Twitter report

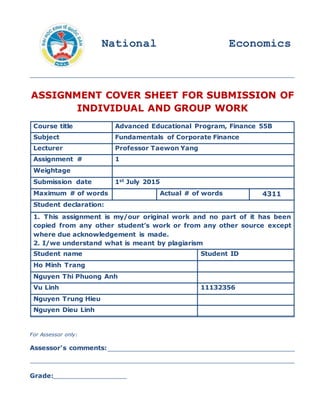

- 1. ASSIGNMENT COVER SHEET FOR SUBMISSION OF INDIVIDUAL AND GROUP WORK For Assessor only: Assessor's comments: Grade: Course title Advanced Educational Program, Finance 55B Subject Fundamentals of Corporate Finance Lecturer Professor Taewon Yang Assignment # 1 Weightage Submission date 1st July 2015 Maximum # of words Actual # of words 4311 Student declaration: 1. This assignment is my/our original work and no part of it has been copied from any other student’s work or from any other source except where due acknowledgement is made. 2. I/we understand what is meant by plagiarism Student name Student ID Ho Minh Trang Nguyen Thi Phuong Anh Vu Linh 11132356 Nguyen Trung Hieu Nguyen Dieu Linh National Economics University

- 2. Content Introduction ................................................................................................................................................1 Income Statement Analysis.................................................................Error! Bookmark not defined. Balance Sheet Analysis.…………………………………………………………………………...6 Ratio Analysis…………………………………………………………………………………...12 Cash Flow………………………………………………………………………………………..16 Performance Evaluation…………………………………………………………………………18

- 3. 1 Introduction Twitter is an online social networking service that enables users to send and read short 140- character messages called “tweets”. It was created in March 2006 by Jack Dorsey, Evan Williams, Biz Stone and Noah Glass and launched by July 2006. The service rapidly gained worldwide popularity, with more than 100 million users who in 2012 posted 340 million tweets per day. The service also handled 1.6 billion search queries per day. In 2013 Twitter was one of the ten most-visited websites, and has been described as “the SMS of the Internet”. As of May 2015, Twitter has more than 500 million users, out of which more than 302 million are active users. In this report, we are going to handle the company’s income statement, balance sheet, cash flow, as well as analyze its financial ratio, before topping things off by giving an evaluation of how well the company fared in the recent years.

- 4. 2 Income Statement Analysis Period Ending Dec 31, 2014 Dec 31, 2013 Dec 31, 2012 Total Revenue 1403002 664,890 316,933 Cost of Revenue 446309 266,718 128,768 Gross Profit 956,693 398,172 188,165 Operating Expenses Research Development 691,543 593,992 119,004 Selling General and Administrative 804,016 440,011 146,244 Non Recurring - - - Others - - - Total Operating Expenses 1,495,559 1,034,003 265,248 Operating Income or Loss -538,866 -635,831 -77,083 Income from Continuing Operations Total Other Income/Expenses Net -5,500 -4,455 399 Earnings Before Interest And Taxes -578,351 -647,146 -79,17 Interest Expense - - - Income Before Tax -578,351 -647,146 -79,17 Income Tax Expense -531 -1,823 229 Minority Interest - - - Net Income From Continuing Ops -577,820 -645,323 -79,399 Non-recurring Events Discontinued Operations - - - Extraordinary Items - - - Effect Of Accounting Changes - - - Other Items - - - Net Income -577,820 -645,323 -79,399 Preferred Stock And Other Adjustments - - - Net Income Applicable To Common Shares -577,820 -645,323 -79,399 All numbers are in thousand

- 5. 3 Income statement: A statement that measures a company's financial performance. It also shows the net profit or loss incurred over a specific period of time, typically over a fiscal quarter or year. 1) Revenues: The amount of money that a company actually receives during a period. It has risen significantly for the last three years. Total revenue in 2014 is 1,403,002, which was twice as much as 2013’s and surpassed 2012 by about 4,4 times. It is due to Twitter’s business strategy to improve the amount that the company sold. Increased revenue means more money coming in, which means more money for paying salaries, more money for research and development, more money for factory expansion or more investment back into the business. 2) Gross profit: Indicates how efficiently management uses labor and supplies in the production process. Gross profit = Revenue – Cost of revenue Twitter has seen a growth in gross profit from 188,165 in 2012 to 956,693 in 2014. It reflects how well the company uses resources and produces the goods and services. We can also calculate: Gross profit margin = Gross profit / Revenue This proportion is essential as the bigger the gross profit margin is, the more profitable the company can be before consideration of general and administrative expenses. From Twitter’s Income Statement, it has changed from 40,6% in 2012 to 68,2% of sales in 2014. You can tell that the company improved its sales quite efficiently. 3) Expenses:

- 6. 4 Operating expenses includes Research Development and Selling General and Administrative Expense. The company has spent much money on improving products and service than others competitors like Facebook, Google,… It is pointed out clearly as R&D expense represents nearly fifty percent of sales in 2014. In Selling General and Administrative Expense, we have some costs like rent, salaries and money spent on office supplies. This expense in 2014 surpass 2012 by about 5,5 times. These two elements have led to a growth in operating expense. However, the fact that expense is much greater than revenue indicates that Twitter’s operating results can be harm as it costs more than it earns a profit. 4) Earning before interest and taxes (EBIT) and Earning before tax, interest, depreciation and mortization (EBITDA): An indicator of a company's profitability. EBIT = Revenue – Cost of goods sold – Operating expenses Twitter’s EBIT was negative and declined heavily for the last three years. It dropped from - 79,170 in 2012 to -578,351 in 2014. Reduction in revenue and higher operating cost had led to the decrease in this factor. Negative EBIT means that the company is not selling enough to cover its fixed costs. Therefore, it is a bad thing as the venture does not have enough earnings to pay for any expenses. Base on this formula: EBITDA = EBIT + Depreciation for the last three years, we have -343,700; -532,795; -2,562 respectively. Negative EBITDA results from negative EBIT. It indicates that Twitter has fundamental problems with profitability and cash flow. 5) Net income: Company's total earnings or profit Net income = Sales – Expenses

- 7. 5 Net income in 2012 is not only negative but is also $565,924 higher than that of 2013. We can conclude that Twitter have suffered from a net loss when expenses exceed sales. A company with a net loss has not made a profit and spending more to operate than it earns through its operations. It needs ongoing capital infusions to keep operating. 6) Profit margin: Measures how much out of every dollar of sales a company actually keeps in earnings Profit margin = Net income / Total revenue This porpotion from 2013 to 2014 is -0,97 and -0,4 respectively. Despite the increase, they are still negative numbers. Negative net income has led to this result. A low profit margin shows a decline in margin of safety.

- 8. 6 Balance Sheet Period Ending Dec 31, 2014 Dec 31, 2013 Dec 31, 2012 Assets Current Assets Cash And Cash Equivalents 1,510,724 841,010 203,30 Short Term Investments 2,111,154 1,393,044 221,528 Net Receivables 418,454 247,328 112,155 Inventory - - - Other Current Assets 215,521 93,297 17,455 Total Current Assets 4,255,853 2,574,679 554,466 Long Term Investments - - - Property Plant and Equipment 557,019 332,662 185,574 Goodwill 622,570 363,477 68,813 Intangible Assets 105,011 77,627 3,753 Accumulated Amortization - - - Other Assets 42,629 17,795 18,962 Deferred Long Term Assets Charges - - - Total Assets 5,583,082 3,366,240 831,568 Liabilities Current Liabilities Accounts Payable 281,474 138,304 61,043 Short/Current Long Term Debt 112,320 87,126 48,836

- 9. 7 Other Current Liabilities - - - Total Current Liabilities 393,794 225,430 109,879 Long Term Debt 1,494,970 110,520 65,732 Other Liabilities 43,209 20,784 19,437 Deferred Long Term Liability Charges 24,706 59,500 12,156 Minority Interest - - - Negative Goodwill - - - Total Liabilities 1,956,679 416,234 207,204 Stockholders' Equity Misc Stocks Options Warrants - - 835,430 Redeemable Preferred Stock - - 37,106 Preferred Stock - - - Common Stock 3 3 1 Retained Earnings -1,572,446 -994,626 -349,303 Treasury Stock - - - Capital Surplus 5,208,870 3,944,952 101,787 Other Stockholder Equity -10,024 -323 -657 Total Stockholder Equity 3,626,403 2,950,006 -248,172 Net Tangible Assets 2,898,822 2,508,902 -320,738 Balance Sheet: It cannot be denied that looking at Balance Sheet is helpful for investors, investment bankers, shareholders, financial institution for verifying the profitability of investment for a specific company.

- 10. 8 1) Cash and Cash Equivalent: CCE is an item on the balance sheet that reports the value of a company's assets that are cash or can be converted into cash immediately. CCE also illustrates the amount of money that the company has in bank accounts, savings or certificates of deposit. It cannot be denied that the more cash on company’s hand, the better since the company can pay for dividends, repurchase shares or pay debt punctually. Looking at the Balance Sheet of Twitter, from 2013 to 2014, the amount of money of Twitter increased from 841,010 to 1,510,000, nearly doubled. It shows that Twitter has better its ability to expense by using cash immediately. 2) Short-term investment: This account contains any investments that a company has made that will expire within one year. For the most part, these accounts contain stocks and bonds that can be liquidated fairly quickly. In 2 years, 2013 and 2014, Twitter increased short-term investment to more than 1 millions (66%), from 1,393,000 to 2,111,000. With strong ability with cash, the company can afford to invest excess in stock and bond to earn higher interest than what could be earned from normal savings. With the amount of stock and bonds in the market, the company can raise investments and use the money to invest into operating activities. 3) Net receivables: Money owed by its customers – Money will never be paid (Bad debts) Net receivables are often expressed as a percentage; the higher the percentage, the more money a company is able to collect from its customers and the better off the company is.

- 11. 9 NR of Twitter changes from 247,000 to more than 400,000, nearly 60%. It shows the amount of money the company is able to collect is increasing within a year. Therefore, bad debt ratio is low. It also shows that the money the company lose through lending is getting lower through time. 4) Total assets-Total Liabilities: This is the account which the investors review before determining whether or not the business has enough existing value to make an investment. A company's total liabilities can be split up into two basic parts, short- and long-term liabilities. Short-term liabilities are typically liabilities which are due within one year or less. Long-term liabilities are those with a time horizon of maturity is past the one year point. Liabilities such as loans, leases and taxes due can fall into either category. Through a 2-year period, Twitter’s TA was getting bigger and bigger, from 3 mil to 5 mil (67%) . The same thing happened with TL. TL is bigger because of long-term debt, from 110,000 to 1,410,000 (1181%). Bank loans and financing agreements, in addition to bonds and notes that have maturities greater than one year, would be considered long-term debt. It can be easily seen from the Balance Sheet that Total Assets is bigger than Total Liabilities. It shows that the financial standing and performance of the company are good. 5) Net Working Capital: Net Working Capital is calculated by Current Assets minus Current Liabilities: NWC = CA – CL As can be calculated from Balance Sheet, Net Working Capital in 2013 and 2014 changes from 2,349,249 to 3,862,059, which means nearly 60%. With this growth, company can pay debt to creditor punctually. Meanwhile, it can decrease

- 12. 10 6) Retained earnings: Twitter company retains its earnings in order to invest them into areas where the company can create growth opportunities, such as buying new machinery or spending the money on more research and development. As can be calculated, the retained earnings of Twitter is negative through years, from 2012 to 2014. It does have some developments, however, negative trend is not a good thing for a company like Twitter. Should a net loss be greater than beginning retained earnings, retained earnings can become negative, creating a deficit. 7) ROA = NET INCOME/ ASSETS The ROA figure gives investors an idea of how effectively the company is converting the money it has to invest into net income. The higher the ROA number, the better, because the company is earning more money on less investment. ROA increased means that the company is able to convert investment nearly 91% into profit better, however, it’s still NEGATIVE. When a company has a negative ROA, it means that the company is investing a high amount of capital into its production while simultaneously receiving little income. If a negative ROA is accompanied by high levels of debt, the effect of the negative ROA is magnified. Businesses often decide to increase their debt when they anticipate a positive future ROA -- a potentially risky strategy that can result in management having to explain its decision if ROA turns out to be less than expected or, worse, negative. 8) Good will, credit rating, current project. The value of goodwill typically arises in an acquisition when one company is purchased by another company. The amount the acquiring company pays for the target company over the

- 13. 11 target’s book value usually accounts for the value of the target’s goodwill. If the acquiring company pays less than the target’s book value, it gains “negative goodwill”, meaning that it purchased the company at a bargain in a distress sale. Goodwill of Twitter rises in 2014 twice as much as 2013. It means, in the view of investors, Twitter is becoming more and more valuable.

- 14. 12 Ratio Analysis Dec 31,2014 Dec 31,2013 Dec 31,2012 Short term solvency Current ratio 10,80730788 11,42119061 5,046150766 Quick ratio 10,80730788 11,42119061 5,046150766 Cash ratio 3,83633067 3,730692454 1,850471883 NWC to total assets 0,691743198 0,697885178 0,534636975 Long term solvency Total debt ratio 0,350465746 0,123649532 1,298438612 Debt- equity ratio 0,539564687 0,141095984 -0,834920942 Equity multiplier 1,539564687 1,141095984 -3,350772851 Time interest earned long term debt 0,291908049 0,03611144 -0,360293795 Asset management Inventory turnover Day's sales in inventory Receivable turnover 3,352822532 2,68829247 2,825848157 Day's sales in receivable 108,8635013 135,7739175 129,1647604 NWC turnover 0,363278241 0,283022362 0,712870597 Total asset turnover 0,251295117 0,197517111 0,381126979 Profitability Profit margin -0,411845457 -0,970571072 -0,250522981 Return on asset -0,099912557 -0,191704394 -0,095481067 Return on equity -0,153821845 -0,218753114 0,319935367 Earning per share -0.860363311 -0.960874032 -0.118223645 1) Current ratio: The current ratio is a liquidity and efficiency that measures a firm's ability to pay off its short-term liabilities with its current assets. The current ratio is an important measure of liquidity because short-term liabilities are due within the next year. The current ratios for Twitter in the year 2012, 2013, 2014 are 5.0; 11.42 and 10.8 respectively. According to the definition, the higher the ratio is, the greater the ability the

- 15. 13 firm has to pay its bill. In three years, Twitter has been improving liquidity and efficiency, because current ratio is improving. 2) Quick ratio: The quick ratio or acid test ratio is a liquidity ratio that measures the ability of a company to pay its current liabilities when they come due with only quick assets. Quick assets are current assets that can be converted to cash within 90 days or in the short-term. Cash, cash equivalents, short-term investments or marketable securities, and current accounts receivable are considered quick assets. The quick ratios for Twitter in the year 2012, 2013, 2014 are 5.04; 11.42 and 10.8 respectively. Base on these results, Twitter can totally cover its total current liabilities by its quick assets. Higher quick ratios are more favorable for companies because that would mean there are more quick assets than current liabilities. The ratio in 2014 is 10.8, which means that the company has almost 11 times as many quick assets than current liabilities. In the span of 3-year, the amount of Current Assets increases significantly, nearly 8 times, so the ratio climbs up as well. 3) Long term solvency : Long term solvency ratios are intended to address the firm’s long term ability to meet its obligations, or more generally, its leverage. - Debt ratio: A solvency ratio that measures a firm's total liabilities as a percentage of its total assets. During the period, we receive a rather stable rate of debt ratio from Twitter (0.12; 0.35 in 2013, 2014 respectively), except for the year 2012 ( debt ratio was 1.29). For a company, a lower ratio is more favorable than a higher ratio. The ratio of 1.29 in 2012 indicated that Twitter's debts exceeds its total assets and the company have to sell all of its assets in order to pay off its liabilities and in this year, Twitter was a highly leverage firm. Once its assets are sold off, the business can no longer operate. The ratio in 2013 & 2014 are both less than

- 16. 14 0.5, and it is considered as less leverage with an opportunity to borrow in the future at less risk for the lenders of this firm. - Debt-equity ratio: The debt to equity ratio is a financial, liquidity ratio that compares a company's total debt to total equity. The debt to equity ratio shows the percentage of company financing that comes from creditors and investors. A higher debt to equity ratio indicates that more creditor financing (bank loans) is used than investor financing (shareholders). Twitter in 2012 experienced a negative debt-equity ratio (-0.83), however, it was a good news for the company. A lower debt to equity ratio usually implies a more financially stable business. Companies with a higher debt to equity ratio are considered more risky to creditors and investors than companies with a lower ratio. The ratio in 2014 (0.54), which is bigger than 0.5, implied that there are more than half of many liabilities than there is equity. - Equity multiplier: The equity multiplier is a financial leverage ratio that measures the amount of a firm's assets that are financed by its shareholders by comparing total assets with total shareholder's equity. A higher ratio means that more assets were funding by debt than by equity. In this case, the ratio in 2012 was the lowest, which implied that the company depended less on debt to finance its assets than the next two years . From the balance sheet, the ratio in 2013 and 2014 are relatively high, which reveals that too much assets were funding by debt than by equity and the firm is considered to be highly leveraged and more risky for investors and creditors. 4) Profitability: Profitability Measures intend to measure how efficiently a firm uses its assets and manage its operations

- 17. 15 - Profit margin: The profit margin ratio, also called the return on sales ratio or gross profit ratio, is a profitability ratio that measures the amount of net income earned with each dollar of sales generated by comparing the net income and net sales of a company. For all 3 years, profit margin ratio is negative, because of the result of net income from the income statement. Profit margin of Twitter decreased significantly from 2012 to 2013 (from -0.25 to 0.97), and then increased slightly in 2014, to finish at -0.410. Creditors and investors use this ratio to measure how effectively a company can convert sales into net income. Investors want to make sure profits are high enough to distribute dividends while creditors want to make sure the company has enough profits to pay back its loans. An extremely low profit margin would indicate the expenses are too high that makes the net income negative Twitter's profit is not high enough to distribute dividends and to pay back its loan. - Return on assets ratio: The return on assets ratio, often called the return on total assets, is a profitability ratio that measures the net income produced by total assets during a period by comparing net income to the average total assets. Since company assets' sole purpose is to generate revenues and produce profits, this ratio helps both management and investors see how well the company can convert its investments in assets into profits.

- 18. 16 Cash Flow Cash flow statement is one of the most important reports. It consists of cash flow from financing, operating and investing activities. Operating activities include the core business activities. One significant thing we can see in Twitter’s cash flow statement is that the cash flow from operating activities rose dramatically from only more than $1 million in 2013 to more than $81 million in 2014. As can be seen from the CFS, operating cash flow is positive while net income is negative. Because Cash Flow from Operating Activities = Net Income + Noncash Expense + Changes in Working Capital, noncash items such as high Depreciation (more than $234 million) and non cash transactions included in Adjustments to Net income result in positive operating cash flow while the company did not actually pay in cash that year. Another factor is Changes in Liabilities, the amount of money Twitter gets back from lending money to others, was more than $140 million. Growth companies spend heavily on investing activities and this figure was negative at more than minus 1 billion thousand dollars for TWTR in 2 years continuously. Sometimes a company might have a negative investing cash flow which may not be really bad if it is due to investment expenses. Financing activities include the cash that comes into a company in the form of loans or interest earned or shareholders money, as well as the cash that goes out. Twitter spent more than $600 million from financing activities for both 2013 and 2014. These numbers were positive because of the money the company gets from borrowings or selling stock. Twitter had a cash and cash equivalents of more than $630 million in 2013 and more than $670 million in 2014 meaning the company is able to meet its expenditure and grow cash.

- 19. 17 2014 2013 2012 Operating cash flow -343,169 -530,972 -2,791 Net capital spending 438,842 260,272 199,716 Change in NWC 1,512,810 1,904,662 -103,737 Free Cash Flow -2,294,821 -2,695,906 -98,770 Free cash flow (FCF) represents the cash that a company is able to generate after laying out the money required to maintain or expand its asset base. Free cash flow is important because it allows a company to pursue opportunities that enhance shareholder value. Without cash, it's tough to develop new products, make acquisitions, pay dividends and reduce debt. The Free Cash Flow of the Twitter company was negative for both year, 2013 and 2014. This was because of the negative operating cash flow, meaning the company was not doing well on its own. It had to spend too much on operating itself.

- 20. 18 Performance Evaluation * SHORTERM- SOLVENCY: PAY DEBT SHORT TERM Current ratio: This means that companies with larger amounts of current assets will more easily be able to pay off current liabilities when they become due without having to sell off long-term, revenue generating assets. The current ratio helps investors and creditors understand the liquidity of a company and how easily that company will be able to pay off its current liabilities. This ratio expresses a firm's current debt in terms of current assets. So a current ratio of 4 would mean that the company has 4 times more current assets than current liabilities. A higher current ratio is always more favorable than a lower current ratio because it shows the company can more easily make current debt payments. For Twitter, in the period of 2-year, from 2013 to 2014: - CA increase 65.3% - CL increases 74.6% - Current ratio decrease: 11,412,000 -> 10,800,000, but the company is still able to cover its debt. * LONG TERM DEBT PAYMENT: TOTAL DEBT Debt ratio = TD/TA 2012 = 1.29, 2013 = 0.12, 2014 = 0.35 A lower ratio is more favorable. In the two years of 2013 and 2014 this ratio always remained less than 0.5, which mean TD < TA -> the company has the ability to cover long term debt.

- 21. 19 We could also point out that for Twitter, 2014 is successful but still is not as effective as 2013. * NEGATIVE INCOME + ROE It's possible for a business to have a negative net income or a financial loss if the company has more debt obligations and operating expenses than revenue. A negative net income has a large impact on ROE as investors likely lose money because the business has no cash left over to pay them. Calculating ROE with negative net income simply plugs in a negative number where a positive one would be in the formula. For example, a company with a negative net income of $1,000,000 and a total shareholder equity of $2,000,000 has an ROE of negative 50 percent. This means the company lost half of total shareholder equity for the given year. As of ROE itself, we’ve already known that it is a measure of how the stockholders fared during the year. Normally for every company ROE should be positive. If it is negative then that’s not a good thing, because that would mean for every dollar in equity, the company would generate nothing in profit. Twitter had ROE of -0.21 and -0.15 in 2013 hay 2014, respectively, so obviously they’re not doing well. * PROFIT MARGIN: Every company pays a great deal of attention to its profit margin. The higher the profit margin is, the more profitable the company is and the better control it has over its cost. If the profit margin is low, then the company needs to control expense more carefully. In the case of Twitter, we can calculate that in the year of 2013 and 2014, the company only had the negative profit margin of -0.97 and -0.41, respectively. This means that Twitter generated less than -0.97 and -0.41 in profit for every dollar in sales. So basically Twitter will need to cut off its expense to bring its profit back to the initially higher state.

- 22. 20 ** CONCLUSION: Base on these facts and stats, we could come to the conclusion that this Twitter company is still able to pay debt but is facing some difficulties in making profit and paying for Equity. Right now Twitter is not profitability enough to pay money for its owners (stockholders).