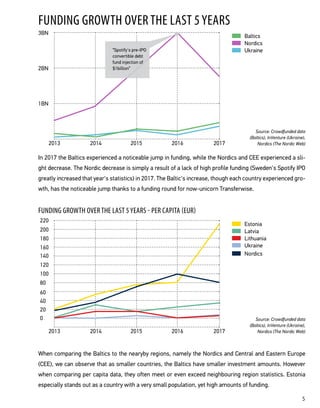

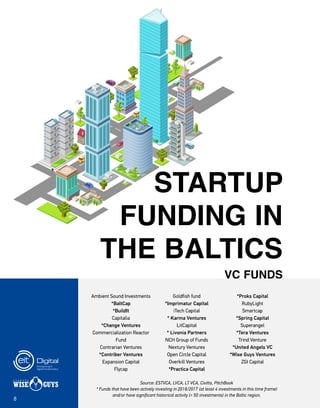

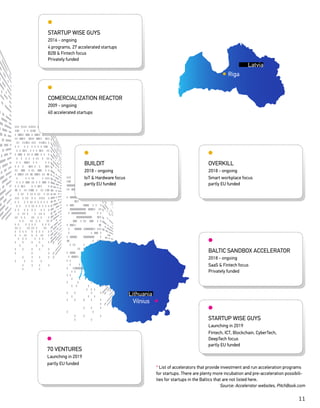

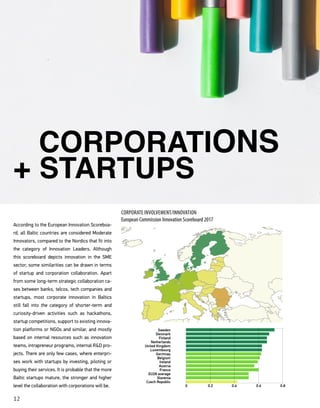

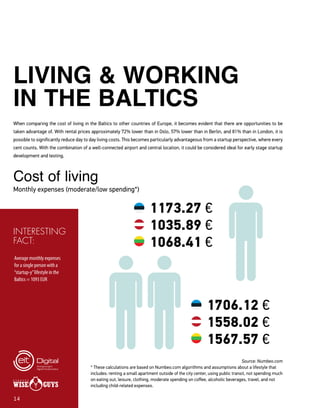

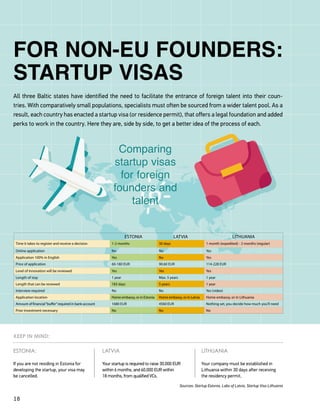

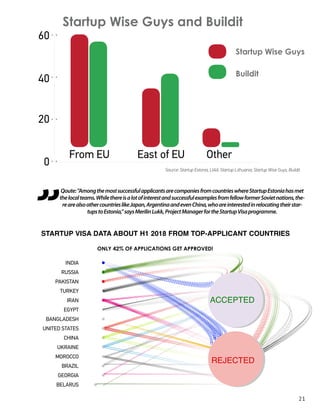

The Baltic startup ecosystem report analyzes the state of startups in Estonia, Latvia, and Lithuania, highlighting significant funding growth and investment potential. Estonia stands out for its high per capita fundraising and active blockchain ecosystem, particularly with ICOs, while the region overall shows promising development in startup innovation and corporate collaboration. Additionally, the report discusses the advantages of the Baltic region's lower cost of living and abundant tech talent, alongside the introduction of startup visas to attract foreign talent.