Kimble Johnson – Proactive Advisor Magazine – Volume 3, Issue 1

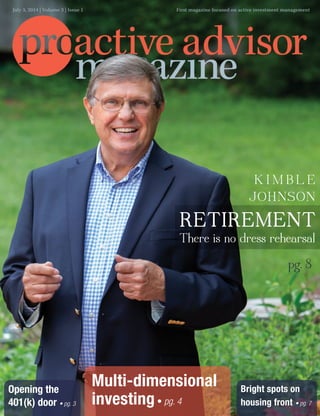

- 1. Bright spots on housing front • pg. 7 Opening the 401(k) door • pg. 3 Multi-dimensional investing• pg. 4 July 3, 2014 | Volume 3 | Issue 1 First magazine focused on active investment management pg. 8 K I M B L E JOHNSON RETIREMENT There is no dress rehearsal

- 3. wealth management needs, which can be closely intertwined with their business. This establishes a holistic financial plan from insurance needs, to tax reduction strategies, to estate planning to asset management. You need to do what you say you will do with respect to servicing the quali- fied plan for the company. You will be directly in front of the decision-maker in these companies as you acquire and service the plan, which provides a wonderful opportunity to build a trusting relationship. Once they have seen how you can help them in their business and personal planning, don’t hesitate to ask for referrals.” n more than twenty years of experience in the advisory business, working with owners of closely held corporations has proven to be a great way to grow my business. I have found over time that there can be multiple benefits of working with business owners. We target companies in a broad range of 25-400 employees. We reach out to target companies in a number of ways: cold-calling, referrals from centers of influence, and current client referrals.One of our largest clients came in through an old-fashioned cold call. After the initial contact, we see if we can build a relationship that can lead to handling their company’s 401(k) needs. We have strong relationships with third-party administrators, insurance companies, and asset managers. That important relationship with a TPA needs to be a two-way street. If you expect them to work with you and refer business to you,you need to do the same. They want to work with advisors who specialize in qualified plans and will deliver a value-added service, making the client’s life and their job easier. Once a company’s 401(k) needs are being met, we try to expand that relationship with the business principal by handling their personal Opening the 401(k) door Daniel Namey Jacksonville, FL H. Beck, Inc. President, Namey Financial Group, Inc. I“ Securities and investment advisory services offered through H. Beck, Inc., member FINRA/SIPC and an SEC-registered invest- ment advisor. H. Beck, Inc. and Namey Financial Group, Inc. are not affiliated. Investments will fluctuate and when redeemed may be worth more or less than when originally invested. Read text only VOTE 20% 40% 60% 80% Last week’s results VIEWER RESPONSE Which client information is most helpful in determining risk tolerance? -Results in next issue This week’s poll How many advisors are actively seeking younger clients to replace older clients or those in “decumulation” phase? Answer: Investment experience A client’s previous investment experience is integral to determining a client’s risk tolerance, as are liquidity requirements, investment time frame, current investments, and expected return on investment. 67% 0%33% Spending habits Investment experience Tax situation July 3, 2014 | proactiveadvisormagazine.com 3 POLLS TIPS & TOOLS

- 4. The question comes up frequently: “What is active management?” Many confuse the phrase with the simple act of running a mutual fund populated with stock picks within the strict guidelines of a prospectus, as opposed to running an index fund, where the manager simply buys and holds the shares making up a particular stock or bond index. While there may be other definitions that have equal merit, I would look at the question in a different way, with active management being a means to adding multi-dimensionality to one’s investing to better reach one’s goals. We are often told to “be a ‘buy-and-hold’ investor.” Yet, while the phrase “buy-and-hold” is two words linked together by a connector, that single conjunction “and” does not give the phrase dimensionality. Buy and hold, in its purest form, has zero dimensionality— you buy. “Holding” is not a word of action. Following this ap- proach is passive investing in its purest form. Does your investing suffer from a lack of dimensionality? By Jerry Wagner proactiveadvisormagazine.com | July 3, 20144 Read text only

- 5. Graphically, zero dimensionality is a dot. It has no length, width, or height—it’s only a dot, just like the period at the end of this sentence. Like the period, it can appear at any place on a page—high or low. Like the return from a buy-and-hold Most investors are one-dimensional investors. They buy and … they sell. Both verbs denote activity—buying and selling. That makes most investors active investors. While passive investors often focus only on the state of the investment itself without dimension (i.e. the factors about the investment that caused them to buy in the first place), active investors view investing in at least a one-dimensional state. in making his or her buy and sell decisions. The market envi- ronment can actually alter the length of time that one holds the investment, whether you buy or sell at all, or even whether you reverse the process and sell short to benefit from a current or impending downturn. Dynamic, risk-managed investing is many steps beyond the simple act of buying and selling. A lot more is going on. Basic, or one-dimensional active managers have factors that influence when to buy—just like the buy-and-hold investor—but continue on pg. 11 investment, it just is. It’s the return of the underlying index and that’s all there is. When the S&P is up, like it was in 2013, for example, the dot is higher. When it’s down 55%, like it was in 2007-2008, that’s all she wrote—you get what you see. No longer just a “dot,” a one-dimensional line consists of at least two dots. They focus on both buy and sell factors. Still, they differ further. Some buy and then sell after a long time, while others buy and then, within a fairly short time, they sell. One-dimensional investing, then, is like a line. And that line can be long or short. Zero Dimensions One Dimension Two Dimensions Three Dimensions To graduate to two-dimensional investing, as one would in drawing, where length and height are combined to form a square, one must add another component and look at direction. A two-dimensional investor, then, considers market direction, or the prevailing direction of prices of the individual securities, Dynamic, risk-managed investing adds a whole new di- mension: risk management. Dynamic, risk-managed invest- ing is like a cube. It’s three-dimensional. It has width, length, and height. July 3, 2014 | proactiveadvisormagazine.com 5

- 6. An investor should consider the investment objectives, risks, charges, and expenses of The Gold Bullion Strategy Fund before investing. This and other information can be found in the Fund’s prospectus, which can be obtained by calling 1-855-650-7453. The prospectus should be read carefully prior to investing. There is no guarantee that The Gold Bullion Strategy Fund will achieve its investment objectives. Flexible Plan Investments, Ltd., serves as investment sub-advisor to The Gold Bullion Strategy Fund, distributed by Ceros Financial Services Inc. (member FINRA). Ceros Financial Services, Inc. and Flexible Plan Investments, Ltd. are not affiliated entities. Advisors Preferred, LLC is the Fund’s investment adviser. Advisors Preferred, LLC is a wholly-owned subsidiary of Ceros Financial Services, Inc. The principal risks of investing in The Gold Bullion Strategy Fund are Risk of the Sub-advisor’s Investment Strategy. Risks of Aggressive Investment Techniques, High Portfolio Turnover, Risk of Investing in Derivatives, Risks of Investing in ETFs, Risks of Investing in Other Investment Companies, Leverage Risk, Concentration Risk Gold Risk, Wholly-owned Corporation Risk, Risk of Non-Diversification and Interest Rate Risk. “Gold Risk” includes volatility, price fluctuations over short periods, risks associated with global monetary,economic,social and political conditions and developments,currency devaluation and revaluation and restrictions,and trading and transactional restrictions. For more information on the risks of The Gold Bullion Strategy Fund, including a description of each risk, please refer to the prospectus. The Gold Bullion Strategy Fund (QGLDX) offers your investors access to gold bullion in a mutual fund format. Launched in 2013, the fund is designed to: • Diversify a portfolio with a strategic allocation to gold • Offer a purer play on gold • Provide a more cost-effective way to own gold with Form 1099 reporting To learn more, please download Flexible Plan Investments’ white paper, The Role of Gold in Investment Portfolios at www.goldbullionstrategyfund.com/white-paper A fresh take on an enduring alternative www.goldbullionstrategyfund.com Fund gross estimated annual operating expenses = 1.55%

- 7. 504 0 200 400 600 800 1000 1200 1400 1600 ‘90 ‘92 ‘94 ‘96 ‘98 ‘00 ‘02 ‘04 ‘06 ‘08 ‘10 ‘12 ‘14 Highest reading since April 2008 Units(InThousands) Bright spots on the housing front ast week’s 1st Qtr. GDP revision to a fairly shocking -2.9% was the lowest non- recession reading since 1947. While markets briefly waffled in the face of this news, by and large it was taken in stride as a backward- looking measure. In similar fashion, Case-Shiller figures showing an April slowing of the rate of home price increases was similarly discounted last week as being effectively two-month-old data. The more timely May readings of existing and new home sales both ex- ceeded market expectations, the latter by a wide margin. Existing home sales for May came in at 4.9 million units, beating consensus by 3%. According to Bespoke Investment Group, new home sales in May “not only beat estimates, they shot the lights out.” The 504K units of new home sales exceeded the consensus forecast by nearly 15%. Bespoke notes that, “The month/month in- crease of 18.6% for May was the larg- est monthly increase since January 1992 and the 10th largest increase in the last 50-plus years.” The median sales price for homes sold during the L Source: Bespoke Investment Group month was $282,000. The average price was $319,200. Further good news on the housing front came in on Monday (June 30), with the release of pending home sales data. The pending home sales index rose sharply in May (+6.1%), with lower mortgage rates and increased inventory accelerating the market, according to the National Association of Realtors. All four regions of the country saw increases in pending sales, with the Northeast and West experiencing the largest gains. Many analysts are cautiously opti- mistic that this better-than-expected data signifies that housing’s early 2014 sluggishness was indeed largely attributable to the poor weather across much of the nation. However, the still lackluster indicators of new mortgage application activity (and approv- als)—especially for middle income buyers—remains a concern. NEW HOME SALES: 1990–2014 July 3, 2014 | proactiveadvisormagazine.com 7 TOPPING THE CHARTS Read text only

- 8. K I M BL E J O H NS ON RETIREMENT There is no dress rehearsal Rebuilding and protecting retirement assets takes center stage with Kimble Johnson. New strategies and investment vehicles are a must—and third-party active managers are the experts he calls. D D 8 proactiveadvisormagazine.com | July 3, 2014 Read text only

- 9. My overriding concern is that my clients have their retirement expenses covered by “guaranteed” income sources, such as from Social Security, pensions and/or annuities. I will usually recommend that the remainder of my clients’ assets be deployed for growth to offset inflation as much as possible. What are the issues you see with retire- ment planning for your clients? The retiree of today is handed a great deal of retirement risk as well as the prospect of navigating a “Brave New World” of investing post 2008. The changeover in our lifetime from defined benefit to defined contribution retirement plans is a prime contributor. The old assumptions and the old tools will no longer work, and I personally think anyone trying to go it alone is facing a tough road. The rebuilding and protection of retirement assets is the most critical task. It requires new strategies and investment vehicles that can transfer or reduce some of the risks. What are those risks? There are really three that I speak about with clients and prospects all of the time. First, there is longevity risk. This is not exactly rocket science or unknown to people, but the implications are seldom well-planned for. Through medical advances and healthier lifestyles, life expectancies keep increasing. Great news for people in general, not so great if not factored into their financial plans. Second, there is market risk. I talk about this in a couple different ways: the so-called “sequence-of-returns risk”: the unlucky event of suffering poor market returns early in retire- ment; and “portfolio risk”: taking on too much risk and sacrificing safety for higher potential income, or alternatively, taking on too little risk and sacrificing potential portfolio growth. Third, and closely related to the first two, is inflation risk. This again is a concept most people understand on a surface level: the poten- tial of inflation to erode their purchasing power. What they generally do not understand is that every retirement portfolio should account for this with a growth component to their planning. What is the solution to these risks? I tell clients that in retirement there are no dress rehearsals. All of these risks have to be considered and planned for. However, over the course of my career I have been involved with just about every aspect of the investment and financial planning business. I have come to believe that traditional buy-and-hold approaches to asset allocation and investment management are flawed. They are the antithesis to active investment manage- ment, where the monitoring of current market conditions is strongly factored into strategies. I am a believer in identifying and managing for risk. That is what active management is all about, so it fits nicely with my world view, as well as my investment philosophy. How do you employ active management on behalf of clients? First of all, there is not just a one-size-fits-all solution. And there might be as many unique slants to active management as there are active managers. Going back to my medical analogy, I feel that I need to have access to all of the finan- cial solutions out there, just as a doctor needs to have access to the latest medical theories and technologies. And like a doctor might call on specialists, I can use active managers who are experts at what they do: monitoring markets, strategies and performance every day. I am also a strong advocate of variable an- nuities and have found opportunities to utilize active management within annuities. These can be fairly complicated products to the lay person, but I take great pains to explain them as simply as possible. By utilizing active management within an annuity, I believe I can deliver several different benefits to clients in one product: some guar- antees on income floors, the opportunity for asset growth, and perhaps most importantly, continue on pg. 10 D Proactive Advisor Magazine: Kimble, can you tell me a bit about your background? Kimble Johnson: I have been a financial advisor now for just over thirty years. I am the son of a doctor, who was the son of a doctor, who was also the son of a doctor. Early on I became much more interested in finance than medicine, and all of my work ex- periences have involved financial planning and investments. I have styled my practice as, and consider myself to be, a “financial physician” and a surgeon, when necessary. 9July 3, 2014 | proactiveadvisormagazine.com

- 10. M U LT I - M A R K E T + MULTI-STRATEGY + MULTI-MANAGER One p rtfolio D Y N A M I C A L LY R I S K - M A N A G E D L E A R N M O R E Past performance does not guarantee future results. The opportunity for profits carries with it the possibility of losses. 800-347-3539 | flexibleplan.com A complete list of all of our recommendations over the last 12 months and Brochure Form ADV Part 2A are available upon request. up there in years and has multiple objectives: maintaining a decent current income, estate planning for his family, and would like to see his assets grow for contributions to charities after he is gone. A pretty complex situation but I have been able to meet all of those objectives with these type of annuity programs. Thank you for the great insights Kimble. Anything you would like to add? Going back to my main theme of risk man- agement, one principle I emphasize with clients is understanding the difference between their risk tolerance and their risk capacity. People may feel comfortable with the results of a typi- cal risk questionnaire that shows them to have a certain appetite for risk. That might be called their “risk tolerance” in an academic sense. But I really like to drill down and work through the numbers with them. When the rubber hits the road, could they really stand, economically, to lose a large percentage of their investment portfolio? The answer usually is no, which is why I like the double-edged sword of risk mitigation through both annuities and active investment management within that. strong risk management. I tell clients to think about their financial assets the way they do their home. You’ve insured your $400,000 home, why wouldn’t you use some insurance, so to speak, on your $400,000 investment portfolio? I have had more than one client tell me “it sounds too good to be true.” And I tell them, “It’s not too good to be true, but it is too good to be free.” Yes, there are management fees asso- ciated with this type of approach, but in general I think they are very reasonable and the benefits far outweigh the costs over the long run. You have spoken a lot about risk. Can these actively managed annuity approaches accommodate clients with various risk profiles? Oh, yes, absolutely. While there are some restrictions placed by insurance companies as to percentages of allocation and number of trades and other things, within that there is quite a bit of flexibility. They can be appropriate for conservative clients and for those interested in a more aggressive growth stance. I have one relatively affluent client with sev- eral million dollars in annuities. He is getting continued from pg. 9 Securities and Advisory services offered through LPL Financial, a registered investment advisor. Member FINRA & SIPC. The opinions voiced in this material are for general information only and are not intended to provide specific advice or recommendations for any individual. All performance referenced is historical and is no guarantee of future results. There is no guarantee that a diversified portfolio will enhance overall returns or outperform a non-diversified portfolio. Diversification does not protect against market risk. Investing involves risk, including loss of principal. 10 proactiveadvisormagazine.com | July 3, 2014

- 11. There can be no assurance that any investment product will achieve its investment objective(s). There are risks associated with investing, including the entire loss of principal invested. Investing involves market risk. The investment return and principal value of any investment product will fluctuate with changes in market conditions. Guggenheim Investments represents the investment management businesses of Gug- genheim Partners, LLC. Securities offered through Guggenheim Funds Distributors, LLC. Guggenheim Funds Distributors, LLC is affiliated with Guggenheim Partners, LLC. x0515 #12526 Uncover the True Cost of Trading Mutual Funds and ETFs The reflexive perception that ETFs cost less, simply based on their low expense ratios, and are more cost-effective than mutual funds, is not entirely true. In addition to an expense ratio, there are additional considerations that should be considered when making an informed choice between ETFs and funds— including spreads and commissions. This informative white paper from Rydex Funds provides an in-depth look at the cost of ownership of no-transaction-fee (NTF) mutual funds and ETFs—with a focus on active investing strategies. Request your free copy. Call 630.505.3749 or visit guggenheiminvestments.com/rydex Chicago | New York City | Santa Monica Rydex Funds A Comparison of ETFs and Mutual Funds—The True Cost of Investing continued from pg. 5 add in a process for determining when to sell. Both the buy and the sell factors are quantitative (or solely numbers based)—no emotion, no subjectivity, just disciplined, mathematical investing. Intermediate-level, or two-dimensional active managers add in the directional dimension—price momentum, the potential downside, the price movement of one investment as it relates to another—all coming together to determine the position to take in an investment. Strategies can be employed that are based on following the trend, doing the opposite (mean reversion) or simply following price patterns that have historical persistency in terms of follow through. Dynamic, risk-managed investors add in yet another dimen- sion—the risk management dimension. Its three-dimensional practitioners incorporate advanced investment ingredients: the active reallocation of the position size in any investments to as small as zero, hedging, the use or avoidance of leverage, shifts to cash and bonds determined by volatility, tactical timing mea- sures, and stop loss signals. These add a whole new element of dimensionality. The result is a complete investment strategy, a strategy based on dynamic, risk-managed investing that considers not just getting invested, or just buying and selling, or even determining whether the market is moving up or down. Instead, it considers all of these el- ements plus the tools to actively preserve the investment in case bad luck or a bad strategy results in unintended losses. Finally, think of each of those dynamic, risk-managed invest- ing three-dimensional cubes, these separate dynamic, risk-man- aged strategies, as bricks. Combine them and you have the safety of a home. Bringing together actively managed strategies in a single portfolio is designed to deliver a strategically diver- sified, dynamic, risk-managed portfolio, which, like your home, is intended to weather the fourth dimension—time. Investors need the solid combination of all of the bricks to form a home, to weather the storms that roar through the finan- cial environment over a full financial cycle—the times when the markets are up and the times when they are down. Only active management, not passive holding of invest- ments, is multi-dimensional. And today, active management is available through a growing number of money managers and the advisory firms who employ their services. So whether an investor’s portfolio resembles a studio apart- ment, a modest three-bedroom home or a far more spacious property, technological innovations can now provide the same active management advantages previously available only to high-net-worth clients and institutional investors. An investor has to ask oneself, “Would I rather stand on a dot on the sidewalk out in front of my future home, or move into the multi-dimensional space inside?” The choice is up to you. Only active management, not passive holding of investments, is multi-dimensional. 11July 3, 2014 | proactiveadvisormagazine.com

- 12. The opinions and forecasts expressed herein are those of the author and may not actually come to pass. Any opinions and viewpoints regarding the future of the markets should not be construed as recommendations of any specific security nor specific investment advice. The analysis and information in this edition and on our website is for informational purposes only. No part of the material presented in this edition or on our websites is intended as an investment recommendation or investment advice. Neither the information nor any opinion expressed nor any portfolio constitutes a solicitation to purchase or sell securities or any investment program. July 03, 2014 Volume 3 | Issue 1 Proactive Advisor Magazine is dedicated to promoting and educating on active investment management. Distribution reaches a wide audience of financial professionals who advise clients on investments and portfolio management. Each issue features an experienced investment advisor who offers insights on active money management, client service, and investment approaches. Additionally, Proactive Advisor Magazine offers an up-close look at a topic with current relevance to the field of active management. Advertising proactiveadvisormagazine.com/advertising Reprints proactiveadvisormagazine.com/reprints Contact proactiveadvisormagazine.com/contact Proactive Advisor Magazine Copyright 2014 © Dynamic Performance Publishing, Inc. All rights reserved. Reproduction of printed form, whole or in part, without permission is prohibited. How to profit in the second half Commentary: While sentiment remains decidedly mixed, be wary of predictions from the same experts who got the first half of 2014 wrong. Why older clients get too conservative— and why they should not Explaining a big flaw in traditional glide path investing. Succeeding as an introverted advisor amidst the “extrovert ideal” Arguably the introvert’s preference for seeking out one-to-one relationships may actually make them good advisors, with the ability to connect and bond with their clients. Taking on a younger client with low assets can be a good idea Even if potential clients have relatively low assets now, it might be a bad idea to turn them away. Earnings potential, savings, debt habits, and career path may be positive factors to consider. Finding the next generation of financial advisors The average age for financial advisors in the United States is older than 50, as relatively few young people are entering the business. Where will the next generation come from? Build a pH-balanced portfolio Blending 12 asset classes might lead to a better balanced portfolio with a favorable risk/return profile. Stay connected Retirement income strategies: How to improve on the 4% rule The “traditional” 4% rule has come under fire for being both too conservative and too aggressive. Are there better alternatives? Editor David Wismer Marketing Coordinator Elizabeth Whitley Contributing Writers Jerry Wagner David Wismer Graphic Designer Roger Ackerman Contributing Photographer Chris Cone © 12 L NKS WEEK Read text only