above supplies individually. Lottery, betting,gambling and horse racing For the purpose of determination of value Lottery is divided into two categories: 1. Lottery run by State Governments 2. Lottery authorised by State Govern ments. The meaning of the above two terms are as follows: (a) “lottery run by State Governments” means a lottery not allowed to be sold in any State other than the organizing State; (b) “lottery authorised by State Governments” means a lottery which is authorised to be sold in State(s) other than the organising State also; and The value of supply shall be determined as follows:

- 31. 30 (a) The value of supply of lottery run by State Governments shall be deemed to be 100/112 of the face value of ticket or of the price as notified in the Official Gazette by the organising State, whichever is higher. (b) The value of supply of lottery authorised by State Governments shall be deemed to be 100/128 of the face value of ticket or of the price as notified in the Official Gazette by the organising State, whichever is higher. a. The value of supply in betting, gambling or horse racing in a shall be 100% of the face value of the bet or the amount paid into the totalisator. b. Services provided by Foreign exchange dealers Suppliers of the above services have got two options: Option 1 The value of supply of services in relation to purchase or sale of foreign currency, shall be determined in the following manner:- If RBI reference rate is available For a currency, when exchanged from, or to, Indian Rupees (INR), the value shall be equal to the difference in the buying rate or the selling rate, and the Reserve Bank of India (RBI) reference rate for that currency at that time, multiplied by the total units of currency: If RBI reference rate is not available the value shall be 1% of the gross amount of Indian Rupees provided or received by the person changing the money: If neither of the currencies is exchanged in Indian Rupee, the value shall be equal to 1% of the lesser of the two amounts the person changing the money would have received by converting any of the two currencies into Indian Rupee Option II This option is to be exercised for a financial year. Option once exercised cannot be withdrawn during the remaining part of the financial year The value shall be deemed to be (i) one per cent. of the gross amount of currency exchanged for an amount up to one lakh rupees, subject to a minimum amount of two hundred and fifty rupees; (ii) one thousand rupees and half of a per cent. of the gross amount of currency exchanged for an amount exceeding one lakh rupees and up to ten lakh rupees; and (iii) five thousand rupees and one tenth of a per cent. of the gross amount of currency exchanged for an amount exceeding ten lakh rupees, subject to maximum amount of sixty thousand rupees. Services provided by the Air travel agent for Booking of tickets for travel by air The value of supply In the case of domestic booking shall be deemed to be an amount calculated at the rate of five percent. of the basic fare The value of supply in the case of international bookings at the rate of ten per cent. of the basic fare For the above purpose the term “basic fare” means that part of the air fare on which commission is normally paid to the air travel agent by the airline. d). value of supply of services in relation to life insurance business: (a) the gross premium charged from a policy holder reduced by the amount allocated for investment, or savings on behalf of the policy holder, if such amount is intimated to the policy holder at the time of supply of service; (b) in case of single premium annuity policies other than (a), ten per cent. of single premium charged from the policy holder; or (c) in all other cases, twenty five per cent of the premium charged from the policy holder in the first year and twelve and a half per cent of the premium charged from policy holder in subsequent years: However the above provisions shall not apply where the entire premium paid by the policy holder is only towards the risk cover in life insurance. e Value of Supply by a person dealing in second hand goods i.e. used goods

- 32. 31 This provision is applicable only when the goods are sold as such. However minor processing which does not change the nature of the goods is permitted. The value of supply shall be the difference between the selling price and purchase price . Where the value of such supply calculated as above is negative it shall be ignored. No input tax credit is allowed on purchase of such goods. Where the goods are repossessed from a defaulting borrower, who is not registered, for the purpose of recovery of a loan or debt, the purchase value shall be deemed to be the purchase price of such goods by the defaulting borrower reduced by five percentage points for every quarter or part thereof, between the date of purchase and the date ofdisposalbythepersonmakingsuchrepossession. f. Value of Token, Voucher etc. The value of a token, or a voucher, or a coupon, or a stamp (other than postage stamp) which is redeemable against a supply shall be equal to the money value of supply redeemable against such token, voucher, coupon, or stamp. g Residuary provisions The government has retained power to notify that the value of certain services shall be NIL. However the the services in respect of which input tax credit is not available u/s 17(5) is out of this perview. However this could be done only on the recommendations of the Council. Value of supply of services in case of pure agent Generally all reimbursements are taxable as supplies. However if one claims reimbursement as pure agent the same is excluded from the value of supply subject to various conditions specified. For the purpose of claiming this exclusion one has to understand the meaning of “Pure Agent” The term “Pure Agent” has been defined to mean a person who (a) enters into a contractual agreement with the recipient of supply to act as his pure agent to incur expenditure or costs in the course of supply of goods or services or both; (b) neither intends to hold nor holds any title to the goods or services or both so procured or provided as pure agent of the recipient of supply; (c) does not use for his own interest such goods or services so procured; and (d) receives only the actual amount incurred to procure such goods or services. The expenditure or costs incurred by the supplier as a pure agent of the recipient of supply of services shall be excluded from the value of supply, if all the following conditions are satisfied:- the supplier acts as a pure agent of the recipient of the supply, when he makes the payment to the third party on authorisation by such recipient; the payment made by the pure agent on behalf of the recipient of supply has been separately indicated in the invoice issued by the pure agent to the recipient of service; and the supplies procured by the pure agent from the third party as a pure agent of the recipient of supply are in addition to the services he supplies on his own account. Illustration. Corporate services firm A is engaged to handle the legal work pertaining to the incorporation of Company B. Other than its service fees, A also recovers from B, registration fee and approval fee for the name of the company paid to Registrar of the Companies. The fees charged by the Registrar of the companies registration and approval of the name are compulsorily levied on B. A is merely acting as a pure agent in the payment of those fees. Therefore, A’s recovery of such expenses is a disbursement and not part of the value of supply made by A to B. Where Value of supply inclusive of integrated tax, central tax, State tax, Union territory tax.- Where the value of supply is inclusive of integrated tax or, as the case may be, central tax, State tax, Union territory tax, the tax amount shall be determined in the following manner, namely,- Tax amount = (Value inclusive of taxes X tax rate in % of IGST or, as the case may be, CGST, SGST or UTGST) ÷ (100+ sum of tax rates, as applicable, in %)

- 33. The truth is actually that anyone can be 68 going on 50. All you need is a motivational mindset. Then you, too, can start counting the calendar backwards at each birthday. Beyond good diet and exercise – which are critical for anyone at any age – getting motivated is the key to aging well. Here are five ways to adopt a motivational mindset, launch your own age rollback and engage the world at any age: 1. Change your WOE to WOW ratio- There›s nothing more de-motivating than living in a world of WOE (which is an acronym that stands for What On Earth). The world of WOE is dark and consists largely of finding fault and blame. WOE is like a leech that sucks the life spirit out of you. Its opposite, WOW (which means Wonderfully Obsessed with Winning) infuses every moment with excitement about the world. WOW is that frame of mind that motivates you to fully embrace whatever you’re doing. No, you can’t get rid of WOE -- it’s part of the human condition. But you can choose to minimize the presence of WOE and focus on WOW; the key is to become more aware of WOE’s presence and to consciously opt for WOW. Try it. Keep a notebook of how much time you spend in a WOE state versus a WOW state. Then set a goal to focus on WOW for 15 minutes as you start your day. Soon, it will become a habit, and you won’t even have to think about it. 2. Get curious - Many studies have shown the more you flex your mind as you age, the healthier your mind will be. In addition to engaging in brain-cell building activities like puzzles, ask questions about how things work and why things are. Nothing motivates like a good question. Find a headline story each day that you want to learn more about. Find a topic each week that you want to research through books or using online resources. Adopt the curiosity of a child. The more new things you learn, the more you’ll be motivated to discover new areas of interest. 3. Invest in the moment - It›s so easy to look back with regrets or nostalgia that we forget to see the joy of what›s happening in the present. Ditto for spending time Author Mr S. Prakash, CEO of See Change Consulting Age Backwards 32