April 2009 Philadelphia Housing Market

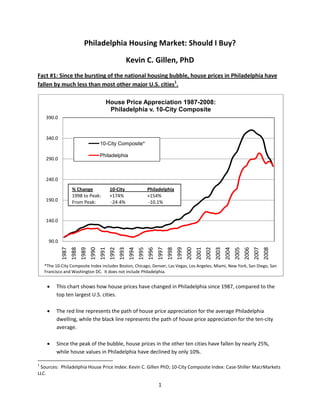

- 1. Philadelphia Housing Market: Should I Buy? Kevin C. Gillen, PhD Fact #1: Since the bursting of the national housing bubble, house prices in Philadelphia have fallen by much less than most other major U.S. cities1. House Price Appreciation 1987-2008: Philadelphia v. 10-City Composite 390.0 340.0 10-City Composite* Philadelphia 290.0 240.0 % Change 10-City Philadelphia 1998 to Peak: +174% +154% 190.0 From Peak: -24.4% -10.1% 140.0 90.0 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 *The 10-City Composite Index includes Boston, Chicago, Denver, Las Vegas, Los Angeles, Miami, New York, San Diego, San Francisco and Washington DC. It does not include Philadelphia. This chart shows how house prices have changed in Philadelphia since 1987, compared to the • top ten largest U.S. cities. The red line represents the path of house price appreciation for the average Philadelphia • dwelling, while the black line represents the path of house price appreciation for the ten-city average. Since the peak of the bubble, house prices in the other ten cities have fallen by nearly 25%, • while house values in Philadelphia have declined by only 10%. 1 Sources: Philadelphia House Price Index: Kevin C. Gillen PhD; 10-City Composite Index: Case-Shiller MacrMarkets LLC. 1

- 2. Fact #2: Compared to most other U.S. cities, Philadelphia is near the bottom of the range of house price declines2. Cumulative %Decline in House Prices from Peak 0.0% -5.0% -4.6% -5.8% -8.0% -10.0% -10.1% -10.8% -11.4% -11.9% -11.9% -12.2% -12.8% -15.0% -13.7% -20.0% -20.7% -25.0% -26.3% -30.0% -30.5% -32.2% -35.0% -34.4% -36.1% -36.4% -40.0% -38.3% -39.3% -40.6% -45.0% This chart shows how much house prices have fallen in large U.S. cities from their peak, since • the bursting of the housing bubble. House prices in Philadelphia have declined by an average of 10.1% since their peak in 2006. • Compared to Philadelphia, seventeen cities have had larger cumulative price declines, while only • three cities have had smaller cumulative price declines. At the most extreme, house prices in the sunbelt cities of Phoenix, Las Vegas, Miami and San • Diego have fallen by over 30%. This is more than three times greater than house prices in Philadelphia have declined. 2 Sources: Philadelphia: empirically estimated by Kevin C. Gillen PhD; All other cities courtesy Case-Shiller MacroMarkets LLC. 2

- 3. Fact #3: House prices in Philadelphia are not expected to decline much further3. Housing: Percent Over/Under-valued, by Mid- Atlantic City Atlantic City NJ 43% Vineland NJ 30% Ocean City NJ 23% York PA 18% Dover DE 18% Camden NJ 10% Reading PA 9% Allentown PA 9% Lancaster PA 9% Baltimore 9% Washington, D.C. 8% Harrisburg PA 7% Scranton PA 6% Lebanon PA 5% Philadelphia PA 2% Wilmington DE 2% Newark NJ 1% -2% York NY New -5% Trenton NJ -10% Pittsburgh PA -20% -10% 0% 10% 20% 30% 40% 50% This chart ranks cities in the Mid-Atlantic by the degree to which their housing stock is currently • considered over- or under-valued. The ranking is obtained by comparing local house prices in each city to their fundamental drivers, such as rents, population growth and incomes. Currently, Philadelphia’s housing is considered over-valued by just 2%. • By contrast, homes in the South Jersey markets of Atlantic City, Ocean City and Vineland are • considered over-valued by more than 20%. This suggests that house prices in Philadelphia are not expected to decline by much further, if at • all. 3 Source: NationalCity/GlobalInsight, Dec. 2008. 3

- 4. Fact #4: Philadelphia has experienced significantly less foreclosure activity than other large U.S. cities4. Foreclosure Rates by U.S. Metro Area as of 2008Q4 STOCKTON LAS VEGAS/PARADISE RIVERSIDE/SAN BERNARDINO PHOENIX/MESA MIAMI DETROIT/LIVONIA/DEARBORN SAN DIEGO ATLANTA/SANDY SPRINGS/MARIETTA DENVER/AURORA WASHINGTON DC LOS ANGELES/LONG BEACH CHICAGO NEWARK CAMDEN ST LOUIS BOSTON/QUINCY DALLAS BALTIMORE/TOWSON SAN FRANCISCO PHILADELPHIA PITTSBURGH WILMINGTON DE BUFFALO NEW YORK/WAYNE/WHITE PLAINS SCRANTON/WILKES/BARRE/HAZLETON ALLENTOWN/BETHLEHEM/EASTON 0.00% 2.00% 4.00% 6.00% 8.00% 10.00% This chart ranks major U.S. cities by their current foreclosure rate. The foreclosure rate • is computed as the percent of all households in a metropolitan which are in the process of foreclosure. As of 2008Q4, less than one percent of all households in the Philadelphia region were in • foreclosure. This is a fraction of what the foreclosure rate is in cities that have experienced severe • house price declines, such as Las Vegas (9%), Phoenix (6%), Miami (5%) and Detroit (4.5%). This suggests a relatively stable outlook for house prices in Philadelphia. • 4 Source: www.realtrytrac.com 4

- 5. Fact #5: The decline in Philadelphia’s house prices has actually made homes more affordable—and hence more accessible5. Philadelphia Housing Affordability* Index: 1980-2008 2.75 2.50 2.25 2.00 1.75 1.50 1.25 1.00 0.75 0.50 1980 1981 1982 1983 1984 1985 1986 1987 1988 1989 1990 1991 1992 1993 1994 1995 1996 1997 1998 1999 2000 2001 2002 2003 2004 2005 2006 2007 2008 This chart plots the affordability of the average Philadelphia home to the average Philadelphia • households. Affordability is measured as the ratio of the average Philadelphia house price to the to the average Philadelphia family income. High values of the index mean that housing has become less affordable to the average Philadelphian. At the peak of the bubble in 2006, the typical Philadelphia home had a price that was more than • 2.5 times the typical Philadelphia household income. Currently, the typical Philadelphia home has a price that is only 2.25 times the typical Philadelphia household’s income. Since local house prices have fallen by more than local incomes in recent years, more homes • have moved into the range of affordability for more Philadelphia households. 5 Sources: Kevin C. Gillen PhD, U.S. Bureau of Labor Statistics. 5

- 6. Fact #6: There is still an above-average supply of homes for Philadelphia homebuyers to choose from6. Philadelphia Houses Listed For Sale: Inventory v. Sales Rate 14,000 30.0% # Houses Listed For Sale % Sold 12,000 25.0% # Homes Listed quot;For Salequot; %Sold = (#Sales/#Listings) 10,000 20.0% 8,000 15.0% 6,000 10.0% 4,000 5.0% 2,000 0 0.0% This chart shows the number of homes in Philadelphia listed “For Sale” in every month since • 2001, as represented by the red bars. The blue line represents the percent of homes listed for sale that actually sold in each month. Since 2005, inventories of listed homes have doubled from their historical average. As the • supply of homes has risen faster than the number of buyers, the rate at which homes have sold has plummeted from their pre-bubble peak. Although there remain more homes for sale than buyers, the supply of listed homes has begun • to fall in recent months. This suggests that, while there still remains an above-average supply of homes for buyers to • choose from, this has begun to change in favor of sellers. 6 Source: TrendMLS, courtesy of www.developphilly.com 6

- 7. Summary: House price declines have been very modest in Philadelphia compared to other U.S. cities. • Most other U.S. cities have experienced house price declines of a significantly larger magnitude • than Philadelphia has. Independent analysis suggests that the typical Philadelphia house is fairly valued, with no • expectation of large future declines. Philadelphia’s foreclosure rate remains well below that of other large U.S. cities. • The modest decline in Philadelphia house prices that has occurred has actually made more • homes more affordable to more households. While the above-average number of homes listed for sale still gives buyers plenty to choose • from, this has begun to recently change direction. Taken collectively, the facts suggest that Philadelphia’s housing market is much more stable than many other U.S. cities. There is little evidence to suggest that Philadelphia has or will experience the dramatic price declines that many other markets have. While the current supply of homes does exceed the current number of willing and able buyers, supply is currently declining. This suggests that probability of dramatic future price declines is relatively small, while the probability of fewer homes to choose from is growing. Combined with the fact that mortgage rates are at historic lows, there is little evidence to indicate that there are any significant advantages to waiting to buy a home in Philadelphia in the current market. 7